Volatility can be super safe and life changing.

Keep your money safe and ready to double in a month or less.

I want this article to be helpful to everyone, of all ages and all levels of investing experience, including none. I also want it to be life changing for everyone who decides to try and I wouldn’t be writing this if I wasn’t 100% certain that it is safe and effective.

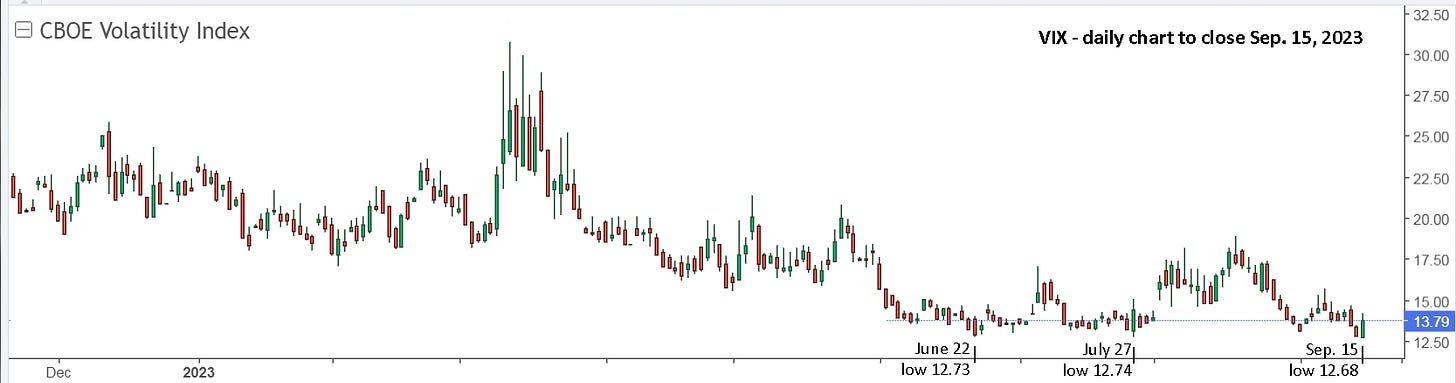

The volatility index, VIX, is often referred to as the ‘fear’ index. When markets crash, fear increases. The harder the crash, the sharper the rise in fear. As you can guess, 2008 and 2020 were the two most recent occurrences of extreme fear/volatility.

If you have investments, you may have lost money those years. With volatility, you could have made 10x your money, +1000% returns in a few weeks. We all know the markets will crash again, so how can you safely profit when they do? It’s really quite simple, and for us Canadians, it finally got simpler with Wealthsimple.

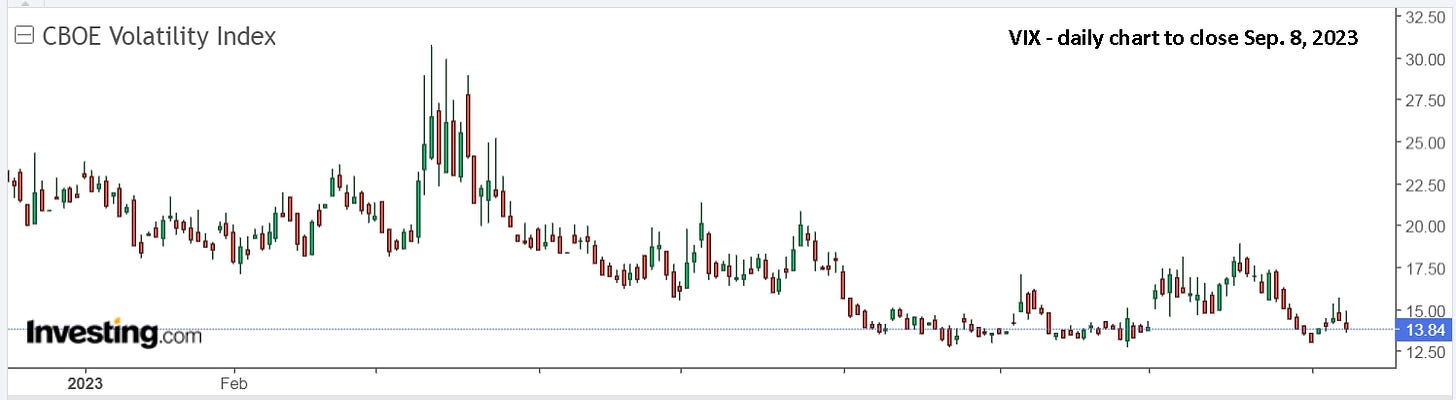

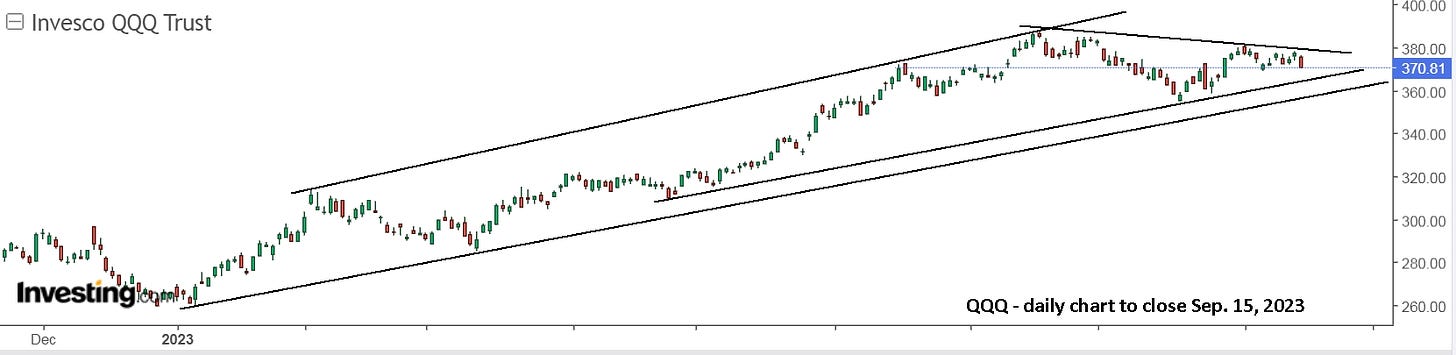

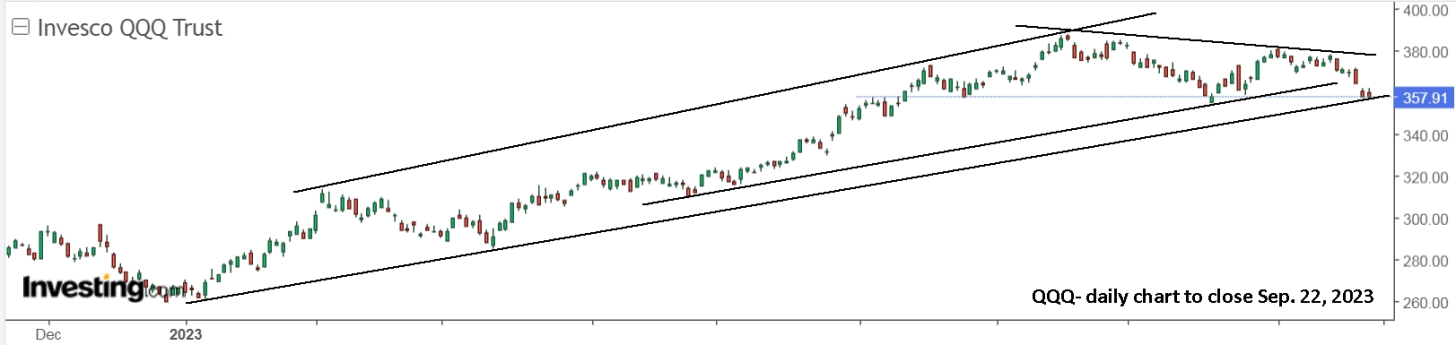

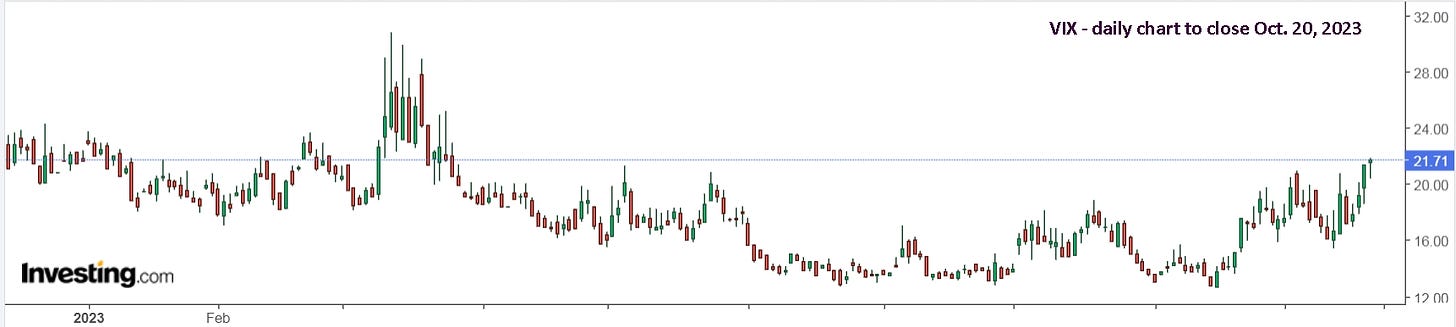

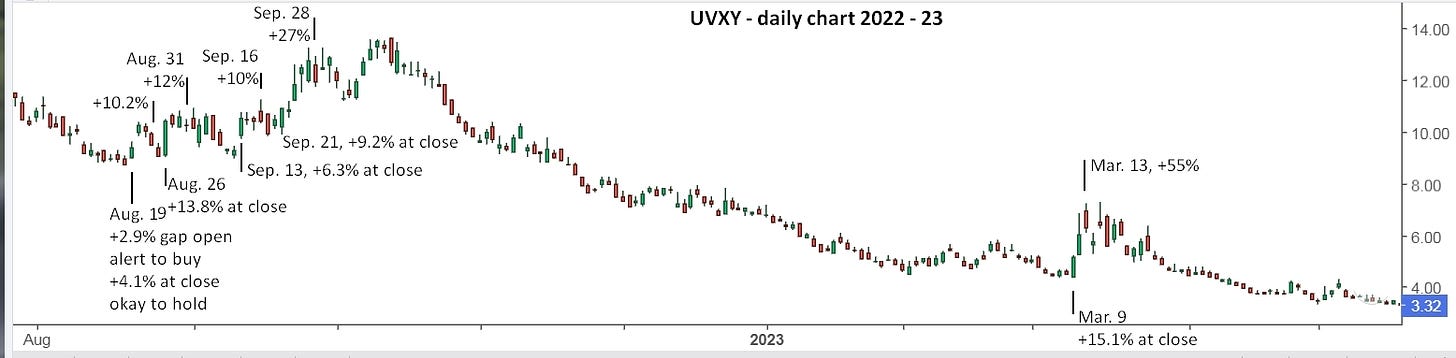

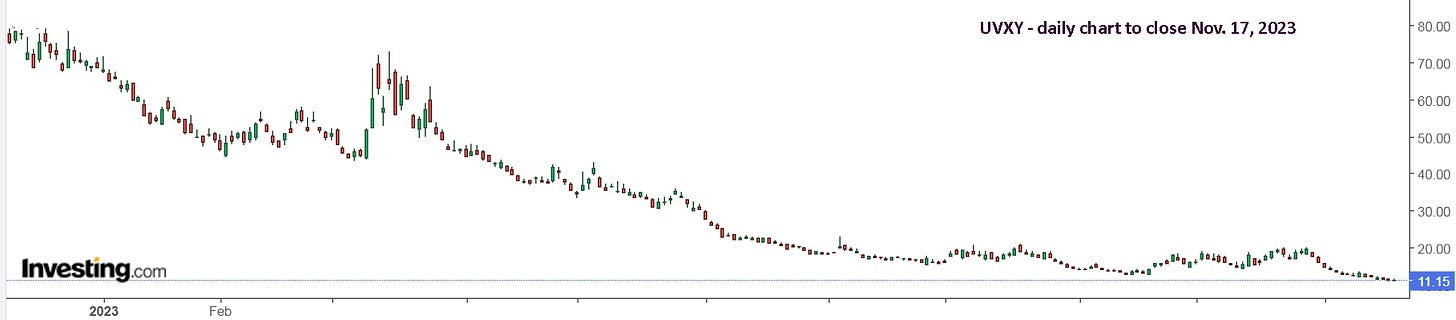

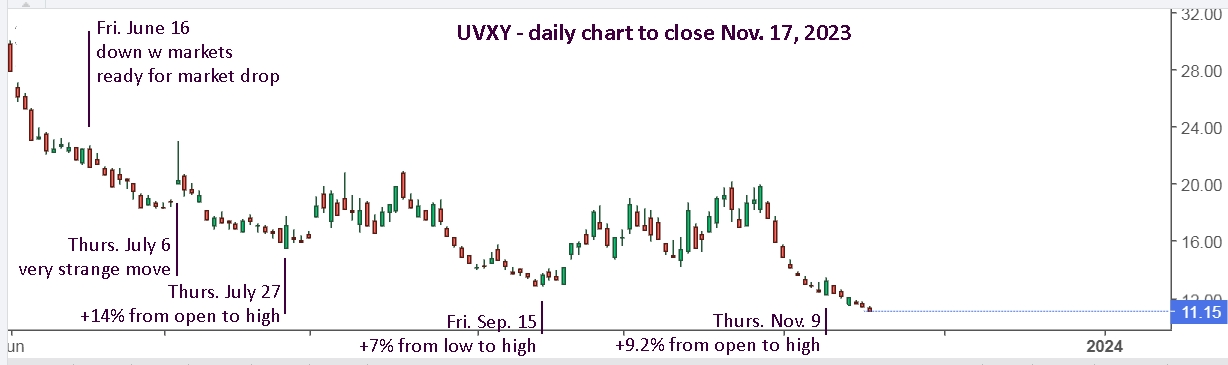

In the chart above, you can see that volatility has been falling since October, 2022, when the markets bottomed and turned up. There’s a sharp spike in March when some U.S. banks failed and it’s now down to multi-years lows. On Friday, June 16, I went short the market and over the weekend wrote, “Are you ready for a market drop?”.

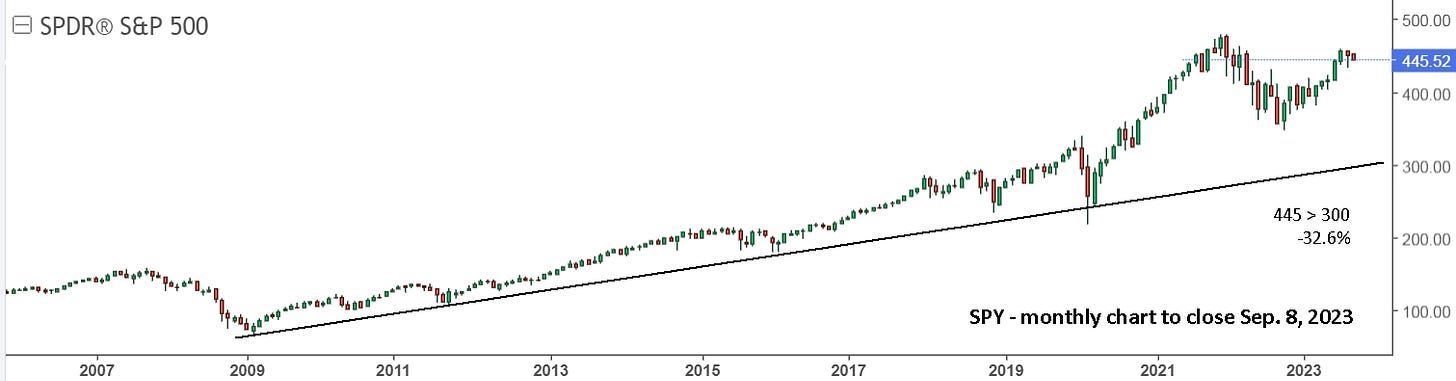

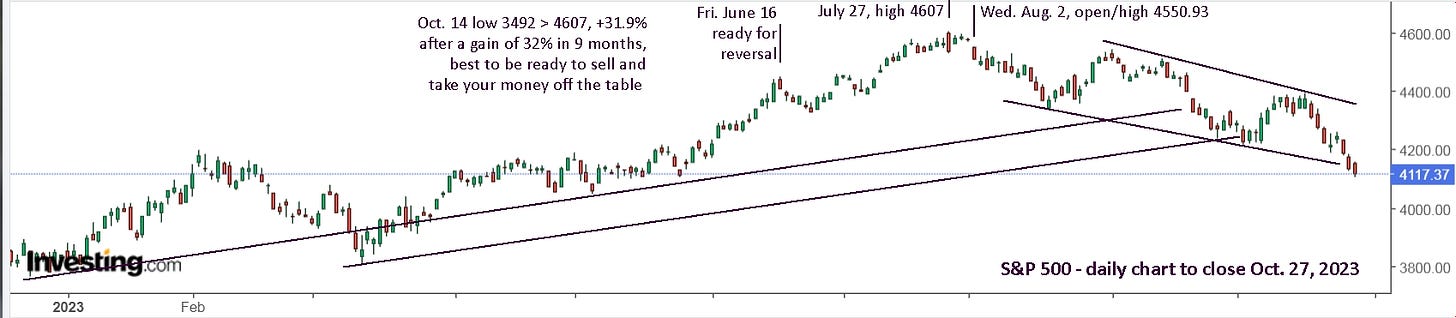

I think everyone would agree that the market looks ready for a drop in the above chart, and it did indeed drop, rallied, then finally had an extended pullback in August. Now it’s in the middle of its channel so it’s difficult to guess where it’s headed next.

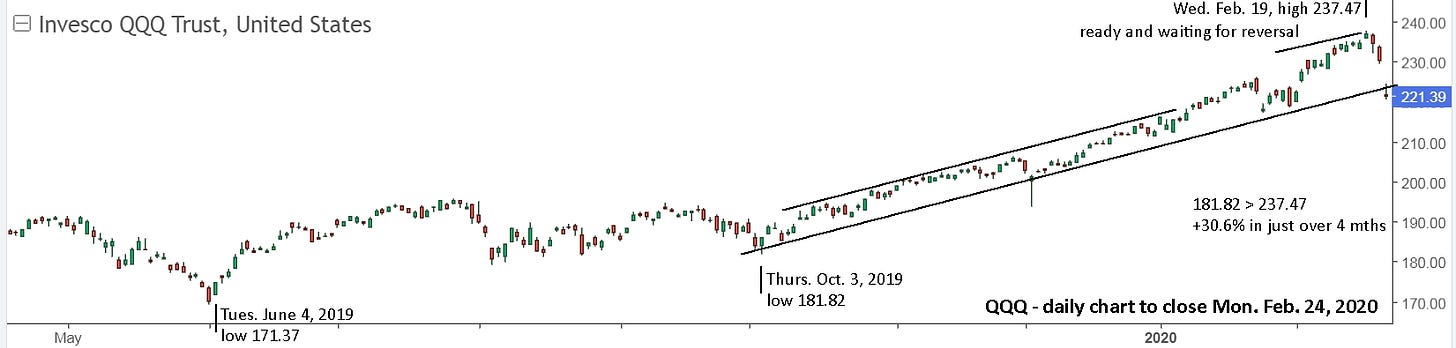

Did your financial advisor caution you of a potential market pullback in June or July? Did they warn you in advance in 2020 and 2008? Did they help you double your money in those years? Super if they did, keep reading if they didn’t. Here’s a look back to 2020. You’re up 30% in just over 4 months with QQQ (which follows the Nasdaq) and it really looks ready for a fall, so you would have sold on Thursday, Feb. 20 or Friday at the very latest. You can see the huge gap lower on Monday, Feb. 24. There was absolutely no reason to have been caught in the covid crash.

We all remember what happened next but a visual reminder should be useful. QQQ dropped 28.5% to the March 16 low, held bottom, spiked to a new low, then turned up. Obviously the world wasn’t going to end with covid and the drop was a major over reaction, but that’s what markets do, and you don’t want to simply ‘ride out the storm’. It’s like sitting through a hurricane in Florida and hoping for the best. How many financial storms are you going to sit through and do nothing but hope for the best?

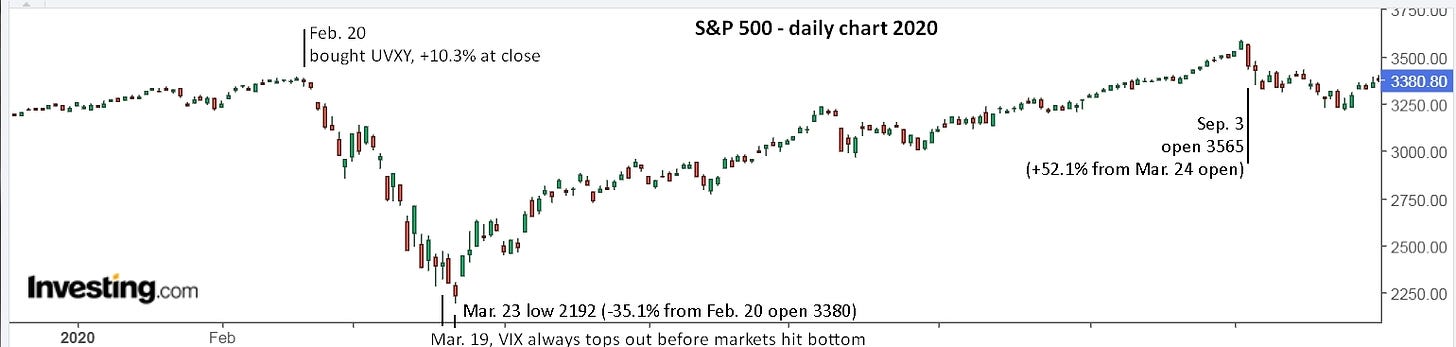

Here’s a look at the S&P 500, and note that it was abundantly clear in late August that the markets were stretched and ready for a pullback. With minimal effort, you avoided a drop of 28-35%, then jumped on board for a 52-65% return in 5 months. Providing you a ‘heads up’ for events like these is what your financial investor should be doing.

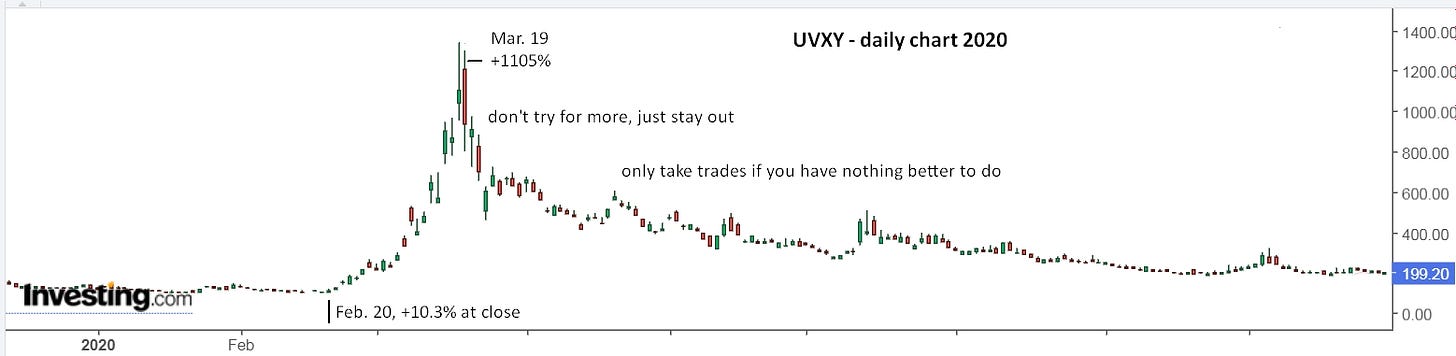

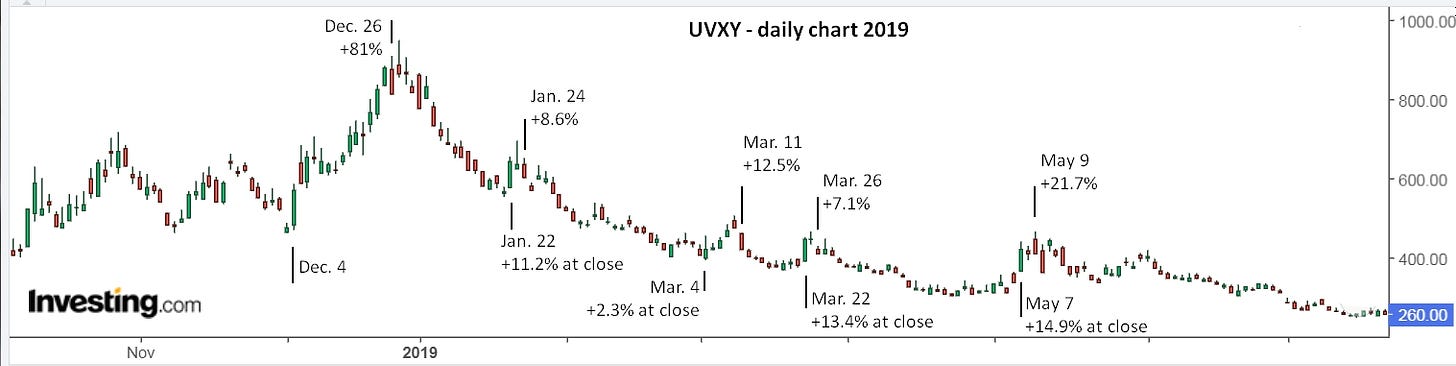

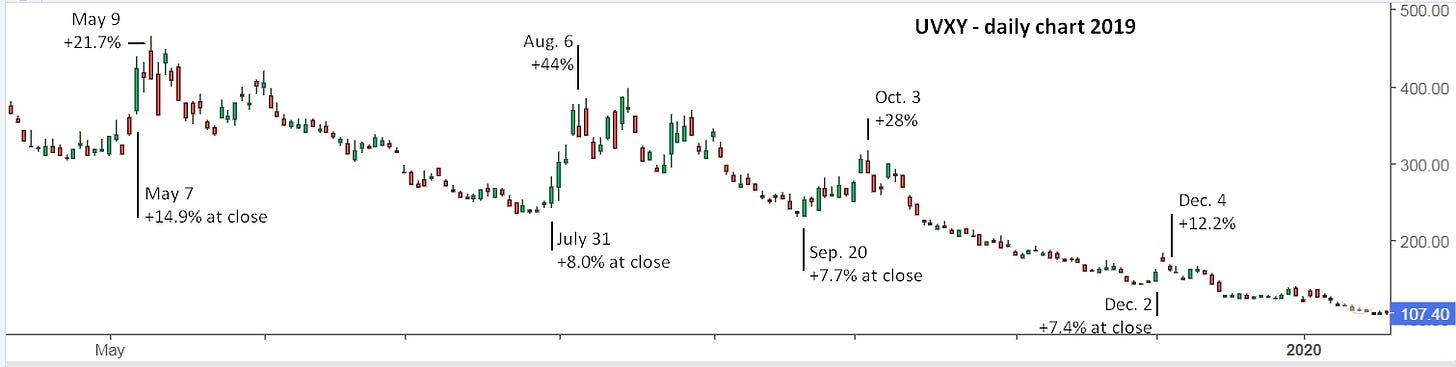

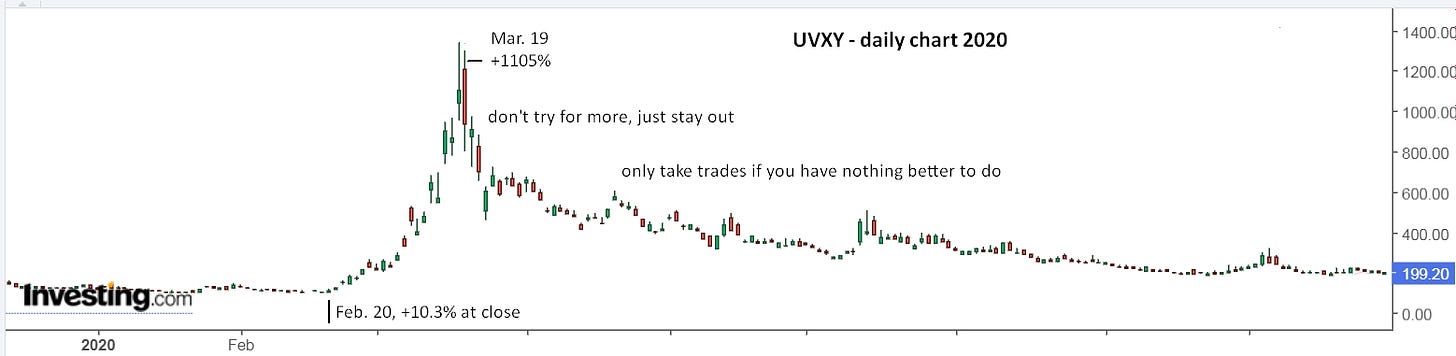

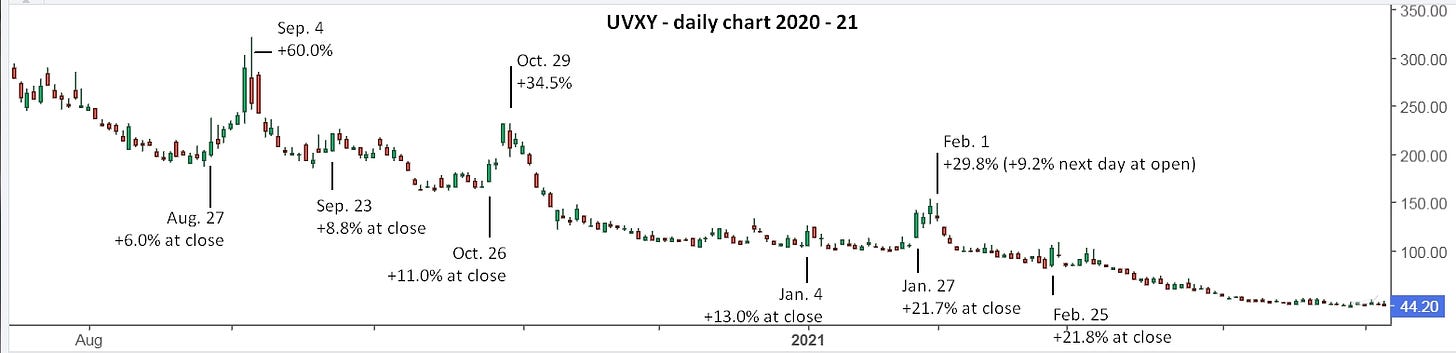

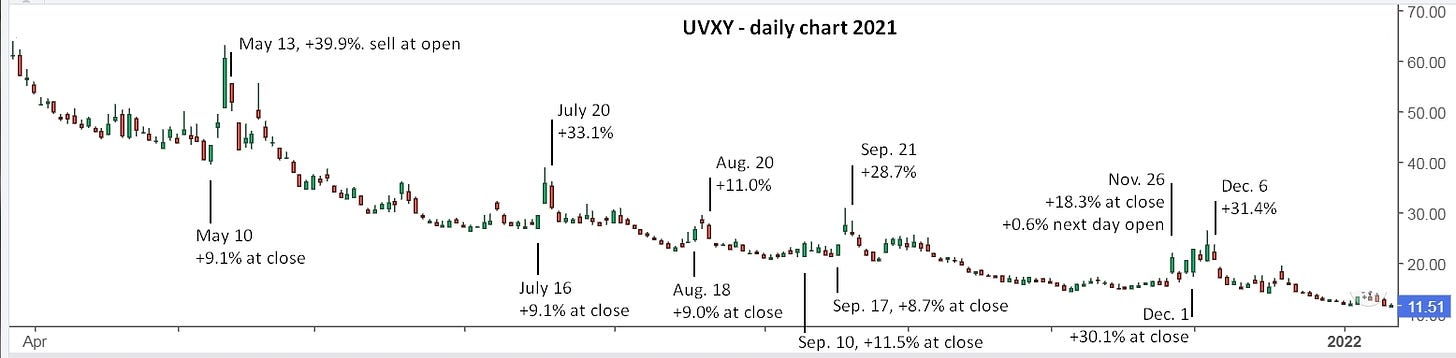

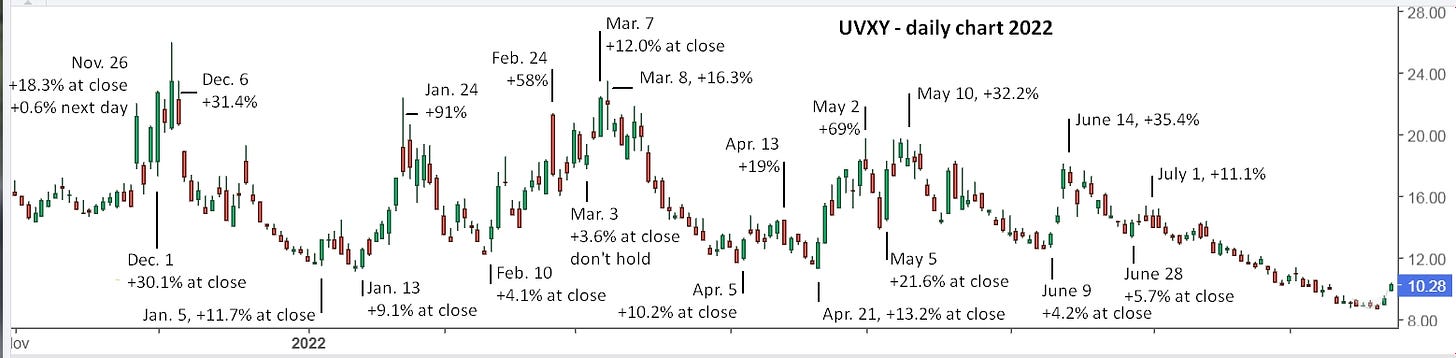

Now, here’s a look at UVXY, and this is what happens on every major market drop. Betting on high volatility in a market drop is like betting on high winds in a hurricane. It’s a fact of nature. Luckily, making money with UVXY is a lot easier than trying to capture the wind power in a hurricane.

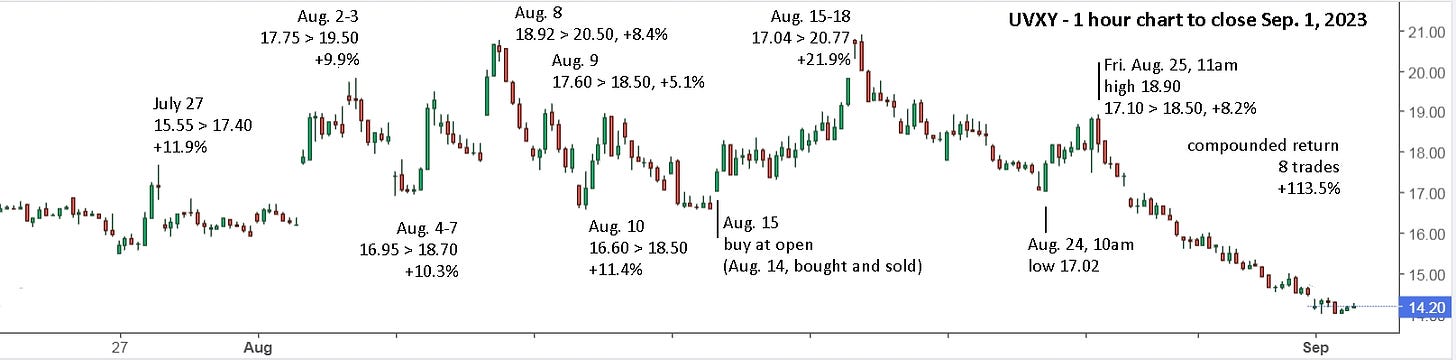

Back to the present, volatility finally made a spike move on July 27, and since you were expecting a pullback in the markets, you would have been ready to take advantage of that move by buying the volatility ETF, UVXY. Below is how you doubled your money in less than a month, +113% on 8 trades.

The secret is to buy early in the day when you see pre-market that something has happened (markets gapping up or down). On July 27, the markets opened higher and you were waiting for them to fall, and they finally did. So, you buy UVXY at the open, ready to sell for a maximum loss of 1%. Late in the day you’re up 11.9% so take the win. It’s really that simple. On August 2, you saw pre-open that UVXY was up 9.5%, so you again buy at the open, ready to sell for a maximum loss of 1%. This time you hold for the next day and sell as it drops for a gain of 9.9%. For a detailed account of these trades, you can read “Make UVXY your winning lottery ticket that keeps on winning.”

I hope you can see that if you never take a loss of more than 1%, it’s mathematically impossible not to make money if you are patient for the opportunities to present themselves. What’s interesting is that 7 compounding returns of 10.4% will yield a total return of 100%. After 14 such trades, your compounded return will be +300%. Worst case scenario, if you only make 7 such trades a year, you’ll still be up 1500% in 4 years. That’s the power of compounding returns. That could be life changing!

A good friend of mine has always considered me to be a thrill seeker. I have always told him that he’s more likely to be injured playing basketball, because there are so many things happening outside your control. I rock climb with a top rope, so it’s nearly impossible to get injured. For investments, he prefers dividends and suggested I talk to his wife who’s more of a risk taker. The fact is, many dividend paying companies can drop 50% or more in price, while paying the dividend, so if you want or need your money, you might only get 50 cents on your original dollars.

Here’s a look at 2 ‘safe’ dividend investments, Intel and Suncor. Dropping over 60% does not feel ‘safe’ to me. I have no idea whether they will go up or down going forward, but I do know for a fact that volatility will occasionally spike providing a ‘dividend’ of 5-10% in a single day.

For Canadians, Wealthsimple is now providing free USD trades and 4.5% interest on cash in accounts of $100k or more. A GIC pays between 3.5 - 5.5% at the moment, and your money is locked up for a year or more. Wealthsimple is paying 4.5% on cash, you can access the money any time you need it, and it’s ready and waiting for a volatility trade. I simply want my dad and my son and all my friends and family, and everyone, really, to not have to worry about money.

And there’s no need to trade the entire $100k. You can set up an account for your kids and stipulate they start with $1000 and take turns making the actual trades. Later they’ll determine who’s best at it and who enjoys doing it, and they can continue to manage the ‘kids account’. Importantly, they will have all learned some valuable lessons.

And the maximum loss in only 1-2%. It’s like rockclimbing with a top rope. You’ll never take a sudden 50% or 50m drop.

There’s no rush to set it up and get trading, but getting set up and ready in advance is a wise idea. And feel free to ask me any questions you like. Eventually there will be another major drop in the markets and you want to be ready and waiting when it happens.

Your choice now is simple. You can ask me a year from now if it worked, or you can look at your own account and see how well it worked for you. In case you feel your money is safely invested, here’s a monthly view of SPY (ETF of the S&P 500). That doesn’t look remotely safe to me, yet I suspect it will make new all time highs next year before it makes a big crash.

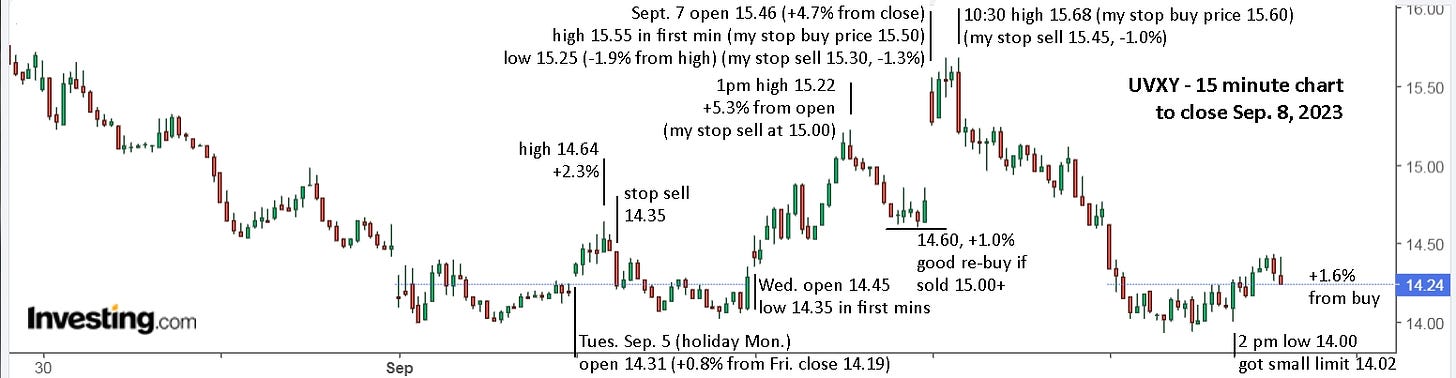

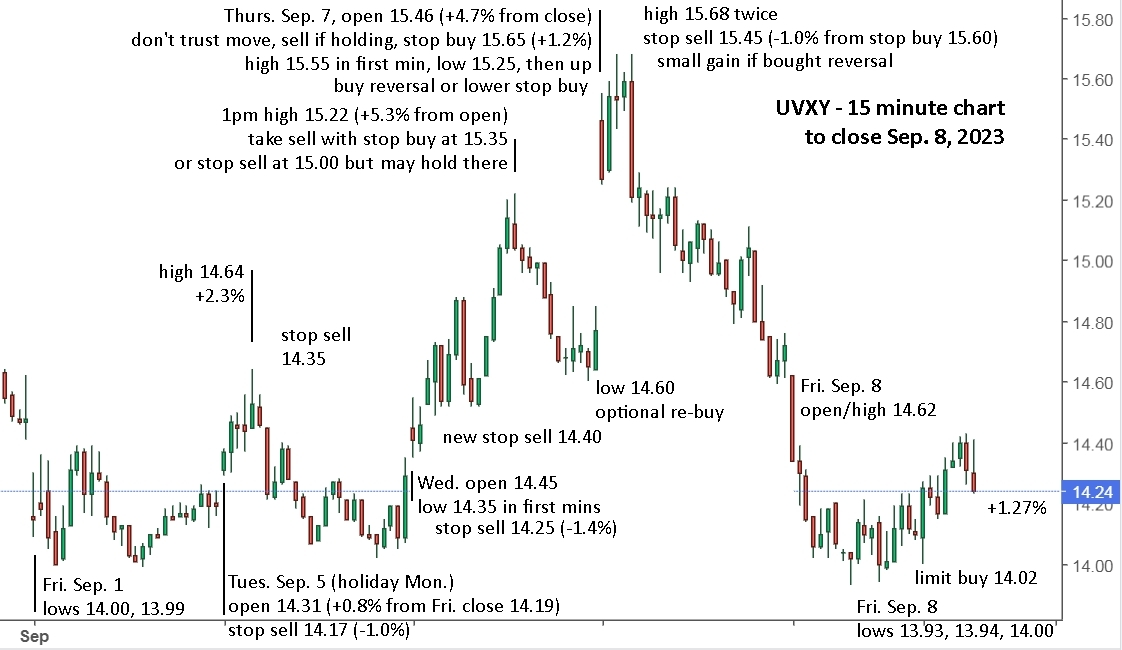

Update, Week 1 (Tues. - Fri., Sept. 5-8): On the weekend I wrote, SPX (S&P 500) is in the middle of its channel so it’s difficult to guess where it’s headed next. It gapped lower Tuesday, Wednesday and Thursday, then showed some strength. I remain very cautious and suspect things could remain choppy through to October.

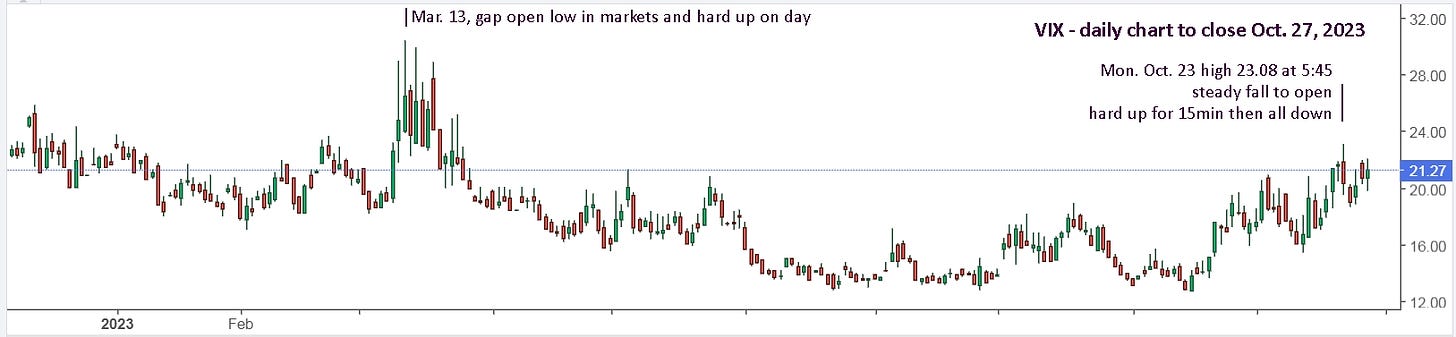

Here’s a look at the VIX and then I’ll take a close look at UVXY trades for the week.

The past week was a good opportunity to ‘get your feet wet’ and practice some UVXY trades. I kept my positions small since I wasn’t expecting a big move, and I need more practice sticking to the trading strategy! I’m a better coach than I am a player. Tuesday opened higher with the markets lower, so buy. I bought (14.31) and set my original stop sell at 14.25 thinking it would continue to teens if it dropped. When it pushed up hard to a new high after 10:30, I upped my stop to 14.35, then sold while it was falling from the high of 14.64. I got 14.51 (+1.4%) and put in a stop buy at 17.70 (+1.3%). It hit 14.02 just before 3pm and I could have bought some, -3.4% from where I sold and back to Friday’s floor, but the safer bet was to stay out. I’m also trying to do less trading. I wrote in a comment, “I bought later at 14.10, sold for a tiny gain and decided not to try again since I think there's a fair chance it will drop lower. Better to buy on a gap up tomorrow than late today. I'd also be careful on a gap up tomorrow in UVXY and would again buy SOXL for a move up, then be ready to sell either one.”

Wednesday, pre-open, I wrote, “I would either buy a small position at open (if you can't trade pre-market), ready to sell quickly, or wait for a push over 15 or VIX over 14.60. With VIX just below yesterday's high, it could hold that range and then fall again. Good luck.”

UVXY hit 14.55 in the first 5 minutes, then slowly fell, so I put a stop in at 14.60. At 10am, something slammed the markets lower, my stop buy was triggered, and I put in a stop sell at 14.50. Too tight in hindsight as I was stopped out by a penny and it reversed. I got back in later at 14.55, but buying off the open at 14.40, then keeping a breakeven stop so it had room to bounce around would have again been the easiest and best strategy. Then, when it hit a high of 15.22 at 1pm, you’re up 5.7% and you can up your stop to 15.00 (+4.17%) or sell higher with a stop buy at 15.35 or so. I went with the stop sell after which it held firm, as I thought it might, for nearly an hour. I stuck with my stop buy at 15.35 (later lowered to 15.10) and it finally dropped at 2pm.

I then bought a bit at 14.70 since I was also in SOXL and didn't know which way it would go and expected some bounce in UVXY for a small trade. I didn't sell on the first rally and then got 14.80 late in the day. I would have been okay holding it, but I expected a lower open Thursday after 2 gap up opens. In hindsight, holding some made sense, I had some profit locked in and a cushion of 1.0% from an early buy of 14.40. I missed the good early buy, so didn’t have that cushion.

When it gapped higher on Thursday, I was very skeptical, put in a stop buy at 15.55 (too tight, +0.58% from 14.46 open) which triggered (exact top) then fell and stopped out, then triggered back in and sold for -1% twice on small positions. It was then easy to stay out the rest of the day as it slid lower. Friday opened a bit lower and fell sharply the first 20 minutes. Sell if you had re-bought and stay out. Set an alert at 14.50, just under the open/high of 14.62 and another alert at 14.10, so you can watch for a reversal from the recent floor. Here’s another look at the chart and you can plan your strategy for going forward.

I’m not confident the markets have found bottom, so I put in a limit buy at 14.02 after hitting 13.94 at 11:30 and 12:30. We’ll see on Monday if I was lucky or not to get the order filled at 2pm.

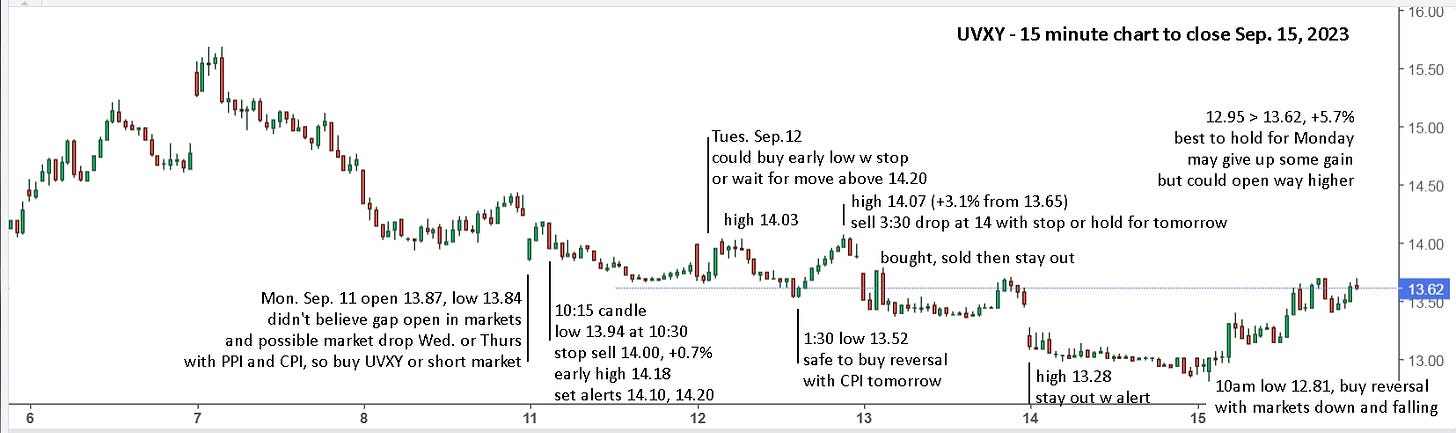

Update, Week 2 (Mon. - Fri., Sept. 11-15): No luck with Friday’s buy as it gapped lower Monday at 13.87, hit 13.84 and moved up. If not holding any shares, it was an easy buy then sell for a small gain. Holding shares has you thinking sell, instead of buy, so it’s important to simply be ready to sell, then buy as you would normally. As it slid lower, stay out. Tuesday opened higher, but below Monday’s high, and fell from the open, then bounced around below 14, with your alert set at 14.20. Knowing that CPI was Wednesday pre-open, I bought the 1:30 reversal (with a tight stop sell) and sold on the late drop, deciding not to gamble.

Wednesday had several hard reversals which you may have bought and sold, then be out at the end of the day. Thursday, after PPI, the markets opened higher and fell, so I was again ready to buy UVXY, did and sold. Once the markets reversed and moved up with UVXY holding flat, buy long and hold. Friday was a complete surprise to me, and one needed to sell long buys for breakeven and buy short. UVXY remained low, with a spike low of 12.81 at 10am, then pushed up. With markets still falling, it made sense to buy the 10am reversal at 12.95 or 13.00, then hold all day. Being up 5.7%, and given the significant drop in the markets, it made sense to hold UVXY and other shorts over the weekend.

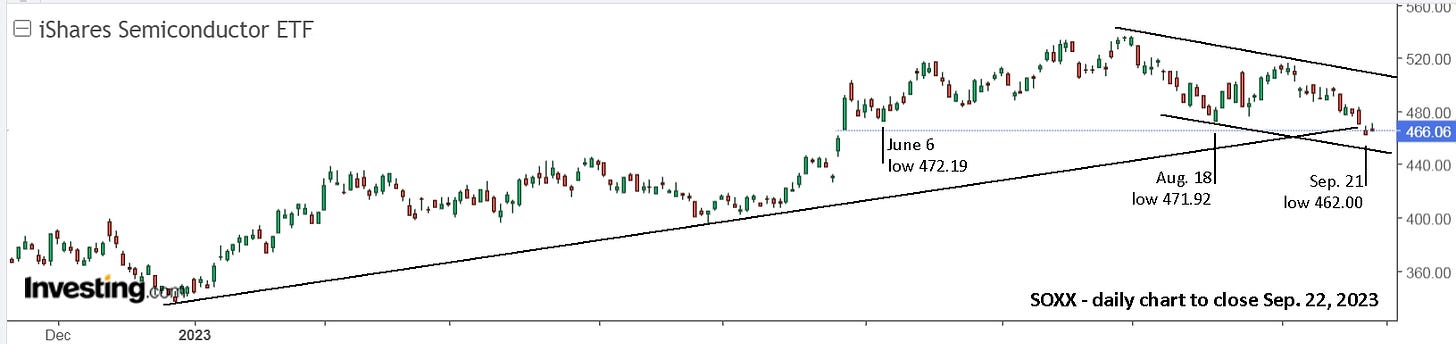

Here’s a daily look at the markets, and you can see clearly that Friday’s move was significant. The upward momentum of the past 6 sessions was completely wiped out. It now looks likely that the lower support line will be tested.

Going short the markets at this point, so near support, is difficult, but UVXY may give a decent move since VIX is so low. If the markets break support, the drop will likely be significant.

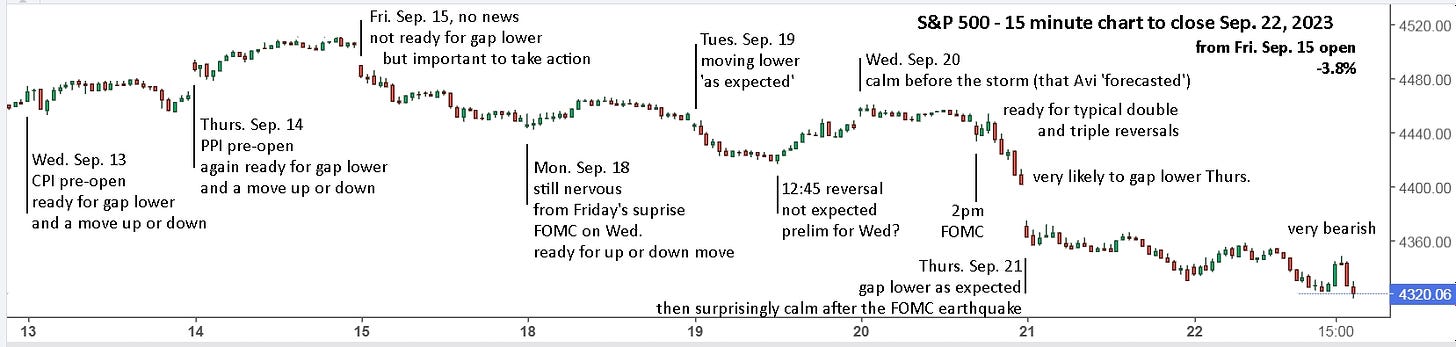

Update, Week 3 (Mon. - Fri., Sept. 18-22): Now we can clearly see just how significant the move on Fri. Sep. 15 was. And we were watching and ready for such a move all week, with Avi’s warnings and our own conclusions. Even being completely ready, didn’t make the action needed on Friday any easier to make. Knowing what you should do and being ready is less than half the battle. Taking the shot and scoring the goal takes practice to master.

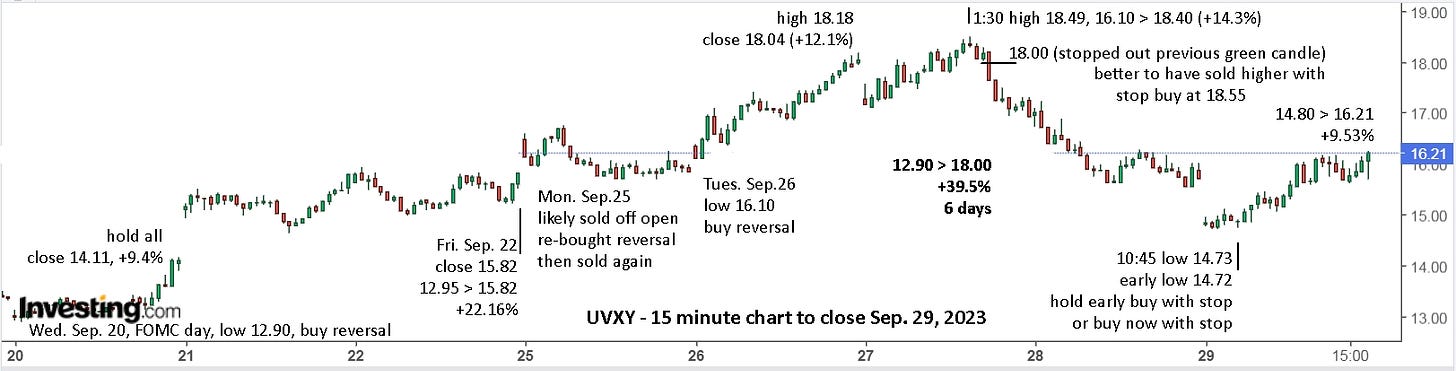

If you have just one or two long ETFs, like SPY and QQQ, then it is relatively easy to sell everything when the markets drop. If you have numerous investments, supposedly reducing your risk through diversification, it’s extremely difficult to sell everything. Holding a sector ETF like SPY and QQQ is all the diversification you need with the super important safety factor of being able to sell everything in minutes from your phone. And then you can buy UVXY and make 22% in 2-3 days.

Congratulations to Sandimas, who decided to try my strategy and made 22% last week. (His number, not mine, but the chart shows exactly how it was possible.) Now here’s a look at the daily market charts to see just how much downside risk there is. Supports have been broken, so holding UVXY for Monday is a good bet. Remember, VIX will go to 50+ on a serious market drop, and it closed Friday at 17.20.

Update, Week 4 (Mon. - Fri., Sept. 25-29): I hope everyone caught some of the 40% Fed induced move in UVXY. I thought the party was over on Wednesday, but Friday turned out to be a solid after-party party for 9%. VIX remained below 20 the entire time, so there is potentially a much bigger move ahead, but I suspect the markets will gain traction and VIX will drop back under 15, hopefully back to 13.

Taking Friday gains off the table or letting them ride for Monday is purely an individual choice, based on what you think the markets are likely to do. For me, Friday was a half sized trade, unfortunately, and I sold half at 16.10. As has been the trend lately, I expect a reversal from any gap open, so will trade according. GLTA!

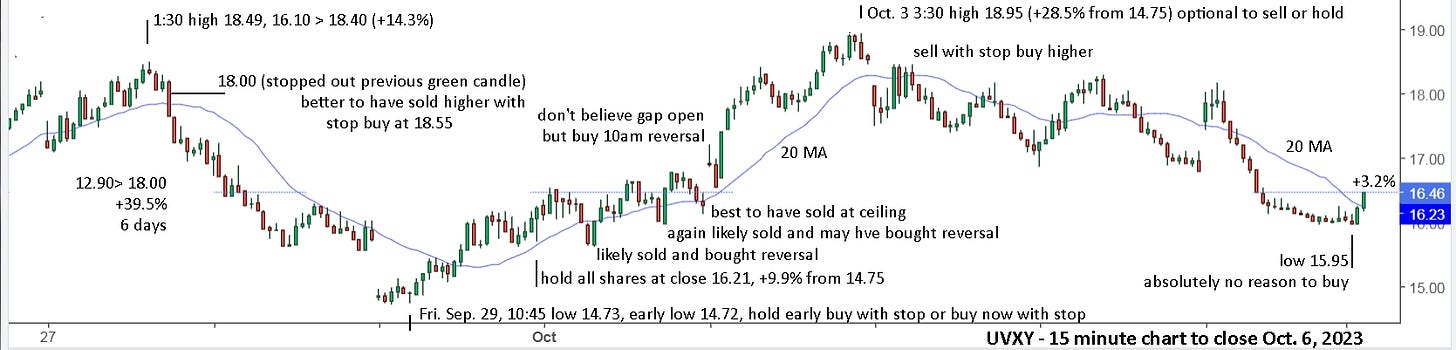

Update, Week 5 (Mon. - Fri., Oct. 2-6): Monday started where Friday closed, so everybody had an even start to the week. UVXY hit 16.01 in the first 10 minutes, then up to 16.53 (+3.2%) and held a ceiling till 10am. You likely bought under 16.20 and put a stop at 15.90 (-1.9% from 16.20). Sometimes it’s best to give extra room so as not to get stopped out too easily. You’ve made profits and it’s now making larger swings, so you need to give it room to make those swings. At 10am it made a hard 5 minute drop to 16.04, and I was stopped out at 16.25. It was back to 16.36 10 minutes later and you could have bought low with a stop at 15.90 or 15.80, bought the reversal with a stop at 16.20 or 16.25, or wait for a move above the early high of 16.53. If the trend is down, go with the third option. Since the trend from Friday was up, go with the first option to buy low with a stop. The blue line is the 20 MA which Sandimas has suggested is useful to help time your trades.

After an hour of holding below 16.50 and above 16.10, then it’s best to sell at 16.40+ and watch to see what happens at 11am. It hit 15.61 (-4.8%) in 30 minutes and reversed. Now it’s best to buy on a stop. Picking a number is difficult. 15.80 or 16.00 could have you stopped in and then holding as it dropped hard. By noon, it was back to 16.42 (+5.2% from 15.61). Maybe tempting to take the gain if you bought early in the reversal, but better to simply sit on the cushion. I have a tendency to over trade and was in and out all day and decided to get back in late in the day. The markets simply looked weak.

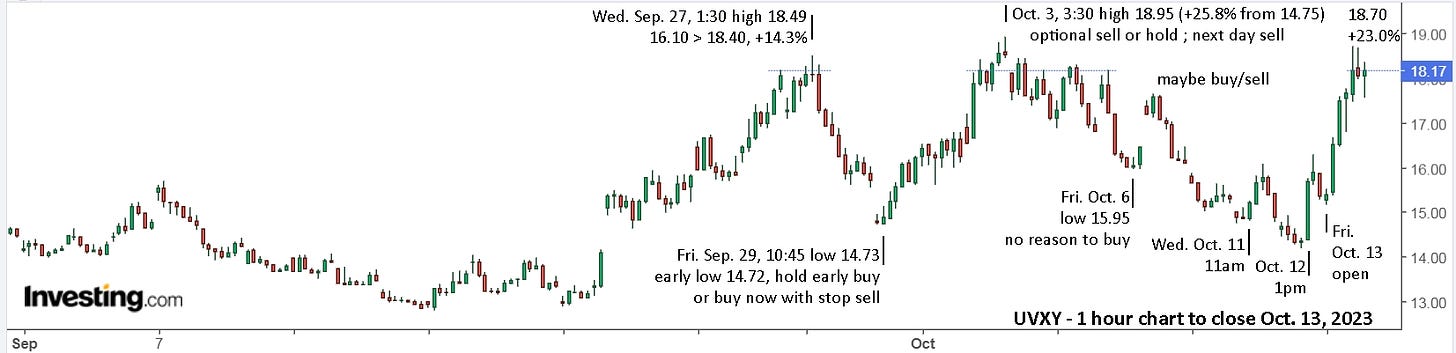

Regardless of whether you held shares or not, Tuesday, Oct. 3 was a day to trade. I sold then re-bought. Late in the day, you’re up 28.5% from buying Friday at 14.75, or 11.5% from buying at 17.00. VIX hit 20.47 and one could hold or sell late. Lucky if you sold, but Wednesday was still a buy as it pushed up from an early low. When it dropped at 10:30 or 11:00, it was time to get out and give it room to fall. When it held near the early low at 12:30, it was reasonable to buy with a stop. After all, the markets could still make a large drop. At 2:30 or earlier it was time to take the small win and again give it room to fall. Thursday was a buy early, a sell at noon and give it room to fall. Friday was again a buy early, but with a lot of suspicion. SOXL was an easy buy with a stop, then sell UVY and give it room to fall and SOXL room to run.

Just about anything can happen next week. The markets had a big move on Friday which may turn out to be the start of an extended move up, or it may turn out to be a dead cat bounce. Stay nimble and willing to trade either direction.

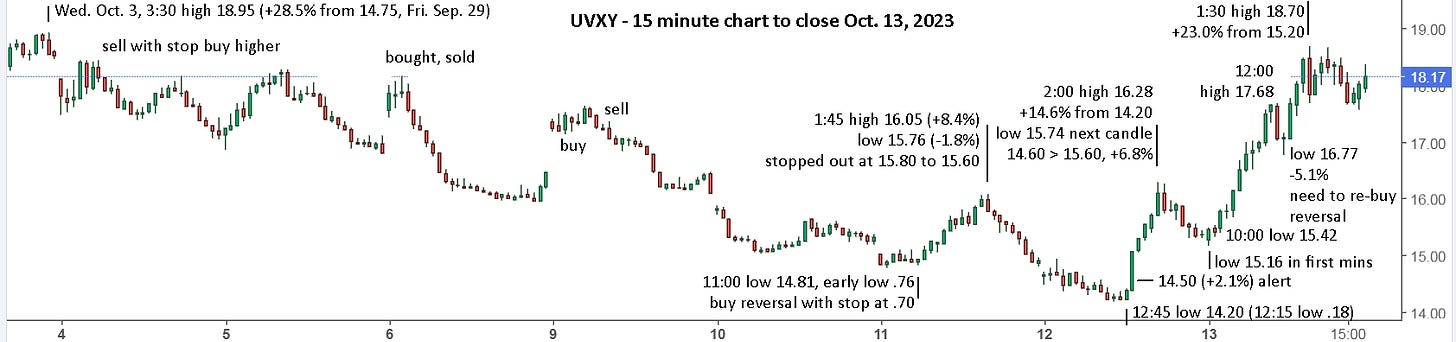

Update, Week 6 (Mon. - Fri., Oct. 9-13): Six weeks of trading UVXY, even if you’re making regular profits, can be tiring. Six weeks and still making unnecessary mistakes is exhausting. In all honesty, I’m exhausted, and I’m the coach! I’m the one who set the rules, completely believes in them, yet still doesn’t strictly follow them. Let’s see what happened this week and solidify a plan for next week.

The markets continued the rally started Friday, Oct. 6 and suddenly had the rug pulled from underneath them at 12:45 on Thursday. It was really remarkable to watch and UVXY was non-stop green 5 minute candles for over an hour. I’ve never seen that happen before. A likely pullback was approaching after the extended rally and a further pullback on Friday should have really been expected, especially when it gapped higher. It rallied till 10 o’clock, just to confuse matters and get you on your back foot, then the rug was pulled again and the drop continued, with a few rallies to keep you guessing, till the low at 1:30. Does anyone really believe the markets aren’t pushed around by big money and algos? The timing and sharpness of the moves are simply too perfect to be the natural sentiment of millions of people.

It certainly looks likely that the drop will continue next week, so it would be perfectly reasonable to hold your UVXY over the weekend, even with a possible 23% gain on the day. It may seem reckless to hold, but holding SPY or SOXL would in fact be much more reckless. VIX fell back to close 19.32 from a 1:30 high of 20.78. Remembering that it easily gets to 30+ on significant drops, there is still plenty of room to go higher, meaning UVXY would also go higher, and SPX looks likely to go lower.

Here’s a 1 hour chart to review and compare to a similar chart from August.

My conclusion is to continue enjoying the ride, so long as it’s moving up, and be ready to exit and stay out once the long slide lower begins.

Update, Week 7 (Mon. - Fri., Oct. 16-20): Sometimes taking the shot was still the best decision, even if you don’t score a goal. It would have been easy to not take a shot this Friday, based on last Friday to Monday result, with UVXY opening down 5.9% from Friday’s close. This Monday could be the same, but it could also open over 20 (+4.1%) and will you be willing to take a shot then?

For perspective, you gave up 5.9% from a possible 23% on Friday, Oct. 13 and sold at the open on Monday for 17.04. You could have bought late Monday 8% cheaper at 15.67 but that would have been completely against the rules and after a brief 5 minute pop at 3:30, it continued a slow slide to 15.53. Tuesday opened +5.5% at 16.38, so you may have felt frustration for not buying late Monday as you wanted to. Again, maintain perspective. The rules are there for a reason: they work and keep you safe.

UVXY fell for the first 5 minutes to 16.19, bounced hard up and down, so buy around 16.20 with a stop at 16.00 (-1.2%). It shot up to 16.66 in 15 minutes, held, then fell hard at 10:05. Worst case scenario you stopped out at 16.30, to give some room to hit .20 and bounce. In fact, it hit 15.91 and shot up to 16.26. Your stop may have now been 16.40, or maybe you were stopped in at 16.00. It dropped hard at 10:30 and continued a slow slide to 15.17 at 12:30. At 11:30, SPX was back to the highs from the week before, so it made sense to be watching for a reversal. From that point on, there was little reason to doubt your UVXY and possible other short trades.

Obviously, the big question now is, “Will the market hold this level?”. If you ask my dad who has absolutely no trading experience, he will say it’s definitely going lower. I agree that’s most likely. If you bought UVXY on Tuesday and are sitting on a gain of over 20% for the week, great. If you sold on Friday, locking in gains of over 20% two weeks in a row, great. If you weren’t able to trade at all the past 2 weeks, fear not, the action needed on Monday and next week is exactly the same for everyone.

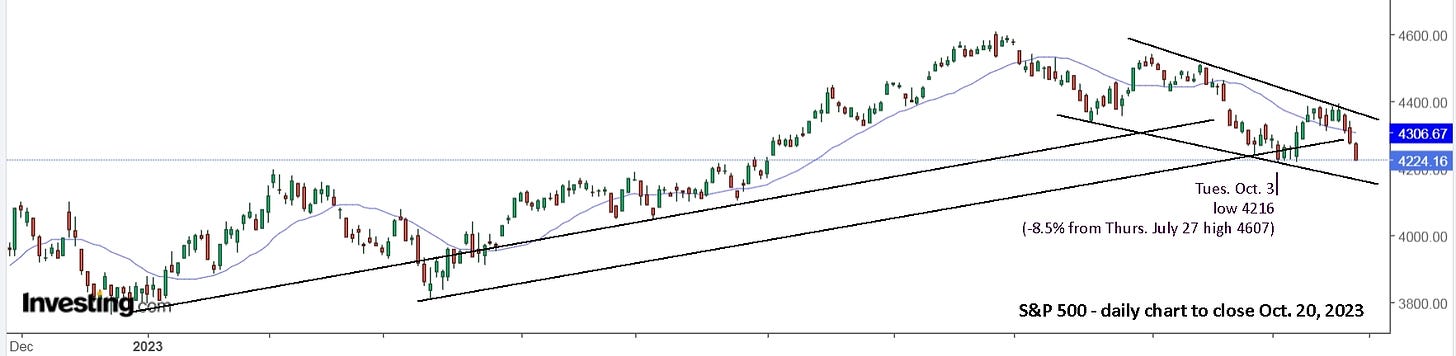

Let’s make a game plan, and I’d like you to consider the possibility of making a bigger bet than you have so far. We know VIX will go to 30+ on a severe market drop and it is currently 21.71 after struggling to break 20. Fear and worry have been building for several weeks. Heck, I’ve even turned bearish on a longer perspective. Here’s the update from my June 18 article, “Are you ready for a market drop?”, and it shows why I’m now bearish and readying myself for big swing at UVXY next week. And I am holding the small trading position from last week.

Since our last update, Oct. 6, the markets continued up from that Friday’s blast, then hit resistance at 4380+. For several weeks in advance, Avi outlined that the 4375-4401SPX region was going to be an important resistance region. If you had gone long SPY after Oct. 3, it was clearly time to sell and go back to cash. If you’re long and did nothing on Wednesday, Thursday or Friday this past week, then you’re clearly hoping for good results in your portfolio versus taking proper action to ensure good results in your portfolio.

I’ve been having a discussion recently with two friends who are blissfully content with their dividend investments, most which have been dropping in value since early 2022. How many investors have remained blissfully content with their investments over the past 4 months since I wrote this article, June 18, “Are you ready for a market drop?”?

From the chart above, do you want to be long or short the market at present? On the sidelines would also be a great answer, but I see no reason to be long. Yes, the current low may hold and then represent a double bottom, but I think it’s more likely to test the lower support trendline. If that breaks, then a very serious drop is likely and I would then suspect that the market highs were indeed hit in late 2021.

On Mon. Oct. 2, Avi wrote, “At this point in time, I am adjusting our support down to the 4165-4230SPX region. The reason I am adjusting the support is because the last segment of the drop exceeded the targets I set for that segment of the pattern. This opens the door to the lower end of support I highlighted in prior articles. …

In summary, as long as the market remains below the 4370/75SPX resistance region, I am expecting that we will test the 4165-4230 support region. Should we see that decline, then this should be the final test of this decline off the summer-time high. As long as the market successfully holds this support, then I am maintaining my expectation for a rally to the 4800SPX region next. Moreover, any move through the 4401SPX resistance region is a strong indication that the rally to 4800SPX has likely begun.

Alternatively, should the market instead see a sustained break down below 4165SPX, and then take us down to the 4000-4100SPX region, then the market is strongly signaling that a long-term top has likely been struck in the market, and we are setting up a decline that will likely take us down below the October 2022 low over the coming 6-9 months.

As for further confirmation for a bearish bias, I am also watching the IWM ETF, which represents the Russell Index. Should the IWM also break down below 167.46, then that would present another strong indication that a major top is in place, and that a bear market continuation will take hold over the coming 6-9 months.”

His bias was still bullish then and has remained bullish, but those are ominous predictions! On Friday, IWM hit closed below Avi’s support.

Will it bounce up from support again? I have no idea, but for sure I wouldn’t have bought on Friday in anticipation of a bounce. I think it will go lower and the monthly view shows possible support is near. If that support doesn’t hold, then it’s very likely that a decade long bear market is nearing its third birthday.

The S&P 500 is equally ominous looking. It’s at weekly support, but it’s a 29% drop to monthly support.

In his Mon. Oct. 16 update, Avi wrote, “As long as we hold the 4280-4302SPX region of support and then break out through 4401SPX, it would make it likely we are on our way to our next higher target in the 4800SPX region. However, a sustained break of that support would concern me that a major top may already be in place.” That support was broken on Thursday and smashed on Friday.

A week prior, on Mon. Oct. 9, Avi wrote, “Although it is a lower probability at this time, if the market breaks down below 4165SPX, it opens the door in a big way to the market setting up for a crash into 2024 which would point us down to the October 2022 low, and potentially well below it. But, it would still likely provide us with a multi-week “bounce” before we see a major break down below 4000SPX. Moreover, should this setup develop in the coming months, then it confirms that a long-term high has been struck in the market, and a multi-year bear market has begun.” We’re literally a day away from that happening, just -1.4%.

As he said, “it would still likely provide us with a multi-week “bounce” before we see a major break down below 4000SPX“, but you’d best have a plan in place for a long, cold winter!

Here’s a 30 minute view of UVXY that may prove helpful. The Friday high at 10:30 was indeed stretched, as it was on Friday, Oct. 13. Buying at 1:30 as it held and reversed, especially when looking at the market charts as well, made complete sense. Even a drop to 18.00 is only -6.35%, so could be a point of reversal.

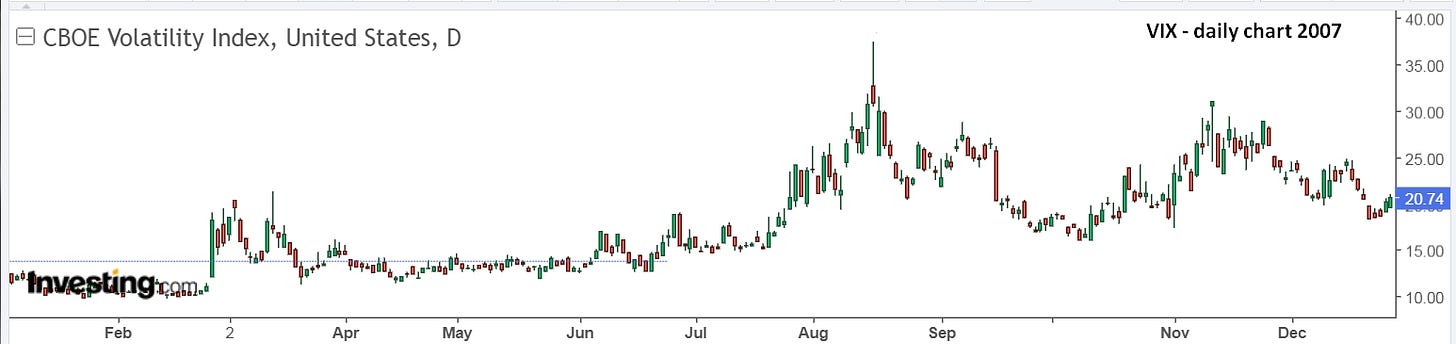

Here’s a view of VIX from 2007 and 2008. A month later, in October 2008, VIX hit 80+.

And now…

My conclusion: This could be the first inning of the world series. Or, it’s the hockey season and we completed training camp in August and are now 5 games into the season. If it’s baseball, it will after be over in 2 weeks. If it’s hockey, settle in for the long season before the playoffs.

Update, Week 8 (Mon. - Fri., Oct. 23-27): In the markets, this past week was essentially a repeat of last week: up on Monday, Tuesday, then down hard the rest of the week. SPX blew through Avi’s support of 4165 hitting a low of 4103 on Friday. In his Mon. Oct. 23 update, Avi wrote, “should the market see a sustained break of the 4165SPX region, and we continue down to the 4060-4100SPX region, then I have no choice but to change my primary perspective and view this decline as wave 1 of the 5-wave c-wave pointing us down to the 2900-3300SPX region as we look towards 2024. As long as we hold the 4000-4100SPX region support if we do drop down to that region, then I think it is reasonable to expect a 2nd wave counter-trend rally back to the 4375-4475SPX region before wave 3 begins to take us down in earnest into 2024.”

In short, he still has a qualifier for a bullish move. If SPX holds above 4100 this week, then we could get a rally through 2024 and he could claim that he ‘predicted’ it, and called the low perfectly. The best option for us is to simply continue drawing and watching trendlines.

A slight break of support and reversal for SPX is completely possible. QQQ looks a little more promising having made a higher low on Friday from Thursday.

A key point to keep in mind for trading UVXY is that VIX usually tops out several days before the markets actually bottom. In March, it was the same day.

A 30 minute chart view provides a clear “line in the sand” for UVXY. It also shows a firm ceiling. The range for a trade is also reducing. With FOMC on Wednesday this week, we’ll likely see a break of either the ceiling or the support, and it might be first one then the other, so be ready for some potential whiplash before the actual direction is established.

Last week was a difficult trade for UVXY, especially trying with a larger position. The prior week was much easier, holding a steadier path from the 12:30 turn on Tuesday to the early high on Friday.

One could draw a trendline from Friday’s low, parallel to the other two, showing about 19.00 as support, but buying there might get you bounced around for small losses. I would rather wait for 18.00, 5.3% lower and room for rallies to 19+ and a decent gain. Buying at 19.00 only gets you 5.0% back to Friday’s high of 19.95 and we may now get lower highs. 19.80 is only 4.2% and just not worth the bother.

It will take a pretty severe market drop to spike VIX to new heights, and then UVXY can run up from 20 to 22+ and higher in a hurry. I’d rather jump on that move than mess around at 19.00. Hope you find those guidelines useful. They certainly helped clarify things in my own mind. Good luck next week!

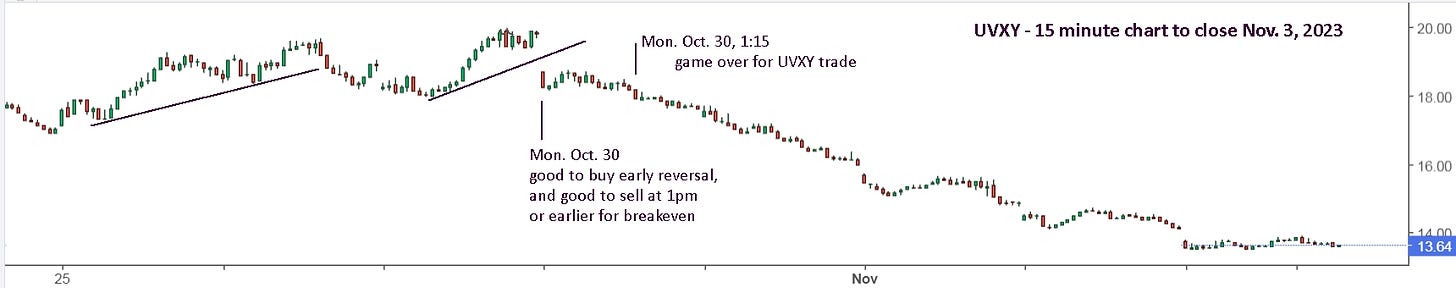

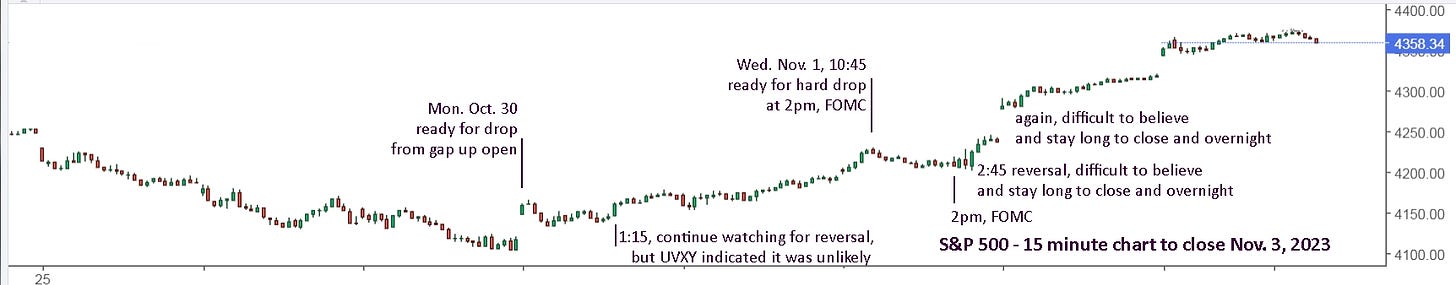

Update, Week 9 (Mon. - Fri., Oct. 30 - Nov. 3): Preparation for UVXY was rewarding this week. The lower open on Monday erased the 15 minute chart possibility but maintained the 30 minute potential until 1:15, and most people should have already sold for a small gain or breakeven before then.

SPX was a good indicator as well, and DJI was even stronger, with a slightly stronger move in the 30 minutes leading up to it.

I was definitely not ready for the fourth fake at 2:45 on Wednesday. The moves right at 2 pm and after, were less than usual, so I stuck with my small long position in SOXL and focused on UVXY, also a small position since nothing was clear. I sold half for a small gain and held the other half for breakeven. I bought again for 15.25 at 2:39 and was stopped out 14 minutes later at 15.20 (-0.3%). I wasn’t willing to play around and be patient. Four fakes is more than usual, so I bowed out and held my SOXL for Thursday.

Given the past 2 weeks, with rallies Monday - Tuesday, and drops to close the week, I was a complete non-believer and even took a small gamble on Thursday late, buying some UVXY and PSQ to hold overnight. Gambles rarely pay off and this one was no different. Oh well, I slept better knowing that I had a small position in for a potential big gap lower in the markets. On Friday, I took a few trades and decided to put the small bet back on for Monday. The more I look at the charts though, the more I suspect the markets have started an uptrend. They definitely moved “too far, too fast” last week, but the trend going forward may be up. Good luck next week!

… It seems I didn't publish my weekend update, so here it is now, Monday after hours. My gamble from Friday was again a losing bet, as I suspected it might be. Pre-open VIX was +2.82%, 15.33, so I was ready for a winning bet, but UVXY was -1.69%, 13.41 and opened 13.37. That often happens and is why UVXY decays over time.

I bought the early reversal from 13.24, getting 13.39, it hit 13.41 and fell to 13.26. Typical, which is why I only added a small amount. Now it had to prove itself, and did manage to get back to .39 and held flat. I decided to stick with a stop sell at 13.20 as I wasn't going to be watching closely and I was again trying to get long SOXL. I was stopped out as it fell to 12.99 and then held around 13.15 with a stop buy at 13.20. It hit .27 and then I stopped out again at .20. I was no longer expecting a big move but put in a stop buy at 13.30 which triggered while I was outside working. It was back down when I checked so I sold and put in a stop buy at .40 for my Friday bet only. It triggered before I went back outside and then stopped out at .30. I had similar bad luck with SOXL but ended up okay by the end of the day, holding some SOXL and out of UVXY. I hope you did okay today and good luck the rest of the week!

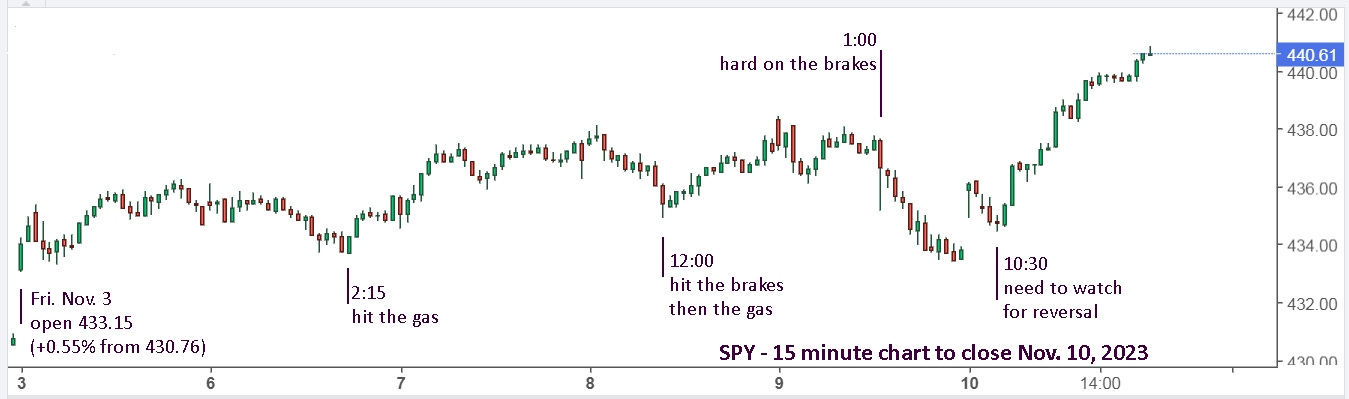

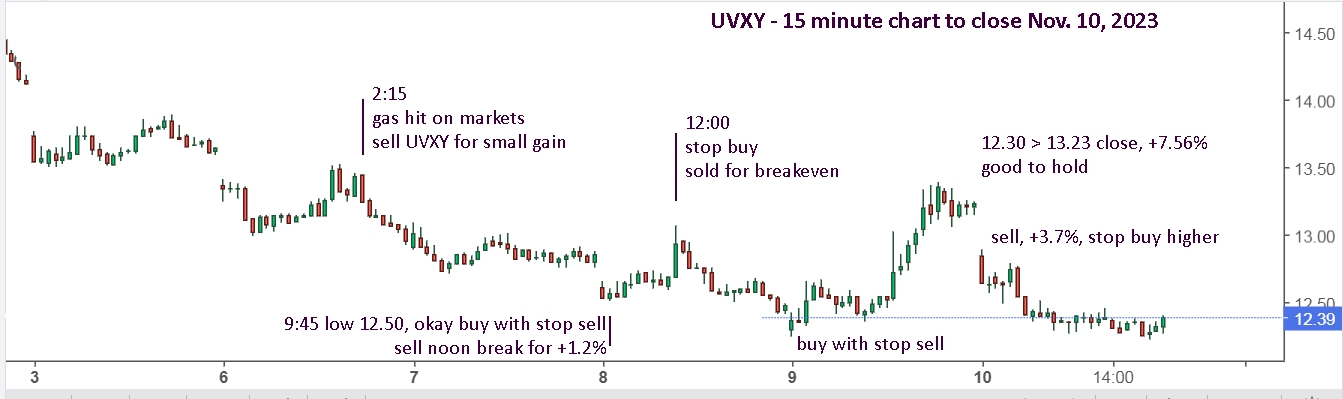

Update, Week 10 (Mon. - Fri., Nov. 6-10): The only reason to be looking at UVXY this past week was the fact that the markets were at resistance and could take a tumble. On Monday, SPX and others were quiet for the morning, slid lower till 2:15, then somebody hit the gas. That momentum followed through on Tuesday. Wednesday showed some weakness and was dropping nicely, but all the markets turned up around noon. Thursday was more ‘hard on the brakes’ from a gap up open, but essentially flat till 1pm when hard selling hit the tape and continued to the close.

For me, it’s not reasonable to assume such market movement is natural. For me, things in motion continue in motion until acted on by an opposing force. ‘Big money’ has trillions of dollars that can easily push markets whichever way they want. News events, like FOMC, can be ‘excuses’ for big money to force big moves, and once initiated, momentum is generally maintained with just occasional extra pushes needed to keep it going. They also know in advance what direction they want the market to go. If they want it to go down, then push it up first to sell at better prices. When they’re ready for it to go up, push it down further to buy at better prices. Clearly, they started buying days before FOMC last week and kept people guessing this past week. The key for us ‘minnows’ is to watch at a safe distance and do our best to get on board for a ride once the turn has been made.

UVXY had potential with the markets at resistance and it was reasonable to look for early lows each day to buy with a tight stop loss. If it gaps lower on Monday, it might be wise to set an alert for 12.50 and give it room to continue lower.

I was rather active each day and I held overnight Thursday, ready to buy more off the open on Friday. I did buy, 12.86 average, and was stopped out at 12.75. The early low was 12.80 in the first 5 minutes, so best to keep the stop tight after that. On Thursday, I sold my SOXL and put in a higher stop buy that triggered, then fell and I quickly sold and re-bought late. On Friday, I was focused on a continued drop from either a gap higher or lower. I properly waited for SOXL to rally, sold near the top, getting 19.36 and it fell back to 19.12 and held. Unlike Thursday, I completely ignored the option to re-buy. That’s what happens when you have a bias instead of sticking to the same plan every day. Oh well, lessons learned again and will try to do better this week.

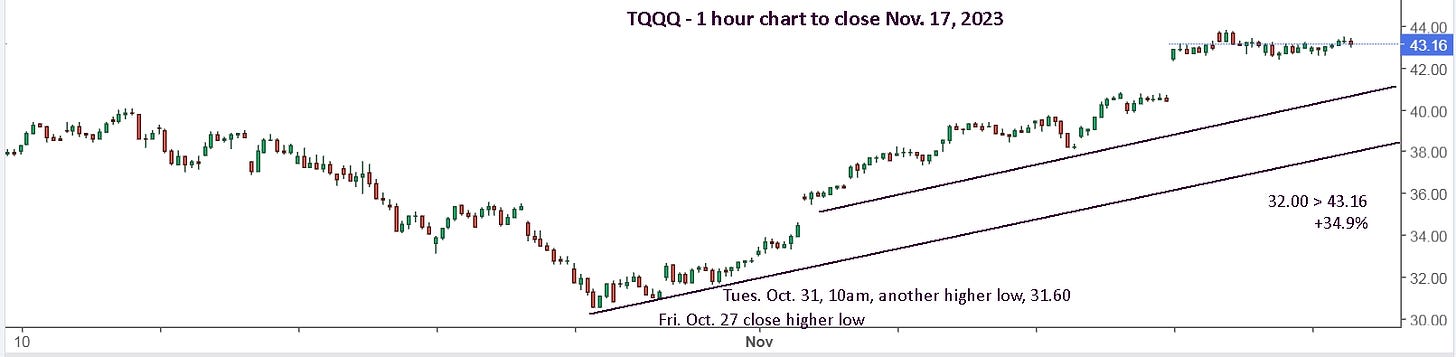

Update, Week 11 (Mon. - Fri., Nov. 13-17): In my Week 7 update, I wrote, "If it’s baseball (the World Series), it will after be over in 2 weeks. If it’s hockey, settle in for the long season before the playoffs." A week later, VIX made a lower high while the markets made a lower low and I wrote, "A key point to keep in mind for trading UVXY is that VIX usually tops out several days before the markets actually bottom." I also wrote, "QQQ looks a little more promising having made a higher low on Friday from Thursday." It was baseball and it was over in a week.

For Week 9, we were wary of UVXY and cautiously optimistic for QQQ. Unfortunately for me, I was wary of the FOMC meeting on Wednesday that week and Avi's switch to bearishness also kept me overly cautious. Simply trusting the trendlines and my own advice would have been very rewarding.

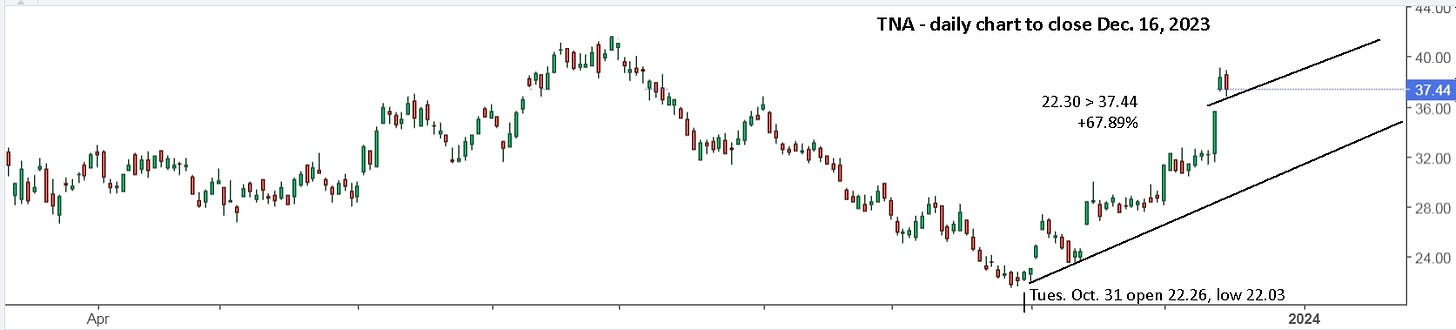

I did get some of the run with SOXL, TNA and LABU, but a fraction of what I could have, and it would have been better to simply focus on SOXL bagging 59%.

It seems nearly everyone is expecting a pullback and gaps to be filled, etc, but it seems to me that some more sideways action will get us back to the trendlines and the markets can push higher without a pullback. I’m holding small positions in SOXL, TNA and LABU and will watch for an opportunity to add, or exit.

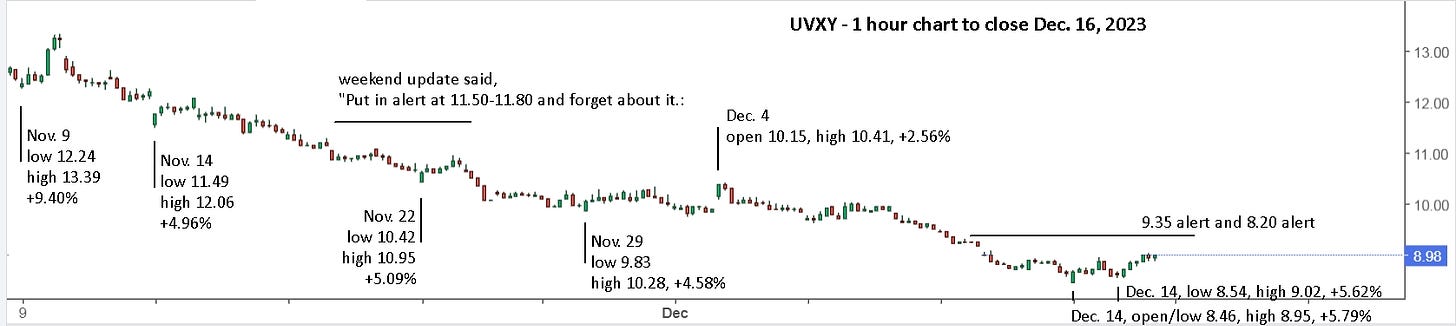

For UVXY, it’s best to almost forget about it. I suggest putting in an alert about 3-5% higher than the last close, so 11.50 to 11.80 now, and you can do both. Add an alert at 10.80 or 10.70 and wait for one of them to trigger. If the lower alert triggers, put a new one in at 10.20 and carry on with your day.

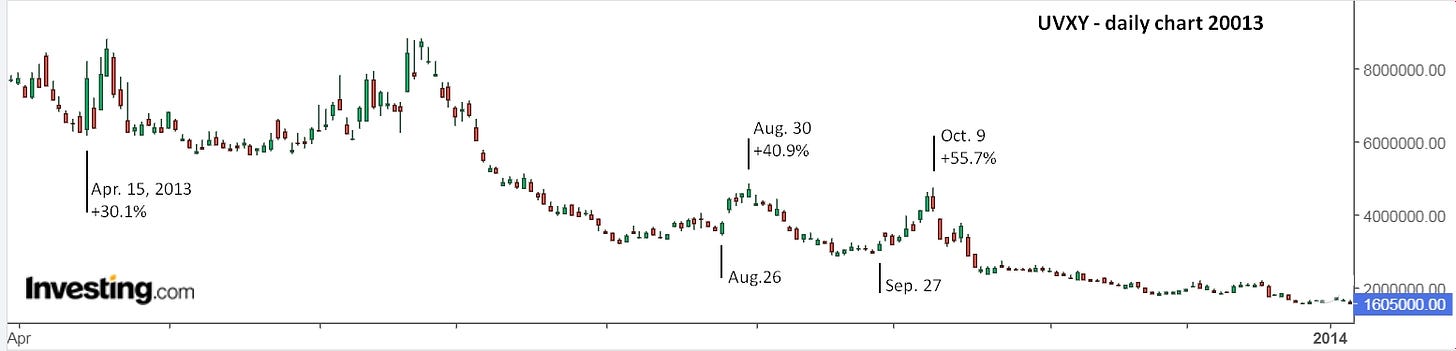

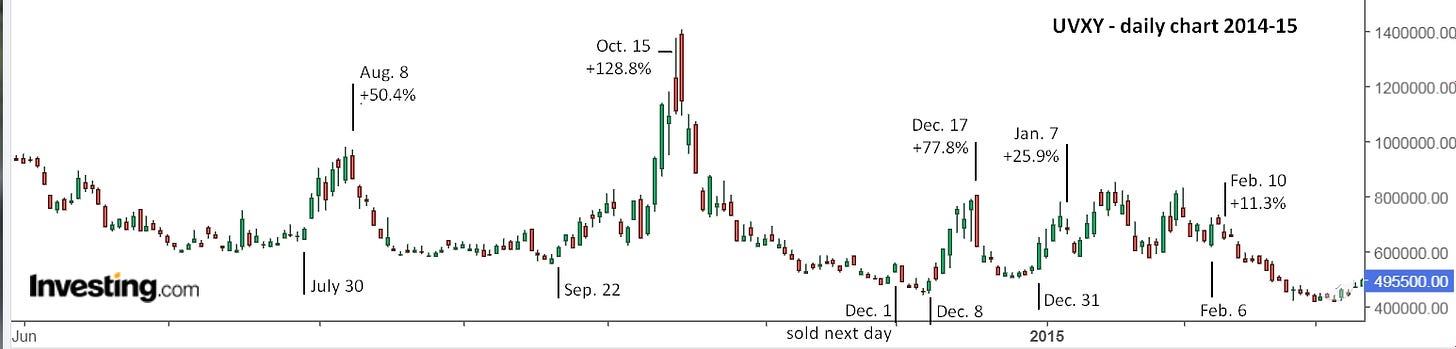

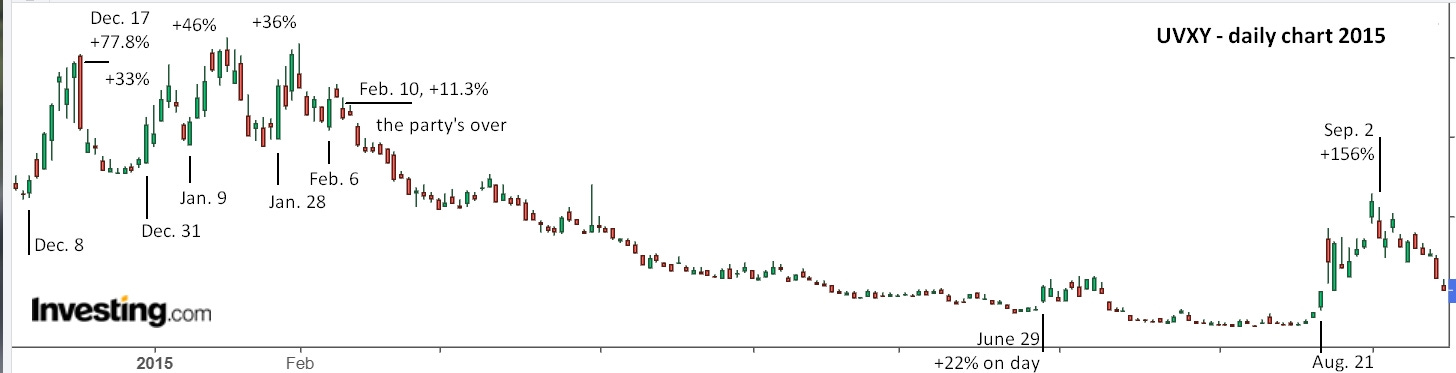

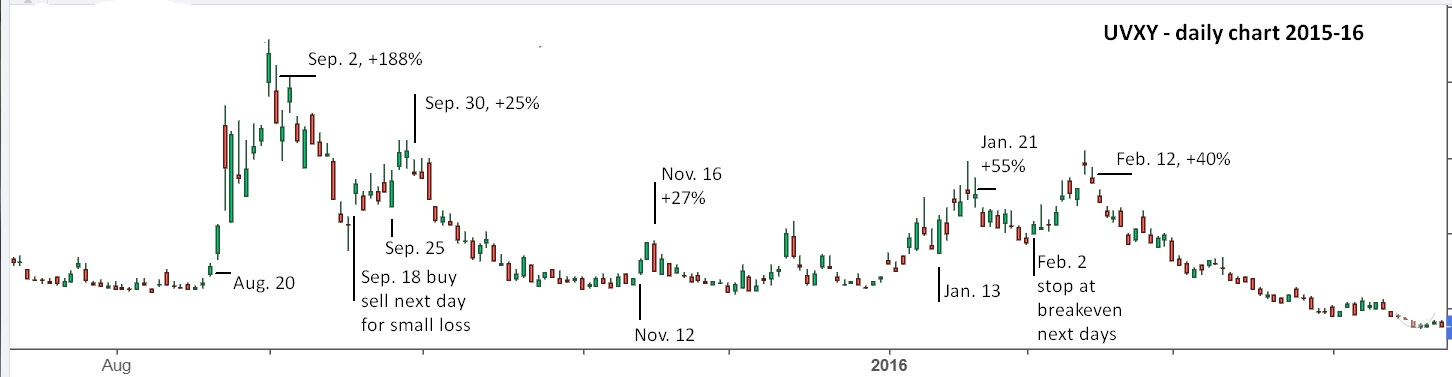

You’ve now witnessed a market reversal and a full cycle for trading UVXY. We could be witnessing a bear market rally, but until the trendlines tell you otherwise, stay long and ignore everything else. Watching UVXY on a daily basis now, with the alerts, will help you control any urge to buy it for a possible bottom, etc. Here’s a look at the daily charts since 2013.

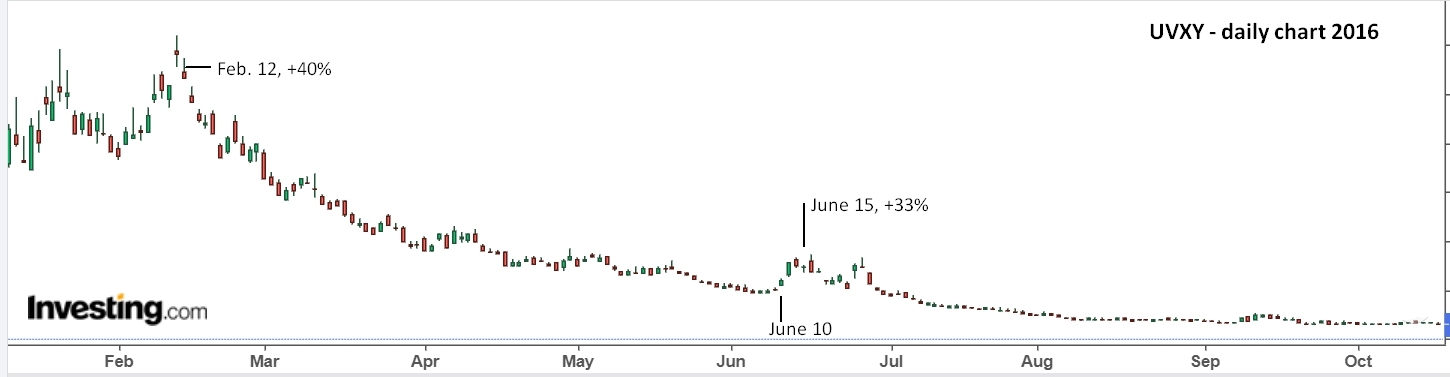

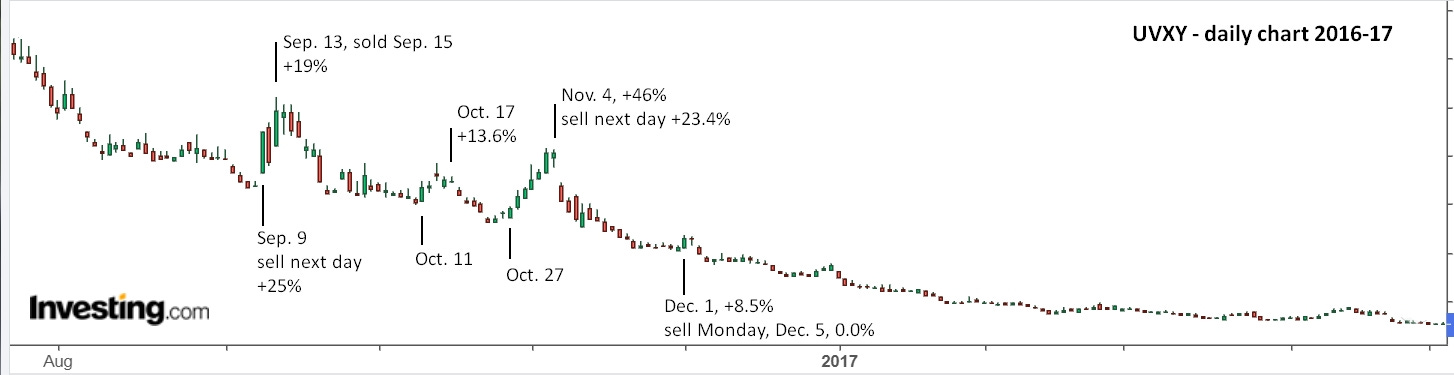

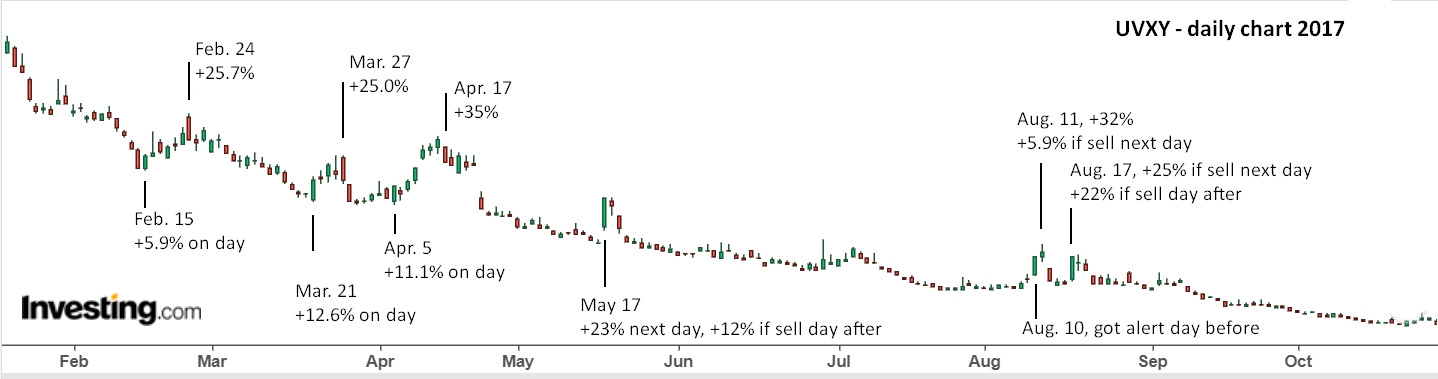

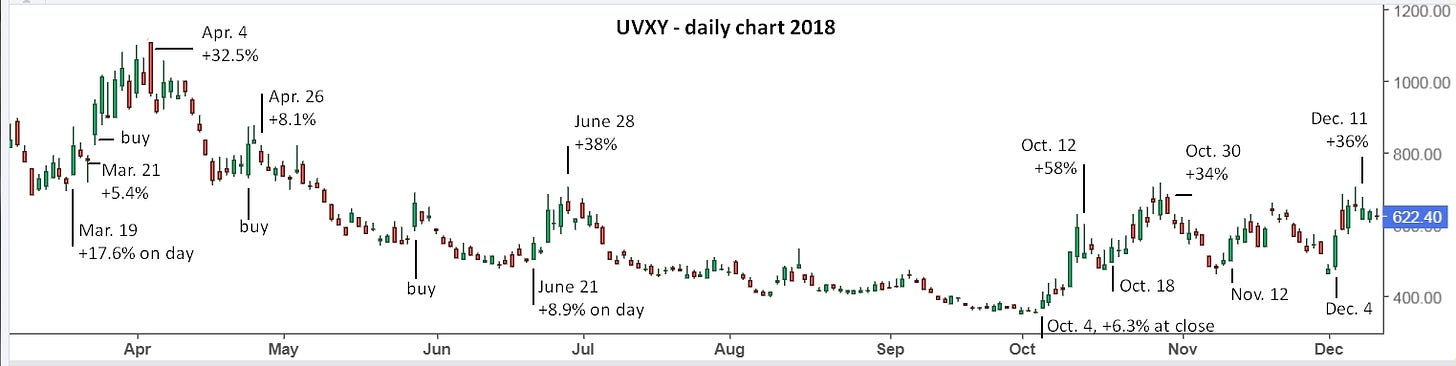

Note in the 2016 chart, the September move is barely a bump on the chart, yet there were actually 2 trades for 20%. Likewise, there doesn’t look like anything for the first few months of 2017, yet there were again several 25-35% moves. The ‘trigger days’ were also all fairly clear.

I hope those charts give you a clear understanding that it’s really best to stay out of UVXY until the next ‘storm season’ arrives. There’s no need to even look at UVXY below 12.20 which is 9.4% above Friday’s close. Sure, if you’re the type of skier who hits the slopes on opening day and closing day and every day in between, then enjoy the continued trade opportunities, but for most people, it’s now time to go golfing.

Things can change in a hurry though, so set alerts and be ready to take action on sudden moves up of 4-5%, especially if they continue for 10%, since 20% moves are fairly common.

Update to Friday, Dec. 15: I love it when I look back at my updates and see that they were ‘bang on the money’, as my dad would say. Early in the last update, I suggested setting an alert at 11.50 and 11.80, and at the end added, “There’s no need to even look at UVXY below 12.20 which is 9.4% above Friday’s close.” As you can now see, that was great advice.

You can also see that there were four decent 5% ‘ski days’ and one false alarm day on Dec. 4 where you would have sold for breakeven. Meanwhile, holding SOXL, TQQQ or TNA provided great returns for everyone who just went golfing.

Clearly the markets are getting stretched and will likely consolidate sideways for a while at least, or they may drop, providing an opportunity with UVXY or the short ETFs, but honestly, why bother? When you get stopped out of the above long positions, just be thankful for the opportunity to triple your money, or more, since this article was written on September 4, a mere 3 months ago. Happy holidays!!

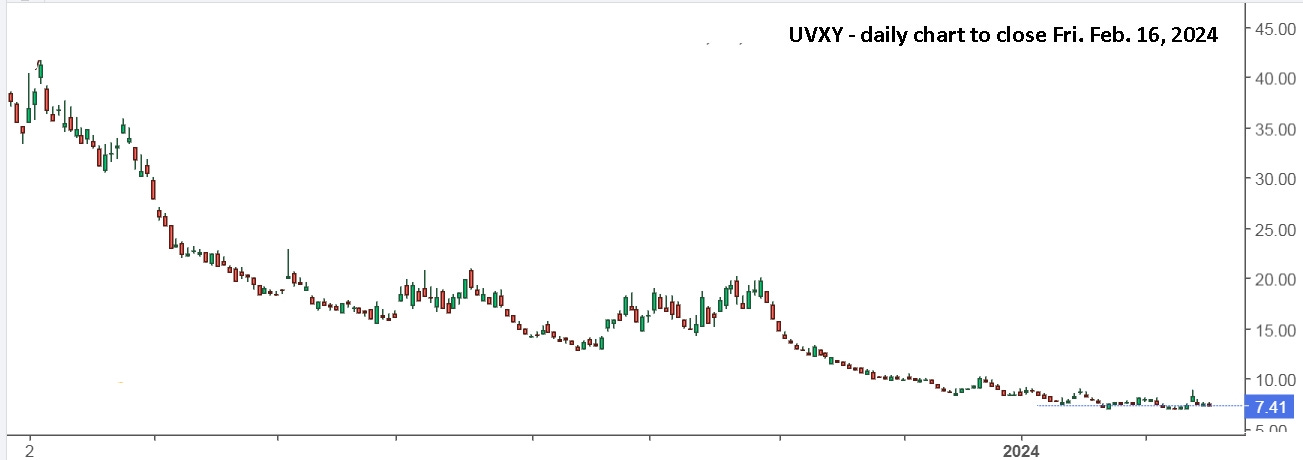

Update to Friday, Feb. 16, 2024: The markets were stretched and returned to the support trendline, while volatility continued to drop. With SPY nearing longer term resistance on Friday, Feb. 9 and VIX under 13, it was time to start considering a short trade. With the CPI report scheduled for Tuesday, Monday, Feb. 12 provided a good setup.

There may be some more opportunities this coming week. Get ready!

Update to Friday, March 8, 2024: The trend has continued for UVXY as the markets move to new all time highs. This past week especially, buying early and selling late was a super simple and profitable trade.

Now that we’ve had a bit of a drop in the markets on Friday, UVXY may drop below the latest support line. If the markets continue lower, then UVXY may shoot up to 8+. Be ready for either result.

First, I'd like to say I don't like the comment setup on this site. Second, the markets are still looking very weak, so volatility is staying elevated. I was 'lucky' to have held UVXY shares from Friday and sold off the open on Monday for +7.8%. I made several trades on the day because the markets seemed ready to crash but finally held up. I was surprised to see volatility up on Tuesday, but it was still the right decision to have sold out of UVXY and not be long anything either. It opened 16.34 (+3.4%) and I put in a stop buy at 16.45. It hit .38 and fell to 16.10. With the markets again looking very weak, I bought UVXY, sold at 16.60, then bought some back as it shot higher, then sold at 16.98 as it fell from 17.08. It made sense to sell and markets were pushing up but seemed likely to resume falling, so I bought UVXY again at 16.44 as it moved up from dropping to 16.34. It just hit 17.18 but I'm very hesitant to sell for 4.3%. The markets can potentially fall a lot more and VIX is only 18.50. Best to stay in UVXY a be willing to give up some of the current gain and not over trade the rest of the day.

Thursday premarket, VIX was up over 8% to 16.50 and UVXY was up 9%, so +18.5% from buying early yesterday. They're dropping slowly now with 15 minutes to open. If you didn't buy yesterday, you don't want to chase it, but you don't want to miss a further run either. If you're holding any long market positions, they're also lower this morning and you don't want to ride them lower. But, this could also be the big money playing around, like August 15-18. The question is, will they push the markets lower today and tomorrow, or push them up from the gap lower today? The first minutes up to 30 minutes are critical. I'm going to sell half at the open, ready to sell the rest or re-buy, then stick to the rules. Good luck!