First, you have to believe it's possible.

Without that firm belief and conviction, it's unlikely to happen.

After Game 3 of this year’s Stanley Cup Playoffs, they interviewed some fans who were completely unwavering in their belief that Edmonton would win the next 4 games and win the Stanley Cup. My immediate thought was, “You’re dreaming.” In the first 3 games, Edmonton played poorly, in my opinion, with lack of effort and big mistakes being the biggest problem. All solvable problems. In Game 4, they scored first, shorthanded, which really fired up the fans and the players, and they went on to win 8-1. The team’s captain, Connor McDavid, remained calm saying “We earned this win and we have to earn the next one, and drag them back to Alberta.” And they did. They then had to earn the win in Game 6, and they did. We’ll see on Monday if they can win Game 7 and bring the Cup back to Canada.

Not many people outside of Edmonton believed such a comeback was possible. There are countless stories in sport and business and life, where ‘nobody’ believed it was possible, but at least one person did, and it turns out they were right. I have believed for years that there must be a better way to invest one’s money and avoid losses on major market crashes. I now know that it’s possible. It’s a mathematical certainty. And most importantly, it’s not difficult and anyone can do it. Here’s how.

The key element is a bit like driving a car and staying in your lane. Obviously, you don’t want to hit the ditch. Here’s a monthly chart of the S&P 500. What do you see?

If you were driving, you’d likely pull back to the center of your lane to avoid a possible collision with an oncoming truck. Sure, it could continue higher, like it did in 2021, but caution, to avoid a ‘sudden’ drop, is well advised.

Of course, the market drops are not ‘sudden’ or unavoidable, and there’s generally a ‘road sign’ advising ‘caution ahead’. You can see examples of that in my article, “DJIA - 100 years in 10 minutes”. Here’s a particularly clear example. The trendlines go back over 10 years, to 2008-9 and the ‘signs for caution’ are pretty clear.

And look at the covid drop. It went almost exactly from resistance to support lines that have been on the chart for 10 years! With these and other trendlines, you were ready and looking for a drop in early 2020, ahead of covid. Covid was simply the trigger for a drop that was waiting to happen. You were also ready in advance for the drop in 2022.

Here’s one that everyone can relate to and watch going forward, Costco (COST). It’s been a great stock to buy and hold since 2009, but is it wise to continue holding it? For me, the caution signs are everywhere.

Here’s a look at the daily chart. You can see it made a ‘ceiling’ of about 850, then made a 3 day push up to 873.94, then fell on Thursday - Friday. Cautious ‘drivers’, pulled over on Thursday at 865. Others, waited for Friday to see how the ‘weather’ looked then and also got off the road at 865. Others, who ‘slept in’ and had a nice brunch, decided to sell at 860 as the price headed lower again from a brief rally to 861.

The simple question now is, “What will/would you do next week?” And more importantly, “Do you now believe that trendlines can keep your investments safe?”

If you decide to do nothing, that’s okay! Whatever helps you sleep at night.

Here’s an update of the chart to Friday, Aug. 23.

I recently wrote to a friend, “Hi, just a shout out to see if you have any Royal Bank shares. If so, I'd sell them before they follow the path of BMO and others. National Bank would be another good one to sell while it's up. There's likely not much, if any, upside left in them, with the markets also stretched to new all time highs. I'd be looking for a chair for when the music stops.” She replied, “I appreciate your concern. I'm not going to sell either of them. My objective is to hold them as assets that pay dividends. It costs to sell and re-buy and I wouldn't want to miss the next ex-dividend date. I have no way of knowing when they may drop to a level low enough to generate a benefit above the dividend that I might miss. And I will have to worry - that's the other part of my philosophy. I don't want to have to worry. And I never worry about any of the bank stock I'm holding, including TD. I just let the dividends roll in.”

Spoiler alert, RY and NA fell the next 2 weeks, and NA dropped over 10% on news they were buying Canadian Western Bank (CWB), for a 110% premium. Here’s a monthly look at CWB. The ‘floor’ and ‘ceiling’ on its stock price are pretty clear.

Here’s a weekly look at TD. Selling in early 2022 for over $100 a share (high 109.07) was clearly a good idea and there was plenty of time to heed the warning signs and exit. Now you can only get 75 cents on the dollar, getting a dividend that is about the same as a GIC deposit, where your capital is guaranteed.

Here’s a monthly look at TD. Just like the charts for Costco, SPX and DJI, the warning signs have been consistently clear dating back to 2007 in these charts, back to 1986 with TD (and I’ve been talking to my friend about this since the fall of 2023), and back 100 years with DJI.

So, do you believe it’s possible to protect your investments and avoid ‘sudden’ losses? If so, great, keep reading. If not, no worries, perhaps you’ll bump into my friend on the golf course.

For those still reading, you’ll soon be on the golf course (or wherever) as well, but protecting your investments with simple alerts on your phone.

In January, I wrote, “TQQQ/HQU - Leverage can be a useful tool.” and continued to post updates for the trade to illustrate the strategy in ‘real time’. The goal was to maximize returns, using leverage, checking once a week to ensure you were 'on the right track’ and there were no warning signs. Monday, January 8 was a buy. Four weeks later, you were up 23.4% with no trades and up 78.9% in 3 months (buy Mon. Oct. 30, 2023). I was also seeing some cautionary signs. Friday, Feb. 9 was an exit for cautious ‘drivers’ and Monday, Feb. 12 was an exit for everyone who took a chance holding over the weekend. Everyone was then safely on the sidelines with all their original investment and 50% profit in 6 weeks on 4 trades.

For me, TQQQ was a definite sell on Thursday, June 20, for anyone still holding. I also bought the inverse, SQQQ. From re-buying TQQQ mid-day on May 31, you’re up 30%. There’s no need to be greedy. When it opened Thursday at 77.46, I would have put in a tight stop sell at 77.30, it hit 77.65 and fell. Once out, I would have put in an alert and stop buy at 77.75 and carried on with my day.

The goal of this article is to keep it that simple. Minimal time and effort. Every Sunday, I will set my stop and alert prices, then take action when and if they’re triggered. I don’t want to continue watching the charts closely. I’ve learned how to play the game, I know what’s needed to win, and most importantly, I believe it’s possible.

I’m holding SQQQ at an average price of 8.10. It closed Friday at 8.40, +3.7% from my buy price and I have set an alert and stop sell at 8.20. I’ve also set an alert at 8.90 and 9.15. If it gets there, I can change my stop sell and set new alerts.

One of the subscribers here, Sandimas, completely believes the possibility and potential, and is committed to developing a strategy to succeed consistently. He has a more structured set of rules for when to buy and sell, whereas I have been ‘shooting from the hip’, based on what I see on the charts. Both strategies need improvement. Last week he provided a link to BANC, who has an “Average gain of +50% per year or more (depending on risk profile)”. They have developed a set of algorithms that provide their buy and sell alerts, sent to members after hours on the day an alert is triggered. 2024 YTD is not very good at +21%, but it will be interesting to see how their alerts match our own alerts and actions going forward.

For me, the key is to catch the major turns and then do a better job of staying with the trade. On June 18, 2023, I wrote “Are you ready for a market drop?” In my update on Sunday, July 16, I wrote, “The Nasdaq is similarly stretched again and for those holding QQQ, you’re up 45.6% since buying Jan. 6 and best to set a trailing stop 2-3% lower and enjoy your summer.” Lots of advance notice to sell and lock in your gains when it topped out on July 19 at 47.14.

In my update on Sunday, Oct. 29, I noted the higher low on Friday and was ready to buy TQQQ on Monday or Tuesday. Buying at 32 was low risk with potentially high reward. The maximum hold would have been a drop below Thursday’s low of 30.47, -5%. A cautious sell was below Monday’s low 31.58, say 31.45 (-1.7%). The reward, doing nothing since then is +132.5%, and you clearly wouldn’t have done nothing in March-April. I would now set an alert for 70 and 76 and wait to see what happens, while holding SQQQ. What will you do?

Go Oilers!!

Update to Fri. June 28: It was an interesting week, with a good example of managing your position. With a small amount of extra effort, you could have sold SQQQ on Tuesday when it dropped, stopping out at 8.50 for a gain of 4.9%. Conversely, your Sunday stop sell and alert at 8.20 would have triggered on Wednesday for a gain of 1.2%.

Note that selling on Tuesday at 8.50, then allowed you to comfortably consider buying Wednesday at 8.20. Selling on Wednesday, then left you worried you might have sold at the bottom and would miss the move back up. This is actually a very common occurrence, so you really need to decide what strategy allows you to feel the most comfortable and relaxed. I prefer to sell early in the drop.

There’s nothing on the SQQQ chart suggesting a buy the dip on Friday, but looking at the base reference chart QQQ, it actually made complete sense. QQQ hit the ATH (all time high) resistance line and was rejected, so it was a perfect time to buy SQQQ.

My focus for this article is to avoid making too many trades and watching too closely, but this past week provides an excellent example of how things can develop, and how easily you can get ‘kicked out’ of a position, before getting the big reward. Sometimes a little extra effort pays off. For those who made the effort, you nabbed a gain of 4.9% and lowered your price for SQQQ to 7.90 or 8.00.

On the flip side, for TQQQ I said, “I would now set an alert for 70 and 76 and wait to see what happens.” It blasted higher for 45 minutes after the open on Friday, hitting 77.53, then dropped hard. If you had a stop buy in, then you needed to heed the buy notice and quickly set a stop sell for breakeven or -1%. Seeing that it was such a hard move up, back to the prior ATH, you likely would have sold high and set a new alert at 78.00 and maybe a stop buy at 78.20 or higher. You absolutely don’t want to get suckered in to buying the top.

An hourly view provides a better view of the high wire that TQQQ shareholders are now on.

For those who are comfortable on the sidelines, set TQQQ alerts for 72 and 78 (possible support and resistance), then decide what to do when you get the alert. For those who like being in the game, watch closely on Monday at the open, and for the first half hour to an hour, to see whether you want to buy TQQQ or SQQQ. For those holding SQQQ, set an alert at 8.10 and a stop sell at 8.00 or 7.85 or 7.78. An alert at 8.45 or so, would then allow you to move your stop sell to 8.20 or so.

Now, get on with your day, and have a great week!

And, regarding the Oilers and the Stanley Cup, they can be commended for their efforts, but it was a lack of effort and some mental mistakes that cost them the winning goal. Draisaitl was coasting behind Reinhart and feebly waived his stick as Reinhart took a shot for the winning goal. Here’s the setup.

Draisaitl, at the far left, has been coasting since half way to the red line. Reinhart, 13, has the puck. The first and biggest mistake is by the defenceman, Brett Kulak. He has to put pressure on Reinhart as it’s a simple 3 on 3 attack. Draisaitl should be watching for a trailer coming in, while also skating over to put pressure on Reinhart. Instead, Kulak drifts back to double team the center Florida player, Verhaeghe.

As with investing, you can see the play develop and the mistakes along the way. Draisaitl and Verhaeghe start side by side in Florida’s zone, as Verhaeghe passes the puck to Reinhart. The Florida player in the middle, 62, skates off for a change.

Draisaitl starts with a slight step ahead of Verhaeghe, but is a step behind before he gets to the blueline.

Kulak now needs to pressure Reinhart along the boards and not let him cross their blueline.

Draisaitl is already coasting, Verhaeghe is still skating hard and both defencemen are completely giving up the blueline. Draisaitl and the right defenceman should both be all over Verhaeghe, the left winger for Florida should also be covered tighter, and Kulak should be at the boards putting his shoulder or hip into Reinhart. Instead, he drifts back into the middle of the ice, leaving Reinhart a clear path to move in for a point blank shot on net.

Even the goalie, Skinner, is a bit to the left, leaving the short side open for a shot from Reinhart. Draisaitl is still coasting and not attacking Reinhart, seeing that Kulak made a mistake not attacking Reihart at the blueline.

Both defencemen then allow Verhaeghe to get right on top of Skinner as Reinhart takes a shot from the faceoff dot. Even the left winger for Florida managed to get position on the Edmonton defender.

The lesson to be learned? Belief is not enough. You have to work for it, and earn it, and not make mistakes at critical moments.

Update to Fri. July 5: This past week was a bit like hockey, a chance at one end then suddenly a goal at the other. Holding SQQQ from Friday turned out okay, it pushed up for 20 minutes, down hard for 10, but stayed above all support lines, pushed up hard for 5 minutes at 10:10 to 8.42, then fell all the way back the next 5 minutes. Last weekend I suggested an alert at 8.45, so it wouldn’t have triggered, but I also suggested watching closely for the first half hour to an hour, to see whether you want to buy TQQQ or SQQQ. That bit of effort could have paid a 10% reward, on top of a 5-7% reward with SQQQ from buying Friday and selling Monday.

Clearly, SQQQ was a sell somewhere around 8.25, or a stop lower, and you may have even bought TQQQ already. Buying SQQQ at 7.90 and selling at 7.25 for +4.4% would have been very well executed.

Once again, my TQQQ alert for 72 wouldn’t have triggered, but watching closely on Monday at the open, and having the horizontal line from late Monday, June 24 low, it was very reasonable to buy near 73 with a tight stop sell. You may have still been holding SQQQ with a stop sell on it. Then, whichever way it goes, you’re in, or you might get stopped out of both, which happens, then set stop buys or wait to see how it develops.

There may have been extra games being played around the holiday, and absolutely anything could happen on Monday and next week. Selling TQQQ on Friday and taking the win was completely reasonable, but the trend is up, with strong momentum, so holding also makes sense.

The number one rule is to not lose money, which includes recently acquired gains. That said, you also don’t want to be out if it continues higher. Wednesday’s close of 79.21 might provide support for a re-buy, or 77.70, the June 17 high. Alternatively, if you’re out and want in, buy whatever early low is presented on Monday and have a tight stop. You can also watch to buy SQQQ, but I would wait on it. Set alerts at 7.60 and 7.70 and make a decision then based on the setup.

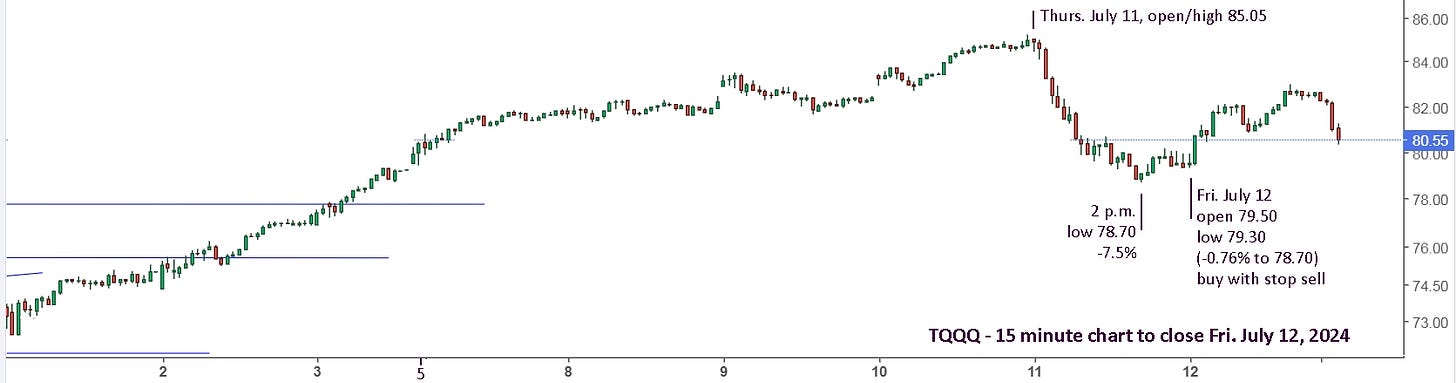

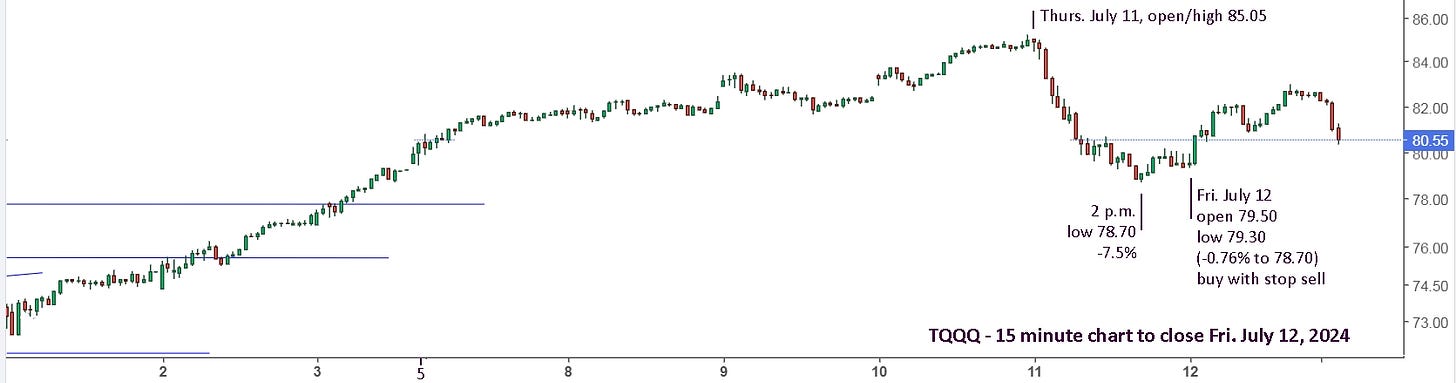

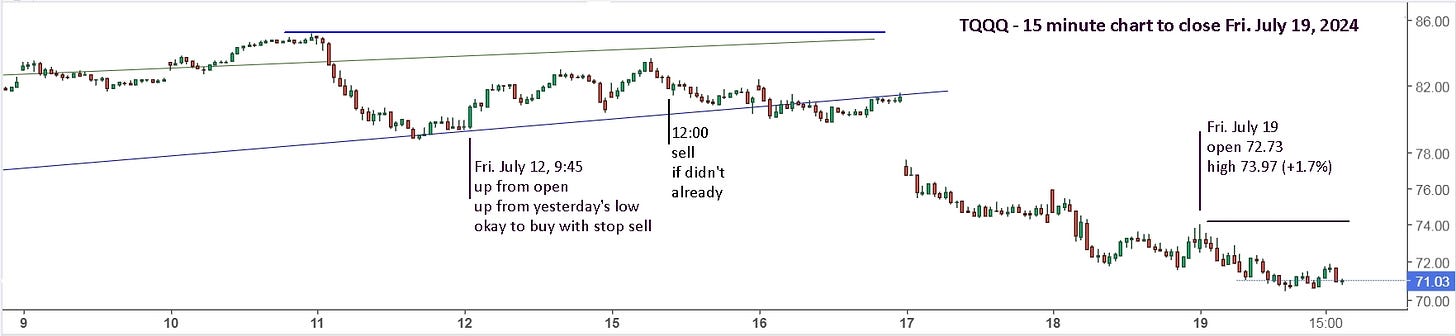

Update to Fri. July 12: On Monday, TQQQ opened about where it closed on Friday, so those who headed to the safety of the sidelines, could now safely get back in the game. It remained eerily quiet until Thursday morning. You’ve been cautiously waiting for the music to stop all week, so it should have been easy to sell TQQQ and buy SQQQ early on Thursday. Once it bottomed in the afternoon, best to sell SQQQ and take the win.

You could have bought TQQQ on Thursday off the low, but why take the risk? Better to wait till Friday. Then you can buy with more confidence and a tight stop. At 9:45 it made a sharp push higher, change your stop to breakeven if you want and enjoy your day. Active traders and Nervous Nellies may have checked in late in the day and sold around 3pm while it was holding flat. That’s what I did. Now, draw 2 new lines on your chart and you’re all set for next week.

Have a great weekend!

Update to Fri. July 19: TQQQ opened up slightly on Monday and pushed higher till 11:15, then you would have sold at roughly the same price you sold at on Friday with a small gain on the day. The sharp push down at noon or later in the afternoon were all additional times to sell if you hadn’t already. Tuesday held lower, so no reason to buy, and the trap door was opened before the opening bell on Wednesday, with all of us safely on the sidelines. Now, I’m trying to pinpoint a more precise strategy for when to buy after a drop.

The key reference points are the prior day’s low and the early high. Friday July 12 opened about even and up from Thursday’s low, so it was a possible buy when it moved up after the first 15 minutes. Then set a stop sell and an alert and carry on with your day. Late in the day was a choice to sell or hold. Monday, July 15 had a similar setup, so it was a buy and a stop sell later in the day. The key is to identify when to try and get long again and remain comfortably on the sidelines when conditions aren’t favourable.

Tuesday opened higher and fell to a lower low so remain on the sidelines. On Wednesday, you can watch to buy early, guessing that the gap lower is a ‘BS’ move, but it’s against the strategy and once it moves lower, for sure, stay out the rest of the day. There was also no reason to consider buying on Thursday or Friday, as it made lower lows and lower highs. For Monday, if it opens even or higher and stays above Friday’s low, you could consider buying. You could also ignore everything under 74. Buying on a move above 74 is equivalent to having bought Friday early. You’re actually trying to be a day late buying and missing the low.

Let’s go back in time to see how the strategy would have helped. Selling the early break lower on June 20 is pretty clear, then staying out with the lower high, or selling if you missed doing it earlier. June 21 is a lower low, so the new plan is to stay out. My old style would have me buying the early reversal and busy with it all day. Okay, I could have made some gains, but I don’t want to be busy with it.

The new strategy has me doing nothing after selling on June 20, until June 25 when it opens higher. It holds, buy with a stop sell, it moves up, you’re in. Move your stop to breakeven later, and you remain in until Friday, June 28. My old, too much trading style would have me selling June 27 when it failed to push through resistance and re-buying support, but I don’t want to be busy trading. On Friday, my new style might agree with my old style and sell the early reversal since it was really an exaggerated move and was back to the all time highs. For sure, late in the day when it broke support, you needed to sell. Last chance to get to safety.

On Monday, July 1, it makes a lower low and reverses hard, then holds. Old style, I want to buy, but the reversal happened so fast I likely missed it, then it holds, threatening to fall again, or blast higher. It makes for an unpleasant day. Tuesday opens lower than Monday’s close, but near the afternoon floor price. Now it’s a much more confident buy and hold with a tight stop. It moves up in the first minutes and it’s a relaxing day and rest of the week. And profitable!

I probably said best to sell on Friday, July 5, just to be safe. It gapped a bit higher on Monday, and quickly fell back to Friday’s late floor, so everyone who sold could get back in if they wanted. You can then clearly see a horizontal floor line through Friday’s late lows. The Wednesday afternoon, July 10, flat top likely had you moving your stop sell up, and the early drop on Thursday, July 11 had you out. As I wrote earlier, Friday, July 12 was an early buy and a late sell or hold, depending on your style.

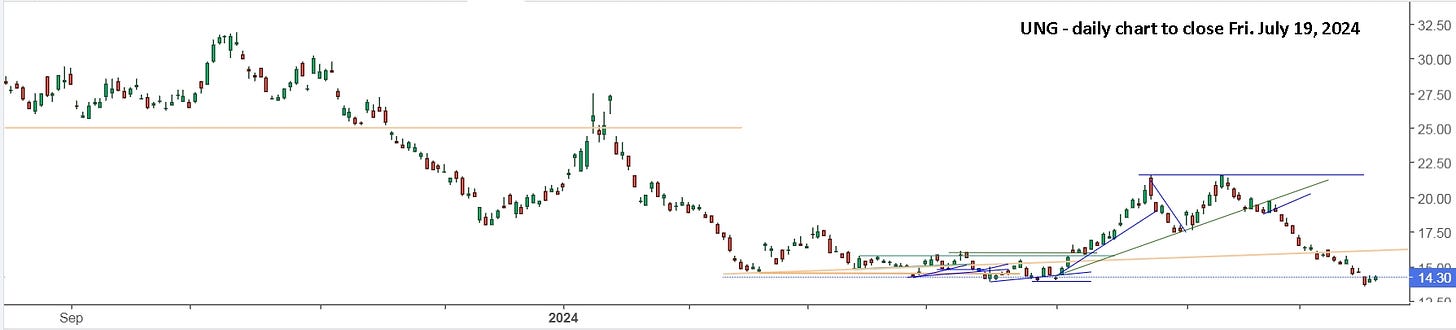

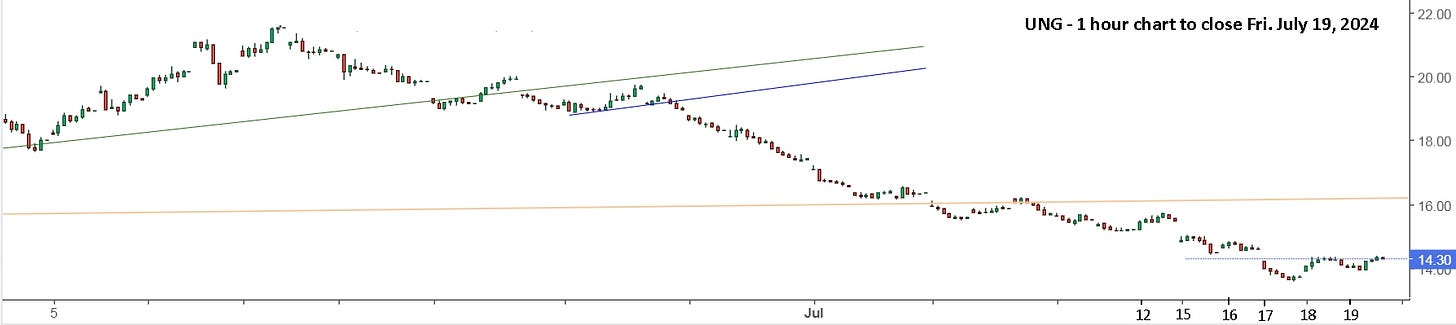

Here’s a look at something else that was a recent buy, based on the new strategy. UNG is the base ETF for BOIL, the leveraged ETF, for natural gas futures pricing. It’s a completely different world with crazy wild moves and frequent large gap openings. Not for the feint of heart, but profitable if you can master the trade. I’m still getting bucked off and trampled more often than I’d like. Hopefully these new guidelines will help keep me off the horse until it’s ready to be taken for a ride.

As you can see, it’s been a long, long drop from the high on June 11. Buying support seemed reasonable at the time, but there were only single days up. Friday was the second day up and the safe play is to wait for Monday. As long as it stays above the Wednesday, July 17 low, there’s hope that the bottom is in. We’ll see how it plays out.

Fundamentals for natural gas pricing are an important factor to consider, but there are no fundamentals on the planet that justify a move from a floor of 2.40 in April - May for the September contract (current holding for BOIL), to 3.20 on June 11, then down to 2.05 on Wednesday, July 17. It’s complete madness. Not unlike oil in 2020 that went to -$40/bbl on one overnight contract expiry. Such low prices cannot last, and the price of NG will be going up. It’s just a matter of when and getting the timing ‘right’, which means being a few days ‘late’. You can read all about it here, “Compound returns with NG can be huge.”

Looking back to TQQQ, there’s also the opposite, SQQQ. Many people may chose to take a break when out of TQQQ and not try the short trade. Here’s a look to see how the new strategy would have worked.

Thursday, July 11 opened above Wednesday’s low and moved up, so buy with a stop. When it’s quickly in your favour, then you can relax, set a stop and alert and carry on with your day. Friday you would sell the early drop. Monday had a higher early low, so it was okay to buy again and hold the rest of the week for a gain of over 20% with the sell and re-buy.

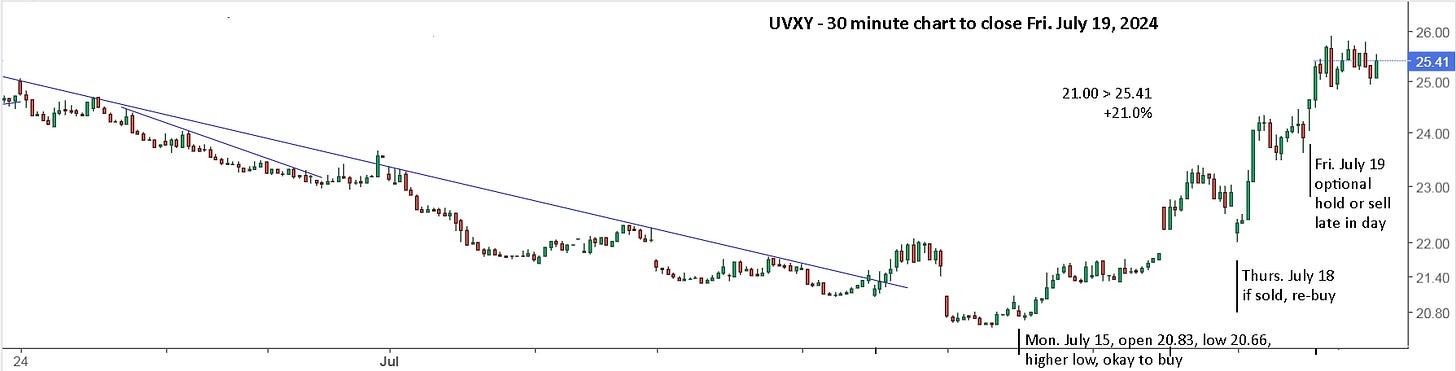

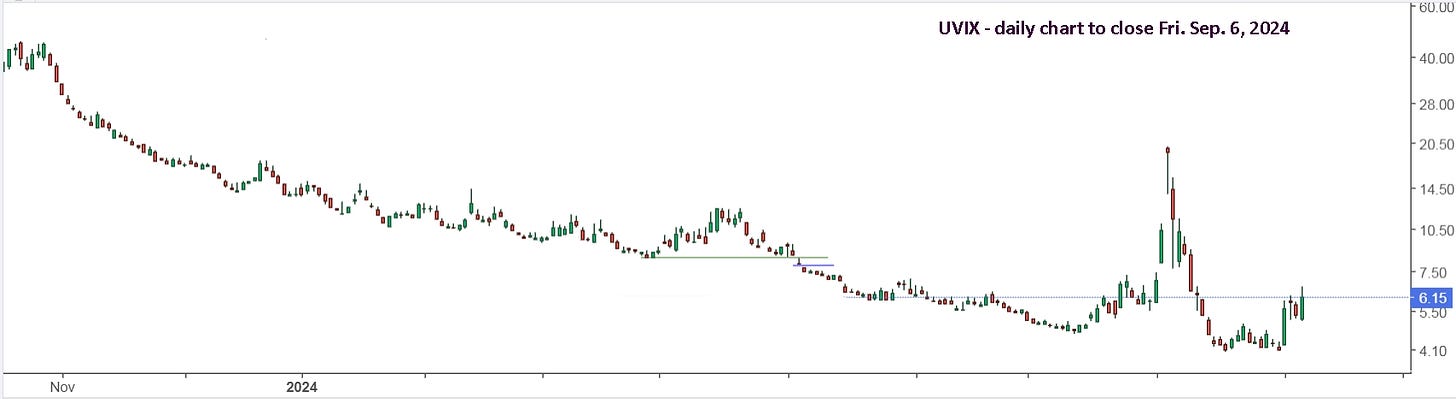

Another trade option when markets are falling is UVXY. It can provide massive returns of 1000% in a few weeks during major drops like 2020. I wrote 2 articles last year, first “Make UVXY your winning lottery ticket that keeps on winning.” in August, and then “Volatility can be super safe and life changing.” The trick is to avoid small losses before getting on board for a run higher.

The market drop on Thursday, July 11 was a ‘wake up call’ that volatility might be coming to life. Monday, July 15 was a buy with a higher low from Friday, along with a stop just below Friday’s low. Once you’re up, stay with it for a possible extended ride. With this ETF, your target is a big win in a few days or weeks, then stay out. Last week gave a possible +21% and you could either sell on Friday taking the win, or hold for Monday.

Our goal now is to be a day ‘late’ buying TQQQ.

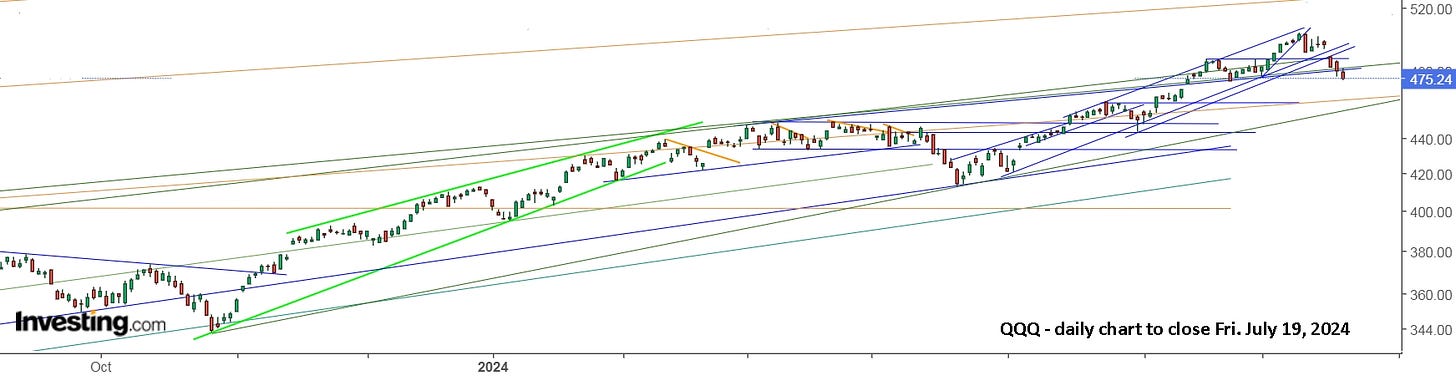

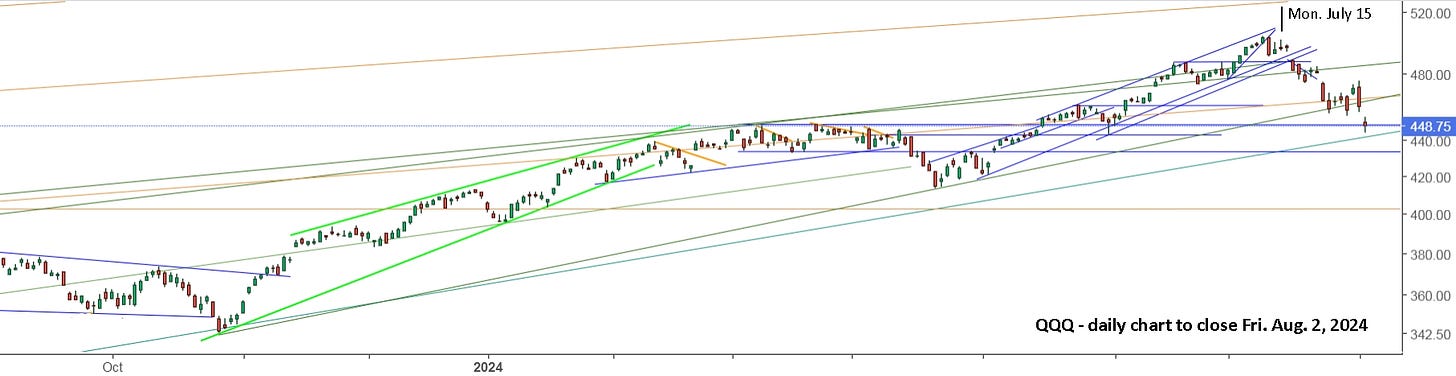

A look at the daily chart for QQQ shows no nearby support lines.

And now is a good time for me to delete a bunch of the old lines, to get a clearer view of what might be coming.

Update to Fri. Aug. 2: The goal from the July 19 update was to be a day ‘late’ buying TQQQ. Since then, you’ve stayed on the sidelines, unless you took a short trade.

The weekly review to Fri. July 12 pointed out the need to be on the sidelines, and you had Monday and Tuesday to take action, before the gap lower on Wednesday.

For anyone holding QQQ and not trading, it’s now back to where it was in early March and hit a hard ceiling. Selling in March, locked in a good gain, then re-buying April 23, 25 or May 2 at 417 to 420, gave another gain of 18-20% selling in July. Clearly it is worthwhile to monitor weekly and trade when it seems appropriate.

For anyone who is still holding, it’s a real dilemma. It may be nearing a bottom and ready to move up. If you sell, then for sure it will move up. Murphy’s law. If you don’t sell, it will continue to drop. My suggestion, forget about everything in the past and pretend you bought Friday and take action on Monday based on what you should do with such a trade.

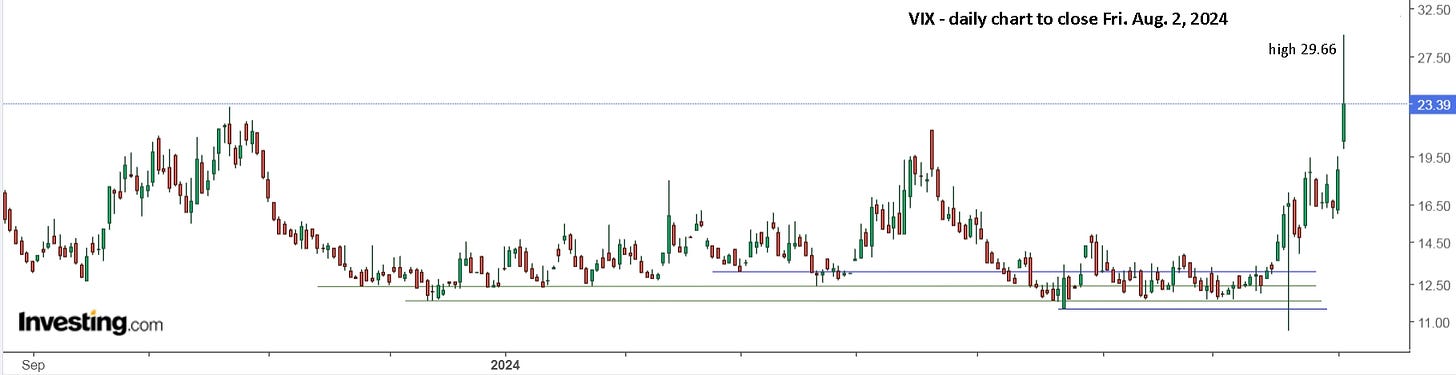

Last week was also a clear example of why it’s best to be completely in cash when things are uncertain and opportunities may present themselves. In my last update, I wrote, “Another trade option when markets are falling is UVXY. It can provide massive returns of 1000% in a few weeks during major drops like 2020. I wrote 2 articles last year, first “Make UVXY your winning lottery ticket that keeps on winning.” in August, and “Volatility can be super safe and life changing.” The trick is to avoid small losses before getting on board for a run higher.”

This week, patience paid off with an opportunity to buy on Thursday and sell on Friday for a gain of up to 60%.

This is the potential with UVXY and more with UVIX (2x versus 1.5). There used to be TVIX, 3x, which was even more amazing. It is absolutely not an ETF that you want to hold for any extended period of time, yet some do and are then lucky to get out with a good gain.

As you can see, April was a decent opportunity, but there was no blast higher in VIX. JC has an excellent system for other ETFs, but it really doesn’t work well with UVIX or BOIL. Buying and holding since May 8 and holding through a slow drop of 37% is simply a bad idea. Without the extra pop on Friday, he would still be underwater on his first buy, and potentially never get a profit on it, like his SOXS buy from last year. The smart trade was to buy Thursday morning and sell half on Friday. That was the cherry on top of +27% buying Monday, July 15 and selling that Friday, and +23% buying July 24 and selling the next day. One may have wanted to sell on Thursday, with it back to the July 26 level, but the key is to stay in the trade for as long as possible. On Monday, Aug. 5 it opened 19.63 from 10.40 (+88.8%), high 19.97, low 13.70 at 12:30, close 19.18 (+84.42%) ; VIX 38.57 (+64.90%), high 65.73, ES close 5186 (-3.00%) gap lower and on the day. That’s the massive win you’re targeting when trading UVIX.

Trading UVXY/UVIX requires a completely different mindset and strategy, but it can be amazingly profitable. The first step is to have sold TQQQ and long positions and be holding all cash. Then, you buy early with a tight stop if the setup is there, and hang on for the ride. VIX will generally make big moves to 30+, and Friday’s move was the first time since March, 2023. Clearly, JC was lucky to be able to sell his shares on Friday.

The markets may find a bottom next week and VIX might push higher, but the best opportunity was last week, with plenty of time to be ready for it. Now, simply remember all this for when the next opportunity comes along.

Update to Fri. Aug. 16: The goal from the July 19 update was to be a day ‘late’ buying TQQQ. In the Aug. 2 update, the ideal was to still be on the sidelines, or short. For anyone still holding, I wrote, take action on Monday based on what you should if you had bought on Friday. In past articles, I have also pointed out many examples of Mondays gapping lower and powering up on the day. Such days need to be acted on, since being a day late makes buying a lot more difficult.

For me, the move on Fri. Aug. 2 was overdone and made no sense. Buying TQQQ then was risky and a bad idea. The markets all gapped way down on Monday, Aug. 5 because of a big drop in Japan, as a result of a carry trade and the increase in interest rates in Japan. As is always the case, it was simply a trigger and excuse for big market players to throw their weight around and rock the boat. The key is to simply be ready for a such a move and take action. Buy early and if it drops, sell. The low of 48.97 was only -0.47% from the open, which was -16.24% from Friday’s close. Within 10 minutes, it was up 6.1% from the open and you can relax and enjoy the ride. By the end of the day, you’re up 9.0%. That’s a good return for taking action and watching for 10 minutes. And a good return on your weekly review to be ready in advance.

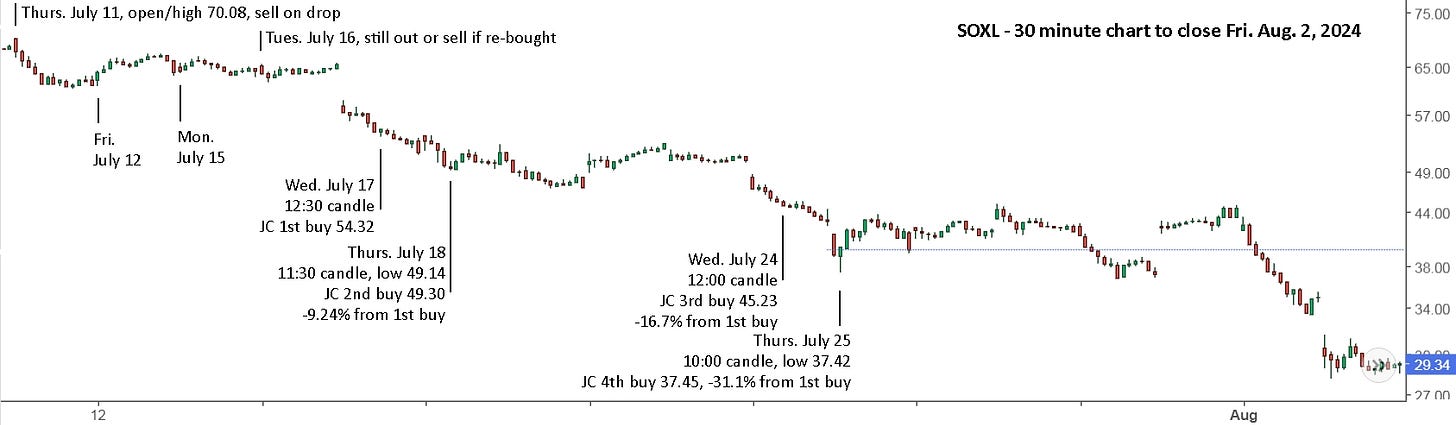

It still surprises me that ‘good’ systems continue to make ‘bad’ buys. JC bought 1/2 of 1st batch at $70.45 on July 19. He was up the next 2 days and could have sold for a small loss on the gap lower July 24. Instead, he bought 2/2 of 1st batch at $69. The next day he wrote that QQQ will continue to descend > 4 weeks until K- for bargains purchases. He has such confidence in his method that he willingly and purposely buys more as it drops. He then bought again after hours on Aug. 7, 1/2 of 2 batch $51.37, which was -12.2% from the high on the day of 58.51, still well below his first 2 buys. On Aug.13, he sold that buy for +23.6% in 5 sessions at 63.47. On Friday, Aug.16 he sold his second buy for +0.4% in 3 weeks. Surprisingly, he bought a third batch of SQQQ on Thursday, 1/2 of 2nd batch $8.25. The first 2 batches were bought in 2023!

I am now completely unwilling to hold positions for a loss, or to hold both short and long positions except for short periods during the day at a possible transition point. BANC bought TQQQ early and sold August 13 for -18% and -14%. BANC is +32.5% YTD, so pretty good, but TQQQ is +39.5% in 2 weeks. On Sunday, Aug. 4, Sandimas commented, “Right now "B" is -24.6% and "N" is -20%. N has never sold for worse than -7.2% since 2004 (about 250 trades).” Typical bad luck. After he starts the program, they have their worst trade ever! With his own trading of SOXL, he wisely stopped out of each early buy, so was only down a few percent on multiple efforts.

Sunday evening, he messaged me saying, “Just a heads up, futures are looking to gap down to a new low and VIX will be key to watch. A Monday gap down could be a fake and then rally all day. I'm talking a -3% QQQ gap down then up +3% by end of the day. It may be the best odds to start with the long bet with a tight stop.” Now that’s the kind of alert these trade groups should be giving, or your personal financial advisor. Clear, actionable, and timely. My reply, “Interesting to hear the chat room fear. A gap lower is what I was expecting. Such moves on Monday happen often enough to say it's 'common'. And if VIX doesn't make a new high, that's generally characteristic of the bottom. I will likely not jump into anything in the first 5-15 minutes and will remain on alert till 11:00. After 45 minutes, I should be able to set alerts to catch a turn.”

For the life of me, I don’t know why I didn’t plan to buy hard at the open if it moved up. Within the first 10 minutes, TQQQ was up 6% and SOXL was up 12.6%. In the next minutes, SOXL went down 5.8%, then up 7.7% to a new high within 10 minutes. Buying the open/low 23.50 with a stop allowed you to ignore those wild swings, especially if you had a committed mindset towards the day, which Sandimas had and I should have had. I even bought SOXL pre-open at 22.48, -24.2% from where I sold on Friday to be safe and not hold. It was only a small amount and I was stuck in some shares from Thursday when my trading account was locked. I should have sold them for a loss on Friday. Such things can really throw one off their game, especially when you don’t have a very clear system to follow. (And I’ve yet to see a clear system that actually works.)

Sandimas got it right, “Yes, I bought SOXL at open as SOXX was right at 193-194 weekly and horizontal support. I went with a 15% position but I really wanted to go larger. My plan was 10% at support, but this drawdown is ridiculous. I am not planning on day-trading or selling early. I 100% trust my backtest.” That’s the conviction needed, and to be honest, one needs to confidently go ‘all in’, and not just 15%. This lesson will definitely stick with me and I won't lack conviction next time.

I don’t have a specific method to determine buy points, which JC and BANC have, but I firmly believe that it’s entirely possible to have caught this recent move, as Sandimas did, along with many others in the past and future. I wish I had a method that specifically sent an alert, at the moment, to buy and sell, but I don’t and never will. I simply have to develop the skill to take action at the moment, on my own and with confidence. I hope some of you reading these articles and updates have already developed that skill. To my surprise, BANC bought SQQQ on Wednesday, so they’re now underwater with SQQQ and missed out with TQQQ. JC bought SQQQ on Thursday, still holding TQQQ underwater, then sold some TQQQ on Friday for breakeven.

When I look at the charts, I just don’t see any reason to be short. I also don’t think it was a good decision to take gains off the table. To me, it seems like the 3 day drop was a departure from the trend, and we’re now getting back to trend.

Whether you made big gains or losses over the past 2 weeks, what’s important is to have learned some valuable lessons that you can apply going forward.

The big mover is almost always SOXX, semiconductors, with SOXL and SOXS the long and short leveraged ETFs. Let’s review this recent move, see what JC did and decide what you want to do the next time it happens. Here’s the lead up.

To clarify, JC sets his buy and sell orders the night before, and he’s completely willing to hold them as the price drops, and thus buys up to 6x for a full position. I prefer to have a plan in advance, but make the decision on the day, and always put in a stop sell after buying. Clearly, the best trade was to have bought SOXS on July 11 after selling SOXL. JC’s fourth buy is -31.1% from his first buy, and the closing price on Friday, Aug. 2 is -46.0%! On Monday, Aug. 5, it opened -19.9% from Friday’s close! JC was down 56.7% on his first buy and not buying at the open.

It seems abundantly clear to have sold on Thursday, Aug. 1 when it dropped at 10 a.m. if you were holding a long position. Once you’ve sold and are safely on the sidelines, then you can search to see what ‘caused’ the drop. Buying a possible morning reversal on Friday made sense, but holding over the weekend was risky. Buying the gap lower on Monday, Aug. 5, was a classic no-brainer gift that comes along occasionally.

If you’ve been reading these posts all year, you should remember the ‘all in’ buy on Monday, Jan. 8 for TQQQ (or SOXL).

So, the best opportunity has come and gone. Now we need to look forward and decide what to do. This weekly view of SOXX shows that it might not be too late to get on board for a run higher, but pick a seat near the exit, just in case the trend turns down like it did in 2022.

I also find it fascinating that the ridiculous drop went from upper to lower trendline, almost exactly. Here’s a monthly view for some additional perspective.

Good luck! And I hope my thoughts help bring clarity to your own.

Update to Fri. Aug. 23: This past week was essentially flat over a range, but it was a pretty big range for SOXL and SOXS if you were able to trade them well.

I decided to hold some SOXL, but I have no idea where the markets will open on Monday and where they will go during the week. The safe play is to be on the sidelines and wait to see what happens. Good luck this week!

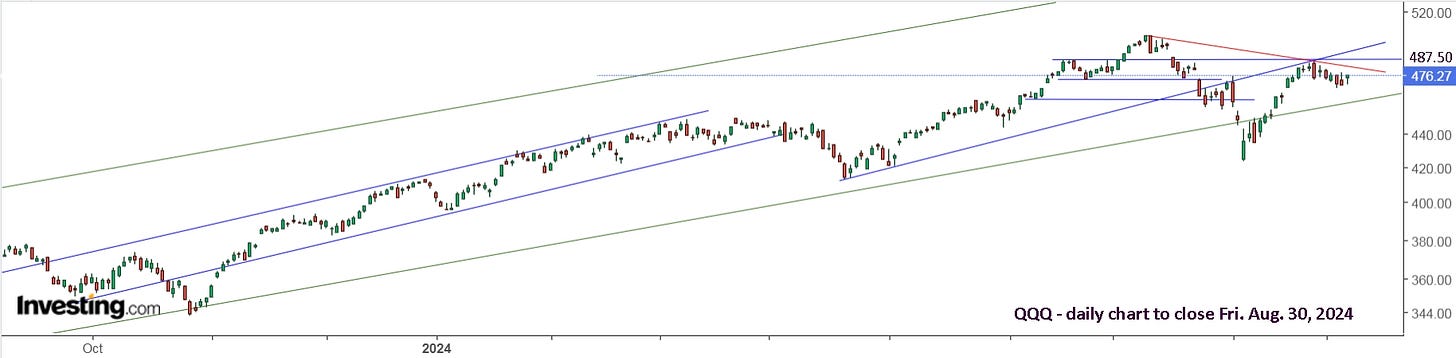

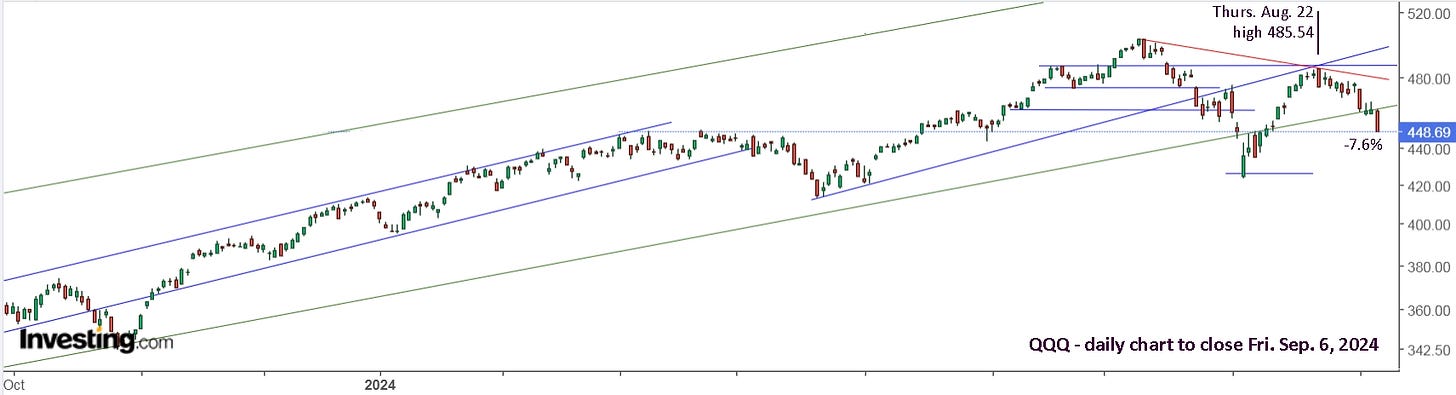

Update to Fri. Aug. 30: Early Monday, I sold SOXL and bought SOXS with a tight stop. The rest of the week, I remained bearish, while trading both long and short.

The early reversal on Tuesday was a chance to buy SOXL with a tight stop and then let it run. It went from a low of 35.55 to a high of 38.96, +9.59%! You did especially well if you held SOXS from Monday. You may have held SOXL for Wednesday, but you soon switched to SOXS, like Monday. I don’t remember a week that was that dramatically up and down repeatedly. Anything could happen next week, so be ready for it.

In general, I’m now biased short. The overall trend for QQQ is still up, but the lower high is ominous. If it pushes above the red downtrend line and then above 487.50, then it’s likely to continue higher. If it holds below the downtrend resistance next week, then there’s a good chance it will drop, perhaps only to the green support trendline, but caution is advised.

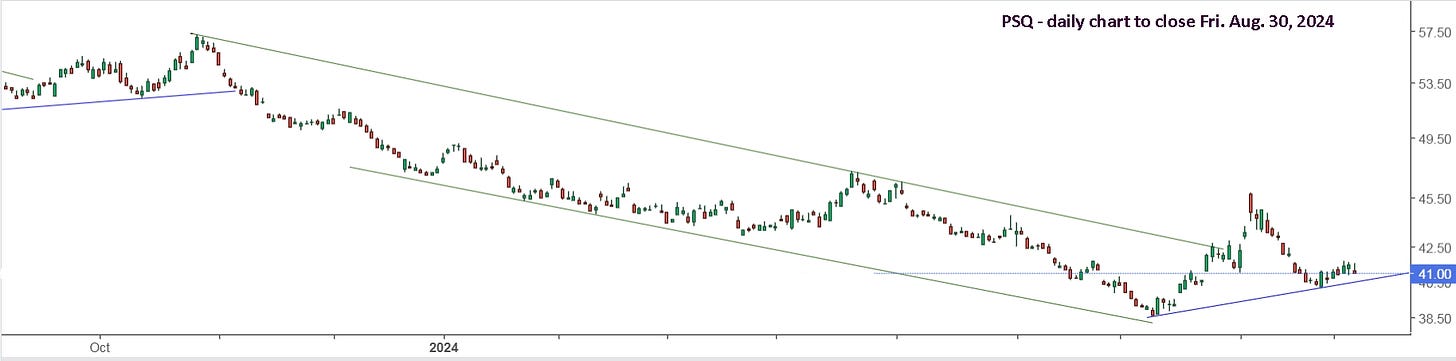

Here’s a look at the unleveraged short ETF, PSQ. This chart shows a clear, potential uptrend. Looking back to late 2021, you can clearly see a possible resemblance.

The potential path forward seems clear and the trendlines should help keep you looking in the right direction. I remain neutral, ready to go long or short.

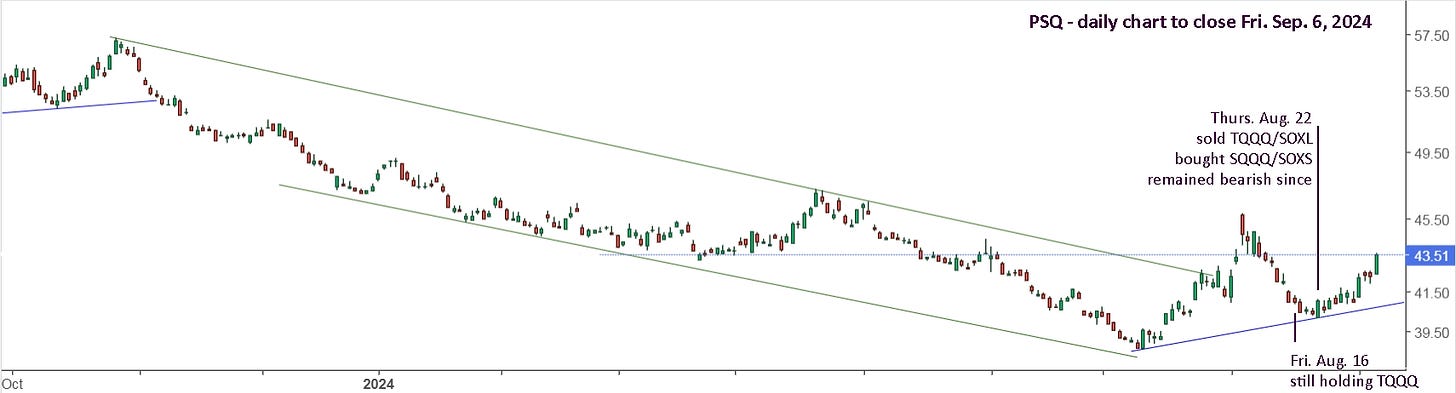

Update to Fri. Sep. 6: The updates for the past 3 weeks have kept you right on track. The update to Friday, August 16 was still bullish and holding TQQQ, even though it had made an enormous run up from the recent low on Monday, August 5. It lost momentum the following week and you switched from long to short on Thursday, August 22.

In last week’s update, I remained neutral, ready to go long or short. Monday was a holiday and I wrote “Getting ready for the next market crash.” I wasn’t expecting a crash right away, but I wanted everyone to be ready and waiting for when it comes. The article also focused on trading volatility with UVIX. It gave a monster move in early August and I wanted everyone to be ready for the next move. Even I was caught flatfooted when that opportunity came the next day, Tuesday, September 3.

The strategy is simple. If it gaps higher (and markets are looking weak), buy with a stop sell, then let it run as long as you can. Wednesday, July 24 was the ‘wake up call’, gapping up 5.9% and giving 19.6% at the close. No reason to sell. July 25 reversed hard at 10am, so sell and lock in your gain of over 20%. August 1 was another clear buy. Holding 3 days till the open on Monday, August 5, bagged a quick 230% gain. In all honesty, that was a freakish move, so don’t expect that opportunity to come around again. Here’s a closer look at this week’s move.

You really need to be prepared and committed in advance, with cash sitting and waiting to be deployed. If you try and decide how much, etc. at the moment, on the morning, the moment can easily pass and leave you watching it run higher every minute. Tuesday was just about as easy as it gets, as was Thursday, August 1. It opened at 4.24 (+4.18%), hit 4.22 in the first minute and went up to 4.30 in the first 5 minutes. That’s only +1.4%. Buy and set your stop sell at 4.19. If you’re stopped out, be ready to quickly re-buy. It hit 4.38 in the first 10 minutes, +3.3% from the open and a drop of 4.34% if you’re stopped out at 4.19. That’s more than I want to lose in 5 or 10 minutes. Delaying the buy by minutes has put me in a difficult situation. It then held 4.30s for 5 minutes, giving you some extra time to get off the fence. It hit 4.53 in less than 10 minutes after that. If you bought at the open, you’re up 6.8% and can move your stop sell to breakeven. Within 25 minutes, you’re set and comfortably watching the day unfold.

You can see the possible additional trades on Wednesday and Thursday. These require you to actively watch on the day, which is generally worthwhile. These ‘game on’ periods only happen every few months or longer, so you might as well play when the time comes.

Friday was a more difficult early setup, but a stop buy, just above the open/high, got you in and a stop sell then had you safe if it dropped hard after buying. It’s really as simple as that. Then, you let the day play out.

Once you’re in, keep your stop sell loose once it’s above breakeven. It’s better to give up 5% and be stopped out for breakeven, than sell for 5% and then have it go up 20%. If you are stopped out, like on the 11:00 spike down at 5.95 for +14.0% (hit 5.80), you can easily set a stop buy for 6.05 (+1.7% from sell). Setting a stop buy at 6.35, just above the prior high of 6.28 is generally a bad idea. It’s +6.7% from your sell price and could easily trigger in and then plunge. It’s best to keep a close eye on the game when the action heats up. Once it calms down again, you can set your stops and go to the concession for hot dogs and beer.

Holding UVIX over the weekend is completely optional. It’s entirely up to you. Greg is holding his full position and I re-bought half of mine.

There’s certainly no reason to be holding a long position with TQQQ.

Update to Fri. Sep. 13: Monday, Sep. 9 turned out to be another reversal with a gap higher open in the markets. Once it held a higher low than Friday, it was time to re-buy TQQQ or SOXL.

The current setup is about as clear as it gets. It will either push through resistance, or it will fall back to support. There was no compelling reason to sell on Friday to lock in the gains for the week, but it wasn’t a bad idea either. Next week has the FOMC meeting announcement on Wednesday, so it’s unlikely that Monday will be a big mover. Regardless, be ready for it and take the necessary action.

If you haven’t made great gains short then long in the past 2 weeks, you need to take a close look at what you did and didn’t do. Then review what you should have done and make a clear plan for how to make it happen next time.

Simply avoiding the drop to start the month, then catching the gain this week provided a gain of 16 - 26%. The support and resistance lines are now very clear, so catching the next move should be a piece of cake. Here’s a look at the short trades.

As you can see, SQQQ, like TQQQ, is less erratic than SOXS and SOXL, but the potential returns are also generally less. UVIX often moves even more dramatically, and sometimes works as an early indicator, like Fri. Sep. 6 when it dropped at 12:30, while the SQQQ and SOXS dropped at 1:00. The strategy is similar for all three, but ‘riding’ SOXS and UVIX isn’t generally as easy as SQQQ. A bit like a regular horse and a racehorse. That said, some days, like Mon. Sep. 3, the UVIX trade can be incredibly easy. Even Fri. Sep. 6 and Thurs. Sep. 12 were relatively easy, just buy the early move and stick with it till it tops out.

In the past 2 weeks, you’ve seen examples of just about everything you need to see. Regardless of your performance over that period, you should be able to see clearly what could and should have been done, and be able to do it better in the future. Good luck!

Update to Fri. Sep. 27: Monday, Sep. 9 turned out to be the reversal from a big drop in the markets on Friday, Sep. 6. You might still be long TQQQ or SOXL since then, but there were some big swings. If you’re holding SOXX or QQQ with minimal trading, then you’re simply still long from Sep. 9.

The move up and down after the FOMC announcement on Wednesday, Sep. 18 was pretty extreme and a rejection of a possible breakout through downtrend resistance. If one was holding SOXL or TQQQ, you’d certainly have been stopped out, as SOXL fell 8.62% from the high. If one was certain that it was going higher, then you could have re-bought late in the day, but unlike NG which is fundamentally under priced and re-buying the drops makes complete sense, there’s really no way of knowing which way the markets would open on Thursday and all signs were pointing down.

To me, a gap higher of 11.4% is simply ridiculous and a clear example of how the markets are manipulated. ‘Sentiment’ did not miraculously change overnight for millions of investors, and regular investors have no way of setting gap prices. Nothing can be gained from complaining about it, so simply do your best to get back in the game. The gap open on Thursday, Sep. 26 was related to the gap up in MU after its earnings report, and that was a good time to sell SOXL on a tight stop. Buying it back 8% cheaper on the reversal was wise, and trading again on Friday would have then provided some nice additional gains for your efforts. All done safely, without any overnight risk. The trend is still up, so holding on Friday makes sense, but I won’t be surprised if the markets gap lower on Monday. Here’s a look at QQQ.

I’ll be watching to go either long or short on Monday.

Update to Fri. Oct. 18: Monday, Sep. 30 shot up early, then fell, then held. If you were short with SQQQ from Thursday, Sep. 26, you’d still be holding. If you were watching to buy TQQQ, you’re still watching and waiting. The late move up suggests that it was best to sell SQQQ and take the win. I don’t like starting a position late in the day, but you may have bought TQQQ. If you did, then you needed to sell first thing Tuesday, Oct. 1, and buy SQQQ. If you sold SQQQ, you simply re-buy, safely.

The support line is an extension of the line from Sep. 6 - 11, so it’s interesting that it came into play again on Oct. 1. No need to buy at 11:15, remain patient, wait for the support to prove itself and buy higher if necessary. If you did buy Tuesday, you either sold early Wednesday for a small gain or break even, or kept your stop sell from Tuesday, which wasn’t hit. After that, the uptrend begins to prove itself.

By Fri. Oct. 11, the uptrend is clear. If you sold Oct. 7, or hadn’t bought yet, then you needed to buy early Oct. 9. Although tempting to sell late on Friday, Oct. 11, it’s best to keep holding. It’s still in an uptrend, at support, so best to risk giving up some gain versus being left behind on a gap up open.

Once it hits resistance after a sharp move up, early Monday, Oct. 14, then you might gamble and sell. Alternatively, you sell on the sharp drop at 10:00 Tuesday, Oct. 15. One could then go long again on Wed. Oct. 16 and draw a new support line through the early low and the low on Oct. 7. As with Friday, Oct. 11, it’s best to keep holding, even though the uptrend was broken.

On the daily chart, the uptrend is still on, but with diminishing momentum, and it’s approaching the point of a wedge, where it will have to break either support or resistance.

SOXX has less upward momentum with horizontal resistance, and is also in a wedge that will have to break.

SOXL shows how the leverage causes decay in just 2 months. I’ll again be watching to go long or short on Monday.

Update to Fri. Oct. 25: The markets were essentially flat for the week, still within their wedge setup. For a more detailed update, see my latest article, “Getting ready for the next market crash.” (Sep. 2).

Thanks for writing another article. Belief and emotion is what separates us from the bots. If we were bots, we would just follow a prepared strategy and do very well. You may be right that it takes belief or maybe confidence. Maybe it just takes careless courage to keep following a strategy regardless what is going on around you.

Yes, I am going to follow a hybrid of BANC and my own strategy. I plan to make large trades long and short depending on alerts. If I would have followed my system 9 months ago, I would be preparing for retirement already next year. So I've seen enough with live testing and getting wrecked for doubting my system. For the most part the trend lines, support and resistance, etc are all very good tools. Just need to be consistent with sizing your trades and sticking with it.