Lessons learned in 2024 and 2021/22.

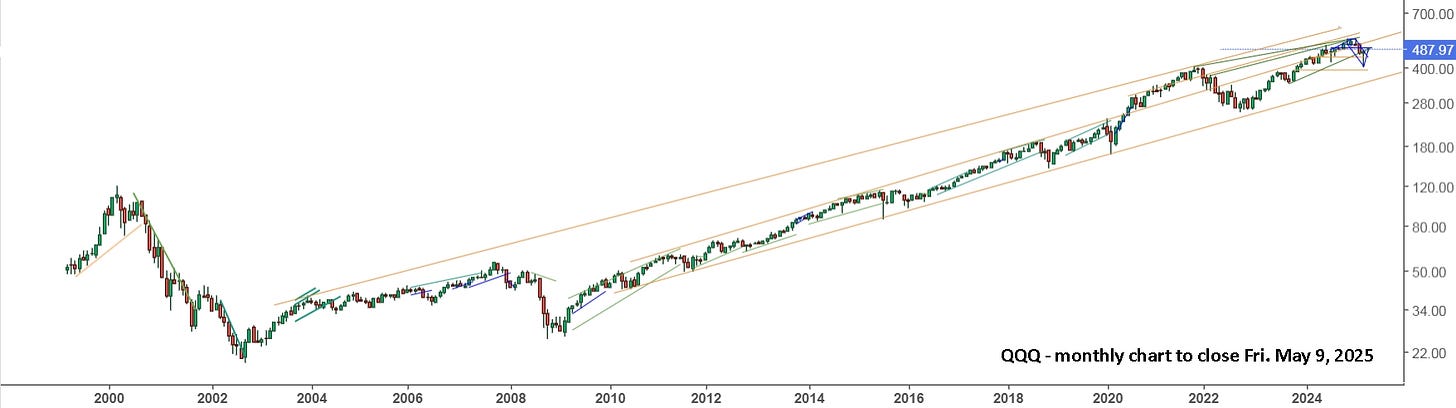

The current market charts look a lot like they did in January, 2022.

On September 2, I wrote “Getting ready for the next market crash.”. I didn’t think a crash was imminent, but I wanted people to start thinking about it again. A bit like getting ready for winter in July, which makes a lot of sense. Since coming back to the farm where I grew up, to help my parents, each spring I have a short list of things I want to do to make the next winter easier and less work. Early summer is the best time to get started, so it’s finished by the end of summer at the latest.

In January, 2022, I wrote my first article on substack, “Are you ready for the next market crash?”. In December, 2021, I wrote several blog posts on Seeking Alpha, so I had indeed managed to sound the alarm in advance, but there’s not a lot you can do in December to get ready for winter. Now that winter 2024/25 is here, I see that there’s a lot of similarity to how things looked in January, 2022.

Here’s a look at SPY, now and then. Both years were looking bullish the day before the ‘holiday’, and switched to looking very bearish and at support the day after the holiday.

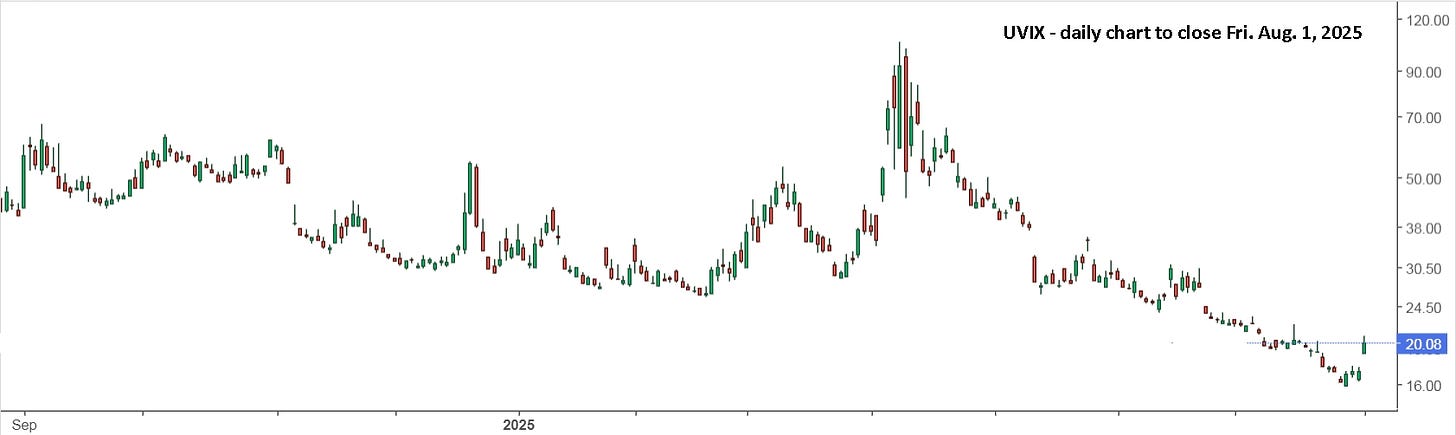

There’s no way to know what will happen Monday and next week, but we’ve been safely on the sidelines since early December, and have been focusing on some UVIX trades since then. More on that later.

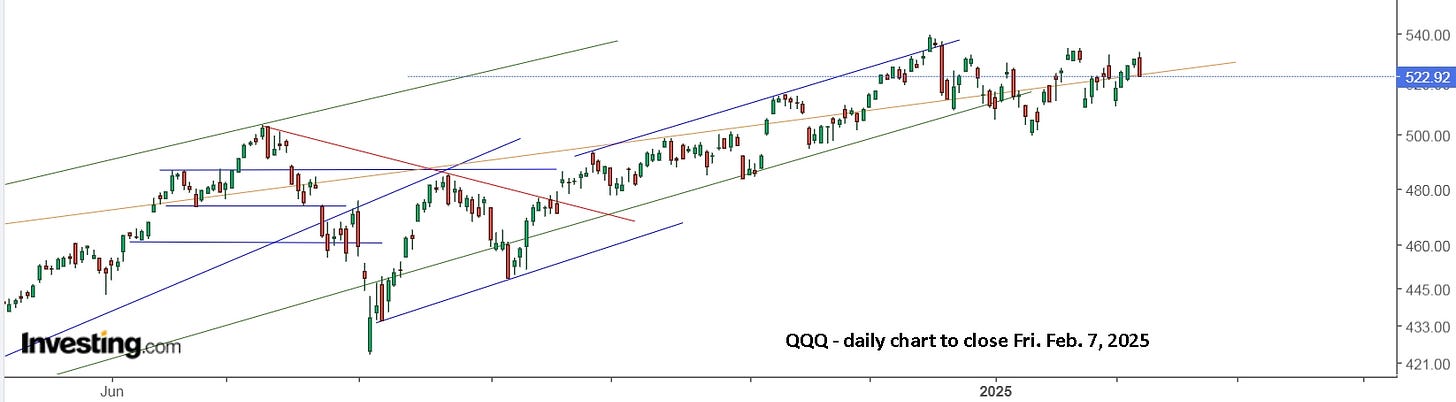

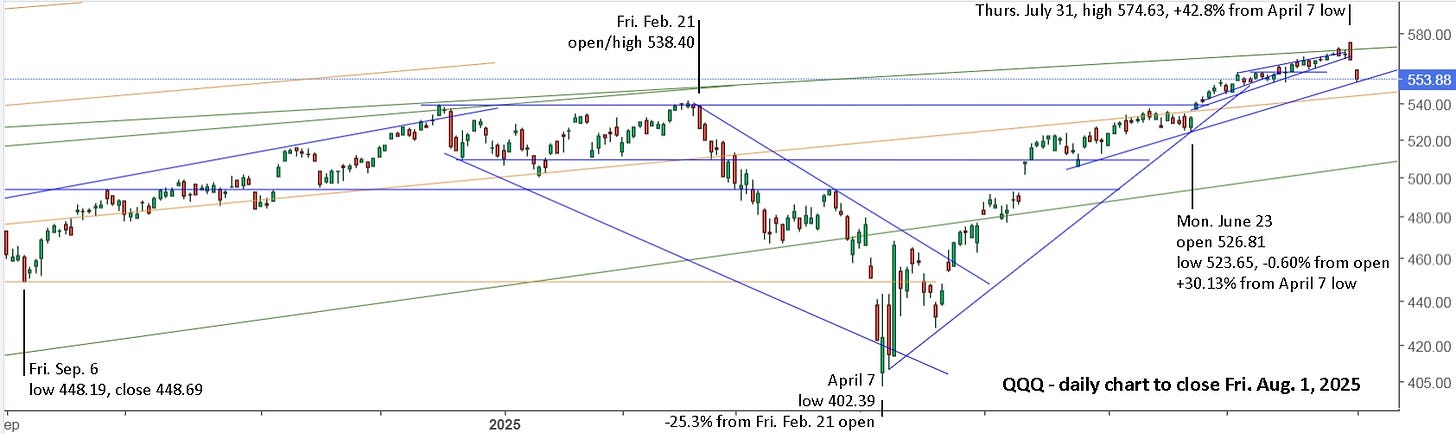

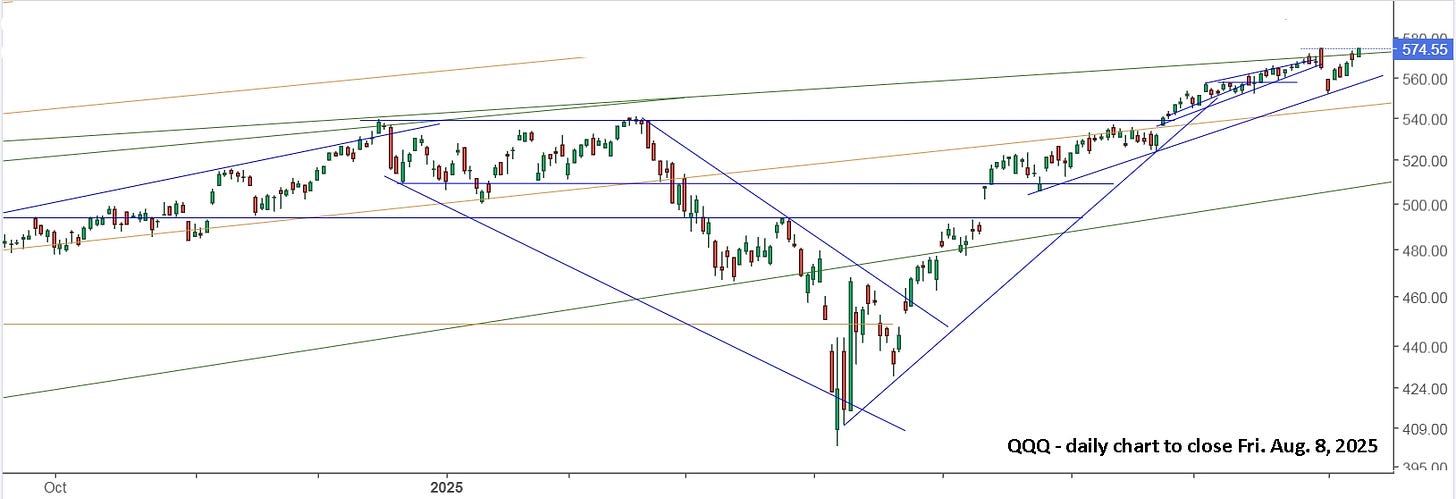

Here’s a look at QQQ, now and then.

And here’s a look at DIA. Note that for all the indexes, the day before the ‘holiday’, there was a higher low and it was reasonable to buy, in anticipation of a continued move higher. The key was to then sell out early the next day and return to safety on the sidelines. The lesson from 2022 (and 2020) is that if you didn’t already sell, you might want to do it first thing Monday.

The next important lesson to learn is that the markets might drop next week, then rally hard up the following week. They may then continue up all year, or they may drop like in 2022. There’s simply no way of knowing and the only thing you can do is to take action on the day, based on what you see in front of you and your experience from past situations. I’ll add that they may also gap lower on Monday and rally hard up on the day. Simply be ready for whatever happens.

It’s best to take everything you read with a grain of salt and a heavy dose of common sense. I don’t claim to be an expert, by any stretch, but my ‘common sense’ has a pretty good track record since I began putting it down in writing. I’ve also noticed weaknesses in the theory of others, which my common sense pointed out to me straight away. Time later proved it to be right.

JC has an active blog on SA, with a lot of followers who diligently try to learn and understand his system. I’ll admit, it works extremely well a lot of the time, but it’s a lot more complicated than my simple trendlines, and it intentionally buys in batches as the price drops. I hate doing that. If the price is dropping, I prefer to stay completely out until I’m ‘sure’ the bottom is in. If I’m wrong, I prefer to get out again.

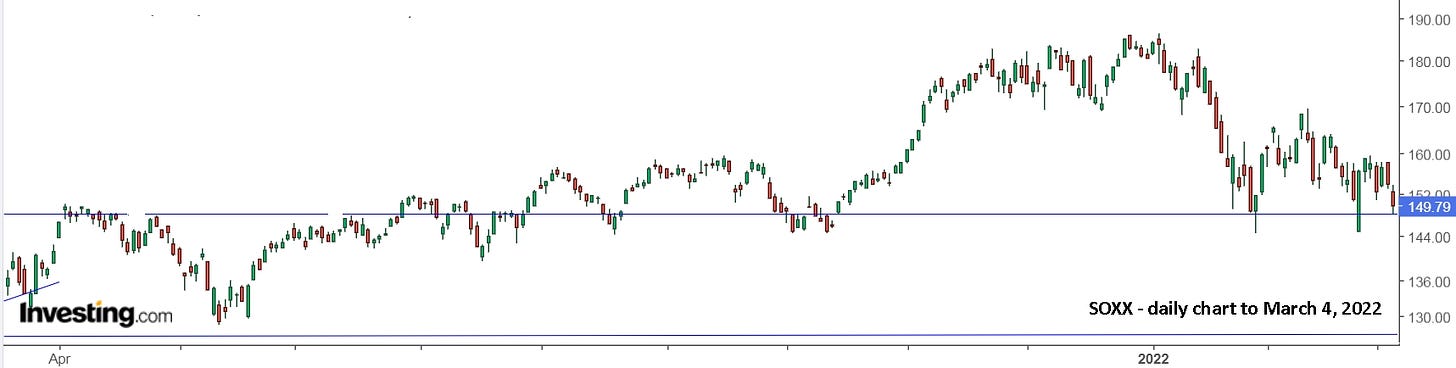

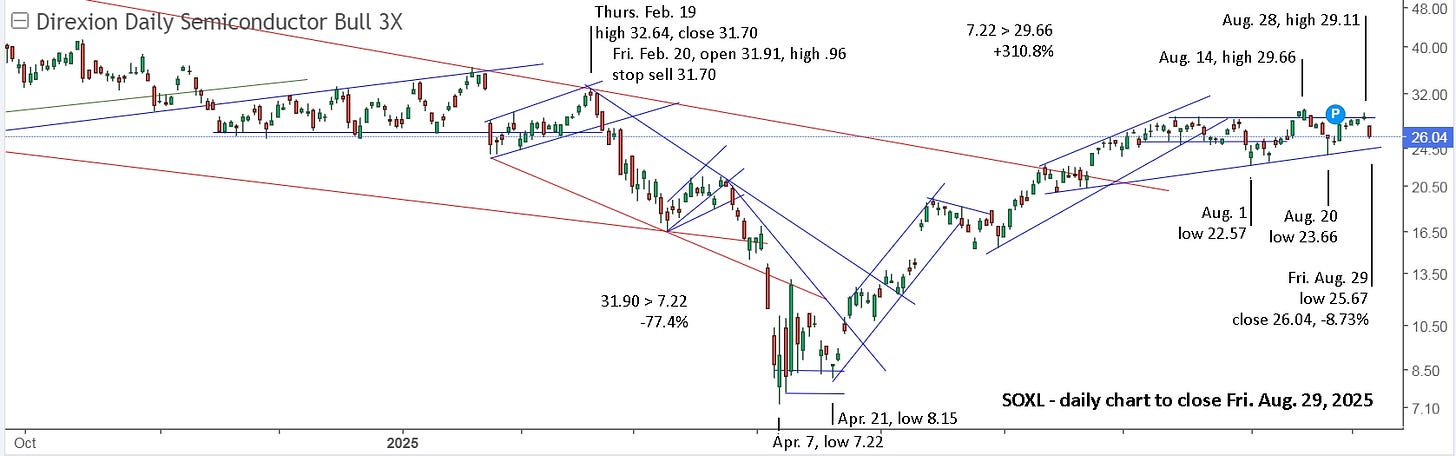

Once in a while, he and his followers get ‘trapped’ in a position for months and months. To my surprise, he has eventually gotten out with a profit, but that doesn’t change the fact that it was a painful process with unnecessary risk. The semiconductor ETF, SOXX, is widely considered a ‘no-brainer’. Just buy and hold forever. Well, it does drop hard when the markets crash and it had a poor year in 2024. I say it’s not a no-brainer, and there’s a risk that it will do poorly this year and next.

Here’s a look at JC’s buys in July.

When he announced his ‘bargain’ buy on July 17, my immediate thought was, “Why buy on the first day of a major drop?” when it hasn’t even started to turn up. Well, that’s part of his system. He generally puts in his orders the night before and he his utterly confident that he will be able to sell for a profit, eventually. He also plans to buy more as the price drops, so he’s essentially hoping for the price to go lower after he buys. I’m even guilty of that, stupidly, with very small positions. I guess it’s human nature. In the chart above, it doesn’t seem like his buys were ‘terrible’, and he could have sold his first 2 buys for a small gain days later. On a daily chart, it looks a lot different.

The daily chart shows the first ‘safe’ day to buy was Monday, August 5, when it gapped lower and powered up on the day. JC made a 5th buy on August 7, -53.0% from his first buy on July 17. I say that was also a risky buy, as it could have easily continued lower the next day. That’s why I prefer to buy early in the day, like on August 5. When it made a higher low early on August 8, that’s another good buy point. The downside to my strategy is that you can’t put in orders the night before. JC is still sitting on his first 3 buys in July. We’ll see if he can eventually sell them for a profit.

Going back in time to January, 2022, JC might have bought the ‘dip’, like he did in July. I don’t remember if he did or not. I don’t see much difference buying then to buying in July, then buying the low, selling for a gain while still holding the high buy(s).

You more or less know what happened after that. It continued lower till finally hitting bottom on October 13. If bought at 170, it was a drop of 43.6% to the low of 95.94, and this is unleveraged SOXX. JC would have bought SOXL.

SOXL just managed to get back to the highs of 2022. It may never get back to JC’s July buy prices of 54.32 and 49.30. Alternatively, SOXL could be over 100 by July, 2025. There’s simply no way of knowing. The key, for me, is to get on when it’s going the direction you want, up, and get off when it’s at risk of turning down.

In my Jan. 25, 2022 article, “Are you ready for the next market crash?”, I wrote:

Did it make sense to sell in 2020 on covid news when you were already up 40.8% in just over a year? I presume you all said ‘yes’ and thus avoided the 33% drop.

If you did sell, then re-buy in March, a simple 2 clicks on your phone, you were then up 109% by the end of 2021, and it was again looking like a good time to be ready to sell. And better yet, sell while it’s up and simply re-buy if it doesn’t drop.

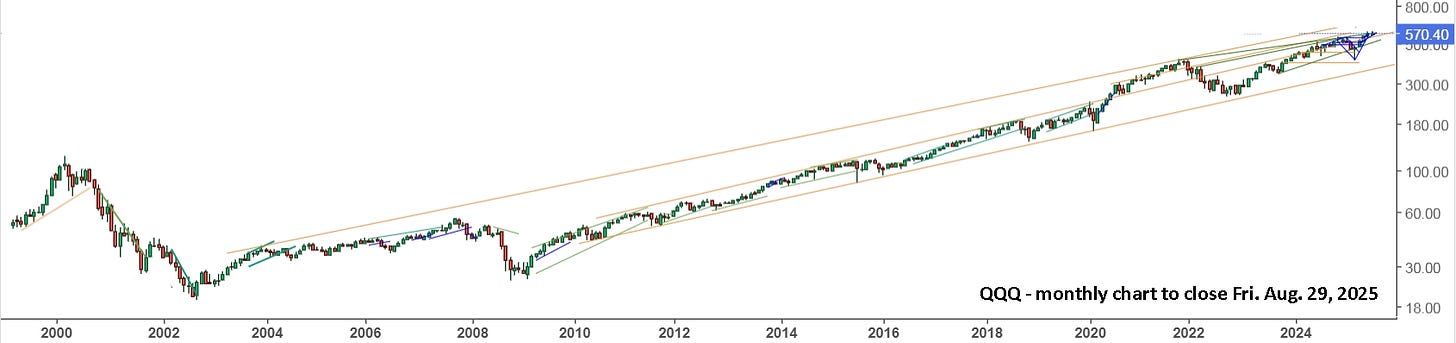

I now use log charts so that the percentage gains maintain perspective over the years. I’ll let you draw your own conclusions from the chart below.

Yes, it could push higher over the next year(s) to hit the green resistance line dating back to 2010, but it first needs to push through the yellow resistance line dating back to 2004. It already pushed through the yellow resistance line dating back to 2000 and 2021.

For me, I’m watching for a drop and will trade it with UVIX (2x) and UVXY (1.5x). In 2020, it went up over 1000% in a few weeks. In 2022, it went up over 100% in January, and the compounded return was way over 1000% in a few months.

For a review of UVXY and updates through to last week, read my September article, “Getting ready for the next market crash.”. Here’s a quick look at last week, which was an ‘easy’ UVXY or UVIX buy on Monday, but then it got tricky.

Good luck Monday and the rest of the year, but we all know that luck isn’t what you need.

Update to Fri. Jan. 17 : The markets did indeed gap lower on Monday and rally on the day. They also continued up for the week, but with large gaps so if you didn’t jump early on Monday and stay with it, then it was a much more difficult week.

A gap lower on Monday, followed by a rally on the day and week, should be a clear and recognizable pattern by now. QQQ gave 3 chances to buy near 500 before turning up at noon. The gap up on Tuesday, followed by a drop, had me selling. I did re-buy the mid-day low, but then sold the late drop and stayed out, thus missing the gap up on Wednesday. Such are the risks of over trading.

My lesson for the week, one that should have been hammered into my head long ago, is to maintain some of a position if it’s still above your buy. Another point that has been becoming ever clearer, is to consciously sell your final shares lower than your prior sell. That way, you can re-buy them higher, along with other shares just sold lower, which prevents you from chasing and only re-buying higher. It also helps keep you in for the entire run.

The Tuesday lows were higher than Monday’s lows, where you bought, so hold, regardless of what you think the markets are going to do Wednesday. Knowing that the CPI report was coming out Wednesday at 8:30 makes it practically a given that the markets will gap up. It happened all last year, like clockwork.

Similarly, you should still be holding some of your shares, regardless of what you think will happen next week. To me, the markets look like Wile E. Coyote when he’s suspended in air after going off a cliff.

The markets were gapped higher after the inflation numbers and there was little follow through on the day. The late drop on Thursday was a complete fake for the gap higher on Friday.

The daily view shows the markets are solidly up from a week ago, but near resistance, and SPY is above resistance. It seems the potential crisis was avoided.

If you went long early Monday and did nothing all week, fantastic, it’s time for you to take over and start sending alerts to all of us. If you’re on the sidelines, prices are still lower than you sold in December for QQQ and SPY, and way back in July for SOXX.

The other lesson that should have been learned long ago, but I forgot on Friday after doing it on Thursday, is to look both ways. Be ready and willing to go long or short. And it even works well sometimes to be holding both long and short at certain times of the day, but buy at the low price with a stop sell, don’t buy with a stop.

The gap up on Thursday and Friday seemed very fabricated to me, so I bought SOXS, and would have sold SOXL if I had been holding. On Thursday, once SOXL was back near Wednesday’s price, it was a fortunate opportunity to buy. You’re also sitting on a quick win with SOXS. To avoid over trading and whiplash, I suggest you leave the original stop sell on SOXS and be willing to give up the quick win, because it will be offset with a quick win in SOXL. If SOXL drops, you’re still in SOXS and take the small loss in SOXL. The early drop on Thursday was over 4%, and provided enough time to try selling and take the wins in both directions.

Friday morning was a tight range of less than 2% and I should have bought SOXL after it made a higher low, and SOXS made a lower high. Thus, I have the best, safe price for SOXL and am sitting on a gain with SOXS. When SOXS dropped back to its early low price, I would then be sitting on a gain with SOXL and back to even with SOXS.

When SOXS hit 18.50 and didn’t trigger my stop sell at 18.49, I added to my SOXS position with a stop sell again at 18.49. I even stopped into some more when it broke higher, which was a reasonable idea, although buying more a bit cheaper was likely a better idea. If I had been holding SOXL, then stopping out of SOXS would have been no big deal, and I could have simply held my SOXL. Not holding SOXL, and remembering the afternoon move on Thursday, had me jumping back into SOXS on a tight stop buy at 18.56 and a stop sell at 18.39. That stop held, so I added in the .40s and was then stopped out of everything again. You get the picture. I wasn’t looking both ways and as a result I was focused on not missing a repeat of Thursday afternoon.

Look both ways early in the day and ignore all biases to what you think is going to happen. I need that to become a reflex, that requires no thought.

I also bought UVXY early and it moved up on the day as the markets also moved up.

No surprise. That happens often enough, and I often find myself holding both UVXY and SOXL. Unfortunately, I didn’t do that on Friday and was focused on SOXS instead. It’s a bit like when a quarterback throws an interception straight into the arms of a defender that he didn’t see. I mean, he was right there, in front of the guy you were throwing to, but you literally don’t see it. Like the bear walking across the court while you’re counting the bounces. Having some tricks to avoid being fooled by our brains and eyes is very useful.

A final point to keep in mind, is that things can look very different from a different perspective. The rules and techniques are there to help you get in and out of positions at important times, to lock in gains and stay safe. After that, it’s easier to stay on for the longer ride. The markets have given a long ride up, and you don’t want to stay on for the next ride down.

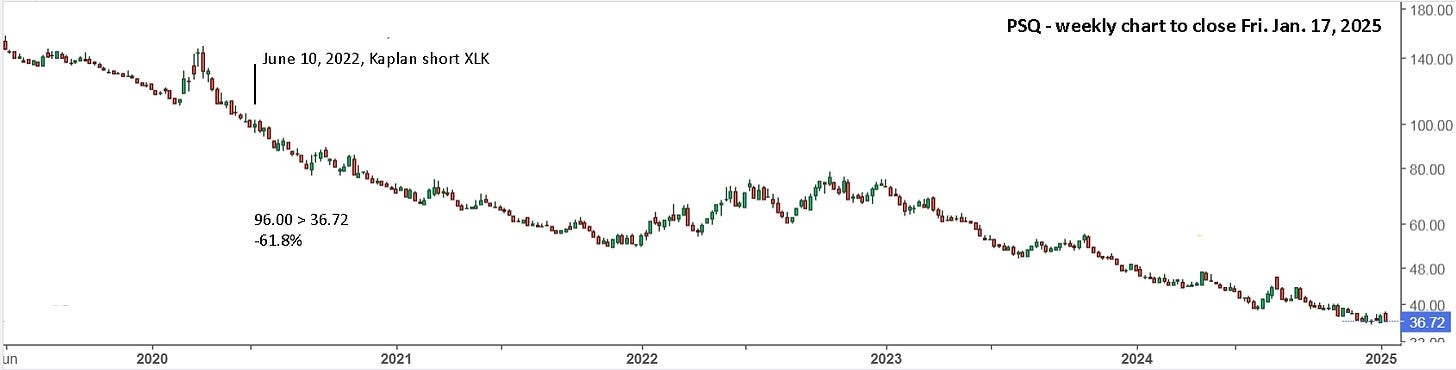

And here’s a final note for the importance of not buying or going short early. JC bought SOXL early, but it’s been going up for years, so he remains confident. Conversely, Steven Kaplan wrote his first bearish article way back on June 10, 2020, saying “It is as important to sell now as it had been at the most extreme stock-market peaks in history including August 1929, January 1973, March 2000, and October 2007.” It’s hard to believe anyone, let alone a self-called expert, could be so epically wrong.

PSQ is the unleveraged short ETF for QQQ. XLK is a tech ETF, much like QQQ, and by August 24, 2020, “I have 16.7% of my total liquid net worth short XLK (half new), 4.4% short TSLA (some new), 0.5% short QQQ (all new). I plan to keep adding especially to my XLK short into strength whenever XLK is near 117 or above. I am currently sporting my heaviest net short percentage since August 2008.”

He apparently closed his QQQ short for roughly breakeven in 2022, but has held his XLK short now for over 4 years and is now over 60% of his total net worth, short XLK and QQQ. That’s the risk of buying (or shorting) early. Here’s 2 individual stocks that I’m watching and waiting to buy.

Both were buys in December and the first one was stopped out in early January, at resistance and falling. That avoided the hard 3 day drop and then it was a good buy opportunity at longer term horizontal support. Trendlines are extremely useful for all stocks and ETFs. We’ll see how these two perform going forward. If you’re curious. The first chart is AMD, where most analysts are bullish and buying early. The second chart is TSLS, a non-leveraged short TSLA ETF. I didn’t have a way to short TSLA back in 2021, so I’m happy for the chance now. I also remember Kaplan and others being way early with their shorts, so I’m staying cautious with TSLS and will hopefully be able to ramp up to leverage with TSLQ.

Update to Fri. Jan. 24 : The markets continued to defy gravity this week, emphasizing the need to just go with the flow and hold on.

Here’s an hourly look at SPY. Clearly, it’s not the sentiment of millions of people driving the daily market moves. Somebody is pushing it around.

A 5 minute view is quite interesting late Thursday and early Friday. Notice how the market was goosed higher in the final 15 minutes on Thursday. That could have been a fake with a gap lower for Friday. Instead it pushed up for the first 15 minutes on Friday, flashed lower at 10am, then meandered lower most of the day.

With all the gaps higher and weak follow through on the day, I’m watching and waiting for the gas in this hot air balloon to be turned off. When it dropped sharply at 10am, I thought it might tank like after the FOMC in December. No such luck.

So, selling early Friday was good, and re-buying late in the day was also good, according to our rules of maintaining some of the position for the entire move. If you’re buying SPY or another unleveraged ETF, then holding or selling and not re-buying both make sense. SPY is up 6% in 2 weeks. That would be enough for me and I would wait for the VIX trade. If you’re trading leveraged SOXX, then it made sense to re-buy SOXL for a second trade since selling on Wednesday.

Conversely, it also makes sense to be holding SOXS if you believe SOXX is headed back down. There’s no way to know where it’s headed next, but both are reasonable trades to have taken and be holding.

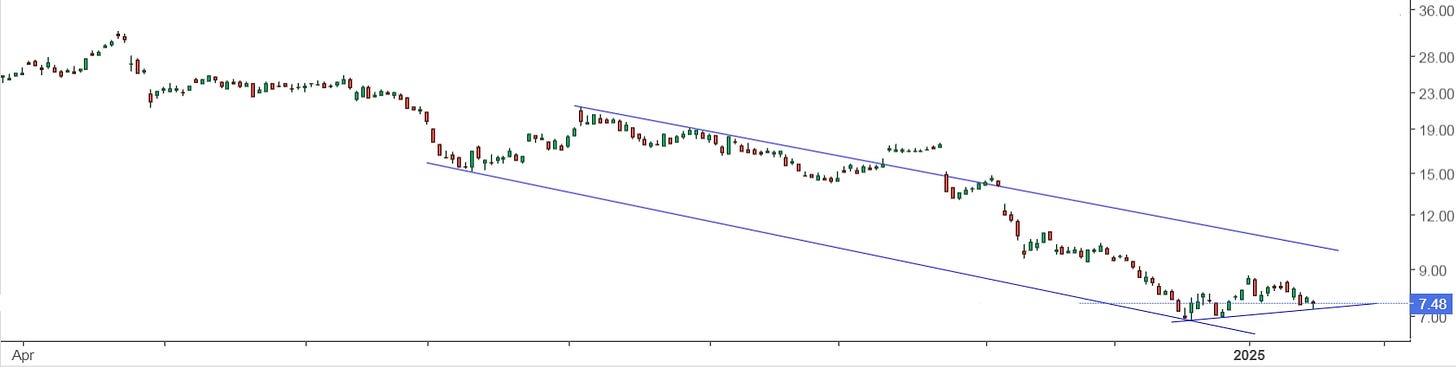

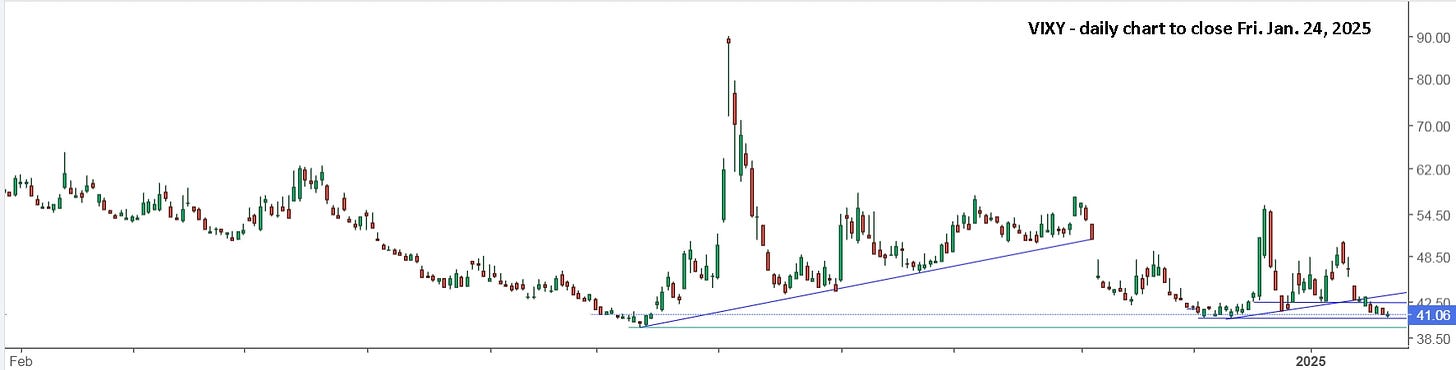

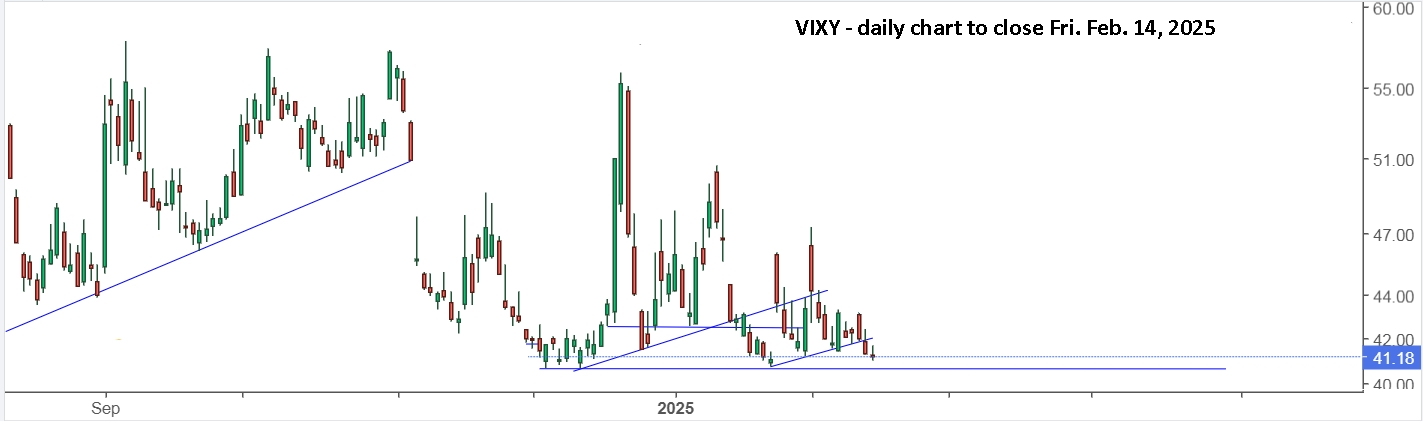

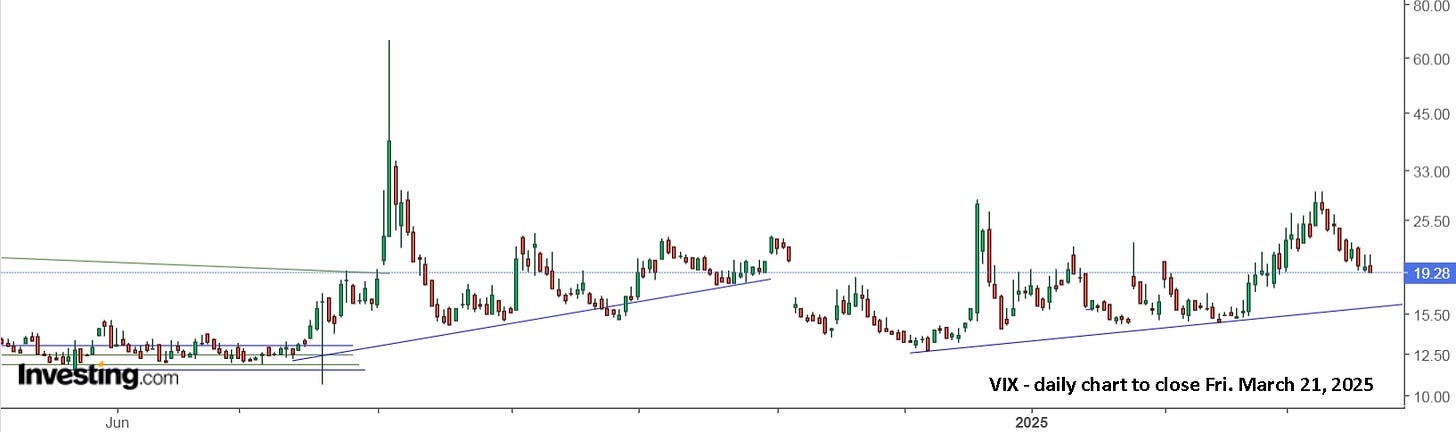

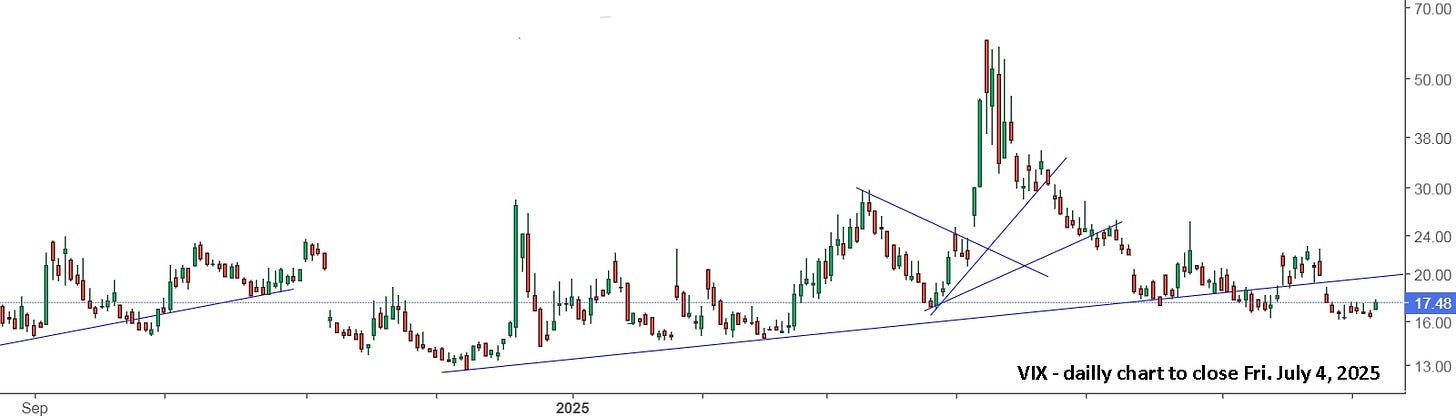

VIXY continues to make lower lows, so remain patient and wait for the opportunity to buy it, or UVIX if the move hits quickly and early in the day.

I have a 3% alert for VIXY and I’m also watching the Dec. 4 low of 40.67.

Update to Fri. Feb. 7 : The past 2 weeks have been rather strange. Both started with a gap open lower on Monday, then rallied on the week. Friday was again a sell and go short. Will this Monday be another gap lower? And can it then rally on the week, or will the markets finally push lower? I certainly wouldn’t want to be holding SPY or QQQ.

On Friday, I again pushed myself to look both ways, and was stopped into SOXL at 9:32 and out at 9:35. It open 27.87 from 27.69, hit 28.25 in the first 4 minutes, then fell hard. I kept my stop buy ‘loose’ at 28.11, then made my stop sell tight at 27.99.

After stopping out of SOXL, I put in a stop buy at 28.31, just above the early high. Then I looked at SOXS. It hit 19.93 in the second 5 minute candle, then pulled back, so I put in a stop buy at 20.01 and waited to see what happened next.

SOXS quickly hit 20.78, +3.8%, then started large swings each 5 minute candle. To avoid whiplash, I’ve learned to ignore such moves and just sit with the shares, willing to lose the quick gain. Looking at Thursday, you can see that one could have bought SOXS and/or SOXL and held all day, waiting for a move. For me, when that move doesn’t happen on the day, I like to get out and avoid getting caught in a gap against me. I chose to hold some SOXS for Monday, willing to give up the 4.5% gain from Friday.

Typically, SOXX is more chaotic than QQQ, and once you’re in SOXS and have a stop sell set, then you can take a look at SQQQ.

Clearly, it was worth buying at 27.55 with a tight stop sell below the early low of 27.50. When it shot up at 9:55, you may have stopped in to more.

Even later to the party was UVIX, which had me doubting the move at 9:55, but it made complete sense to buy, or buy more from buying in the first 5 minutes.

When there was no follow through in UVIX, and remembering the drop from the small blast up on Thursday afternoon, and seeing it on the chart, it’s easy to sell to avoid the drop, or up your stop sell, which I stupidly did. Don’t. Leave your stop sell at breakeven and let the day unfold. Even better, be ready to buy more on the fake drop at 10:50. Selling out of your shorts later would be understandable, but if you again look at the daily chart, it makes sense to keep holding them, or at least a portion.

If these gap lower on Monday, be ready to sell or buy more, and be ready to go long with SOXL and/or TQQQ. After that, hang on for the ride!

Update to Fri. Feb. 14: The past week continued the bullish-horizontal trend. Looking at SPY, Friday may have been another time to sell, making it 4 Fridays in a row.

QQQ was the strongest of the bunch, but like SPY, didn’t quite make a new ATH.

SOXX remains stuck in the middle of its horizontal channel. It makes sense to be holding or on the sidelines. I’m back on the sidelines.

Zooming way out for a 50 year look at SPX, there are a few key points that I see. First, there is room to get up to the 50 year resistance trendline. Second, the current conditions do not appear madly over bought like in the 1990s. Third, a long drop back to support could happen at any time.

I’m erring on the side of caution and believe I can make up the difference with short term trades.

VIXY broke the short term uptrend line, but is still above horizontal support and is still above the July low.

I plan to continue watching for a sudden move and will watch for a new short term uptrend to start.

Sitting in cash is never a bad option, especially when there is a lot of uncertainty.

A friend was ready to buy some MSFT, GOOGL and others to hold for the next 10 years, and I convinced to wait a few months before buying. He agreed that if he was going to hold for 10 years, that paying a bit more wouldn’t be a big deal. If he can then wait and buy at a lower price, it might turn out to be a big deal.

GOOGL was above long term resistance, threatening to break higher, then it gapped lower recently on good earnings results.

MSFT has made lower highs while holding horizontal support. One could buy support, but if it’s to be a long term hold, why not wait to see if it continues lower?

In the weekly chart, you can see MSFT is above long term resistance, which then became support in 2020 and 2022. I say wait to see if it holds again. Looking at a monthly view shows that a long term top may already be in.

GOOGL is also a money making machine, but the share price growth may be over. A pullback to support below 130 would be a 35% drop from buying recently at 200. It hit 207.05 ATH before earnings. Waiting to buy at 210 or 130 seems like a wise move.

Buying the IPO back in 2004 was obviously a good decision, and selling in November 2007 and 2021 was also a good decision. As with everything, set alerts and wait to see what happens.

Here’s an interesting short article “Warren Buffett Continues To Quietly Sell”. “What Is Berkshire Thinking? Money market funds currently pay a return of about 4.35% per year risk-free. Additionally, cash carries optionality because at any point of your choosing, you can switch out of cash to buy stocks at low prices. Investors debate how much this optionality is worth, but history shows that in the right time and place it's worth a huge amount. Berkshire used the optionality of cash to make many, many billions of dollars during the 2008 financial crisis from having plenty of cash on hand to bail out struggling companies. But the preparations that allowed Berkshire to be one of the biggest winners of the financial crisis were made long before the market started to crash.”

This chart shows more similarity to late 2021. The past few weeks have indicated that the big fish aren’t ready to let the markets drop, but they haven’t yet pushed them up to new highs either. I’m content to be holding cash, waiting for bargains.

Update to Fri. Feb. 21: That’s now 5 consecutive Fridays that were a sell for SPY, and it finally had some momentum on the day. That said, there’s now less downside to reach support. This Monday, could turn out like Monday, January 13, then make a move to 620+. Or, it could break support and test support at 575. There’s no way to know which will happen. All you can do is be watching and ready to act.

QQQ also managed to hit a new all time high, but again, barely over its December high. There’s a chance these are highs for the year and even the next several years. There’s no way to know. Selling out Friday put you in the driver’s seat, with extra trade gains since December and safely on the sidelines for Monday, and likely with extra gains from buying SQQQ, SOXS and/or UVIX on Friday.

SOXX put in a solid week, then gave it all back on Friday. It’s been sideways since August, so perhaps SPY and QQQ will now also continue sideways for several more months, which is fine, so long as they continue to swing over a 10% range, providing 20-30% trade opportunities with leveraged ETFs, over and over.

Trading SOXL can be a battle, but it’s the one that consistently presents the bigger potential. It also provided a definite exit signal on January 22, keeping you on the sidelines Friday, January 24, avoiding the big gap lower on Monday, January 27 on DeepSeek news.

One should have sold TQQQ on January 22 as well, but one could have been trying to avoid extra trades and held.

Either way, now is a perfect time to review your trades, make some adjustments to your strategy and be ready for next week. In my case, my strategy was fine, but my actions weren’t. My returns on SOXL for the year are still good, but on a minimum trade position, and I missed taking a big swing on key days. The main gain is experience and confidence to take a big swing on the next setup.

In conjunction with SOXL or TQQQ, UVIX provided some good trades as well. One of the keys with it is to avoid extra trades for small losses. Be patient, set alerts and wait for a setup. If the setup comes early in the day, take a big swing. Friday gave a gain of 13.6%.

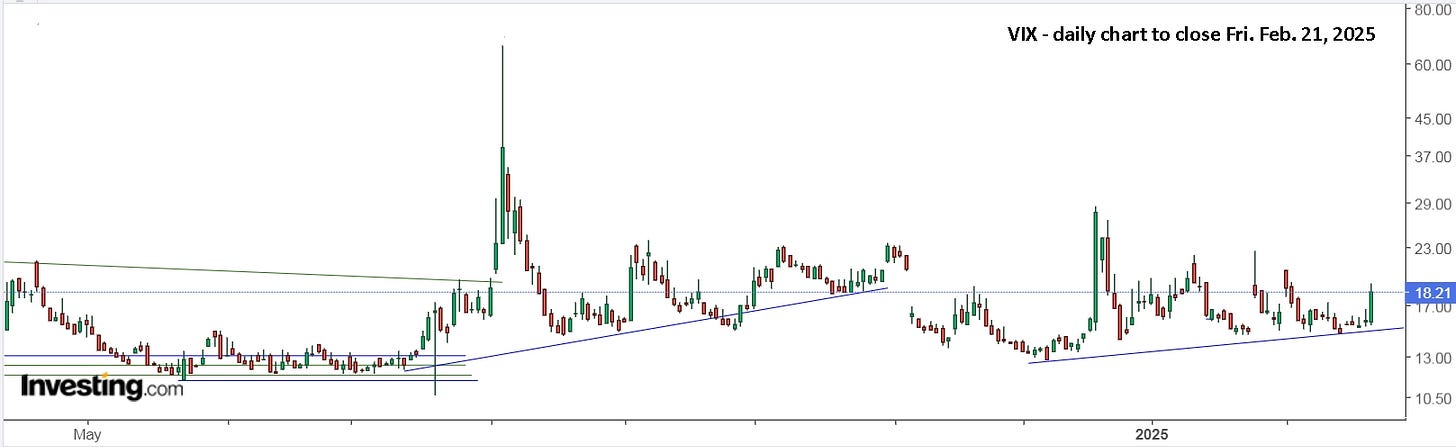

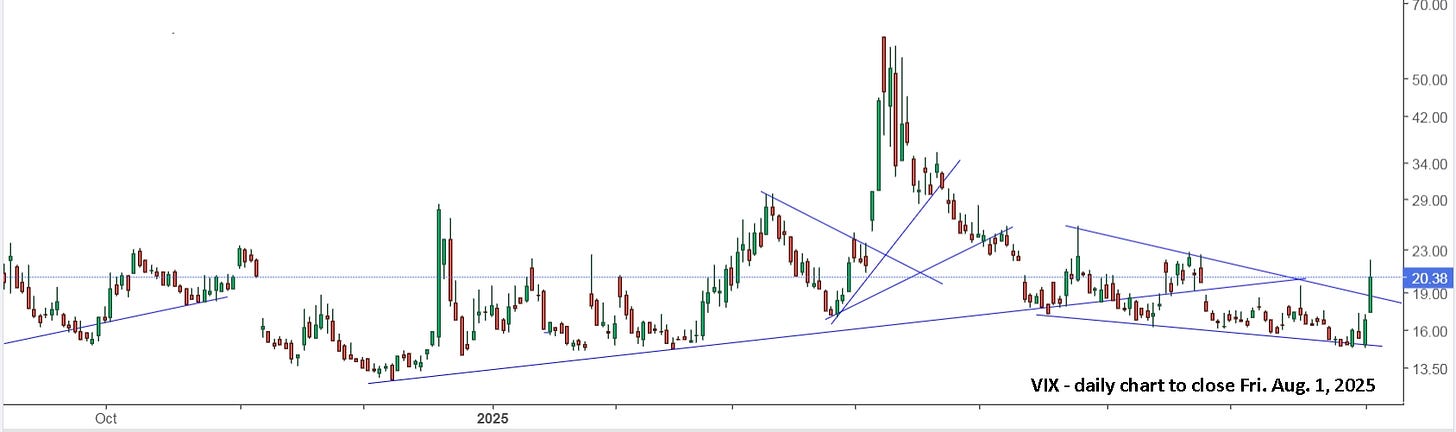

If you missed any or all the above trades, Monday will still provide an equal opportunity for everyone. Will you take action? The markets may hold support or they could crash further. VIX is still low, so UVIX could make a big move.

Good luck!

Update to Fri. Feb. 28: Good thing we sold last Friday, or earlier in the week, or 2 or 4 weeks ago. In last week’s update, I wrote: “This Monday, could turn out like Monday, January 13, then make a move to 620+. Or, it could break support and test support at 575. There’s no way to know which will happen. All you can do is be watching and ready to act.” It gapped higher on Monday, then fell, so you remained on the sidelines or went short. Tuesday and Wednesday tested support, which then broke on Thursday.

You might wonder what caused the drop on Thursday and full rally back on Friday. No reason. Just the games that get played. Here’s a 15 minute view.

It pushed up to just over resistance of a prior ATH, gapped lower and fell on Thursday, Feb. 20, a clear sell signal. It then held around support from Feb. 25 to 2pm Thursday, Feb. 27. Was there some specific new? And was the entire problem solved at 2pm on Friday? No. It’s all complete nonsense and Nvidia earnings after hours on Wednesday was a likely trigger, with no legitimacy. The earnings were very strong and the price dropped, rallied higher and fell back after hours. Thursday it opened higher and immediately fell. That doesn’t happen naturally.

Then it held flat all day and fell hard at 2pm, opened lower on Friday and later rallied. So was this the tail wagging the dog? We have no way of knowing. All we can do is jump on the opportunities when the come along. You could have quickly sold NVDA and bought NVDS. Or quickly sold SOXL and bought SOXS. You might have still been holding SOXS from buying Feb. 20.

In 6 short days, and 5 minutes on the 7th, SOXS is up a whopping 47.3%! With a few smart trades, you could have bagged even more. It wouldn’t have been easy though.

Now, there’s a chance that SOXL will do the entire move in reverse.

Buckle up and be ready on Monday for a move up, or a continued move down.

Update to Fri. Mar. 7 : Friday, Feb. 21 was the 5th consecutive Friday to sell SPY and other long positions. In my weekend update, I wrote: “This Monday, could turn out like Monday, January 13, then make a move to 620+. Or, it could break support and test support at 575. There’s no way to know which will happen. All you can do is be watching and ready to act.” As you can see below, it tested all supports, and eventually broke support at 575, hitting horizontal support at 565. That’s a drop of 7.3% that was easily avoided.

Once the move started, the best action was to draw a down sloping trendline through the highs Feb. 20 and 21 and wait for the downtrend to break, which it still hasn’t. It was broken slightly at the open on Monday, March 3, but it quickly failed. That now makes it a stronger resistance trendline.

SOXL has fallen a significant 42.56% from high to low. Kudos to everyone who held SOXS for the full gain, or more with good trades.

One might be still waiting on the sidelines for the downtrend to break, but last week provided some big moves of +10% or more from potential support. One should also note how the gaps higher on Feb. 27 and Monday, March 3, promptly failed. Be ready for the same this coming Monday. Be ready for the opposite as well.

Tuesday, March 4 wasn’t an easy day to make a large SOXL buy, but when it pushed higher at 11:30, one needed a stop buy for more, or a re-buy if it had spiked lower stopping you out. Another stop buy higher yet, gets you a bigger position, with it now trending up and you can move your stop sell up to breakeven on all shares. Late in the day, raise your stop sell further and perhaps sell some near the high. The trend is still down overall, and it just made a +17.6% move from the low 19.00 to 22.26. You may have sold some when it dropped from 21.23 at 1:15, as I did, but best to keep the stop loose till late in the day. Once you manage to get a large position at a good price and it quickly moves in your favour, then you want to let it run. Late in the day when you’re up 17%, then I’d be ready to sell all. Once it fell 8.7% in 30 minutes to 20.32 and started moving up, then I would buy a minimum position back to hold overnight.

On Wednesday, SOXL swung madly over a 4% range, every 5-10 minutes. That’s impossible to trade, so sit tight a wait for it to settle down. At 10:55, it started down from the ceiling again and continued down through the floor to the day’s low of 20.13 on a 5 minute spike down at 11:30. That new floor held for 20 minutes, so time to buy with a stop sell at 19.99. The first pop at 11:35 hit 20.37, so I put in a stop buy at 20.41 and waited to see which stop was triggered. At 11:55, it moved up hard to 20.70. That’s only +2.73% from 20.15 where you could have been buying as it hit .13 over 5 candles in a row. I had added a stop buy at 20.31, but didn’t buy nearly enough at 20.15. Selling at 19.99 is only -0.79%, but I was expecting it to break lower and fall back to 19.00. That was a very reasonable decision. Each of us have to make our own judgement calls, in such situations.

I was stopped out on the 5 minute spike down at 1:05 from 21.49 to 20.95 and then stopped back in to my minimum trade position at 21.30, where I stopped out at 21.29. It then went up to ‘break’ the downtrend resistance line at 22.00 on the spike up at 3:00, but I wasn’t trusting that at all, given the spike up and down Tuesday at 3:20. It did spike down for 10 minutes at 3:15, but reversed and held, so I held my minimum position.

If you held a lot of shares overnight Wednesday, it was a painful morning to see it down -10.2%. My strategy is to set a stop sell and buy. It’s also important to remember that the Tuesday low was 19.00, which you hopefully bought and sold. Even if you didn’t, so didn’t have the profit cushion to fall back on, nothing changes. That remains the no fly zone. Most importantly, you don’t want to sell shares held overnight and not buy back 5 minutes late when it reversed.

I stopped out of my minimum shares at 19.49 and stopped back in at 19.52, then double that at 19.81, then the same again at 20.04. That gave me a 25% position. It hit 20.09 and fell to 19.74. A drop back to 19.49 would stop me out for -2.2% on a larger position than I held overnight, compounding the loss, but still not severe, and I’d love to get another chance to buy a full position near 19. It shot up from 19.74 to 20.48 in a few minutes, pulled back to .33 and up to .63. A stop sell at 20.19 wiped out the loss from holding overnight and put me at breakeven. A stop sell at 20.29 gave a tiny gain of 0.5%, and since it had dropped to .33, best to put the stop at .19 to give more room to avoid stopping out.

I never used to have that calculation done on the day, helping me decide my price points. Having it is a huge help. From 20.63, it pulled back to .37, a higher low from the prior dip, then up to .81, back to .49, up to .88, back to .60, up to 21.01 in 10 minutes and now at a horizontal line on my chart. To sell or not to sell? It then fell hard in 12 minutes to 20.36 and up to 20.74 and held .50s.

Now it’s decision time. Leave my stop at 20.19, or sell some at 20.55 or up my stop to 20.29? Selling at 20.55 with a stop buy at 20.81 gives up 1.27%, not bad, but not ideal. Setting a stop buy at 21.04 gives up 2.38%. Each dip has been above .30, so I upped my sell to 20.29 and planned to stop buy at 20.51, +1.08% if it triggered. Again, knowing the numbers is a big help.

It fell to 20.13 and spiked up to 20.58 in less than 5 minutes. Now what? Since it was now just my minimum 5% position, I held it, not wanting to stop out and in again higher. It promptly fell to 19.94, held a few minutes and moved up to 20.06. I bought another 5% at 20.00 and set my stop sell at 19.89 for all. That gave me an unpleasant -3.1% on the high stop re-buy, but the break lower at noon was clear and strong, continuing the strong reversal at 10:45. Given the price action of the past few days, it could easily fall all the way back to 19.00. At 12:45, it broke the recent floor of 19.35 and hit 19.05. I had taken a few punches on the way down, but far less than I made on the way up the day before. Here’s a look at the 5 minute chart again for reference.

At 2:30, with it back down to 19.02 and holding, it made total sense to buy with a stop sell at 18.89, -0.84% from 19.05. I stuck with my stop buys at 19.21 and 19.31 for 10% each, put in after stopping in to 10% at 19.24 at 1:45 when it moved up from 19.13 to 19.51. When the stop at 19.21 triggered, I looked to see it was a sharp move from holding a floor. I decided to buy more and more again before the stop at 19.31 triggered. That put me up to a 50% position. I sold 10% at 19.70 for +2.1% since that was near the top of 19.80 at 1:20 and it had paused. I didn’t get my order to sell 5% more at 20.00 as it only hit 19.99, so I sold 5% at 19.90 and was stopped out of 25% at 19.59, leaving me with 10% which I was prepared to hold, or stop out at 18.89.

It fell to 19.14, rallied to 19.71, a lower high, back to .44, up to another lower high, back to .43, up to .58 and I put in a stop sell at 19.39. No point holding now. It fell to 19.14 again and held. Just before the close, I decided I really should hold my minimum shares, so I bought at 19.23.

Friday played out in a similar manner, but I was much more inclined to buy near 19 as it held above the low at 18.75. I even made my stop sell super tight at 18.73. I bought up to a full position with an average price of 19.02, so the stop sell was -1.55%, bigger than I usually like but it was a good setup. The final 25% was bought at 12:22 at 19.01, moving up hard from 18.83, so my patience was good, and I could have bought more with a stop at 19.21 and 19.31, but I decided against it. Now that I’ve had success, I’ll also have the confidence to take the chance and go harder when the setup is good.

The hard spike down at 12:55 from 20.14 to 19.48 (-3.28%) stopped me out of all but 10% for +3.3%, after not getting a 10% sell order at 20.13 or 20.05. So, I was holding 10% again. It immediately popped up to 20.18, selling me out, before I had a chance to cancel the order. It promptly fell to 19.77, so I put in a stop buy at 20.21 and waited to see what would happen.

My stop buy triggered on a sudden move up at 1:35, and I could have then bought more, but the downtrend resistance line was at 20.30, which it hit on the 1:50 candle and held for 20 minutes before pushing up, with a hard 5 minute move down at 2:05, of course, just to fake people out.

Friday’s break of resistance is much stronger than on Wednesday, and it’s back to the Thursday high. Still, it’s not a setup where I would want to hold a full position, even if it was all bought at 19.00. This is another example where each person has to decide for themselves what to do. I’m content with my 10% position and will trade next week, the same way I did this past week, trying to get a full position for an extended move, while getting out of all drops.

I’m not sure if everyone, or anyone, likes reading all these details, but it helps me review my actions and thoughts, and provides reference for me to look back on, and for others to review and learn from. It’s all a process with incremental improvements and occasional significant improvements, which I’m now feeling.

Now let’s look at the short side, starting with SOXS. I’ve decided that it’s always best to sell your last shares for significantly less than your last sell, and to hold your minimum position for the full ride, even if that means giving up all or most of your gain early in the trade.

On Thursday, Feb. 20, one easily and simply stopped out of SOXL and into SOXS. The move didn’t last long and started lower after 11:00. The SOXX and SPY charts were indicating a possible top, so it was okay to keep holding SOXS with a stop sell at breakeven. Late in the day, you might want to sell for breakeven, but that’s optional since it’s a minimum position. Most importantly, you’re not holding SOXL. The next day, Friday, Feb. 21, it opened a bit higher at 17.17, hit .15 and moved up and you’re stopped in at 17.31 or lower, or higher. I got 10% at 17.30 and bought another 15% at 17.37. Going short, I would never take a full position like I would with SOXL. 50% is plenty, along with UVIX, which I do want to get a full position, if possible.

I mistakenly traded on the day, instead of just holding and selling some late in the day. Lesson learned. After that, best to just let it ride, while watching for SOXX to find a bottom. If you’re still holding SOXS when you buy a minimum SOXL position, the gain in SOXS will continue to offset a stop loss with SOXL. Even this past week, getting good gains with SOXL trades, one could have continued to simply hold SOXS. You might have decided to finally sell on Friday for a gain of 55%, or you might still be holding it.

Trading both SOXS and SOXL is difficult. It can be done, especially off the open, but it’s more effort than it’s worth. Going forward, I plan to hold some SOXS for the full move and trade additional shares when I’m in the mood and the setup is good.

A similar strategy is best with UVIX, except that with it, I’m looking to get a big position and hold it for a top. Holding a minimum position from Feb. 20 at 26.00 gave a gain of 70.3% at the high of 44.29 on March 4. Obviously, you won’t time the exact top, but you can get fairly close. At 10:12, I stopped out of my larger position at 42.17, down from 42.91. It hit 41.97 and reversed, stopping me into my minimum at 43.36. It hit the high 44.29 at 10:20 and stopped me out at 43.26. Holding the minimum from 26.00 was still a tidy +66.8%. Since it’s a minimum position, it’s not big money, but the strategy allows you to continue trading over the entire run, and doesn’t leave you guessing whether you should hold overnight or not.

When it dropped to 35.16 and shot up at 3:25, it was an easy stop buy for the minimum position at 35.50, or 36.00, a nice discount from 43.26 and you’re still in the game, which is important since the market drop could continue, VIX was only 23.50 and it always goes to 30+ on a significant drop, and goes to 80+ on a major drop. Thus, it’s imperative to hold that minimum position. This is a new revelation for me.

Selling near the high on Wednesday with a stop buy higher was also a good decision, as Tuesday might have been the blow off top. I sold a larger position at 39.79 on a stop at 11:43, then stopped back into my minimum 3 minutes later at 40.03. The spike was brief, so I put in a stop sell at 39.39, -1.6%, which triggered at 11:53. Then I simply waited with a loose stop re-buy. I was stopped in at 36.03 at 2:37, and instead of just holding, I stopped out at 35.27, -2.1% at 2:50. It continued over the range from 35 to 36, and dropped late to 34.90 and closed 35.09. I should have re-bought my minimum.

I did hold 5% UVXY, along with 5% SOXL, but I really needed to be holding 5% UVIX, as it opened Thursday +12.6% at 39.50. That's a difficult buy, but I did buy 5% at 39.50 as it moved up from the initial dip, then stopped in to 5% more at 40.03. It hit 40.63 in the first 10 minutes and stopped me out at 40.39 for a quick and tiny +1.6%. If I was holding 5% and a 12.6% cushion, then I’d be able to safely buy a larger position for a potential hard move higher.

It fell back to 37.83 at 10:45, bounced to 39.07 in 10 minutes, fell back to 37.69 and rallied to 38.99 in 20 minutes. That’s a 3.4% range over a short time period that can’t be traded. If I had held my minimum from Wednesday, then re-buying near 38 and holding was easy, and I could focus on SOXL. The longer it held a hard floor and SOXL continued falling from its high at 10:45, the easier it became to buy some more UVIX each time it was near its low. I ended up with 30% at 38.09 average and was stopped out on a tightened stop at 40.91 at 13:17 for +7.6%. It hit 40.27 on the 10 minute drop and shot up to 41.29 and continued to ratchet higher. Again, it’s impossible to trade those ‘tight’ ranges with a large position, and difficult with a small position, but one can easily re-buy and hold the minimum that was bought at 26.00 and traded a few times, thus lowering its equivalent cost even further.

It continued up to a hard ceiling of 43.01 and then dropped hard at 2:40 to 39.91 in just over 10 minutes. That’s a 7.2% drop and a chance to re-buy your minimum if you stopped out, and a little extra with a stop buy as it shot back up in 5 minutes to 42.42. I did then hold a minimum position in UVIX and UVXY and SOXL, but the reason wasn’t yet completely clear in my mind, and wasn’t yet supported by actual numbers and calculations.

Friday provided a 12.5% move in UVIX, from 40 to 45, then it fell to 39. Selling out completely on the bounce back up to 45.15 was easy. The earlier high was 45.20, so sell out and put a stop buy in at 45.31 for your minimum position. Once it was back to 39, why not re-buy your minimum? Its equivalent price is now well under 20 from the original 26, and that’s not counting all the gains on additional shares traded. Holding that minimum position through all the gaps lower and higher, and only trading it near the end of the big run, and during the day when it could be re-bought, would have been a big, big help for me to have performed better. Another lesson learned and locked in! Now, let’s put those lessons to work for us next week!

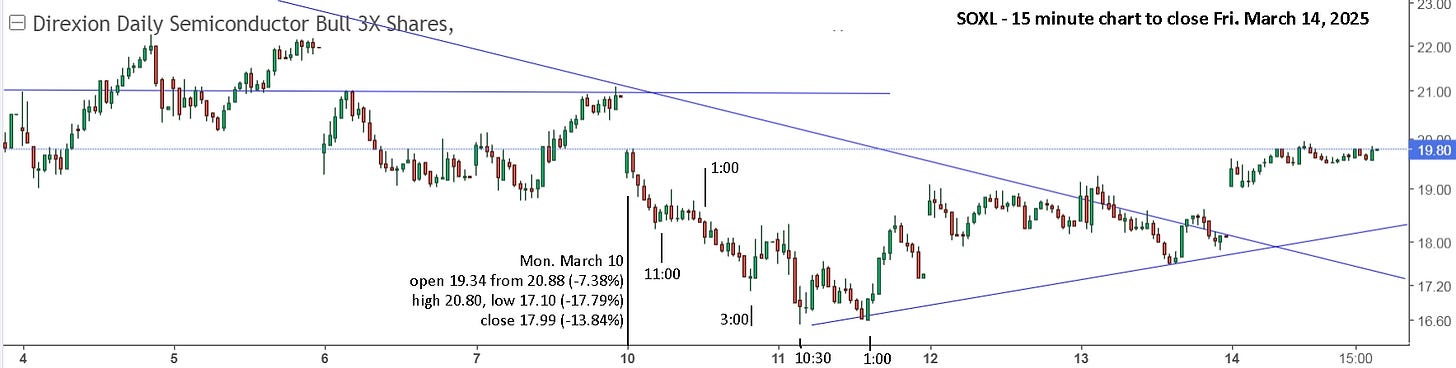

Update to Fri. Mar. 14 : I’ll try to keep this update brief. On Friday, March 7, JC wrote, “JC, semiconductor sector has arrived at +dvR Friday e.g. SOXX, FSELX, etc Therefore, it will transpire to ascend until R5+ destination for taking profits at least EMA20 in 4 consecutive days or shorter … perhaps EMA50, or +k (maximum boundary) for overall liquidation.” The markets moved up sharply at 12:30 on Friday and continued through to the close, placing SOXL near resistance, closing at 20.88 and +9.89% from buying at 19.00. I had sold early and was then stopped into a 10% position at 20.22, which I held over the weekend. Given the strength of Friday’s rally and JC’s comments, one may have decided to hold a full position over the weekend.

For reference, here’s what happened to me: “The hard spike down at 12:55 from 20.14 to 19.48 (-3.28%) stopped me out of all but 10% for +3.3%, after not getting a 10% sell order at 20.13 or 20.05. So, I was holding 10% again. It immediately popped up to 20.18, selling me out, before I had a chance to cancel the order. It promptly fell to 19.77, so I put in a stop buy at 20.21 and waited to see what would happen.”

Here’s what happened Monday, March 10: open 19.34 from 20.88 (-7.38%), high .80, low 17.10, close 17.99 (-13.84%). Pretty nasty if you’d held a full position from Friday, but you still sold out where I was stopped out, or near Friday’s close, so no big deal.

If you sold Friday, or were only holding a small position, like me, then you bought the early move up, sold when it reversed and were hopefully in SOXS and/or UVIX when it dropped further at 10:00. Once it held a firm floor after 11:00, I bought up to a full position with a tight stop. I’d already decided that I don’t really like that strategy, but old habits and natural inclinations are hard to break or control. And isn’t it interesting how the time is usual so exact, at an even number.

Best to have ignored the late move at 3:00, but that’s where I recovered some of my earlier losses on the day. The best decision was to have simply remained holding SOXS all day from the early buy. Tuesday, March 11 had wild swings early before finally breaking lower. Buying a full position as it moved up from a double bottom at 1:00 wasn’t easy, but I managed and was stopped out at 18.19. I re-bought some on the late drop, but not a lot, obviously, since it could have gapped lower as easily as it gapped higher. In hindsight, that might be the risk one needed to take. It had gone up 11.4% from 16.60 to 18.49 and then fell 6.3% to 17.33. That’s a pretty good discount after an hour and a gap lower at 16.60 would be only -4.2%. Instead, it gapped +6.81% higher at 18.51 and then you’re left struggling to sell a small position for a gain or buy a full position before it goes higher. The dilemma held all day Wednesday and Thursday, then it gapped +5.25% on Friday at 19.04.

I had been saying to Sandimas that buying near 19 was still cheap, but it no longer felt cheap with it up 14.5% from 16.60. One could have bought a full position Friday at 19.00 and be up 4.2% at the close of 19.80, but I’m only holding 10%. A new rising channel is now showing on the 15min chart, which is a positive sign, but SPY made a lower low on Friday, before rallying, and I just can’t shake the feeling that there’s more downside to come. Yes, the markets are due for a rally, but what does it look like longer term? Here’s a look at what I see is possible.

I don’t normally look at a weekly chart for SOXL since the decay distorts the ‘actual’ picture, but it seems useful at this moment.

Here’s a look at SOXX. Both charts suggest to me that there could be a lot more downside coming.

In 2022, it was inflation that ‘caused’ the markets to drop. I always felt that the inflation was a direct result of excessive government and business actions during covid with supply chains thrown out of whack, and that it would ‘quickly’ pass. I also felt that the markets were really stretched and due for a pullback.

The extreme valuations in early 2021 was essentially a pump and dump. Pumping share prices higher while government covid support money was lying around and enthusiasm was high. Then leave the suckers holding the high priced shares and let the prices fall and fall. The broad market didn’t finally start falling till the end of 2021. Canadian banks and others started their fall in early 2022.

Here’s a look at Gamestop’s brief but well publicized flash in the pan.

The were also many fintech companies with ‘revolutionary’ AI concepts that would revolutionize industries, like insurance and banking. Here’s a look at Lemonade.

I watched ASAN in amazement, waiting for it to finally follow the others, but it instead it went higher and higher and higher. And then it did indeed follow the others.

Many of the promising companies, remain promising, and their businesses continue to evolve and grow. Here’s a look at ROOT, which fell steadily from its IPO at 468 in late 2020, with a high of 530.64 the same day, to its low of 3.31 in March, 2023. That’s a drop of 99.4%! Imagine if you had bought even a single share.

Then imagine you put another $530 dollars on the line in May, 2023 at 4.60 when a clear uptrend was in place. I did buy some on May 8 at 5.65, but only a little, hoping it might erase the loss from buying earlier as it fell. I wasn’t trading very wisely back then. A year later you could have sold for $100, easily recovering your initial loss. The key is to remain patient, wait for the bottom to be truly in, then lean into it hard as it moves up.

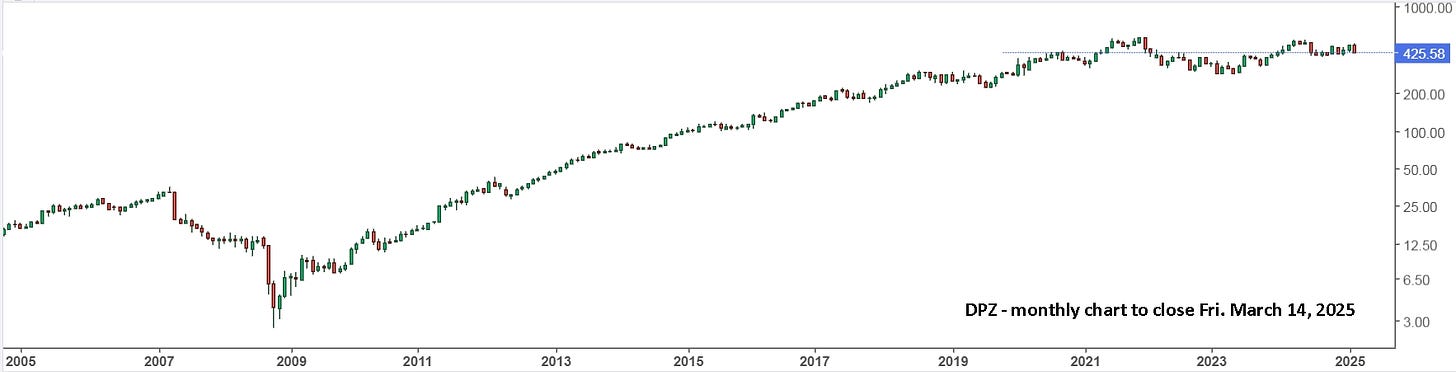

Here’s a monthly view of Domino’s Pizza that nearly went bankrupt in 2008.

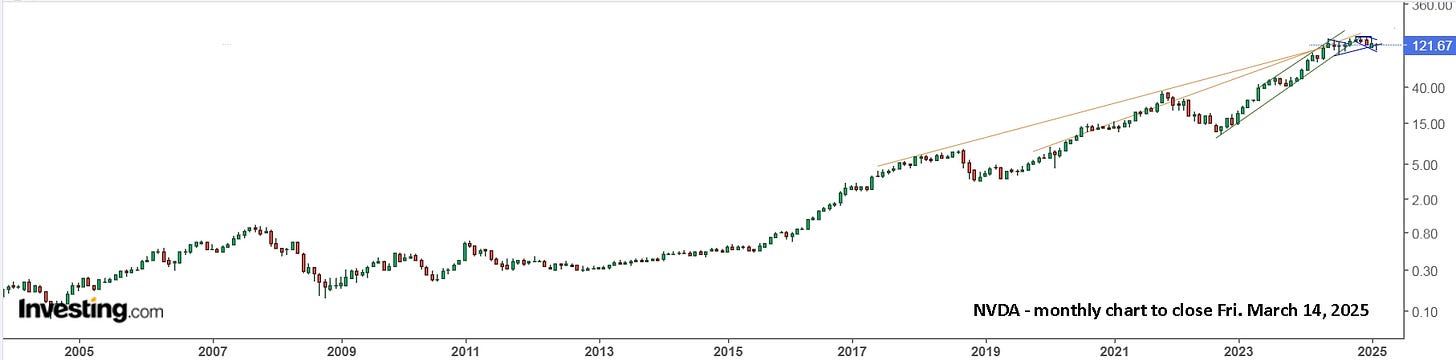

If you followed the news, liked eating there and didn’t believe they were going to go out of business, then it was a massive investment opportunity. I completely missed this one, but I did have shares in AMD when it was on the verge of bankruptcy and NVDA when it had lost its shine. Unfortunately, I didn’t hang on to those shares.

I was sure AMD wouldn’t go out of business and got the win from around $2 a share to around $12 and then sold. With NVDA, I didn’t know their business well and finally got bored with it and sold around $16 in late 2013, which is 40 cents on the chart below. Too bad I didn’t do a little more research on the potential.

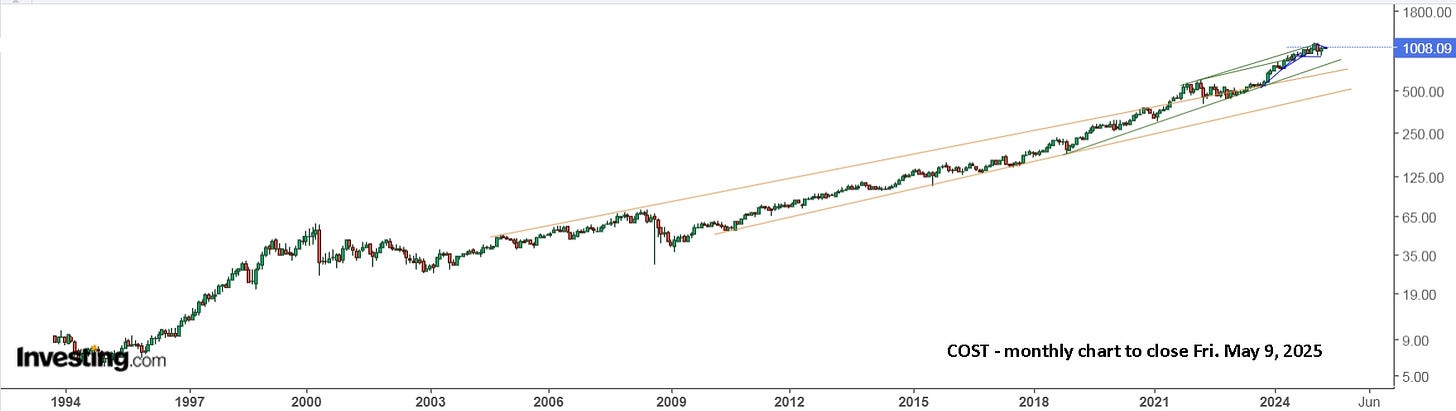

Moving back to present day, does it make sense to buy or hold NVDA shares now? Or AMD? Or DPZ? My dad, with no investment experience, says absolutely not. “Those prices are coming back down.” Here’s a look at Costco which I’ve been waiting to finally start a fall.

It was clearly outside the lines in late 2021 and again for all of 2024. Tariff news could easily push it back to support, just like the inflation news did in 2022.

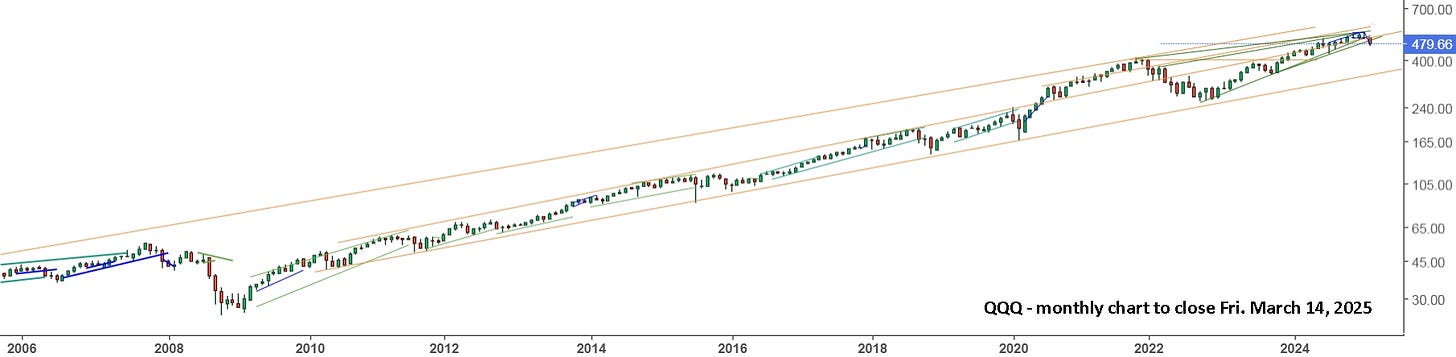

Here’s a monthly view of SPY, QQQ and SOXX.

There sure looks like a lot of downside potential. If you’re trading, it doesn’t matter where the markets will be in 6 months, but if you’re not, and you’re still long the markets, you might still want to look for an exit.

Here’s some additional useful information from an SA comment: “Bearish breadth divergence as measured by LTTFTrader's method has been in effect for 15 weeks. Anything over 13 weeks corresponds with bear markets all the way back to the late 1940s. (LTTFTrader has back tested to 1929, and there was a lot of extreme volatility in the 1930s and early to mid 1940s that distorts this relationship.)”

And this is interesting. This SA author wrote yesterday, “S&P500: I Called A Correction To 5484. Is It Time To Buy?” He writes weekly articles and the other articles referenced in this one were in September and January, about the time I wrote my articles. This article says, “Despite Trump's policies and tariffs, the correction was inevitable given pre-existing conditions; recent data suggests no imminent recession, but slower growth is expected. Technical analysis indicates the correction might not stop at 5484; a significant buying opportunity lies at 5377-5402. Expect a second phase of decline targeting 5100 later in H1; any recovery may result in lower highs, requiring reassessment and adjustment.”

On January 5, he wrote, “Prepare For The Largest Correction In 2 Years”. I was starting to think he really nailed it, but his articles in late February predicted a breakout to the upside. Also interesting in this article, he wrote, “The chart below suggests the century-long super-cycle beginning after the 1929 crash is nearing an end.” That would match Avi’s early prediction last year of a decade long bear market. This author has left the door open for a continued bullish trend, but concludes, “Analyst 2025 outlooks look overly optimistic, and previous bears have turned bullish just when the 10Y-3M yield spread is un-inverting and the unemployment rate is rising. Furthermore, long positions are reaching extreme levels and triggering buyer exhaustion signals. From a cyclical perspective, the S&P 500's recovery since the 2022 low appears to be nearing its peak, and this could also signal the end of longer-term trends. Considering all these factors, 2025 is likely to experience the largest decline since 2022, potentially evolving into something much more significant if trend starts forming lower and there is further bearish evidence.”

For those who don’t want to trade, stay on the sidelines. For those that do, keep looking both ways.

Update to Fri. Mar. 21 : The markets stopped the cliff dive of recent weeks, and may stage a rally this coming week, but caution is still advised.

Markets all gapped lower Friday, then rallied back up. For active traders, this week will likely provide more opportunities. For others, stay on the sidelines.

Here’s a look at SOXL which Sandimas and I are trying to trade.

Sandimas has a 1hr algo which is doing well and I now have a better understanding of how it sets buy prices. As he said on Friday, “This has been a tough period for SOXL. In the past 1 year, SOXL is -58% and SOXX is -11%. My daily algo is +1% and hourly algo is +279% in the past 1 year.” I suspect you’ll agree that the hourly algo has done well. It still has some drawdowns, as he wrote March 6, “1h algo is -35% since Feb 24th and -5% YTD while daily algo is -13% since Feb 24th, and also -5% YTD.” My focus now is to minimize the losses, while catching most of the upside.

We’re also using the chat feature to share thoughts every day. I will start a new chat for this week and we’ll see how it goes. His 1hr algo had a buy late Friday at 19.23, and his daily algo has a buy for SOXL on Monday >19.23.

Volatility has dropped off significantly, VIXY broke its rising trendline, but it could spike up again at any moment.

Good luck next week!

Update to Fri. Mar. 28 : Last week was great if you remembered to look both ways. At the high on Monday, you were up 11.1% on your SOXL buy on Friday. Sandimas’ 1hr algo sold at 20.75 on Tuesday for a gain of 7.9%. It bought at support on Wednesday at 19.45 and sold on a stop at 19.21, -1.23%. It gave another buy signal at 18.41. I bought, sold some near the high, then decided it was best to sell out completely. Ideally, I should have been holding UVIX and SOXS. His algo sold Thursday at 17.50, -3.9%.

It’s easy to say in hindsight, that one should have bought SOXS early Mar. 26, but that’s exactly what I’ve been recommending all along and especially emphasizing lately. “Look both ways and if you get it right early, then stick with the trade.” Regrettably, I’m still having trouble executing my own advice.

I am getting some decent trades with SOXS and with UVIX, but I need to get better.

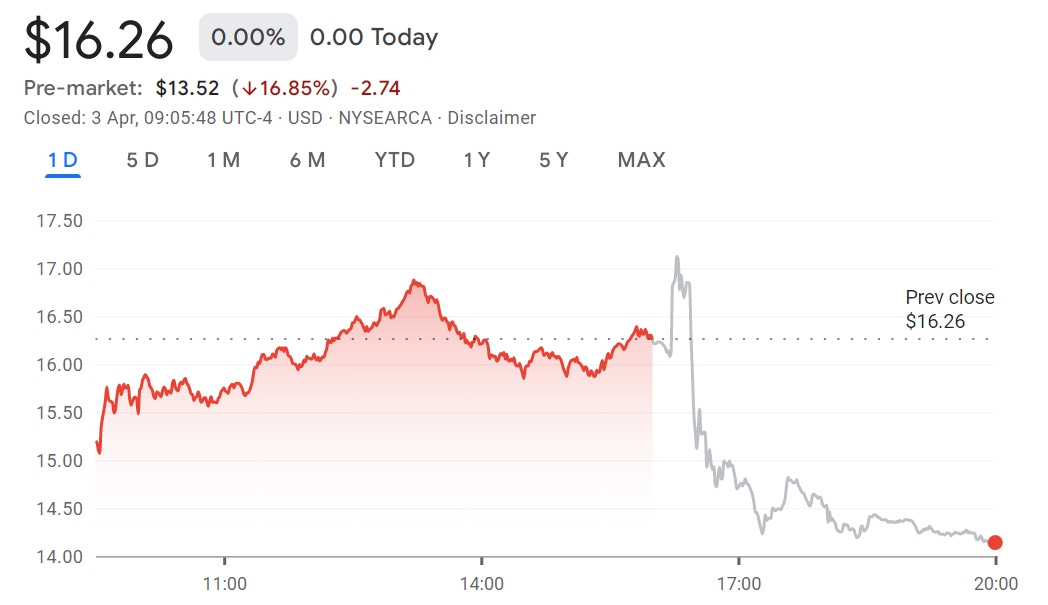

Both UVIX and SOXS gave a potential 29% return in 3 days and best to still be holding. On a daily view, the markets look a bit like August last year, when Monday, Aug. 5 gapped lower and rallied hard on the day. Keep that in mind for this coming Monday.

For those of you that have done nothing since selling in February, you now have a daily downtrend line to watch, and you can continue doing nothing until that is broken. And remember that took almost a year in 2022.

Here’s a look back to SOXL in August.

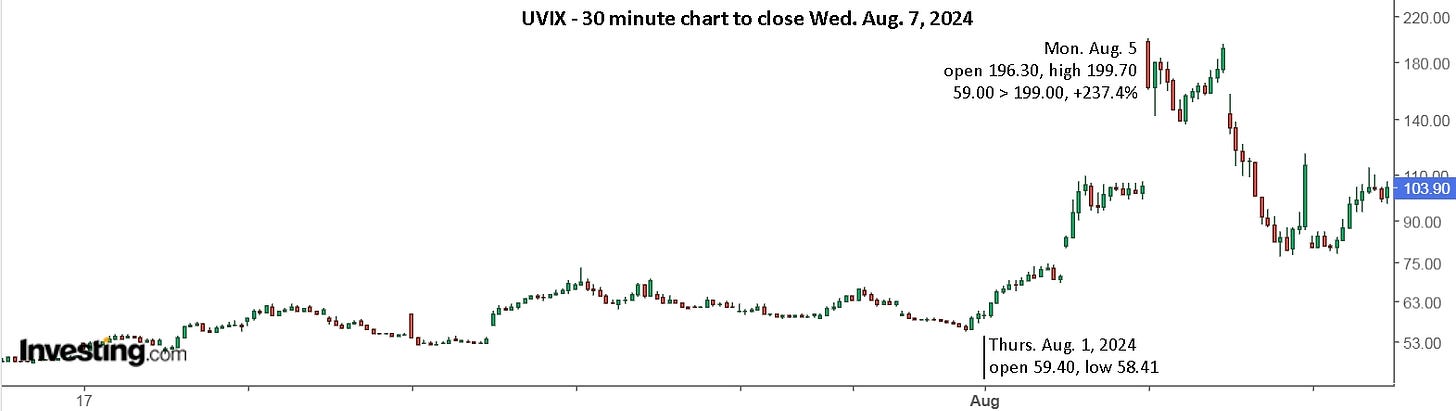

And here’s UVIX, which was admittedly an extreme and rare move, +237% in 3 days.

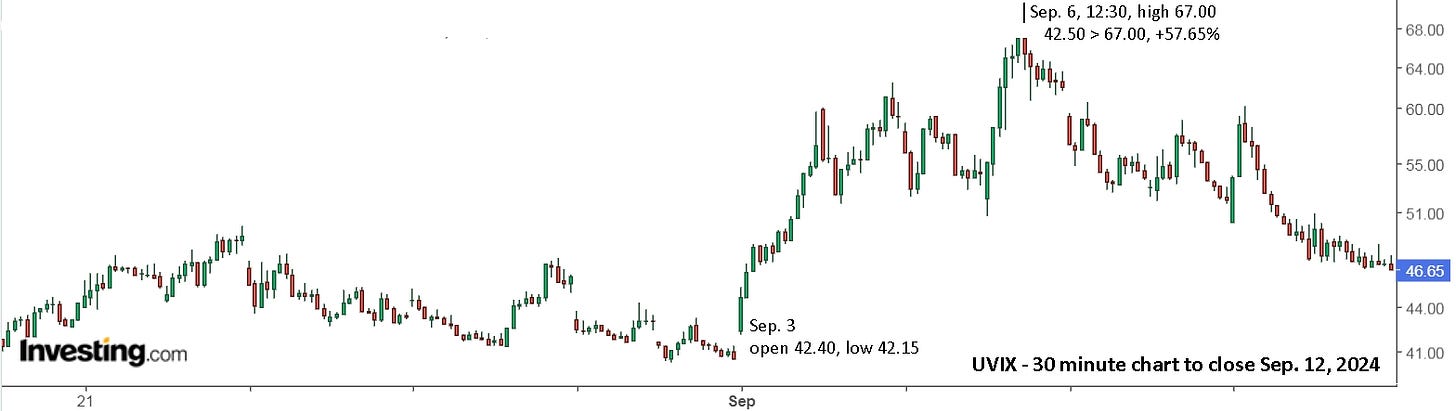

Here are other UVIX opportunities since then.

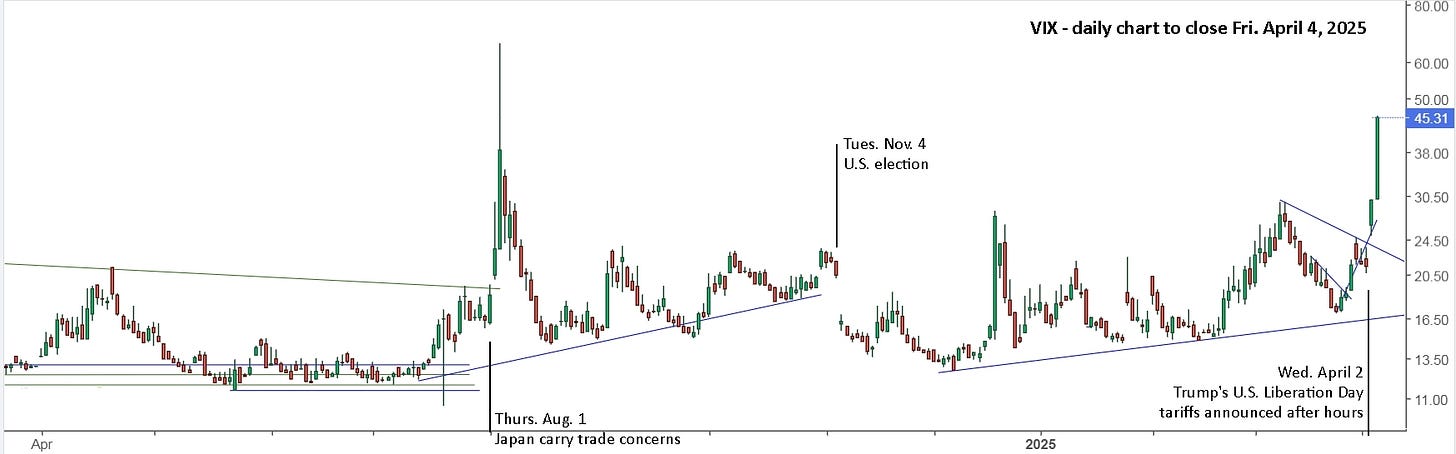

And a reminder look at the current chart. If the tariffs are implemented, UVIX could easily double from Friday’s close, with VIX going to 30+.

Good luck next week.

Update to Fri. April 4 : Once again, this past week was great if you remembered to look both ways. In the last update I wrote, “On a daily view, the markets look a bit like August last year, when Monday, Aug. 5 gapped lower and rallied hard on the day. Keep that in mind for this coming Monday.” That’s exactly what happened, though it wasn’t as strong of a rally as on Aug. 5.

It continued up through Tuesday and Wednesday, but not nearly as hard as it dropped the week before. I sold out when SOXL hit the resistance line at 1pm on Wednesday. I also bought some back later in the day as I wasn’t expecting harsh tariffs on Canada and Mexico, since Trump had already imposed tariffs and it made sense to wait a month for our federal election to be over and then deal with the new government.

Regardless, I watched closely after hours. SOXL slid a bit lower for the first 10-15 minutes, but no hard move, so I quickly went to have a pee. Naturally, the markets then shot up, which was okay since I had re-bought some SOXL. I sold my UVXY shares while on the toilet. Then, while I washed my hands and returned to my computer, UVXY shot back up and SOXL was falling. What the….? I quickly sold some SOXL and re-bought my UVXY, 8.2% higher than I had sold just 8 minutes earlier.

I have a theory for the after-hours action on Wed. The algos were set to move up, expecting the announcement to be 'better than expected', which they were for Canada and Mexico, as there were no new tariffs. Thus, the initial move up. Then, the mad hatter math on other countries was seen, which is beyond all possible comprehension, let alone predicting, and the algos were (perhaps manually) kicked into reverse. There were pauses, as some thought to buy the dip, but it was eventually a complete and fundamental pivot, that we needed to make also. Heck, I've been saying "get ready" since December to my friend, Alejandro. I first said get ready in September, 2024.

This is a good example of when you need to pivot. You must at least get to the sidelines for safety. Sure, it could have easily gap higher on Thursday, locking in a loss from selling low, but if you look at the reason for ‘why’ it happened, then it’s best to be safe, and if you’re going to be more aggressive and make a bet, then make a bet where the ‘odds’ are in your favour. I bought some UVIX, but I had already bought some SOXL back at 15.30, which is okay, since it was a very small position and I had made gains on the day and on the week, but I still should have sold it all.

You undoubtedly know what happened pre-open on Thursday. From the gap lower, it made sense to be ready to buy SOXL and then sell on a tight stop when it reversed. After that, there was no reason to buy.

Again, I have been emphasizing lately. “Look both ways and if you get it right early, then stick with the trade.” Regrettably again, I didn’t follow my own advice on Thursday. I held UVIX and UVXY for a while, but I didn’t buy SOXS. By the end of the day, I had made my pivot, sort of, and wasn’t holding any SOXL and was holding some UVXY. Definitely too little, too late, but also better late than never. Sandimas unfortunately held a larger partial position on Wednesday and held some again on Thursday, ‘logically’ fearing the risk of a large gap higher on Friday. Such thoughts, feelings and decisions are completely ‘normal’ and natural. It’s human nature, but it’s a bad idea to give in to it.

Now what? Well, better late than never. Even if one didn’t take proper action early in 2000, 2007, 2020 or 2021, it was still a good idea to take action later.

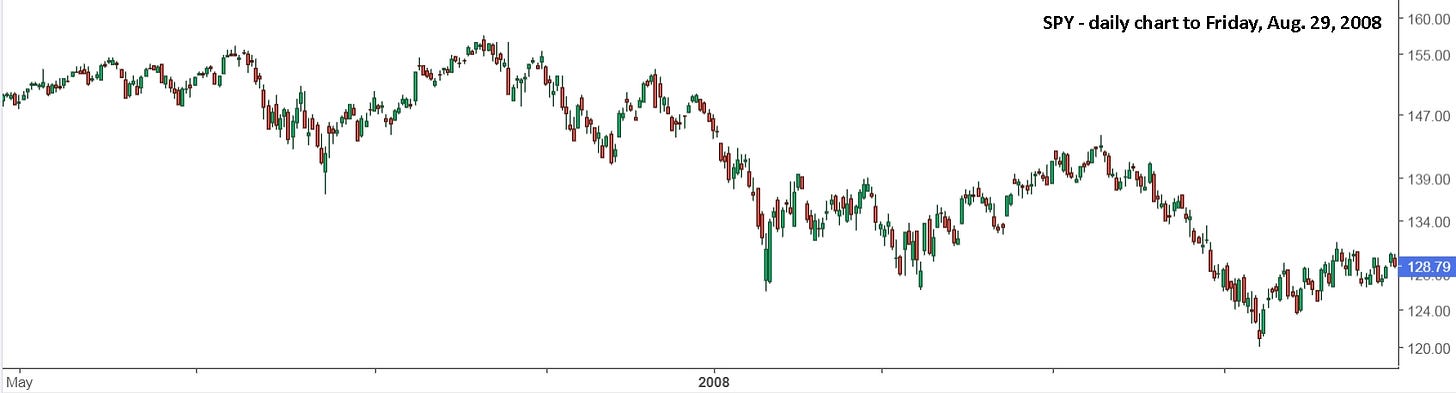

If you look at 2008, you can see a rally in April and May, when those still on the bus had a chance to get off, more or less unscathed. After the hard drop in June and early July, there was another month and a half to get off the bus before it went off the cliff in September. What did you do then? What will you do this time? Here’s a look at the early opportunities to get off the bus.

Lower highs, lower lows, after a big move in a year. That’s a pretty clear signal to be ready to get off the bus. For those on the QQQ bus, it wasn’t as clear, but resistance was on the horizon.

For those on the SOXX bus, it was finally moving north after going nowhere for nearly a year.

As we know, one should always be looking both ways and ready to get off the bus on a moments notice. The move north in SOXX quickly reversed and held flat again before finally heading south. Get off the bus.

SPY made more lower highs in December, so: Get off the bus!

QQQ did the same and if you weren’t paying attention over Christmas, then you certainly need to take action early in January, 2008 and: Get off the bus!!!

For everyone still on the bus, late May, early June was another really good time to get off the damn bus! The rally in August was really the ‘last call’. Note, the green downtrend line on the right is intentionally shortened so you don’t see it in advance when moving forward through the chart, but it clearly extends back to the prior highs to the left. In the chart below, jumping off ‘late’ at any of the above lows, still looks like a really, really good decision, as it avoided a drop of nearly 50%.

The question you need to ask yourself now is pretty simple and obvious: Should I get off the bus, and if so, when? Here are the monthly views to help you convince yourself of the need to get off the bus.

Those monthly support lines are a significant ways away. And they might not be solid ground at the bottom of this cliff. They could go lower.

My advice? It’s the same as it is every week, and the same as it has been since my first article in December, 2021, only with a lot more certainty now. Be ready early Monday and look both ways. Once it goes in your favour, stick with it. Then trust the charts and stay safe.

I would add, that I really don’t think Trump is going to back down any time soon, and the economic impact could and likely will be significant. The financial crisis in 2008 wasn’t resolved in a matter of weeks, and I expect the same this time around, and it might even last the full 4 years of Trump’s presidency. I simply don’t see him ever backing down. So, unless he can somehow spin the story so that he’s the hero and can claim victory, or unless other Americans can take control of the situation, we’re in for a 4 year tragic comedy show.

On the bright side, if you’re not living in the U.S., things will sort themselves out, we’ll make new friends and trading partners, and life will return to a new normal, with a nightly comedy show on TV in the news.

I couldn’t help thinking of a scene from Tarzan in comparison to Trump and the effect his actions will have.

Extra update on Sun. April 6 : I’ve been wondering how I could have logically done better with UVIX last week, and with SOXS, and sold SOXL after hours on Wednesday. Here are some thoughts on VIX and how to justify a large UVIX gamble on Wed. April 2.

We know VIX will always go over 30 when the markets drop hard, and it will go over 80 when they drop hard. We’ve been watching the markets drop since Friday, Feb. 21, and I've been looking for safe entries and trades in UVIX since then. It's often possible, but Wednesday was an example of when it makes sense to take a big swing without a good setup.

Looking back to Wed. March 26 below, you can see my preferred setup: a gap lower open and rally from holding flat and low the previous day. The high at 32.62 was +13.07% from the open/low 28.85 (-2.43% from Tuesday’s close). It would be tempting to sell some and take the quick gain, but unless you took a full large position at the open and want to sell some, it’s best to hold for a potential bigger move.

If you didn’t buy and hold at the open on March 26, Friday, March 28 was a ‘must buy’, and it was a ‘must hold’ over the weekend. Wednesday, March 26 was my ideal buy and Friday confirmed the move, so add more if not at a full position, and hold it all for Monday, March 31, ready to sell early, like Monday, August 5, 2024. Doing that gave a possible, and relatively simple gain of +48.7%, if you managed to sell at the exact high of 42.90. Remember, the buy at 28.85 should have been automatic, so even selling on a stop at 42.50 or 42.00 was a gain of +45.6% ‘worst case’ scenario.

Given that the tariff issue remained, it made complete sense to re-buy some UVIX late in the day on Monday at 36.80 or so, up from 36.64. That’s -12.4% from selling at 42.00 or -14.2% from selling at 42.90. That’s a great discount. When it then dipped to 36.44, -1.0% from 36.80, you might have stopped out, meaning your stop was too tight. You’re sitting on great gains for the week and you weren’t re-buying a full position. Keep the stop sell loose.

Tuesday provided another easy trade, selling 40+ for a quick gain of 8.7% or better. Then, it was an obvious and easy re-buy at 36.80 again, with over an hour to think about it, from 11:15 to 12:15. You might have then sold after it hit 39.03 and fell, for an extra 6.0% or less, and if you did, you needed to re-buy. With the late drop on Tuesday, holding shares overnight was more risky than Monday, but it was still a good bet with less than a full position.

I held UVIX from Tuesday, sold early Wednesday on the gap up and drop, then looked for a re-entry, expecting uncertainty with the tariff announcements planned for after hours. Unfortunately, or fortunately, it dropped relentlessly till 1:15. I bought and sold for small losses as it fell. I added ‘fortunately’, since I wanted a drop so that I could re-buy, and the fact that it did drop a LOT more than I expected, shouldn’t have caused me to waiver in my plan. I need to get better at maintaining conviction while following the price action on the day.

Conversely, SOXL gap opened lower (-4.89%) and was an early buy and hold till 12:55 when it hit resistance, or 1:15 when it reversed from the high, +11.34% from the open. I sold at resistance, then bought UVIX. A standard, every day trade setup. They each reversed sharply at 2:30, held the range till 3:15, then SOXL moved up and UVIX moved down. So, I sold UVIX and bought some SOXL.

Under normal conditions, that would be the end of trading for the day and there would be no reason to hold UVIX, since it was trending lower for the past 3 days. It and VIXY had also slightly broken the rising support line. VIX had clearly broken its rising support line, and was down around 21. It could easily gap down to 18 or lower on good tariff news, much like it gapped lower after the election.

Still, I decided to hold some UVXY, which was the ‘right’ call. Trading after hours is really, really difficult, since you can’t use stop sell orders for protection. But, when you know of a specific after hours event, it makes sense to watch and take immediate action as necessary. As I wrote earlier, everything first moved one way and then the other. That’s when conviction and logic need to come together and make a decision.

Holding SOXL or any long positions was a severe risk. The trend was down and the expectation of the tariff news to be moderate was completely blown out of the water. It was beyond what anyone, other than Trump, could comprehend or imagine. This was a chance to take a big swing with UVIX. Worst case scenario, it gaps 5-10% lower, but that would be nearly equivalent to a blue moon, and that loss would eventually be recovered because VIX will eventually pop to 30+.

The daily views weren’t clear on Wednesday after hours, but they certainly are clear now. UVIX was a good bet. SOXL wasn’t.

Holding any SOXL or TQQQ or anything on Wednesday was simply a bad idea. That’s all in the past now and everyone needs to set their strategy for Monday and next week. For me, trying to get a trade with SOXL is akin to trying to grab pennies off a freeway. I’m likely to get run over. Watching to buy UVIX or SOXS could be like waiting for something to snap back, like drawing a bow and arrow. The could both be slingshot higher from a pullback.

My primary goal since getting a 10x gain with a small TVIX in 2020, has been to do it again with a large position. I totally fumbled the ball last week, but if a 10x gain is on the horizon, then it will take a few weeks to get there.

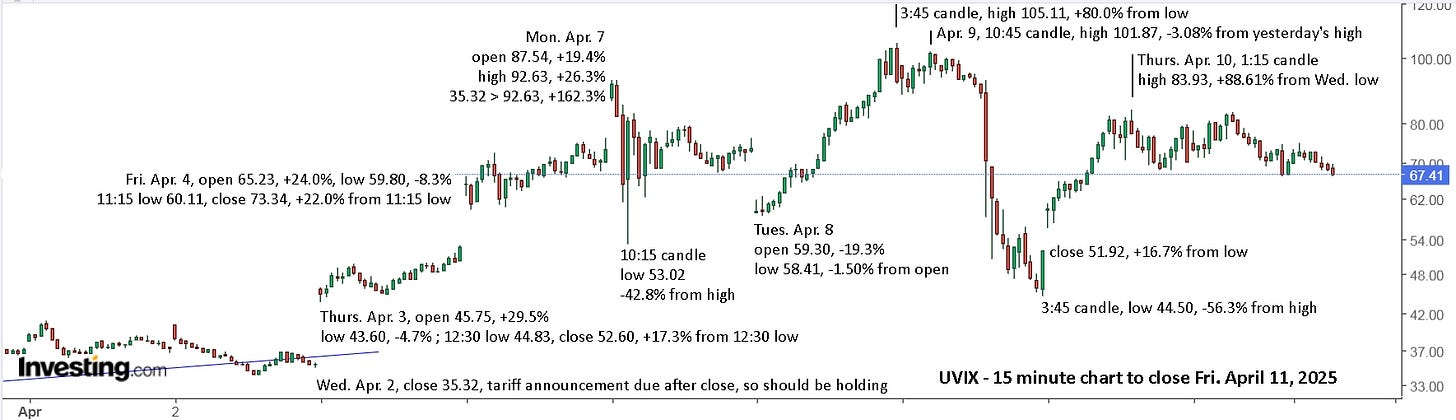

Update to Fri. April 11 : What a week!! One for the record books. The markets did gap lower on Monday, as expected, fell for 15 minutes, then reversed hard, also expected. I hope you were ready and waiting for the move, and took full advantage of it. Unlike Monday, Aug. 5, the underlying issues remained, so I wasn’t expecting a continued move up all week, but I also wasn’t expecting a 50% rally in just over 30 minutes!!

Trading these enormous moves is essentially the same, but you can no longer rely on regular stop orders of even 3%, let alone 1-2%. It can easily swing 5-6% in minutes, back and forth, so you have to ignore that and buy near a possible low, ready to jump in quickly with more, then get out quickly if it reverses below the recent low.

One could have bought a large position early Monday, because you were ready and watching for it, but it was down -9.85% at the open, from Friday’s close, then fell 8.26% in the first 15 minutes, rallying each 5 minute candle from a possible low. It then blasted up 9.8% in 5 minutes to just over the opening high. Buying there is difficult, risking a 9% drop back to the low, so one needs to have confidence in the strategy and the ‘logic’, in the face of extreme conditions.

Once it was up to Friday’s floor price and you’re sitting on a fast gain of 10% or more, depending on your buy price, it could be tempting to sell, but the message from many articles and updates is to hang on and let it ride. Once it was back to Friday’s early high, and up nearly 50% in 30 minutes, then it made a LOT of sense to sell. After that, it was much like a bouncing ball.

If you caught the first move with a large position, take the rest of the day off, or continue to practice your trading but with a much smaller position. I mean, nothing has changed fundamentally, so the large swings are simply ‘waves’ in a ‘wave pool’, caused by the algos. They even maintained a ‘natural’ rhythm till mid-day, establishing a firm floor, so then it was reasonable to buy a large position again with a clear stop sell below the floor. Holding overnight was a complete gamble, but you might as well leave some of your winnings on the table. That paid off nicely with an additional 14% gain. Again, let it ride off the open and when it got within 2 cents of Monday’s high with no momentum left, it was a clear sell, and a reasonable idea to go short with SOXS.

Selling SOXL off the high avoided a 29.9% drop to the late low. Buying SOXS provided a potential gain of 41.2%. I’m sure those are record breaking moves, but they were eclipsed the next day, Wednesday, April 9, when Trump announced a 90 day pause on the reciprocal tariffs.

Some people might complain of insider trading and manipulation, which could very well be true, but the charts and our strategy had you holding SOXL and enjoying the full move without any advance knowledge of what was going to happen. That’s an important aspect to remember. None of these moves should be a complete surprise. There are plenty of signs in advance. Just as the signs were clear last week, knowing that reciprocal tariffs were going to be announced after hours on Wednesday.

Holding SOXL shares overnight Wednesday was not really a good idea. I did hold a small position, with the mindset hoping it would go lower and okay if it gapped higher since I was holding some. Frankly, that’s my old emotional logic that isn’t the least bit logical. I shouldn’t have been holding any, and if it gapped higher, then it was simply a chance to buy SOXS and UVIX at a better price. I mean, the pause on reciprocal tariffs for Vietnam and numerous other small countries is essentially meaningless with increased tariffs on China, and maintained tariffs on Canada and Mexico. Wednesday’s move was like a climb to the high platform of the dive pool. And when a diver takes a dive, they go a long way down below the surface. By Friday afternoon, the markets were back to the surface from their Wednesday dive overnight.

The boundaries for this coming week are pretty clearly set. If you didn’t make huge profits with SOXL and SOXS last week, no worries, it was an exceptional week and valuable lessons were learned.

UVIX also made monster moves last week, with gains of over 100% available.

I was completely confused by the drop all day on Wednesday, April 2. I held shares from Tuesday, sold early for the win, then watched to re-buy, but it kept falling, breaking possible rising support. This is where some conviction, courage and confidence are needed. You’re also playing the odds, and you can be ready to sell after hours when the tariffs were announced.

I bought UVXY, but I was then faked out by the initial move higher in the markets, down in VIX. It then reversed moments later and VIX shot higher. Risking a large position is difficult, but likely worth the risk. Again, having a clear strategy and understanding what’s happening and how the VIX works is important. I quickly bought UVIX, but then sold for a mere 8.3% and held UVXY.

Holding from Wednesday’s close to Monday’s high was a tidy gain of 162.3%. That’s potential that always exists, but it’s a unique trade that takes practice to master. I haven’t mastered it yet, but last week provided excellent live practice. It’s not a great idea to be holding over the weekend, but I did decide to hold a small UVXY position.

For everyone patiently, and happily, waiting on the sidelines, there’s no rush to ‘buy the dip’. I suspect the downtrend will continue all year. QQQ and SPY look about the same as in last week’s update. Costco, COST, has been very steady over the years, and understandably so, but it is looking rather inflated in price and due for a drop.

COST was a sell on Tuesday, Feb. 18 (holiday Monday), just ahead of the market sell later in the week, or any day that week.

I don’t see any reason for this to push to new all time highs, but tariffs and lost jobs will certainly reduce the amount that consumers are spending, and will likely cut into the margins for most businesses. The pop this week was likely a good chance to sell, if you hadn’t already.

Looking back to 2008, after the sharp drop early in the year, there was a decent bounce to sell, ahead of further drops that should have been considered likely. “The first phase of the crisis began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of derivatives linked to those MBS, collapsed in value.”

I suspect the sharp market drop the week of Feb. 26, 2007 was triggered by financial news, and it was the first ‘wake up call’. QQQ was hugging resistance, perhaps due for a drop, and waiting for a trigger to send it lower. As QQQ pushed higher, and SPY held below resistance, that should have been more incentive, along with continual financial news, to sell your long positions. December, 2007 was a great time to close out everything.

If you didn’t sell in December, or January or February, in 2008 or 2025, then you had some decisions to make. If you didn’t sell in 2008 because you were already down over 20%, then you had to endure an additional 40% drop to the bottom. It amazes me that people who held through the drop in 2000-2003, and 2008-2009, and 2020, and 2022 are prepared to hold through another possible drop. The trendlines have given notice of each of the drops, in advance, and they provided the exact same notice this time.

I also sent out a first notice in September, 2024. That was plenty of time to prepare oneself to take action. Now, will there be an opportunity to sell over the next few weeks, or months? And will people decide to sell, or not?

There’s also little risk to sell while the markets are ‘above water’ now. Don’t panic sell at the lows, deep underwater, but it is likely best to sell all the rips. If the current downtrend turns into and uptrend, you will likely be able to buy near the price you sold, likely cheaper and perhaps higher, but most importantly, you were safely on the sidelines waiting for the potential storm to pass. Good luck next week!

Update to Thurs. April 17 : No extreme craziness this past week, and next week could be up, down or flat over the new range. There’s a good chance that SOXL support will hold and the sharp downtrend resistance will be broken. What’s most likely is a range of 8.50 to 11.00, which is a significant range of 29% to trade.

Volatility has subdued but remains elevated. Surprise news from Trump could move things sharply up or down.

Happy Easter!

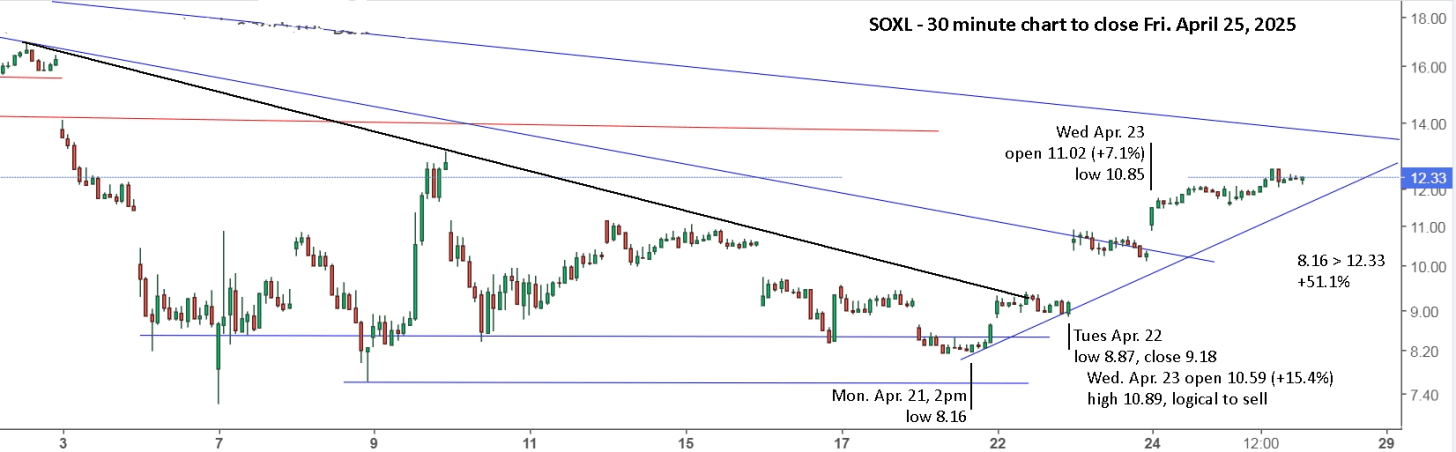

Update to Fri. April 11 : What a week!! One for the record books, which is exactly what I wrote 2 weeks ago! The markets did gap lower on Monday, as expected, which is also what I wrote 2 weeks ago, only this time they fell instead of rallying. Apparently, it was related to Trump ranting about Powell.

Selling April 15 turned out to be a good idea, and avoided a 23% drop to 8.16, even more, since you sold higher than 10.60. Each gap and rally was a good trade, and the gap lower open on Monday, April 21 was another buy for a potential rally, but it dropped, supposedly related to Trump ranting about Powell. With it holding support mid-day, it was a very reasonable buy above 8.00 with a stop sell at 7.99. When it failed to get going on Tuesday, April 22, you could have drawn a new, steeper downtrend resistance line that it was now at. It seemed best to me to take the +12.5% or more win from buying the day before.

Unfortunately for me, Bessent commented on China tariffs after hours: "Virtually all semiconductor stocks closed higher on Tuesday after it was revealed that U.S. Treasury Secretary Scott Bessent told a closed-door investor summit he expects the tariff turmoil with China will de-escalate as the situation is unsustainable. Later in the day, White House press secretary Karoline Leavitt echoed the sentiment made by Bessent at the investor conference, indicating a potential trade deal with China is getting closer."

That bit of BS news caused SOXL to gap up +15.4% at 10.59, then it hugged the existing downtrend line all day as it slid lower overall. Now, that was a clear sell for anyone who held from Tuesday. The early high was 10.89, so a possible gift of +18.6%, for a total win of +33.5% from buying Monday afternoon. There's no reason that I can see for buying back shares at the low of 10.10 or higher as it moved up. I mean, nothing had changed. There were no talks with China and there's little chance a deal will be reached for months, likely a year or more.

If one was sticking to the old strategy of letting it run, then you'd continue to hold some shares. Even if you didn't, then it was easy enough to buy shares on Thursday, April 24 around 11, as it opened at 11.02, hit a low of 10.85 and moved up. Assuming you sold at 10.50 or better on Wednesday, waiting to re-buy on Thursday at 11 or lower was likely the best choice. Safer and you gave up less than 5%.

It seems madness to continue holding for Monday, but that's what the chart is saying. On Wednesday, April 23, JC wrote, "Felicitously, harbinger SOXX (Semiconductors) is arrived at X-up today morning. Therefore, it will continue to ascend until at least R5+ for destination in future ... perhaps EMA50 & +k < $193.70. Corollary, SOXL (3x Semiconductors) < $15.50, Ditto, US major indices {QQQ, SPY, DIA) this afternoon now very auspicious." That seemed highly unlikely to me, but he might turn out to be right. On Thursday he gave a sell target of 12.60 for SOXL. The 1pm candle high on Friday was 12.59. That's some pretty spectacular forecasting, which is essentially what he does, very similar to forecasting the weather. He simply processes the data and ignores all news events. Now, we'll see if SOXL can get to 15.50.

Before you blindly start following JC and his system, remember that he bought his first SOXL batches in July, 2024, and is still holding them.

2024-07-17, 1/2 of 1st batch $54.32 ; 07-18, 2/2 of 1st batch $49.30 ; 07-24, 1/2 of 2nd batch $45.23. He has traded other batches since then, for good gains, but will he ever be able to sell those original batches for a gain? I’m doubtful, but I was also doubtful with his LABU buys in 2022 and he did manage to sell them for a gain over a year later, which is still a bad trade in my mind.