UVXY - Volatility can be fun and profitable.

Big market drops can be as fun as surfing huge waves and very profitable, like +1174% during the covid drop. This year’s 12.4% drop in the S&P 500 came with a 150% gain with UVXY if you dropped in and took a ride. And best of all, the risk of loss is very low, unlike surfing huge waves which can pummel you senseless.

The volatility index, VIX, is often called the ‘fear index’, which is a very apt analogy. Fear rises quickly and subsides quickly. Any time the market does a sharp drop, volatility spikes up and now small investors can profit from this with UVXY. Here’s a look at a weekly chart of VIX.

To catch the blast in VIX, you can buy UVXY with a simple click of the ‘buy’ button on your phone or laptop. Here’s the daily chart in 2020.

As you can see, when volatility is low, like early February, it’s impossible to suddenly drop further, so buying UVXY is ‘safe’. I mean, you can’t go from not afraid to really not afraid, but you can easily go from not afraid to a bit afraid to really afraid.

As you can also see, you don’t want to keep holding UVXY as the markets calm down from being ‘really afraid’. This also makes complete sense. Once danger has passed, you’re no longer really afraid but it takes quite a while for your heart to stop racing and to become calm.

Here’s a look at the VIX in 2008-2009 where it again surged to 90.

Obviously the next time the markets crash, there’s going to be another great ‘wave’ to ride with UVXY. I mean, it’s as certain as death and taxes!

As with anything, you don’t want to try the big wave/jump before a lot of practice on small waves/jumps. Knowing what you should do is also a LOT different than actually doing it. So, I’ll be your coach and let’s have a look at the waves you could have caught this year.

Over Christmas, I wrote a few blog posts on Seeking Alpha, warning people to get ready for a big market crash, perhaps in 2023, showing a simple strategy that would have worked remarkably well since 2005 and I encouraged people to let others know, "Give The Gift Of Financial Security Next Year." Following that simple strategy in January would have netted you +10.1% with SPY and +150% with UVXY.

Here’s the hourly chart to Friday, Feb.4:

The key is to buy early in the day when it moves up sharply. If you’re up 5% or more by the end of the day, then it’s a very safe hold overnight. If you buy and it reverses, sell for breakeven or a small loss. NEVER hold this ETF on a drop.

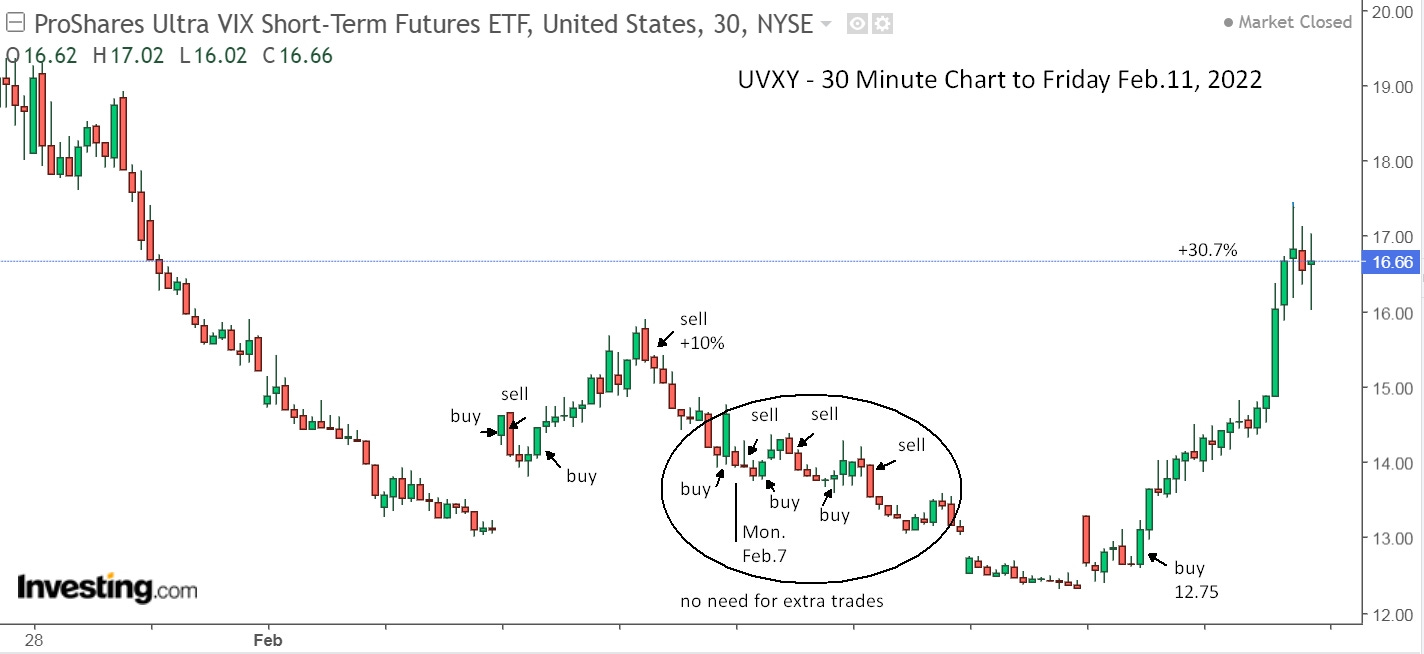

The late re-buy on Friday, Feb.4 is completely optional, and is a risk, but there’s a good chance that the markets could drop hard on Monday and you’re already up 150% so it’s easy to take a chance. Plus, our buy price of 14.15 was 10.2% lower than our sell price of 15.75 before lunch and is up 3.5% at the close. Worst case would be it opening around 13 (-8%), so size your position accordingly. As it turned out, we sold at 14.15, took 2 small trades over the day then stayed out as the markets rallied and volatility dropped.

Again, the buy on Thursday at 12.75 was very low risk. If it reversed and fell sharply, then sell for a small loss at 12.50 (-2.0%). Once it moved higher, then set a stop and let it run. By the end of the day, you’re sitting on a gain of 10.1% and the markets look ready to fall lower so let it ride. By Friday’s close, you’re up 30.7% and you have to decide if it was a BS move in the markets based on news of an impending invasion of Ukraine, or whether the markets will gap lower on Monday.

Well, you’ve often seen the markets gap lower on Monday, hit the low point of the multi-day drop and reverse hard. So, go with that. Hold all your UVXY for Monday. Sure, it could open way back at 15.50 or lower, but that’s really unlikely, and if it does, you’re only giving up some of the easy money you made in 2 days with one click on your phone. At 15.00, you’ll still have bagged +17.6% in 2 days. Not bad and most importantly, you were on the wave early, in case it turns out to be the 10x whopper you’ve been training for.

So, pretty simple, right? And we’re up 187% YTD. Most importantly, we’re getting practice at pulling the trigger, and an important aspect of that is to make your first buy the biggest. If you’re cautious with your first buy, then you’ll be wanting to add more, thinking it could be a big move, and as soon as you buy more, it will pull back sharply and you’ll think maybe you were wrong and the move is finished. All that second guessing and thinking takes away all the fun and profit. Just like dropping in on a big wave, you have to fully commit and go for it.

Now let’s have a look at what the markets did compared to UVXY, and remember that the VIX is tied to the S&P 500, so it’s best to watch that. An extra tip is that the Nasdaq often gives an ‘early warning signal’ of the other indexes dropping.

Notice that the markets rise steadily over time, so you can ‘ride out’ the sharp drops and still do okay. That’s why financial ‘experts’ say don’t worry about the ‘small’ drops, stay focused on the long term. Well, -12% in a few weeks is a lot, especially when you could have easily stepped aside and avoided it entirely. That’s $12k gone on a $100k account. Sure, you can call it a paper loss, but it’s a real opportunity loss since you could have sold and then re-bought 12% cheaper and that $12k becomes real money in your pocket.

Notice also how UVXY steadily falls over time. That’s why you must not hold it once the volatility passes, and don’t hold it expecting a market drop and waiting for it to come. It’s a completely different trade from other stocks and you have to trade it accordingly.

Remember, I said it’s a very safe trade because you typically buy it early in the day on a sharp reversal and have a ‘cushion’ by the close. Plus, when volatility/fear is low, it can’t suddenly drop lower. It’s a bit like being asleep. You can ‘fall’ to a deeper sleep and you can also suddenly wake up and jump out of bed hearing a huge crash. Stocks on the other hand, can easily drop hard overnight, even when they’re big companies and are already down to ‘support’. Here’s NFLX, Netflix.

Sure, it’s been a great long term investment, but once it starts falling, get out. Imagine buying on January 19 or 20, thinking it was at ‘support’ where it held July-August 2020 and then moved up. Now you wake up on January 21 and it’s down 21.2% before the markets even open and you can sell. And then it’s nearly impossible to sell since it could rally up strongly. UVXY will never do that, but it might open up 21%.

Here’s FB, Facebook / Meta, and it was moving up nicely but was hammered after the earnings which certainly didn’t announce a 24.3% drop in their business! Or maybe it did and that’s why it’s still falling?

And how about AMZN, Amazon? On the same day FB crashed, AMZN opened down a sizeable -5.9% and continued lower on the day. Needless to say, with FB and AMZN down sharply, ‘fear’ was suddenly up and held all day with UVXY +18.00%. There was no reason to be holding UVXY the previous day since it was in a steady downslide, but buying off the early low and selling later in the day or early the next day was a tidy gain of 10.1%.

The next day, the sky isn’t falling, so Chicken Little is silenced, and AMZN gaps open +12.1%. Imagine the gut wrenching feeling if you had ‘wisely’ sold the day before? Meanwhile you could have calmly sold UVXY for a tidy +10.1% from buying the day before and it closed the day -5.37%, calming down and ready for the next ‘amber alert’.

With AMZN only falling back to where it had held a firm ‘floor’, you likely wouldn’t have sold, since it was only back to your buy price, but you’re certainly not getting a good night’s sleep with your 3 big ‘safe’ holdings all down significantly and falling.

And imagine if you (or your advisor) prefer to ‘buy and hold’? Yikes!! AMZN -25.9%, FB -41.0%, NFLX -43.6%! Yeah, you’re still up 10x with AMZN from buying in 2014, +744% from buying FB in 2013, and a whopping +4787% on NFLX from buying in 2012, but that’s no reason to give up 25-44% of your winnings. It’s time to change how you play the game.

The advantage of buying an index ETF like SPY or QQQ, is that you’ll have shares in major companies like AMZN, NFLX and FB, but you’ll never wake up to a 24% hair cut. You also won’t get the huge long term gain if you pick the one winner, but it’s basically impossible to know which one of a dozen potential stocks will be the ‘big winner’. Holding some of all 12 will leave you struggling to sell them all quickly when the storm hits suddenly. If you have just one or two index ETFs, then you can enjoy the steady climb and get out quick, avoiding the sharp drops.

So how about our new game plan? UVXY gave a gain of 1174% during covid, in just over 4 weeks. Only NFLX topped that and it took 10 years. YTD we’ve gotten a cool +187% and NFLX is down -35%. So far so good. We know we can repeatedly pocket gains of 20-30% with UVXY, while staying safe and waiting for the big crash for another 10x win. We have no idea how AMZN, NFLX and FB will do going forward but we’re pretty sure they don’t have another 10x win in them. It’s time to put them out to pasture.

The ‘experts’ will also tell you that it’s impossible to time the markets, but just about anyone can look at the charts for AMZN, NFLX and FB and point out where the ‘steady’ climb ended and it was time to consider selling. And now you can with a simple click on your phone. You now have the tools you need to play the game with a new strategy and win, big time.

You could compare it to guerrilla warfare versus traditional strategies. The successful generals were those who adapted strategies to current conditions. With everything in life, new ideas and techniques eventually replace old, worn out practices. High frequency trading and ‘algos’ have changed the investment landscape, and so has free online trading accounts. Now, someone with as little as $50 living on the beach in Baja over winter can have success.

I’ll leave you with the daily chart of UVXY and decide for yourself where you would have bought and sold.

Now, set up your online trading account, put some money in it and get ready to catch the next wave. And tell your friends to do the same! It’s time us ‘minnows’ started feasting like sharks.