My goal for the past few years has been to figure out how to make money consistently and safely with minimal time and effort. As with anything in life, figuring out simple solutions to problems usually requires a LOT of time and effort. And it often requires ignoring many traditional solutions that simply don’t work. (Feel free to scroll down to the second chart if you don’t wish to read the background story.)

I graduated from university in December, 1986 and took that winter to ski before looking for a job. I found and got the job I wanted Stampede week 1987 (July). I worked for Tartan Engineering for 2.5 years, then decided to ‘retire’ and go to Australia to windsurf the waves. That was the start of a 20 year adventure and no investing.

I was in Indonesia during the Asian financial crisis, and had just taken a 3 year contract on a restaurant location. It was another great adventure, but cost me the rest of my savings and then borrowed money to try and make it work. Y2K and the dot.com bust were mere news events with little relevance for me at the time. When I returned to Canada for a visit in 2008, I had no idea another major economic crisis was happening. It was upsetting to see friends losing a substantial chunk of the money they’d been saving for years, and for most, this was a second time for that experience.

In early 2009, just about any stock in the S&P 500 and Nasdaq bought and held since 1999 was down 30-50%. How could anyone still believe that ‘buy and hold’ and ‘dollar cost averaging’ were reasonable investment strategies? Worse yet, how could financial advisors still be recommending these strategies?

Fortunately, by 2009, there were more options for managing your own money. My brother had started trading with Questrade that charged C$4.95 per trade, which was much cheaper than the $10 charged by banks, but still a lot for a guy with no money and no job. Naturally, I borrowed some money and jumped in with both feet.

I was trying for big wins to pay off my debt and make money to give Mom and Dad to finish building their ‘new’ house. Spoiler alert. I did terrible. I had some big winners, but more smaller losers. Information and advice was completely contradictory. Some said inflation was going to be a major problem, others said deflation. Gold and gold miners were touted to be the best investment, it made sense and they did well till August, 2011 and after that they were horrible. Many people remain committed gold bugs, many also remain convinced to buy and hold all their stocks. Diversification and stock picking are also supposedly important, but what’s really the best investment strategy?

Prior to the covid crash in 2020, I was living in a tent on a beach in Baja kitesurfing every afternoon and watching my investments in the morning. I had learned a lot and had plenty of ideas, but I still didn’t have a clear and effective plan. By the end of 2021, I was finally willing to stick my neck out in order to help friends and family avoid a potential drop in 2022. On Dec. 19, 2021 I posted a blog, “Are You Ready For The Next Market Crash?”. On Boxing Day I posted, “Give The Gift Of Financial Security Next Year.” It’s an entertaining read that starts,

“Twas the week before Christmas and the markets were still stirring with market makers playing games with the sheep. Since Thanksgiving they have merrily played, first down, then up and back down again hard. Naysayers then shouting, "Beware! We told you so!" Then quick as a wink, with a nod of their heads, up the markets rose and on the rooftop they sat. Now all Whos in Whoville were huddled in awe and despair, what's next they asked? As quick as they rose, down the chimney they fell and again rang the bells, but not of good cheer, of alarm! Fear not, it's Christmas they said to themselves, and up went the markets like naughty young elves. So now what to do, asks wantingly all of you, well pull up a chair and I'll tell you what to do.”

2022 provided a LOT of lessons. I was generally right about everything but still missed the empty net after faking out the goalie. I was also handicapped by trading Canadian ETFs which don’t have the necessary volume like the U.S. versions.

On Jan. 8, 2023, I posted “Trends to start 2023.”. Basically I was bullish and staying with the trend, which was up. I also highlighted the lessons learned in 2022. On June 18, I posted “Are you ready for a market drop?” Note that I wasn’t expecting a crash, just a drop. I wrote updates in those articles as time passed, so you can follow along if you like.

Fast forward to now, my ‘final’ lessons were learned in the recent blast higher and I was finally able to ‘prove’ what I had been thinking. Primarily, buy and hold is a bad strategy and secondly, leverage can be very profitable if managed carefully.

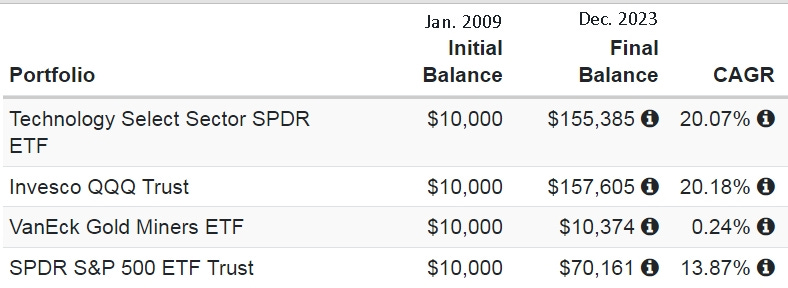

Here’s the performance of various ETFs since 2009. XLK and QQQ follow the Nasdaq. Currently 44% of XLK holding is split between Microsoft and Apple. QQQ is more evenly spread with 17% in MSFT and AAPL. SPY follows the S&P 500 and GDX holds a group of gold mining stocks.

That above chart is dramatic and clear, but it doesn’t put a clear dollar value on it. Portfoliovisualizer.com is an excellent tool to calculate returns over a specified period, including reinvesting of dividends.

Clearly tech was the winning investment since 2009, and note you double your final balance by getting 20% a year return versus 13.9%. Also remember that tech was the big loser from the dot.com bubble in 2000. Are we nearing a bubble now? Will gold finally be a good investment? I don’t know the answer to those questions, but I do know a safe investment strategy that will give you even better returns and requires 10 minutes a week to make sure everything is okay.

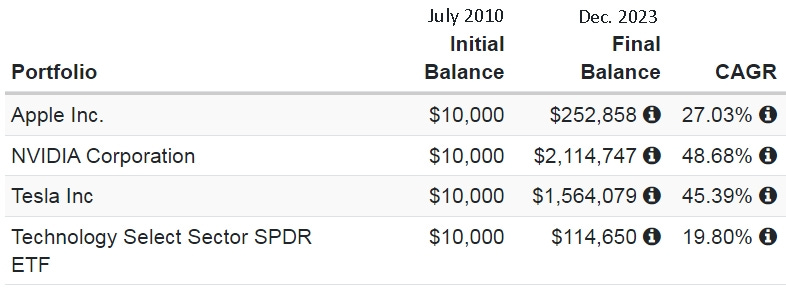

Naturally, people wish they had invested in companies like Apple, Nvidia and Tesla. Many that did, including myself, wish they had held on for the full ride. Here’s how they did compared to XLK since July 2010.

I was in early for both NVDA and TSLA, got good gains with them, but didn’t have $10k invested in them and didn’t hold on for the full ride, so I wasn’t able to give my gift to Mom and Dad. Note the massive difference in the final balance with an annual return of 48%. Most people are happy with 10-15% returns, but those aren’t really life changing. Picking winners like Apple, Nvidia, Tesla, Netflix, Google, etc, really isn’t that difficult. Getting those huge, life changing returns is. My goal for the past year was to simplify everything to a single safe investment that also provides those life changing returns.

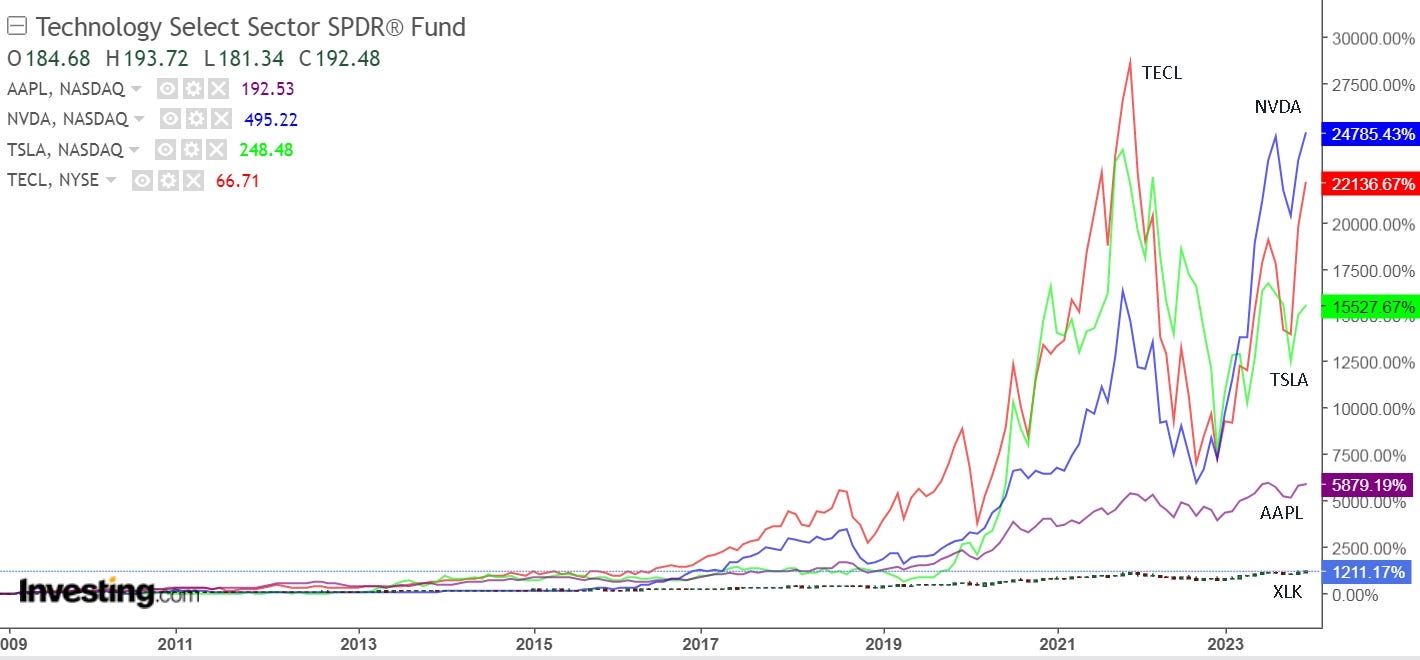

The chart below shows that getting those amazing returns with TSLA and NVDA was also a roller coaster and it shows that they could have been matched and even bettered, with a a leveraged version of XLK.

Remember, XLK and QQQ were the ‘big’ winners compared to SPY and GDX. Now, their 1211% return in 14 years looks like 0%. We also concluded long ago that buy and hold isn’t a good strategy, yet it still gave amazing returns, even with a leveraged ETF. For me, this was the final piece of the puzzle that was there all along but I didn’t see it till I made the chart above and was able to calculate the actual returns. Buying a leveraged ETF, like TECL or TQQQ, can match or exceed the best individual stocks. Finally, you can stop looking for that next big winner and simply watch over a diversified ETF that will have all the winners in it.

XLK is an ETF that holds tech stocks like NVDA, TSLA, AAPL, MSFT, etc and TECL is simply a 3x leveraged version of XLK. Buying XLK allows you to avoid picking individual stocks and buying TECL can provide equivalent returns to picking the best stocks. If only I’d known all this back in 2009! Oh well, my son is only 23 and he will be able to apply what I’ve learned for many years to come.

Let’s review the lessons learned. First, compounding returns provide massive results. Likely everyone knows that, but the magnitude isn’t likely fully appreciated. For example, people talk about getting a 10 bagger (1000% gain). For a gain of 100%, you only need 7 compounded returns of 10.1%. If that’s your annual average return, you’ll get a 10 bagger in just over 23 years, turning $10k into $100k. As my dad recently said, “I don’t have 20 years to wait.”.

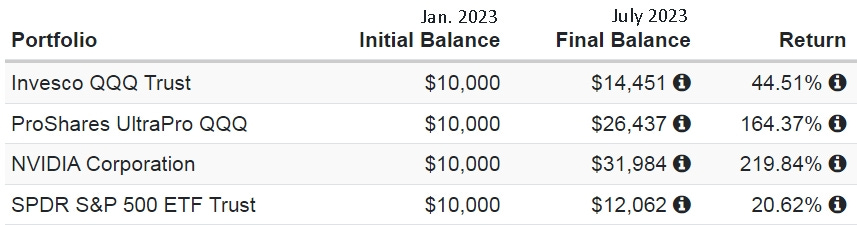

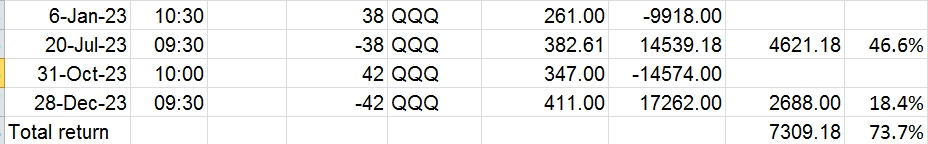

From 2009 to 2023, XLK and QQQ gave 20% CAGR, which gets a 10 bagger in just over 12 years. You may be hearing in the news that the S&P 500 gained nearly 25% in 2023, and the Nasdaq returned 54.77% year-to-date, matching a performance not seen since 2003. Those are good returns, with no leverage, and not picking NVDA which is up 255%, and most importantly, not selling the end of July after being ready to sell for over a month. Here are the returns for January through July.

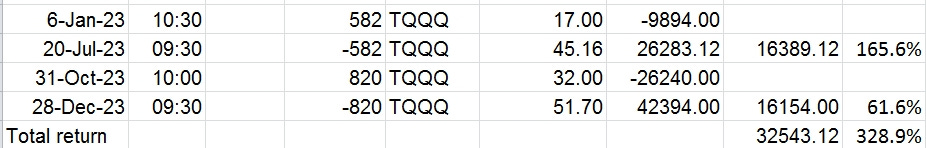

Those returns nearly match the full year returns. If you were checking your position once a week and sold ‘properly’, you avoided the drop and then re-bought late October and perhaps sold to close out the year. Now the return for QQQ is 74%! Doing exactly the same things with TQQQ gives a one year return of 329% which beats NVDA.

Those are the facts. That’s the potential. Yeah, I know it sounds impossible, but it is what it is. Those are the numbers. The only thing left to ‘prove’ is that you can ‘time the market’ effectively. To that point, I wrote my first blog posts in December, 2021 saying get ready for a crash in 2022. Then I wrote a blog post in June, 2023 saying get read for a market drop. I don’t use any fancy techniques and I have in fact discovered that all the fancy tools and predictions simply make it more difficult, for me, and for sure for my dad and others with no investment experience.

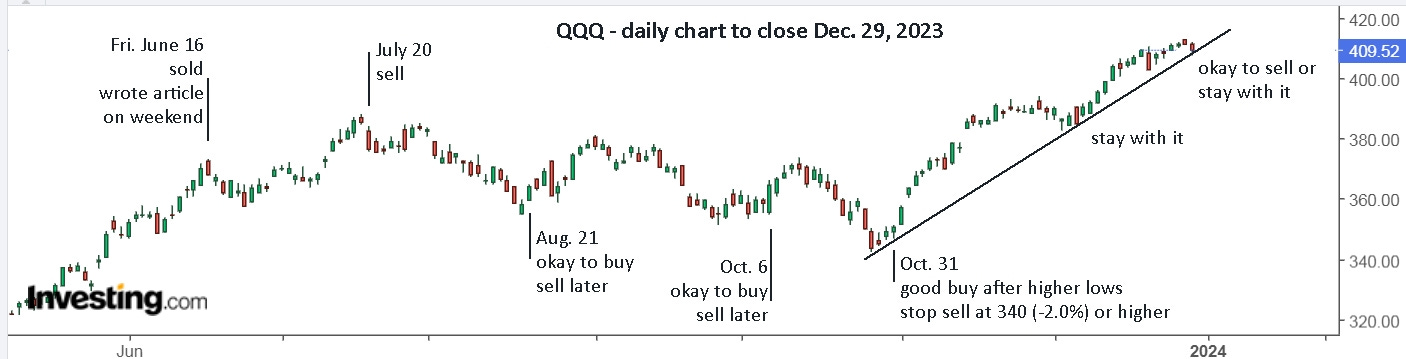

So, let me show you how you can ‘see the storm coming’ without a weather report. Here’s the daily chart for QQQ till Friday, June 16 when I was ready to sell, did and went short. Sure, it could continue higher, but I was content with a 41% gain in 6 months and it was looking ‘overbought’. You’re simply watching for it to stay within the lines.

Unlike most other systems, I’m trying to avoid making any predictions. It’s like driving. Simply keep your eyes on the road and make sure you don’t hit the ditch.

As you can likely guess, it made sense to re-buy QQQ at a discount and stay with it so long as it stayed between the lines. When it gapped sharply lower on July 20, it was clearly time to hit the sell button. After that, enjoy the break and continue checking the ‘weather’ once a week.

Fast forward to now, you can see for yourself when you might have bought and you can read my weekly updates in the June 18 article “Are you ready for a market drop?”

Now you have all the information you need for 2024.

The reason I use shorter time frame trendlines is because there are always waves in price movements, but there are not always long up trends like 2023 or 2021 where you can just walk away and let it grow. I want to regularly compound my investment and not depend on a bull market. I also want to avoid trading the inverse ETFs. Years such as 2000, 2001, 2002, 2005, 2008, 2011, 2015, 2016, and 2022 offered very little in terms of easy long trend lines. But there were several waves to be played. Buying and selling TQQQ during these years could have made > 100% profit while TQQQ was flat or -90%.

2023 should have been an easy year. It was the best year for TQQQ and TECL ever - even if you just bought and held for 1 year it was +200%. That almost never happens, and it would be foolish to think it can be repeated again in the next year.

I said I would have many comments...

It's great that you don't need to study hundreds of companies looking for promising growth opportunities, or worry about what might happen to these companies every quarter when earnings are reported. Because as much as you study and prepare for this, there is no guarantee the stock will even move in the logical direction following good or bad news. People say fundamentals matter eventually, but then you wait 3 years while the stock continues to slide down. Meanwhile you are wasting time waiting and could have been trading, compounding gains.

Generally when people buy individual stocks and the price goes down, they buy more because it is a better value. The author has written about this dollar-cost-averaging strategy or buy-the-dip which is a complete fallacy. Just look at a stellar company like PFE. The stock price peaked in 2000 then fell for 9 years. It didn't recover until 2021, and has again been falling for 2 years. Should you have bought the dip in 2022, or 2023? Well can you imagine buying the dip in 2001, 2002, 2003, 2004, 2005 (when is this going to end?) 2006, 2007, 2008? At some point you are out of money to buy the dip.

Instead, learn to sell losers at the first sign of trouble (trend break) and move on to something else. Or be willing to buy it again later when it breaks the down trend.