Did you avoid the sharp drop in the markets to start 2022? Did you make over 100% with UVXY? If not, it’s time to change your strategy.

Over Christmas, I started my musings and began formulating a simple strategy that everyone can follow to protect their savings/investments. The primary focus is not to lose money on a potential market drop. As the markets returned to a hard ceiling after Christmas, it was clear that caution was needed and on Jan.4 we hit the sell button and headed for safety.

I wasn’t expecting a big drop and knowing that the markets often fake lower on Monday and reverse, we went long again SPY on Monday, Jan.10. A mere 3 days later, on a hard reversal we headed for the sidelines again. Remember, the key is don’t lose money.

On Monday, Jan.24, we were again watching for a potential reversal and, having avoided a drop of nearly 12%, all our capital was safe and ready to re-deploy. Since then, things have remained volatile and you may have traded if you’re an active trader, but it was easiest to do nothing since the price held above your buy price and now you’re sitting on +5.3% as of Friday’s close.

It’s important to remember that the ATH (all time high) may have been hit and the markets could continue to fall all year. No problem, since you can easily sell to lock in some gain from your re-buy on Jan.24.

Is it going higher or lower? I’m not able to make such predictions, but others have proven themselves to be quite good at it. In particular, Avi Gilburt says were going to 550 this year or early next year. That’s +29% from your re-buy price of 426 (or better). Regardless what happens, you’re in good shape now +5.3% YTD, versus -5.5% if you hadn’t bothered to hit the button on your phone twice. That’s a difference of $10k on a $100k nest egg. How did you or your advisor do?

Of course, a little extra effort is usually rewarded. Here’s an hourly view that shows where we traded. Once the volatility drops off and the markets calm down, then even you hard workers can sit back and relax.

So, that’s +10.1% YTD with just a little extra effort taking action when alerts were hit, and all your cash is safely off the table, since there’s no way of knowing what will happen Monday.

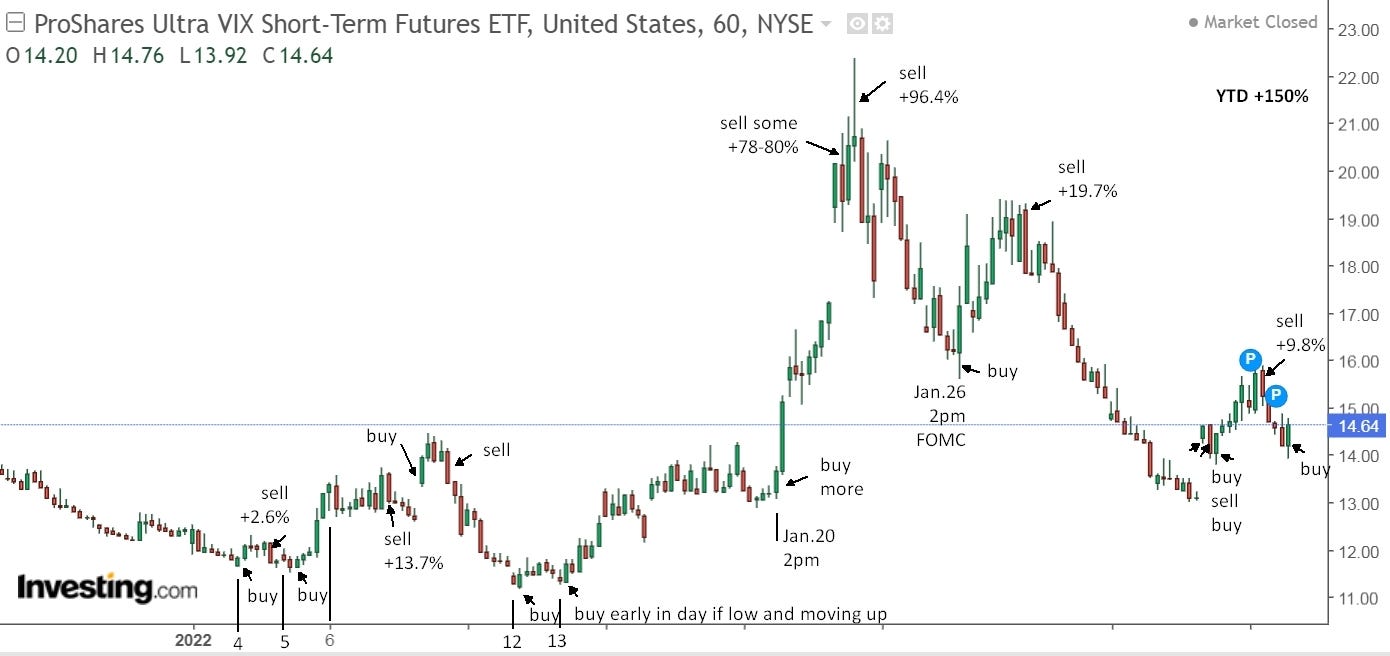

In my Christmas musings, I also suggested trading the volatility ETF, UVXY (HUV in Canada), for quick and safe gains. Here’s a look at it.

When markets are looking to be at risk of a drop, like they were to start the year, then watch UVXY early in the day for a buy. If it continues a slow fall, set an alert to catch a reversal and get on with your day. If it moves up, buy and set a stop to sell if it reverses. At most you lose 1%. If it continues up, move your stop to break even.

Remember, we sold SPY early Jan.4 with a stop to re-buy on a move back up. You could then also have bought UVXY and sold later in the day when it fell sharply for a quick gain of +2.6%, but most importantly, you’re back to the sidelines and safe. On Jan.5, the reversal came around 11am, and you got the alert, so take another swing. It closed at the high of 13.18 and you’re up +12.6% so stick with it, don’t sell any. Sure, that’s a nice gain for one day but this trade can potentially be much, much more so stick with it.

The next day was flat and on Jan.7, when it reversed sharply, you cashed out for a nice gain of +13.7%. It continued lower to the close, so no reason to re-buy. The next day it opened up sharply and moved up, so buy. It failed to follow through so you sold for a small gain. Jan.12, you again bought early on a move up. It didn’t make a big move, so you might have sold, but most likely held since you’re still long SPY and it makes sense to keep UVXY as a hedge at least. The next day you sold SPY early on the drop and could have bought more UVXY. By the end of the day, you’re up nicely and you expect more volatility, so stick with it. When it made a sharp move up on Wed. Jan. 20 at 2pm, you got an alert to your phone and you could have bought more. By the end of the next day, you’re now up 51.8% from your buy Jan.12. You may be tempted to sell, but stick with it since it closed high. If it opens lower the next day, don’t sell quickly, wait for a possible reversal and you might even buy more then, and then be ready to sell everything on a reversal.

On Monday, January 24, you’re positioned superbly for a wash out in the markets, but you’re ready for an all too common Monday reversal from an early hard drop. Bingo! That’s what happened, so you sold all your UVXY for 80-100% depending on your timing, and you re-loaded your SPY. Here’s the chart again for reference.

The markets then rallied nicely in your favour and volatility dropped off. On Wed. Jan.26, FOMC day, you’re ready and waiting at 2pm since you know there’s usually fireworks at that time. Sure, it’s all nonsense, caused by the high-frequency traders and algos, but you might as well take a coffee break to catch the action and hopefully pocket enough for a new espresso machine.

Sure enough, you quickly switched horses again, sold SPY and bought UVXY - two clicks on your phone. You switch horses again on Friday at 10am on the sharp reversal. I thought that would be the end of it, but Avi and Robert expected a possible re-test of the Jan.24 low. Since I respect their advice, I stayed alert, and, sure enough, early Feb.3 sold SPY and bought UVXY. I was no longer looking to buy SPY until things settled down and I focused on UVXY, sold on the reversal for break even, then re-bought less than an hour later when it reversed again. It continued up, so hold overnight. The next day it reversed sharply at 11am, markets found some strength, so sold UVXY for a quick 9.8%.

It’s good to remember now, not to be greedy. There’s no need to re-buy SPY since we really don’t know which way it’s going to go next. Sure, Avi thinks it will go to 550 this year or early next, but he’s also watching for a fall to 420, so just stay on the sidelines. There was also no need to re-buy UVXY late on Friday, but since you’ve already doubled your money with it, you might as well put your original bet back on since it’s ‘house money’.

One guy from SA (Seeking Alpha) commented that a 100% gain on UVXY is a “magical number”. Sure, it’s sounds unbelievable, but they weren’t difficult trades to make, it didn’t take a lot of time and effort, and your total YTD with it is actually +150%. Combine that with +10.1% with SPY and you’re off to a good start.

I should add, that you’re not likely to put all your capital into UVXY like you are with SPY, but once you’ve had repeated success and are comfortable playing the game, why not? It’s like counting cards in Vegas: keep the bets light until the deck is stacked in your favour.

If you haven’t yet opened up an online trading account, get to it! And please, spread the word to family and friends that might find this useful.