Compound returns with NG can be huge.

And provides a trade that is completely separate from regular markets.

Last year I wrote an article “Trading natural gas in 2023.” and continued to update it over the year. 2022 was a crazy year, with NG hitting $10, which was completely unsustainable. The last remains of those ridiculous prices was finally washed out in November, 2023. Going forward, there will likely continue to be excellent trades but with pricing more in line with fundamentals. The rough breakeven price for producers is $3, so with the current price around 2.20, there’s significant upside potential which will be ultimately based on production and storage capacity.

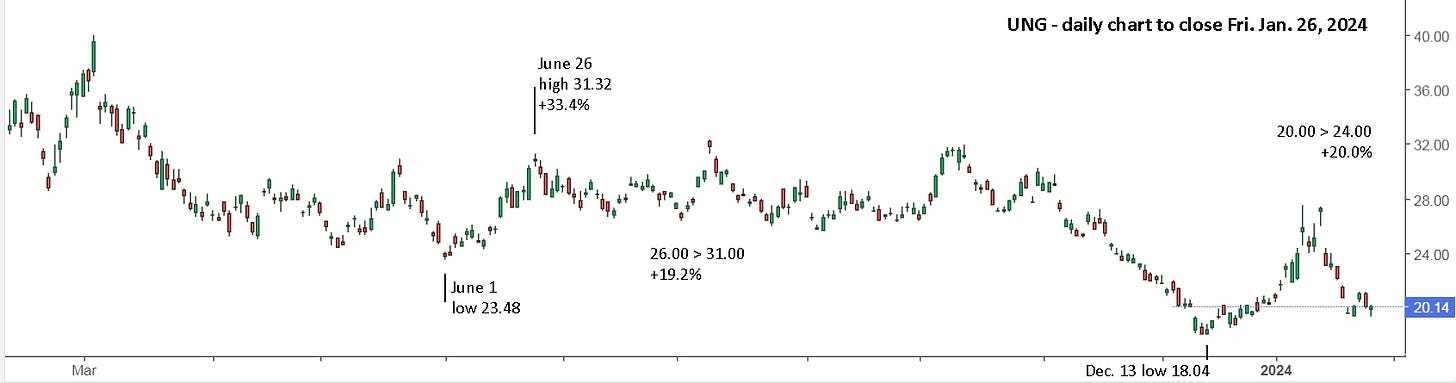

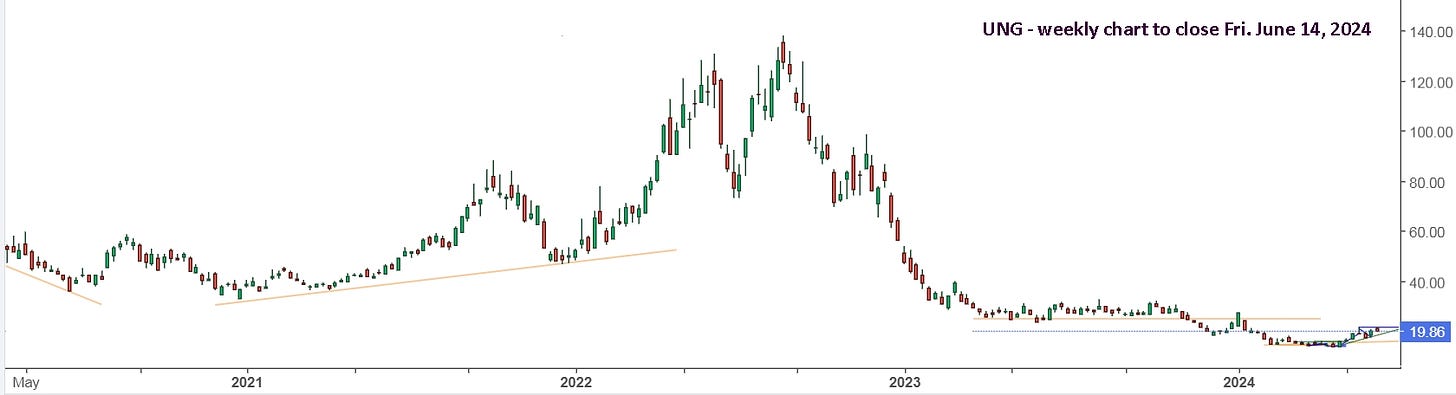

The beauty of trading NG is that it can make large swings over a range of 20% or more. Compounding returns of even 10% can add up in a hurry, with just 7 10.5% trades needed to yield a 100% return on initial capital. Here’s a look at UNG (non-leveraged ETF) for last year.

From April through October it went up and down over a 20% range. Trading leveraged ETFs (BOIL/KOLD or HNU/HND) covers a 50% range that can be captured up and down. The big drop in November was the future contracts finally dropping from an inflated 3.80 to an oversold 2.10. In January, NG made another ridiculously exaggerated move to 3.39 (Feb. contract), based on cold weather that only lasted 2 weeks. Looking at the March contract below, you can see the price only touched 2.80.

If the weather continues to be warmer than average, NG could fall to 2.00 and lower, but I’m doubtful that will happen. If it does, it simply sets up a better long trade with HNU or BOIL.

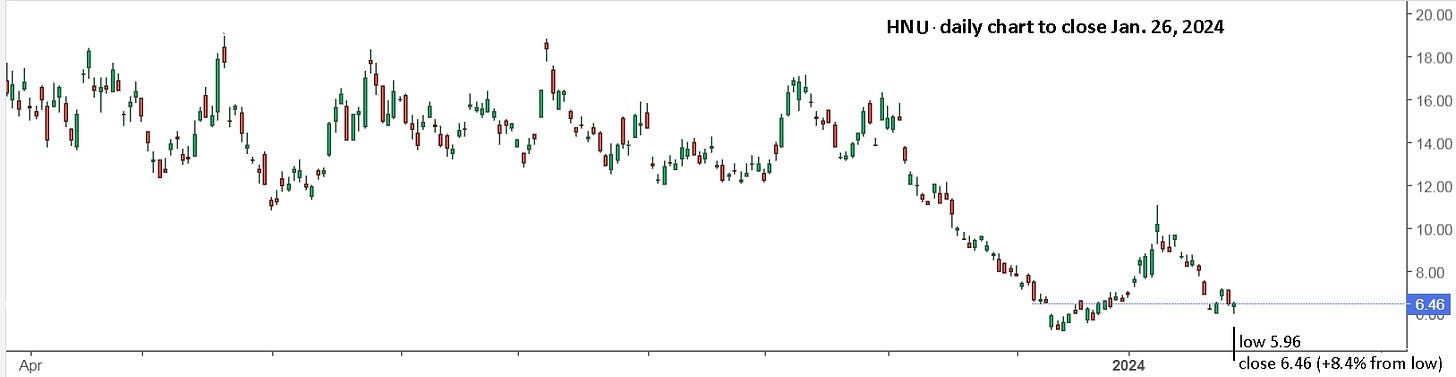

The chart looks similar to UNG, but the ‘tiny’ move on Friday, from the low of 5.96 to close 6.46 was +8.4%. A range of 6.00 to 8.00 is 34%. That’s a big opportunity to go after. In the past, I’ve had trouble trading HNU/BOIL profitably. I’ve had much better success with HND/KOLD. This year, I want to focus on getting the trades ‘right’ in both directions.

I’ve yet to find anyone who trades NG well, consistently. Following technical indicators rarely works without consideration of the fundamentals. The frequent large gap opens, often in an unexpected direction, can get one underwater, which can then have one struggling for weeks to get back in profit. On Seeking Alpha, there is only one person, I know of, that ‘consistently’ makes large profits trading NG. You can follow Greg’s trades in the comments of “Trading Your Plan Not Others”. I strongly suggest you simply follow the comments for information and don’t follow him into trades. He has a tendency to get down 50% or more with a large position. You can read a summary of last year’s events in “Trading natural gas in 2023.”

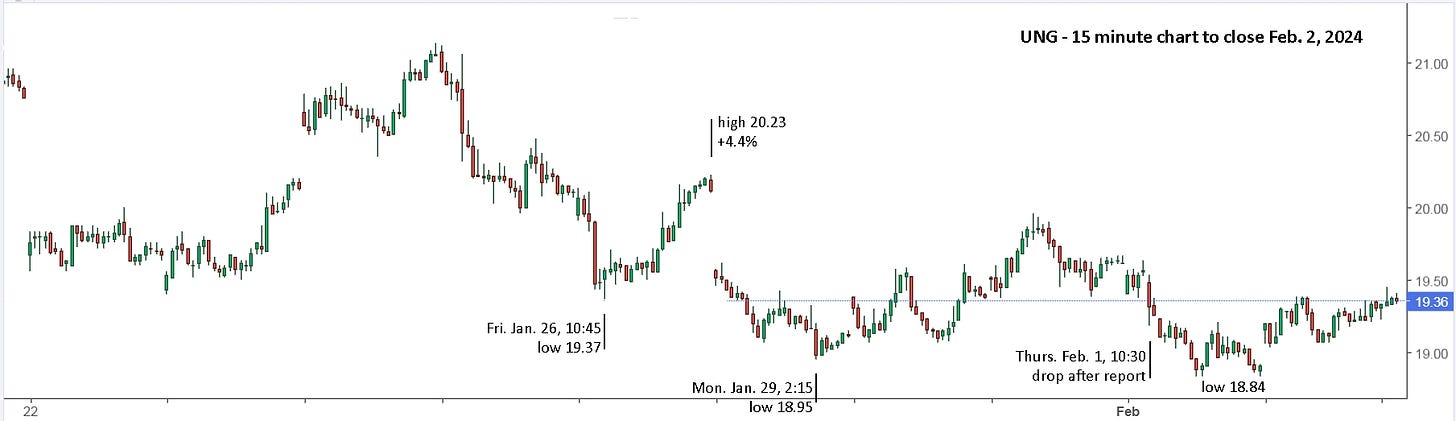

I recently wrote “TQQQ/HQU - Leverage can be a useful tool.” It shows the incredible potential returns with just a few trades, checking the charts once a week. Now that the markets are getting stretched, I have turned my focus to HNU while I wait for a re-entry into HQU. Friday was an ideal opportunity. Here’s a look at UNG.

As you can see, it looked to have bottomed on Tuesday, Jan. 23 and rallied in the afternoon. Wednesday it was up more, opened even on Thursday, then slid lower. Every Thursday at 10:30, EIA releases its Weekly Natural Gas Storage Report. Usually, NG will gap one direction and move the other in seconds, and often moves back again a half hour or more later. Basically, you need to be ready and waiting and act quickly, or simply stay on the sidelines and wait for an entry some other time.

You can also see that the price dropped sharply on Friday at 10:15. If you were holding, you needed to have had a stop in place. Once it held and you read some nonsense explanation for the move, then you can buy with some confidence, with either a limit or stop buy. By the end of the day, you’re up about 8% with HNU or BOIL and 3% with UNG. With most ETFs, that’s a comfortable margin for holding overnight. That’s not the case with NG, especially over the weekend. There are often gap openings of 8% or more.

At one o’clock, Greg posted, “I bought 10K BOIL at 22.97.” It had held above 22.85 since noon. I had bought some HNU at 6.05 average. Regardless of whether you are able to buy 10k shares or only 10 shares, the strategy should remain the same. I will continue to post updates so you can follow our trades and devise a strategy for yourself.

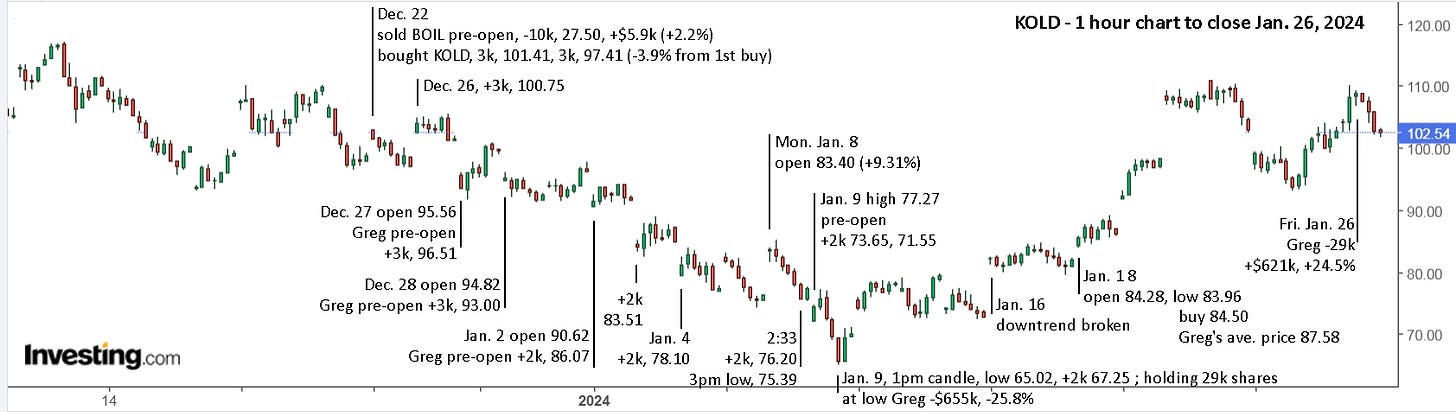

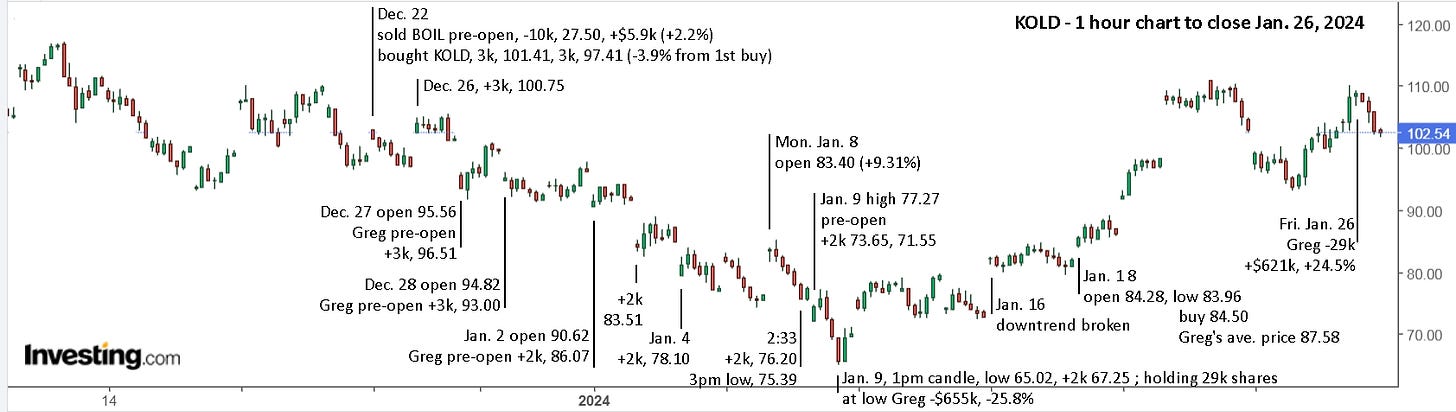

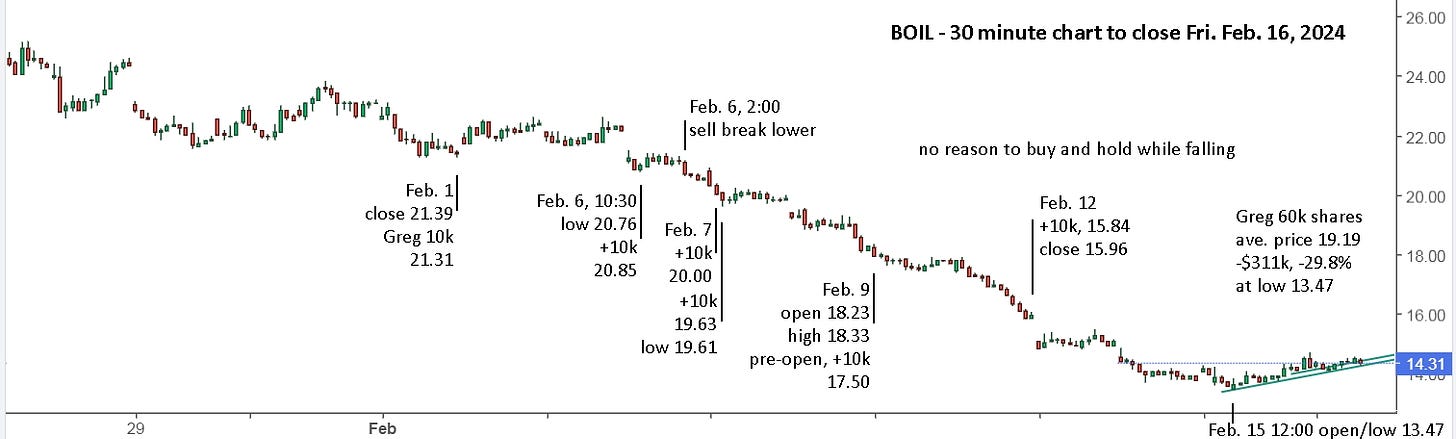

In the meantime, to help you formulate a preliminary strategy, here are Greg’s trades since December.

As you can see, once Greg sinks his teeth into a trade, he is relentless. He believes in the ‘necessity’ of building a large position as the price falls. That is the generally accepted and promoted strategy. I completely disagree and have repeatedly suggested buying on the way up, instead of down. Each purchase for Greg is upwards of $300k, which should give you some comfort in making a large purchase. I recommend making a full purchase and then be ready to sell if it goes against you. I would also suggest that your ‘full’ purchase be an amount that you’re willing to lose 10% of, because of the frequent surprise gap openings.

Buying more as it falls 35% from your initial buy is not easy to do, and I believe it is completely unnecessary and unproductive. Note that Greg began buying in 2k allotments as the price dropped. His initial conviction was high and he bought in 3k allotments. He switched to 2k when he had $1.5M in the trade and was down $176k (-17.6%). He also did essentially time the bottom with his final buy. He has proven repeatedly that his timing is good and that he can trade for consistent and large profits, but once he gets focused on building a large position, he consistently gets deep underwater. After his final 2k buy at 67.25 on Jan. 9, his average price was 87.58. That’s 30.2% above his low buy! He needs a 30% move to get back to breakeven. That’s not a position I ever want to be in, let alone with a large position. Greg’s was just over $2.5M.

I completely agree that the rally in NG was ridiculous and unjustified, but such moves happen all the time. As such, go with it, instead of fighting it. BOIL went up 51% from his Dec. 21 buy to the high on Jan. 9. That day was crazy! NG kept going up and up and up, hitting 3.39 before finally snapping lower. When you stretch a rubber band or blow up a balloon, you know they will eventually break, and you can watch in amazement at the extreme stretch before they do break. Watching NG that day was exactly the same. Buying that ‘snap’ with a large position was the best strategy by far. Unfortunately, not everyone can watch and wait for the bubble to burst.

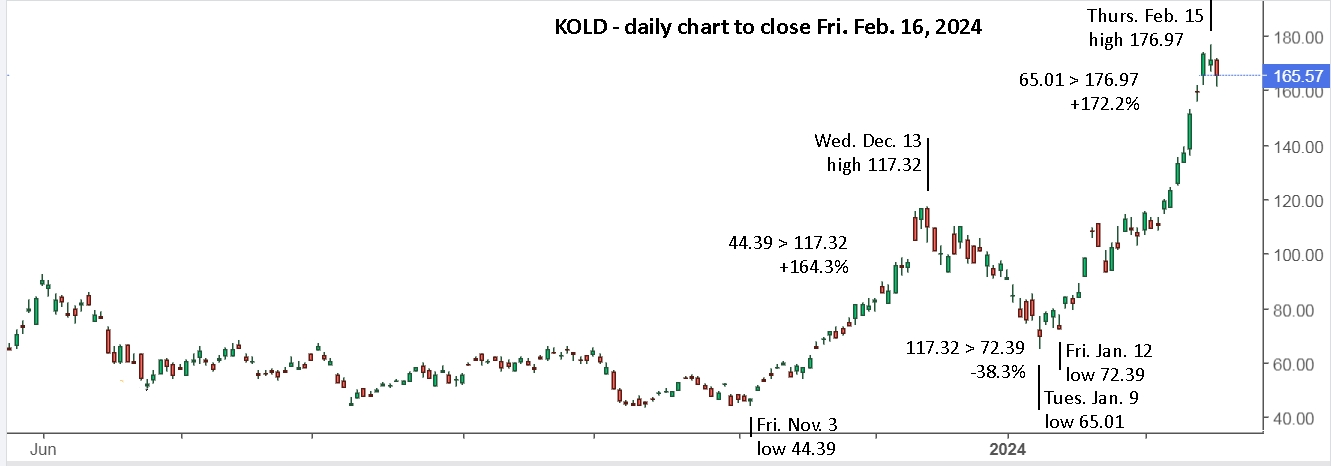

On Friday, Jan. 12, NG rallied again, pushing KOLD down. If you had bought Jan. 9 and sold the next day for +19%, then bought and sold Jan. 11 for 8% (and you could have traded both directions for 8% each), then bought and sold Jan. 12 for 4% (and maybe to BOIL for 5-6%), then you could have comfortably bought KOLD late Friday at 72.80. It was a good gamble since the fundamentals were completely in favour of KOLD and the downtrend would be broken on a gap higher open. Sure, it was still risky, so don’t bet the farm, but certainly bet all your trade gains for the week, at least.

Monday was a holiday and it did gap higher on Tuesday, Jan. 16, held roughly flat for 2 days and gapped higher on Jan.18. That was a great point to buy for conservative traders. Buying 2 weeks ‘late’, still had you in at a better price than Greg’s average price of 87.58). Plus, you hopefully had many compounded trade gains, allowing you to comfortably take a significantly larger position. Here’s the chart again for easy reference.

So, decide if you would have bought HNU or BOIL on Friday and then play along until you’re ready to do it with real money. Good luck to all of us!

Update to Fri. Feb. 2: The cautious decision last Friday was to take the 8% gain with HNU or BOIL. If you bought UNG, then you likely didn’t sell for 3-4%.

If you did hold, then the ‘proper’ decision was to sell Monday and wait to re-buy. Clearly, it’s a lot more effort than TQQQ, which is up 23.4% in 4 weeks with no trades and 78.9% in 3 months. Its trend is still up, but nothing goes up forever and most things don’t drop forever. Eventually, QQQ will hit a top and UNG will hit a bottom. I try to write articles early enough to give you time to think about it and get ready for the trade. BOIL and HNU might provide similar returns in the next 4 weeks and 3 months, or KOLD might give the returns over the next several weeks. It’s important to not try to predict what might happen, simply make decisions based on what is happening.

Update to Fri. Feb. 9: On Monday, there was good reason to buy BOIL and likely hold overnight with a 3% cushion. On Tuesday, you needed to sell for a 2-3% loss. If you didn’t sell, for whatever reason, then you rode those shares down 17.1%.

It’s difficult to sell when you’re ‘sure’ it’s a good price, and you may have held till 2 o’clock. That drop removed all uncertainty. Sell and wait for the next setup. You could also have bought KOLD and bagged 17% profit on the drop. Holding either over the weekend is a risk. NG was down to 1.81, so there’s no rush to get long. Holding for a further drop might also be considered greedy. A cold weather forecast could have it gapping up much higher. Patience is best.

Look back to 2020, with everything down due to covid. Oil hit -$40/bbl on one overnight contract roll. There’s no rush to get long NG now.

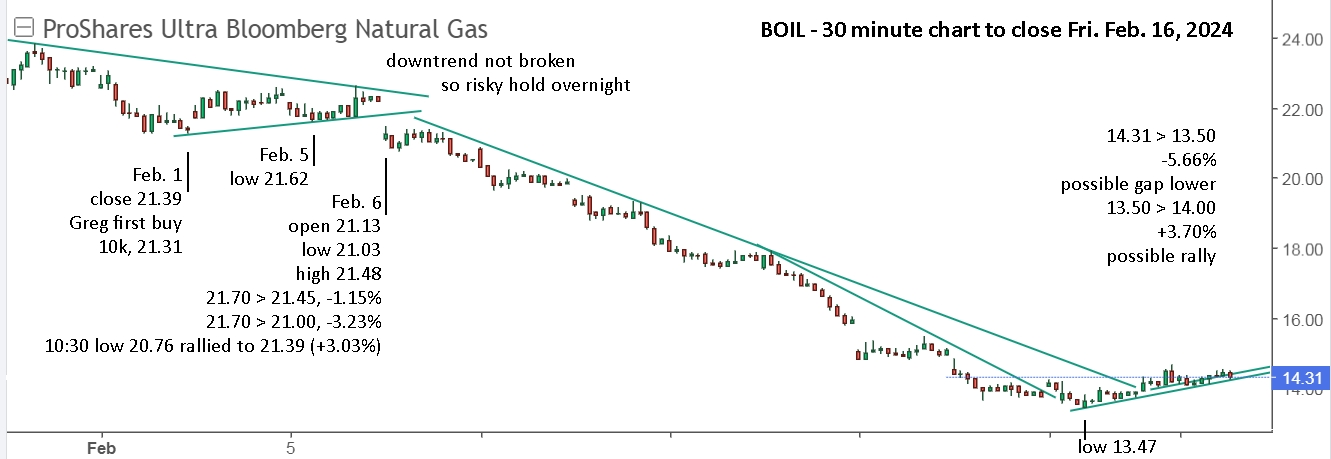

Update to Fri. Feb. 16: NG seemed cheap at 1.81 and, as warned, it got even cheaper, hitting 1.57. Here’s a look at Greg continuing to buy BOIL as it fell lower. Honestly, there is simply no logical reason to do this. At noon on Thursday, Feb. 15, it gapped lower at 13.47, moved up immediately then held around 13.60. NOW, it made sense to buy for a possible rally. Greg still believes NG will hit 1.50. I’m doubtful.

Why hold your buys from early February as the price fell when you believe that NG will continue to fall from 1.80 to 1.50? It makes no sense. Why hold even if you absolutely believe that the price of NG won’t fall any lower? The trend is down, respect that. Feb. 13 and 14 had moments of bullishness. The gap lower and rally at noon on Feb. 15 has all the hallmarks of a final push lower.

If there was no rally after the bearish report at 10:30, then I wouldn’t have been watching to buy. The gap lower and reversal at noon caught my attention and got me watching. Buying at 13.60 with a stop sell at 13.40 (-1.5%) made a lot of sense. The spike lower at 2:30 gave 2 points for a rising trendline, which was touched and held, with a rally in the final 10 minutes. Those were all bullish factors to justify holding overnight.

An extra thought, to provide confidence in buying holding BOIL now, is that Greg consistently gets deep underwater in his trades and then nearly always sells for a profit. Here’s his record for last year when he bought large positions over a period of time.

BOIL, Dec.28'22 - Mar.20'23, max. draw -59.5%, -$1.089M, sold -$1.06M, -58.2%

KOLD, May 8 - May 31, max. draw -19.3%, -$328k, sold +$290k, +16.4%

KOLD, June 15 - Sep.8, max. draw -25.1%, -$430.8k, sold +$25.9k, +1.5%

KOLD, Sep.22 - Nov.20, max. draw -27.6%, -$423k, sold +$189k, +12.3%

KOLD, Dec.22 - Jan.26'24, max. draw -65.5%, -$655k, sold +$621k, +24.5%

BOIL, Feb.1'24 - , max. draw -29.8%, -$343k, sold ??, ??

Despite going a million dollars in the hole to start the year, he still managed a profit of over $370k for the year. His BOIL buy late 2022 and hold through March was simply a really bad decision. NG was 4.60 when he first bought and he wrote, “I bought 10K BOIL at 18.50, it's possible NG could drop to 4, but since I have no idea when it will flip higher, I'm going to start buying the dip!”

I was convinced NG would fall to 3, at least. It fell to 1.96 by Feb. 22. On Feb. 1 he bought at 6.84, 6.36 and 5.70 for a $1.6M position with NG falling from 2.80 to 2.53. His last buy was Feb. 17 at 5.20, for an average price of 10.75, and it continued down to 4.34 on Feb. 21, -16.3% from his last buy, -$1.088M, -59.5%, and -76.5% from his first buy. That’s not buying the dip!

Amazingly BOIL then rallied 83.6% to 7.97 high on Fri. Mar. 3. I said the move was ridiculous, but was afraid to buy a large KOLD position. Greg felt NG would go higher and didn’t sell. BOIL gapped lower on Mon. Mar. 6 at 6.16 (-21.6%) completely erasing Friday’s +15.6% move. Welcome to the wacky world of NG!

Fast forward to the present, Greg's comment, Thurs. Feb. 15:

The COVID year was more an issue of the time where nobody knew what would happen with society so NG and oil plummeted on what was seen as much lower demand, to no demand. The 1.61 low was a major downside support which failed today, so the next support level is 1.50. The all time 2020 low was actually 1.38 for about a minute. But the situation today is much worse that any previous I can remember. You have everything working against the bulls, production at all time highs, demand at record lows, weather biblically warmer than average, largest oil production in history increasing supply via associated gas, and lets not forget the Freeport outage which is curbing export demand for LNG.

Have I missed anything? Maybe I will think of something else, but there's nothing to be bullish about other than the fact that NG is about as low as it can go!

But if things continue the way they are, I could see NG putting in a new all time low before truly bottoming. I didn't expect it to get this bad, but the bearish fundamentals and weather just keep coming. When it breaks nobody know for sure!

I agree with everything he says, which is why I have been very cautious buying BOIL. Eventually, there will be an 80% rally or better, so be patient and catch it.

Update to holiday Mon. Feb. 19: NGH24 (March contract) opened lower today and hit 1.522. It might be back up to open tomorrow, but if not, best to have a clear strategy in mind.

A look back to early February might be useful. That’s when Greg started his position, and instead of selling for breakeven or a small gain on Feb. 6, he bought more and continued to buy more as it fell. That’s not a strategy I recommend. With NG near 1.50, it’s difficult to imagine another steady 2 week fall from current levels, but with NG, anything is possible.

BOIL could easily gap 5-10% lower tomorrow, so I would watch to trade it, much like Feb. 6. An early rally is likely, and I would watch to sell when it stalls, then put in a stop buy higher. If it falls from a gap lower open, then I’d sell and put a stop buy just above the early high. The longer term downtrend line might turn into support, but if the current uptrend support line is broken, you simply want out of the trade at the best price you can get and wait for another buy setup like last Thursday-Friday. It’s also wise to remember that BOIL could have powered up higher on Feb. 6 from the early low and continued higher for the past 2 weeks. That’s a possibility for tomorrow as well.

For everyone on the sidelines, you’ve had a great view of past events with no early punches taken. It can’t go down forever, so wait for your opportunity to land your own knock out punch.

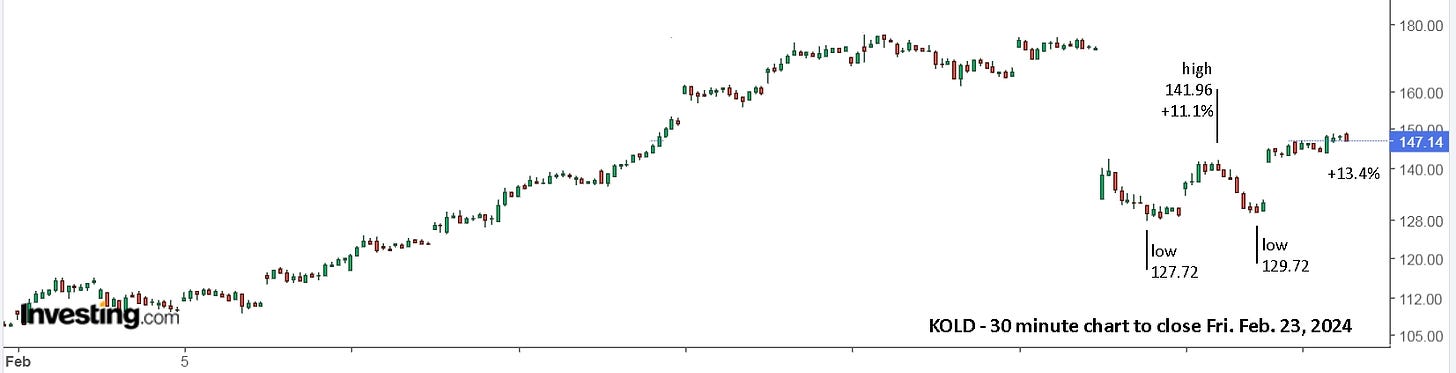

It might also be helpful to have a perspective on KOLD since it started up in November. As I’ve said before, it was amazing that the futures pricing for NG had remained so high, for so long, which made be tentative with the KOLD trade, especially after the crazy run up in December and early January. Paying attention to the trend as well as the fundamentals, should have allowed me to hang on till last week’s high. By any measure, holding KOLD over the weekend now is a bad bet. Greg has a history of being lucky though, so betting against him often goes against you.

At least you don’t have $1.15M in BOIL, sitting -$293k, -25.4% at Friday’s close. Stay patient this week and good luck!

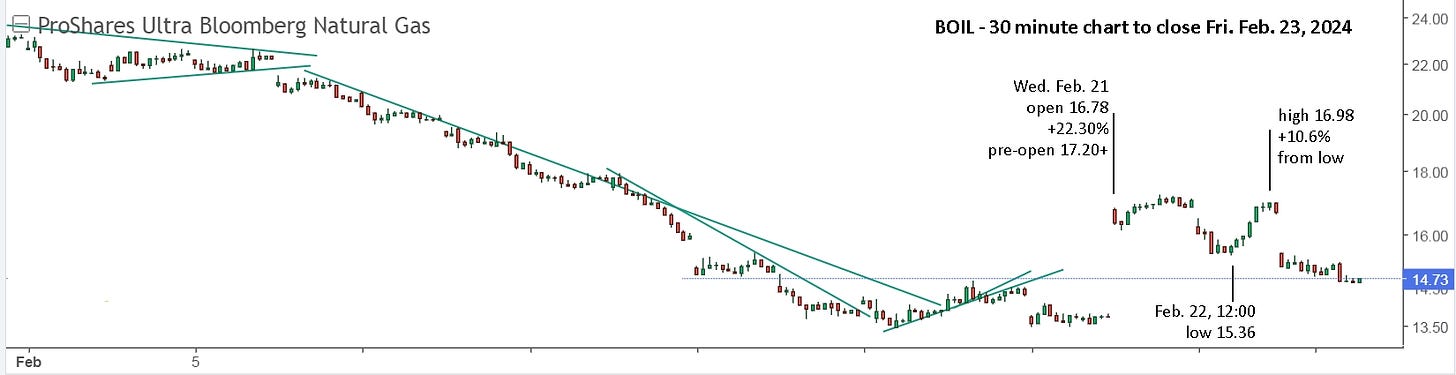

Update to Fri. Feb. 23: Wow! What a week! BOIL gapped lower on Tuesday but held above Thursday’s low. That broke the Thursday-Friday uptrend, but with it holding all day, it was a reasonable bet to hold. Watching after hours was super beneficial as NG took off higher based on CHK saying in their earnings report that they were going to cut production. You could have bought BOIL after hours quickly and then held overnight. It gapped up 25% on Wednesday. I thought it might continue a bit higher on Thursday, but it fell back.

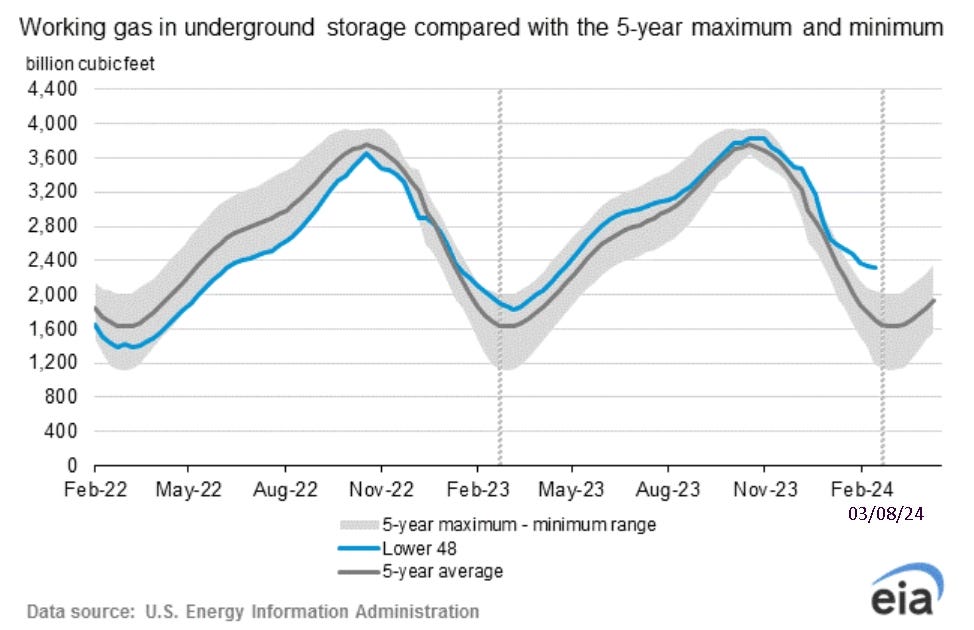

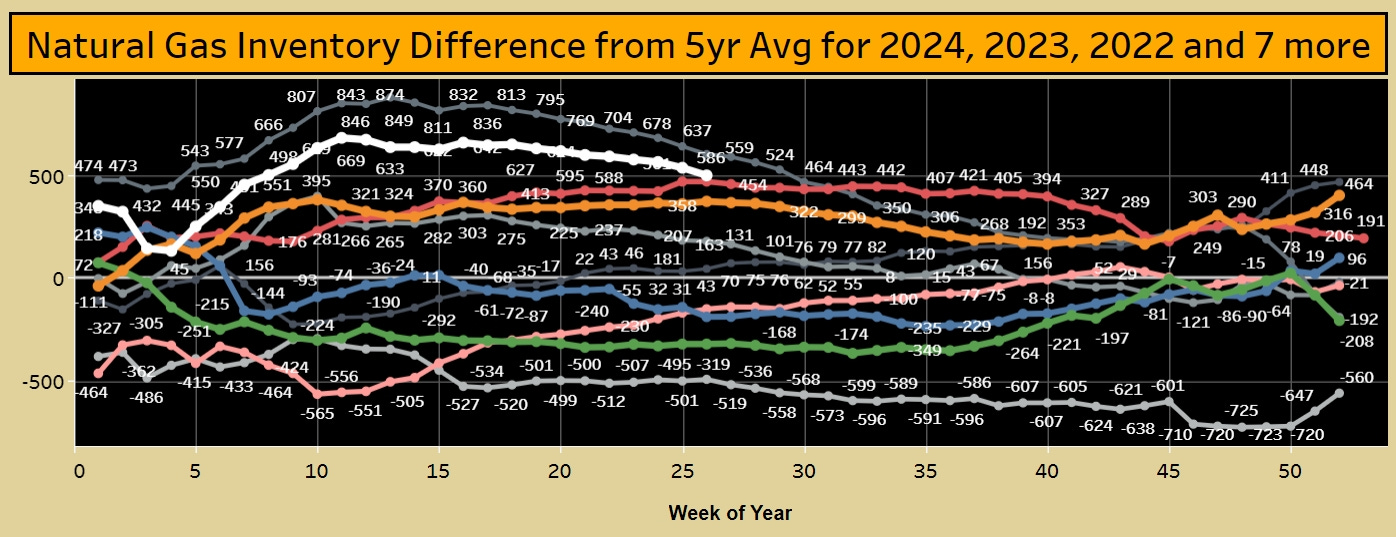

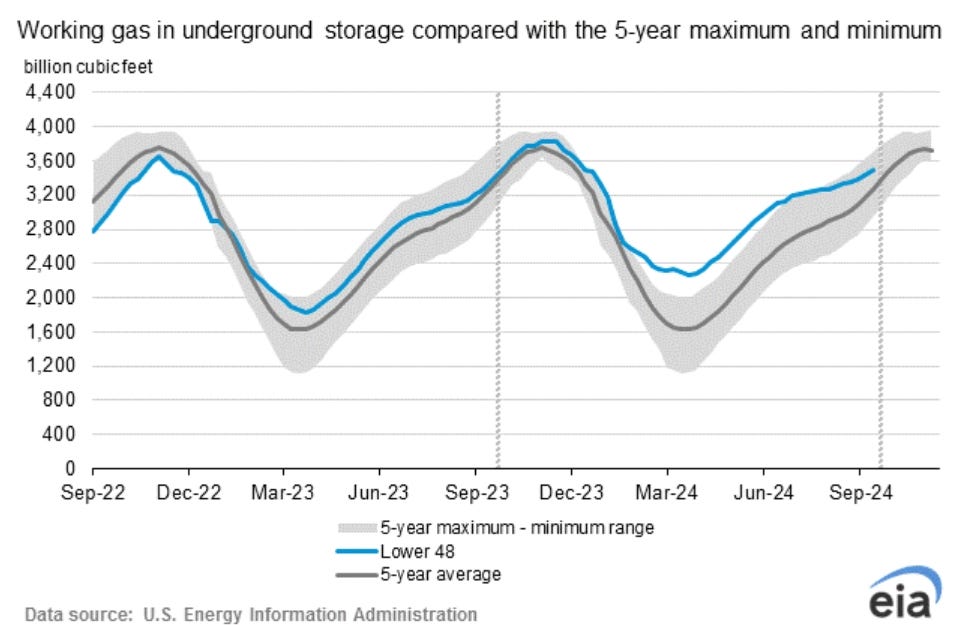

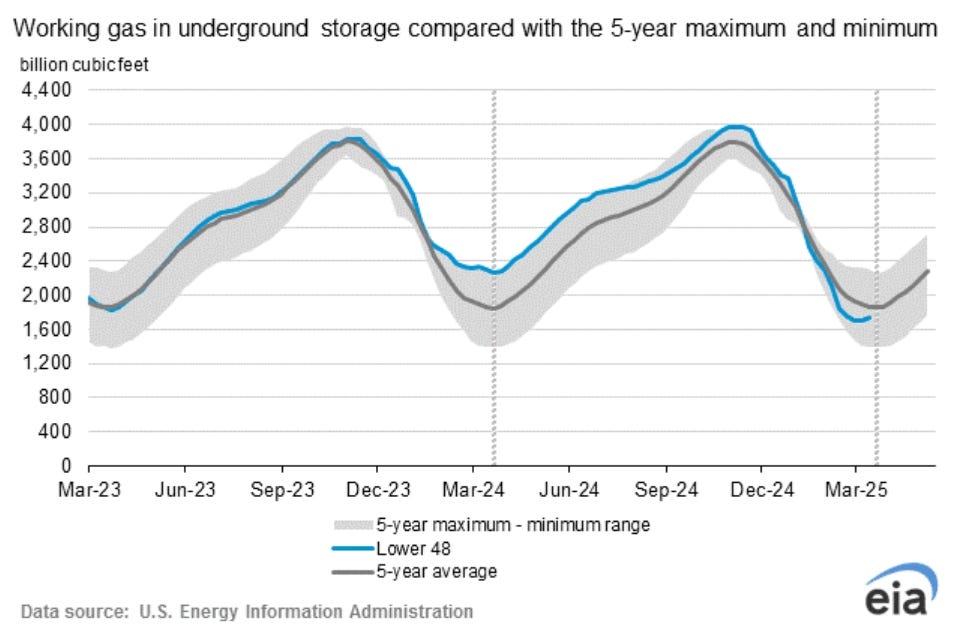

Catching the 10% rally on Thursday on top of 25% selling on Wednesday, and likely buying and selling for a trade on the day, has you well up from buying on Tuesday. Buying on Friday was obviously tempting, but holding as it fell during the day was a risky decision. The rally on Thursday after a bearish report with a jump in storage to 22.3% above the 5 year average was surprising. It could gap higher or lower on Monday and there’s simply no way of knowing. I chose to stay on the sidelines. Greg sold his BOIL at 17.10 for a loss of $125k (-10.9%) and bought KOLD. (Remember he bought KOLD on Feb. 15 as a hedge for his BOIL position.) He thinks NG will go lower given the current fundamentals. The argument is sound, but I wouldn’t want to take the risk. I’d rather wait for the eventual BOIL trade.

This article, “UNG: Not The Way To Profit From Natural Gas” provides a lot of useful information that is useful to know and keep in mind while trading BOIL. It recommends buying producers, which could also be profitable, but it won’t come close to the compounding return potential from trading BOIL and KOLD.

Update to Fri. Mar. 15: Greg finally closed his KOLD trade on Friday, saying, “I sold KOLD at 148 for a 302k profit (+14.6%), I still believe NG will go lower but not taking any chances considering the rally yesterday on nothing.” At the March 5 low of 106.00, his trade was -$380k, -17.9%. That’s not a swing I like to sit through.

The move up in NG after Thursday’s bearish report made no sense, but such is often the case with NG. The current excess storage is a whopping 37.1%, up from 30.9% last week and 26.5% the week before. That’s a very rapid increase, and I don’t know if storage has ever been this much above the 5 year average.

Production has dropped and, if cuts are maintained, the excess storage will eventually return to the 5 year average, but future prices for NG remain elevated, so there’s no clear trade. Front month prices will gradually increase, but since BOIL and KOLD hold future months (currently May and will roll into July), they’re likely to continue to trade over a range.

The front month, April, closed Friday at 1.655 with May at 1.789 and July way up at 2.37. The roll doesn’t start till early April and will favour KOLD. Here’s a look at BOIL and KOLD over the past few weeks.

They might now be setting up to hold a 10-20% trade range. Since the fundamentals are still bearish, I will continue to remain cautious with BOIL trades. Conversely, news and bullish enthusiasm can easily spike NG higher, as was the case in February and early March, so best to be cautious with KOLD trades as well.

Update to Fri. April 19: It’s been a month since my last update

Here’s a theory for how prices can be manipulated. I have no idea if it’s true, but it makes sense to me and provides a physical way for it to happen. To gap prices higher at the open, my ‘bots’ put in high buy prices, but since my bots are really fast, most of the orders are withdrawn before being executed. I buy some, just enough to keep the ‘fire stoked’, and get other traders to join the buying. As soon as the markets open, I start unloading all the shares I actually have. To force the price ever lower, I begin naked shorting. I sell shares that I don’t have at lower and lower prices. Again, my fast bots pull most of the orders before they are executed, while the huge volume of low priced sell orders push the price lower and lower. I then sell the shorts that I did buy and take the loss, knowing that I’m going to continue pushing the price lower, selling shares that I don’t have and in fact, don’t even exist. At one point, AMC was 140% short, which is nonsensical. Many buyers, the bulls, had no intention of selling. If they hold 50 or 60% of the shares and the remaining shares are held by ‘weak hands’ that might sell, then the shorts can continue to push the price artificially lower, but at some point, they have to close their shorts. That’s the point where the share price bottoms. Sometimes, the reversal can be dramatic, for example, OUST and ROOT, which took forever to top out.

Update to Fri. May 31: It’s been over a month since my last update, which was only a quick note on my thoughts for how prices are pushed around, so basically over 2 months. The past 2 weeks, NG prices were dramatically pushed up for a week, then down the following week. We may now be on the cusp of the price moving back up.

With absolutely no understanding of the fundamentals, the one week move from Thursday, May 16 to Thursday, May 23 looks unnatural, and it was, as it is now all the way back down in a week. Yes, it’s completely ridiculous, but that’s what happens with NG. You could have nabbed 53% with BOIL in one week and 53% the next week with KOLD. You can also see a hard move up in January, which was also completely unjustified, but in winter, weather can be used as an excuse for such crazy moves.

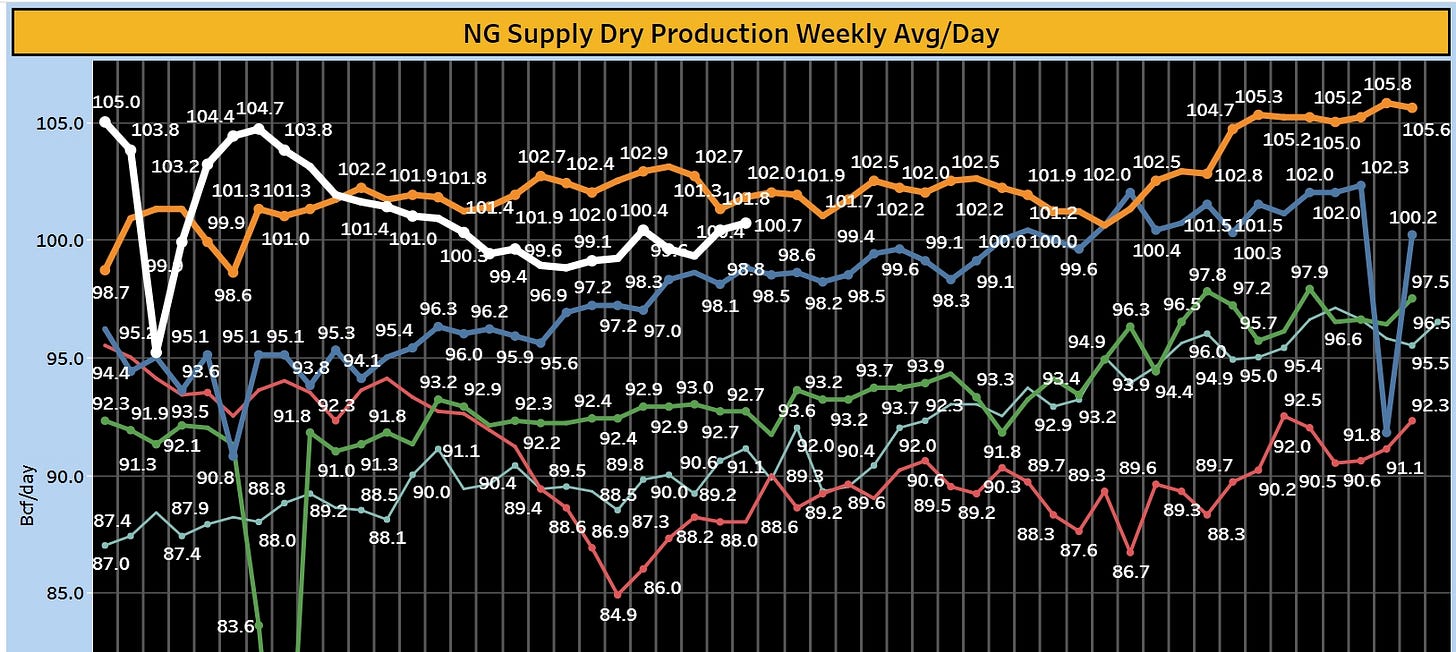

The fundamentals are actually more bullish now than they were in April. Excess storage topped out in mid March, but held over 35% until late April. Remember, I’d never seen it above 30%, so storage was high, justifying low prices. In mid April, production dropped below 100 Bcf/day, so prices should have continued to slowly move up. Instead, they were pushed back down, making it difficult to confidently buy and hold BOIL. It also conditioned one to expect a smackdown, so the hard move up on Thursday, May 16 and the next 5 sessions was a complete surprise that made no sense. Remember that move for the next time it happens.

NG will eventually get back over $3, so with it now priced at 2.59 for July and 2.65 for September (the next contract roll for BOIL), there’s a very good setup to go long with UNG, BOIL or HNU (for Canadians). Buying on Friday risks holding into a gap lower on Monday, but that pain was felt through March and April, when it wasn’t yet known if production would be cut. Production moved up last week from 99.2 to 100.1, which is a little concerning, but excess storage is down to 26.5% and dropping about 2% per week, so it could be even or under the 5 year average in 13 weeks, the end of August.

There’s certainly potential for BOIL to fall back to 13, -19.8% from Friday’s close of 16.21, but there’s also potential for it to top 30 with NG back over $3. I bought some extra on Friday, willing to sit through a 20% drop if necessary, en route to a potential 100% gain. Saddle up for the ride if you want to try a little bronc bustin’!

Update to Fri. June 7: It was a good decision to buy BOIL on Friday, May 31 as it gapped up significantly on Monday, June 3. As the price starts to fall early, sell and be ready to re-buy. When it bottoms at 11:30, it makes sense to buy since you’re expecting it to continue up overall. When it gaps lower and falls on Tuesday, sell again and let the market makers do what they want to do. When it was nearly back to Friday’s price after 2pm on Tuesday, take the gift. You’ve had 2 trades to lock in gains and if it goes lower you can buy more. When it shot up late before the close, I even bought a bit more.

When it gapped up on Thursday, June 6, it again made sense to sell, just as it did on Monday and Thursday, May 23. In fact, the best prices are often available early, pre-open. You can watch NG and it will very often move one way then reverse. After the report, NG dropped, but there was nothing bearish about it, so be ready to re-buy all your shares.

I actually expect NG and BOIL to gap higher on Monday, but I played it safe and sold most of my BOIL and held most of Dad’s HNU, since I’m trading it less and I can’t buy and sell it until after the open. I still expect BOIL to get above 30, and expect to continue to be a bumpy ride.

Update to Fri. June 14: It was another good week for trading NG, especially Monday - Tuesday. Monday opened way up and held a firm ceiling so definitely sell, but be ready to buy it back. NG was only around $3 and on May 23 it was up to 3.16, so it could easily go higher, just not necessarily in a straight line. One also could have bought KOLD for a trade as NG fell. Late in the day was a great chance to buy back BOIL 12% cheaper than you sold a few hours earlier. The gap up on Tuesday had you ready to sell, but not selling as the price held and slowly moved up. Late in the day, I sold out completely, expecting a chance to re-buy cheaper.

BOIL gapped lower on Tuesday and moved up, so I bought, when it reversed, I sold some, but not all. I’m biased long and don’t want to miss a bigger move like I did in May. When it reached support and pushed up, buy. It opened a bit lower on Thursday and the smart decision was to sell ahead of the report and be ready to buy. It fell hard on a fairly neutral to bullish report and was back near Monday’s low. For everyone who wisely sold at the top on Tuesday and patiently waited till after the report, you were rewarded with a chance to re-buy for 13% cheaper than you sold.

Without a long bias, one would have sold for a small gain later on Thursday, then not have bought on Friday. For everyone with a long bias, NG is back to 2.88 for the July contract and 2.94 for the September contract (which is the new contract for BOIL). It could easily go lower on Monday and next week, but overall it will be going up.

The daily chart for UNG shows how difficult the trade was in March and April, as the price of NG was suppressed. Followed by an explosive move in May that was difficult to stay with the entire way for +54% with UNG and over 100% with BOIL and HNU. The pullback from May 23 to 31 was a gift to get long again, and Tuesday, June 4 was an extra opportunity. UNG may fall back to the support line, and maybe lower, but my focus is on catching the move to 26+. Production is back down from the brief rise, so fundamentals remain mostly bullish. Excess storage dropped 1.2% last week, down from 2% recently, but still going in the right direction. If NG provides another gift, make sure you take it.

Final thought, the green support trendline isn’t overly steep, and is roughly the same slope as the yellow support line in 2021. I don’t expect any craziness like in 2022, or later 2021, but I do expect an overall climb for perhaps a year or more. It all depends on the discipline of producers to limit production until storage levels are back to normal. Then, with new LNG export capacity coming online, demand could continue to push prices higher.

Update to Fri. June 28: It’s been a surprising few weeks and NG is back to where it was on Friday, May 31. It was a good decision to buy BOIL then as it gapped up significantly on Monday, June 3. I have no idea if that will happen again this Monday.

Let’s start with another look at the chart to Friday, June 7.

Monday, June 3 gapped up, sell the drop, re-buy the reversal, sell Tuesday and re-buy late. I really don’t like trading so much, but there’s a risk it will go lower. The safest buy was on Wednesday, June 5 off the open (low 17.08). The safest choice on Friday was to sell and take the 22% gain in 2 days, but you also want to stay in for the full run that you may have missed in May. (Also remembering that the May run up made no sense at all.)

It opened up sharply on Monday, June 10, and with no upside momentum, it makes sense to sell. When it drops 13.2% to 19.91, below Friday’s closing price, and starts moving up, buy and take the gift. With BOIL up 18.5% late June 11 from re-buying June 10, it’s wise to take this gift and not be greedy, hoping for more.

With a rising trendline in place, it made sense to buy on June 12 with the price back near the support line. It also made sense to hold overnight. The key was to sell the next day and not hold any shares because you believe NG will move higher. Once out, stay out till you see it moving up, namely early June 18. Selling at the end of the day was optional, +6.8% from buying off the open. June 19 was a holiday and it gapped lower on June 20, and you have to sell for a small gain, ready to re-buy if it moves up.

Monday, June 24 was the next buy setup. Holding or selling at the end of the day is a personal call, but it definitely made sense to hold. When it gapped lower, be ready to sell, it moved up, all is okay, then you need to sell as it turns lower in the afternoon. I didn’t. Then I didn’t sell out on June 26. I tried, then it reversed and I bought it back. I lacked conviction to sell and stay out because the drop in price made no sense. Like before, nothing had changed in the fundamentals, so why drop again after 2 hard rallies up. NG doesn’t need a good reason for anything.

If you made mistakes with this trade, or other trades, don’t be too hard on yourself. Everyone makes mistakes. The key is to learn from them, then take advantage of the next opportunity. If BOIL goes lower, you still need to sell, but it will bottom eventually, (soon?), and then you can catch the next big move.

Greg has made millions trading NG, and he says this year has been his best year ever, yet when I look at his trades, I honestly think they’re often terrible. He sold BOIL on May 16 for good gains, then took losses with KOLD, as NG continued higher. He then bought 10k shares of BOIL at 19.80 on May 24, with it falling. The next day, May 28, was a reasonable buy with it moving up, but then it gapped lower and one needed to sell. That’s not Greg’s style. He bought more, 10k shares at 18.02, then 10k more at 17.51. He then bought 10k more at 15.95 on May 31, at which point he was down $74.8k (-10.5%), which is very, very small for him. He routinely gets down 30% and over $500k. He then sold June 3 at 18.90 for a gain of $43.2k (+6.1%). Not bad, but not great.

He then bought KOLD on June 7 and took a $22.25k (-11.0%) loss on June 10, and bought 15k shares of BOIL at 21.06. He sold the next day at 23.68, a penny below the high, for a quick gain of $39.3k (+12.4%). He’s completely capable of timing his trades very well, but he believes in the need to build into a large position as the price drops. I completely disagree with that strategy. I don’t think it’s necessary and I hate holding shares as the price drops.

Now, you have a chance to buy while the price is low and trade for maximum gains. Greg bought 15k shares of BOIL at 22.50 on June 12, definitely early. He then bought 10k shares at 21.42 on June 13, (my strategy says to sell), then 10k at 19.19 on June 17, (could have sold for a gain), then 10k at 18.00 on June 21, (again could have sold for a small gain), all the while now believing that NG could drop to 2.50 or even more. At Friday's close, he's down $218k, -20.2% and BOIL is down 30.4% from his first buy. I’m also certain he will eventually sell this trade for a gain. His current break even price is 19.63 which is +25.3% if you bought at Friday’s close, 15.67.

Here’s some additional information that will be useful to consider. The production is up again slightly and may drop off again, or it might rise, there’s really no way of knowing.

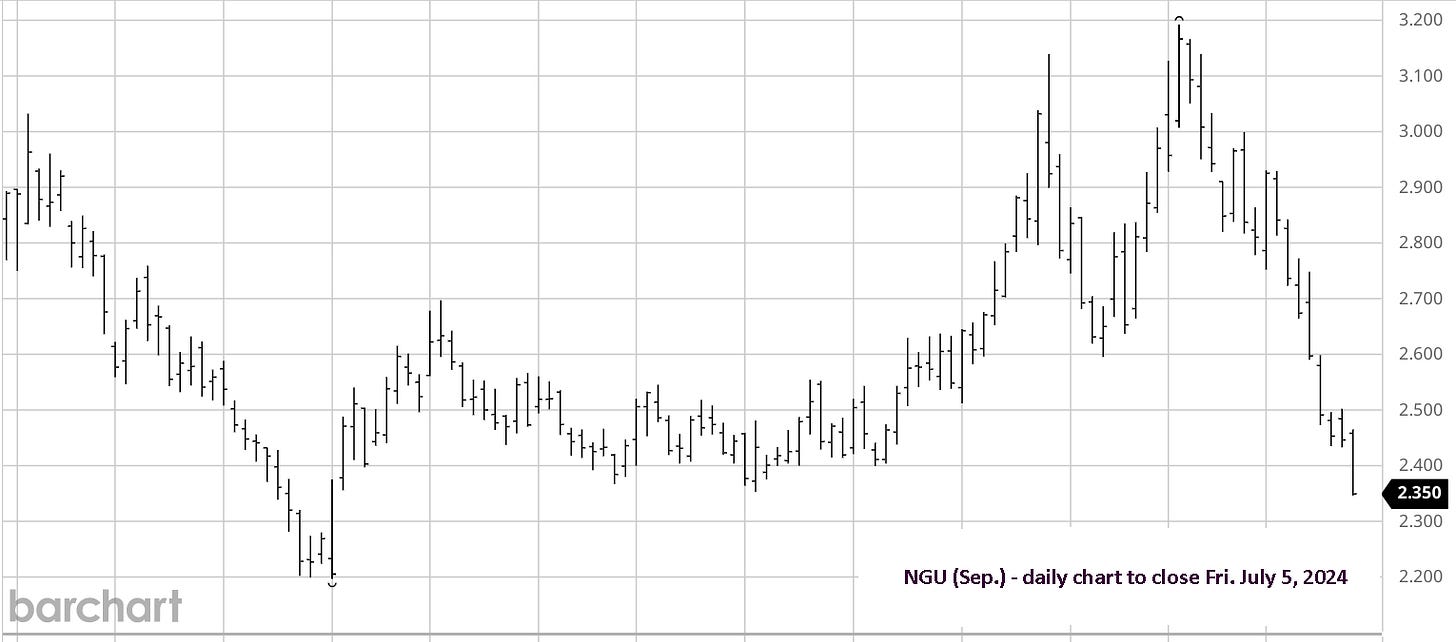

And here’s the daily price chart for NG (September contract, which BOIL will hold till early August).

The price may indeed drop to 2.50, or even 2.40, but the fundamentals are still bullish, and have been since April as production slowly dropped. There is absolutely no fundamental reason for the mad rallies in price to 3.10+, or the drops back to 2.60. It is simply traders pushing the price around. It’s a bit like an artificial wave pool. The water is flat until they turn on the wave machine. Your choice is to play in the waves or not. Best of luck!

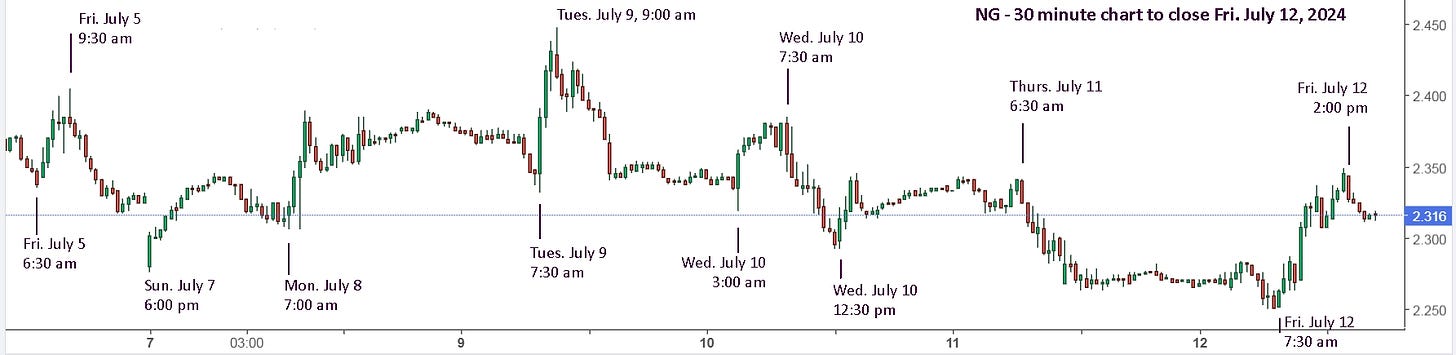

Update to Fri. July 5: It was a smackdown week for NG! Hitting a low of 2.47 on Monday, 2.41 on Tuesday-Wednesday, then smashed down to 2.33 on the July 4 holiday. It moved up later in the day and was up to open Friday, so I thought it would hold and Thursday was simply traders slamming the price down to pick up cheap long positions. NG hit 2.40, then reversed down hard at 9:40, finally hitting a low of 2.317 at 2:30. Simply incredible.

Now what? Was that the bottom? Was BOIL a buy at 12.80 from a low of 12.70? I have no idea, but I’m against buying late in the day and would rather miss a gap up on Monday, than be holding for a gap down. Greg bought another 10K BOIL at 13.15, saying “this is very over sold in my opinion, but if production keeps climbing it's tough to say how low it can go!” He’s now holding 85k shares at a breakeven price of 17.50, so nearly $1.5M and down $408K (-27.4%) at Friday’s low of 12.70.

I did some digging and came across this chart that seems important to me. The top grey line is 2016 and it continued back to even with the 5 year average by the end of the year. The 411 and 448 on the far right top is the end of 2015.

A look back at NG prices in 2016 might prove valuable.

The March and April lows this year were 1.48, so lower than in 2016, but in line. It then pushed up to 3.00 on Friday, July 1, 2016, held a range with a low of 2.52 the week of August 8.

The above daily chart is a continuous futures chart, and the large gaps are contract rolls. The conclusion I end up with is that the push up to 3.22 on June 11 was ridiculous, and was a great time to buy KOLD and stay with it for a push under 2.80. Buying BOIL on June 12 at support was simply wrong, based on the fundamentals and history. The drop in NG this past week was indeed way overdone.

Last Friday, the September contract was at a double bottom of 2.60, along with May 31. This past Monday could have easily gapped higher like it did on Monday, June 3, then pushed higher. That would have been completely reasonable, especially with the high temperatures across the U.S. Instead, NG was smacked down to prices in March-April. NGX24 (November) is now 2.90 and NGF25 (January) is 3.66. That will present a roll loss for BOIL in early August, but it shows where prices will eventually go. The key now is to stay in the battle, like in March-April.

In past situations like this, I have suggested to Greg the idea of doubling down, with a stop sell. He’s completely against it, but it actually makes sense.

He bought BOIL at 22.50 pre-open on June 12, so could have sold for breakeven when it reversed from a high of 23.37. Yes, it could have reversed again and gone higher, but it was already excessively high. Now, with the price down to 12.80, it’s excessively low. His current breakeven price is 17.50, and he will undoubtedly get that, but if he doubles down at 12.80, for example, his breakeven price drops to 15.15, 13% lower. It is definitely not advisable to have bought Friday, but that wasn’t advisable holding 0 shares either. The key is to wait for the eventual bottom, buy early in the day with a stop and then stay with the new uptrend.

For everyone on the sidelines, waiting for 14+ to buy is very reasonable. Even 15+ or 16+ are okay, waiting for the uptrend to be solidly confirmed. I will watch for the early price and a move up or down from that. Best of luck!

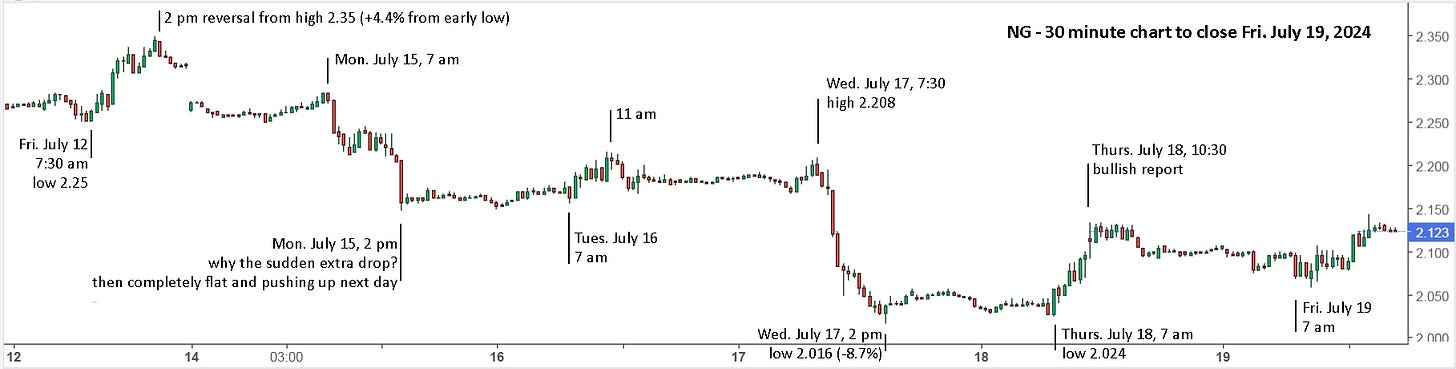

Update to Fri. July 12: It was another smackdown week for NG, hitting a low of 2.25 on Friday around 7:20 in the morning, down from a hard floor of 2.26 on Thursday and overnight. The report on Thursday was bearish and a surprise to me with an injection of 65 Bcf versus 57 last year and the 5 year average. The excess storage managed a slight drop from 18.8% to 18.7%, but that’s a really bad sign, in comparison to a weekly drop of 1-2% since March, and dropping from +41.1% in 14 weeks. Unless it gets back to that trend, then NG is doomed to low prices.

This link shows some useful information. “Impacts from tropical cyclone Beryl continue to weigh due to Freeport LNG remaining offline and still showing flows near 0 Bcf. In addition, more than 1 million Texas customers are still without power. Natural gas prices closed lower for a 3rd straight session Thursday, and down 14 of the past 16 as surpluses just aren’t decreasing as fast as the natural gas markets were expecting in early Spring.” But that impact only started this week, dropping from 1.85 Bcf/day to 0, so next week’s NG report could be much worse than this past week.

NG gapped lower and rallied higher in the first 5 minutes after the report at 10:30 on Thursday. One needs to be open to buy either BOIL or KOLD at that point. The games will be played and eventually a direction will be taken. In this case, NG dropped and KOLD was a good trade. NG could have been crushed lower on Friday, but it wasn’t. No need to ask why, just sell KOLD and buy BOIL.

The 5 minute BOIL chart above shows just how ‘silly’ NG trading can be. The rally up on Wednesday was just a head fake, catching some eager bulls waiting to buy. Less than 2 hours later, they were shot and taken to the butcher. After the report on Thursday, it gaps lower and shoots higher. The gap lower is completely manufactured, since it happens in seconds. Traders can then take a quick look at the report, it’s bearish, yet NG pushes up hard. Why? It doesn’t matter. Just jump in if you want to catch a possible wave. It fell the next 5 minutes and was back up the next 5. Best to continue watching and waiting. Alternatively, since the report was bearish and the trend is down, buy KOLD at the low with a tight stop and put in a stop buy for BOIL around 12.42, just above the early morning high. Within minutes, your KOLD is up and NG starts a steady fall. Perfect.

Pre-open on Friday, NG is pushed lower, then up it goes. Again, don’t ask why, just sell KOLD and buy BOIL. It’s always wise to watch for a move at 2 p.m. on Friday, so best to sell for a gain of 6.7% if you bought the open at 11.90, or more than 8% if you bought early around 11.70. The safest spot for the weekend is on the sidelines.

Here’s a look at the nonsense moves in NG outside of normal trading hours.

The down up down on Friday, July 5 is not a natural phenomenon. The gap lower Sunday isn’t either. Big traders are making this happen, and there’s no point complaining and saying it isn’t fair, etc. Just accept the reality and decide if you want to play or not. If you want to water ski or paddle board, go to a nearby lake that’s nice and flat. If you want to surf waves, NG has some of the biggest ‘waves’ in the market.

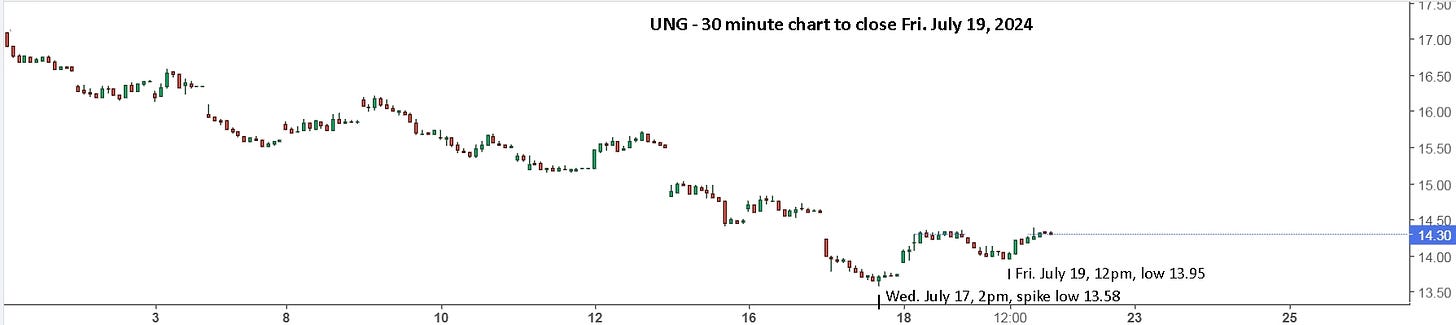

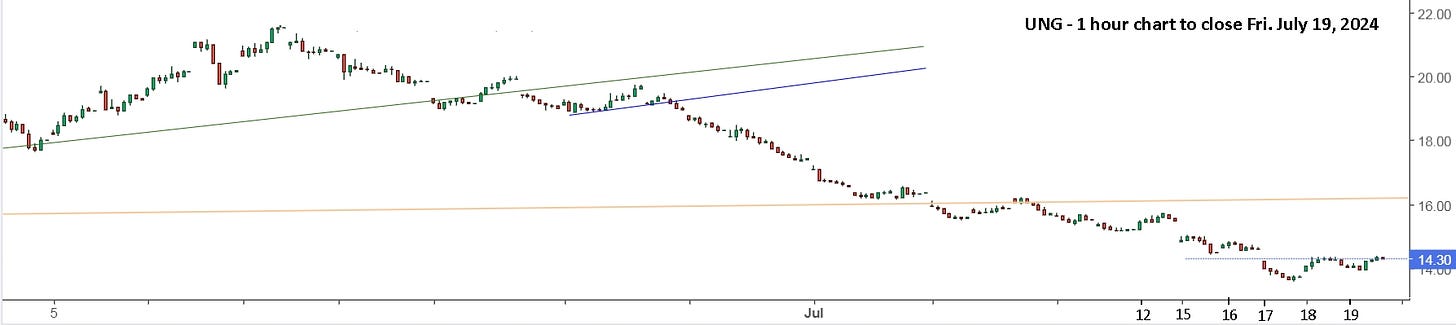

Update to Fri. July 19: It was yet another smackdown week for NG, hitting a low of 2.05 on a 15 minute spike lower on Wednesday at 2pm. It promptly reversed the next 15 minutes. Predictions for the report on Thursday were bullish, in contrast to last week’s surprisingly bearish report. Before the market open, NG was pushed down again, then moved up, so I gambled and bought BOIL at 9.90 average. That worked out well as it pushed higher. After the bullish report, which made last week’s report all the more suspect, it plateaued around 10.70 and I finally decided to take the 8% win.

Two weeks ago, I wrote, “The key is to wait for the eventual bottom, buy early in the day with a stop and then stay with the new uptrend.” I’d like to now clarify some thoughts on how to safely wait for the bottom and not buy and hold early. Friday, July 12 was a possible bottom and reversal, one of many since the overall high on June 11. Holding over the weekend was costly. Holding this weekend could also be costly and it’s simply not worth the risk. Yes, NG is way oversold and ridiculously low in price, but that’s been true for over 3 weeks as it fell ever lower.

I’ve long said it’s better to buy as it moves up versus buying as it drops, but I’ve never formed a clear strategy for doing that, and it’s very difficult to control one’s natural urge to catch the bottom. My new strategy says to focus on being late, intentionally. I wrote about it in my recent update for TQQQ. The key reference points are the prior day’s low and the early high. Looking at UNG, Thursday was a possible buy, which I took with BOIL. It was a good gain of 8% but I then bought it back later 2.8% cheaper which was a mistake. It’s just not worth the risk.

Buying the low on Friday was okay, as it was higher than Thursday’s early low, but it still requires a lot of watching and trading, and worrying! I don’t want to be doing that. The better play is to wait for Monday, and wait for the bottom to be clearly in. You are now trying to be intentionally late and not buying off the bottom.

You can see above how catching the ‘bottoms’ in June worked out, and they were at possible support lines, and the fundamentals were ‘bullish’. Greg bought more BOIL this past week, 20k shares at 10.93 on Tuesday and 20k at 9.98 on Thursday. His breakeven price is now 15.25 and he’s down $658k and 34.5% at his last buy price, which is 55.6% below his first buy price. That should completely turn everyone off the idea of adding to a position as the price falls.

BOIL could easily open 3-8% higher at 11.00 or 11.50, which is 16% higher than a ‘good’ buy at 9.90 pre-open on Thursday. Even if you buy at 11.50, you’ll be up 32% when Greg is back to breakeven. NGU (Sep.) is way, way down to 2.165, well below the floor of 2.40 in March - April when excess storage was +41.1% to the 5 year average. In the last report, it dropped from +18.7% to +16.9%. Production is down and Freeport will be coming back online, so there is absolutely no justification for the current price.

Here’s another look at the nonsense moves in NG outside of normal trading hours, and a look at this past week.

The week to Friday, July 12, albeit ridiculous, held a horizontal range until the Thursday drop after a surprisingly bearish report. You tell me if it was BS or not. The injections starting the end of May were 98, 81, 71, 57, 32, dropping each week, likely due to hot weather and increased power burn for AC, and these numbers were all well under last year and the 5 year average. Suddenly, on July 11, the report says an injection of 65 compared to 57 last year and the 5 year average. I didn’t believe it to be accurate and expected an adjustment this past week. The injection for the following week was a ‘surprise’ 10 compared to 49 last year and 43 for the 5 year average. Obviously, the last 2 reports need a little adjustment to around 40, 35.

The smack down on Wednesday, July 17 at 7:30, after rising from a 5:30 reversal, was quite incredible to watch. It was simply relentless! There is nothing in the natural world that can justify an 8.7% drop in a few hours. For me, it was a move by big traders to push the price lower in order to buy ahead of the report on Thursday, which they knew would be bullish. Regardless of why, it was better to wait till Thursday, and when the price started moving up at 7am, buy! Watch for a reversal, but this is a setup you want to catch.

It’s a virtual certainty that NG will get back to $3 and higher, but it could also get smacked down to 1.90 and lower first. Next week could be the turn, so be ready to buy, and be happy that you didn’t catch the bottom.

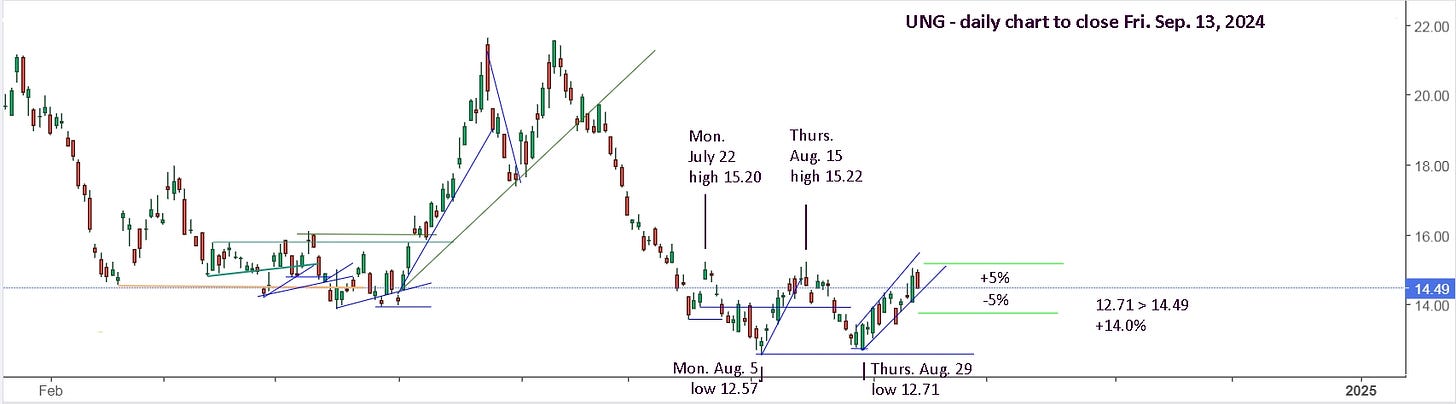

Update to Fri. Sep. 13: Since my last update, July 19, NG has continued to be a difficult trade. It started off well, gapping higher on Monday, July 22, and could have made a big run higher, like in May, but fell to a new low instead. By mid-August, it was set up for another potential run, and that failed as well. Will it now fail for a 3rd time? I have no idea, but I’m increasingly hopeful.

I’ve added horizontal reference lines now for 5% above and below Friday’s close. A 5% drop would break the support trendline, but may be a good buy price. I’m selling rallies, but watching for more of a blast higher like in August.

Update to Fri. Sep. 27: NG finally pushed higher as excess storage has continued to drop. The price drops continued, but those were opportunities to re-buy a full position. Thursday, Sep. 19 was a buy and hold as it moved up on the day. Selling this past week as it held a firm ceiling made sense. The drop on Thursday, Sep. 26 made no sense, so re-buying everything you sold made a lot of sense.

Here’s a look at BOIL. You can see clearly that UNG is a much better buy and hold, but if you’re trading and can get the timing right, BOIL can give great returns.

Selling some on Friday was a good idea and perhaps selling all will turn out to be the best decision, but there’s still room to the upside, so I’m still holding the bulk of my position.

Excess storage is down to just 7.1% above the 5-year average and 4.8% above last year. This year may repeat last year when it held around the 5-year average, which will take away the price momentum, or it may drop below the 5-year average and shoot the price higher. Be ready for either outcome.

BOIL is still on the November contract at 2.90, but will soon roll over to the January contract which is currently at 3.55. That’s a big difference, so I will look for a chance to sell out soon.

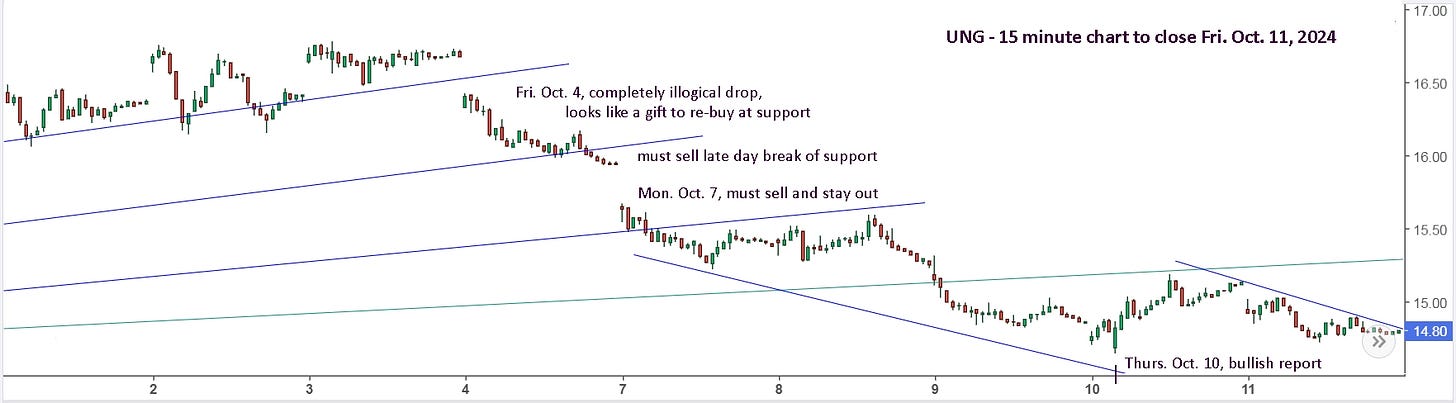

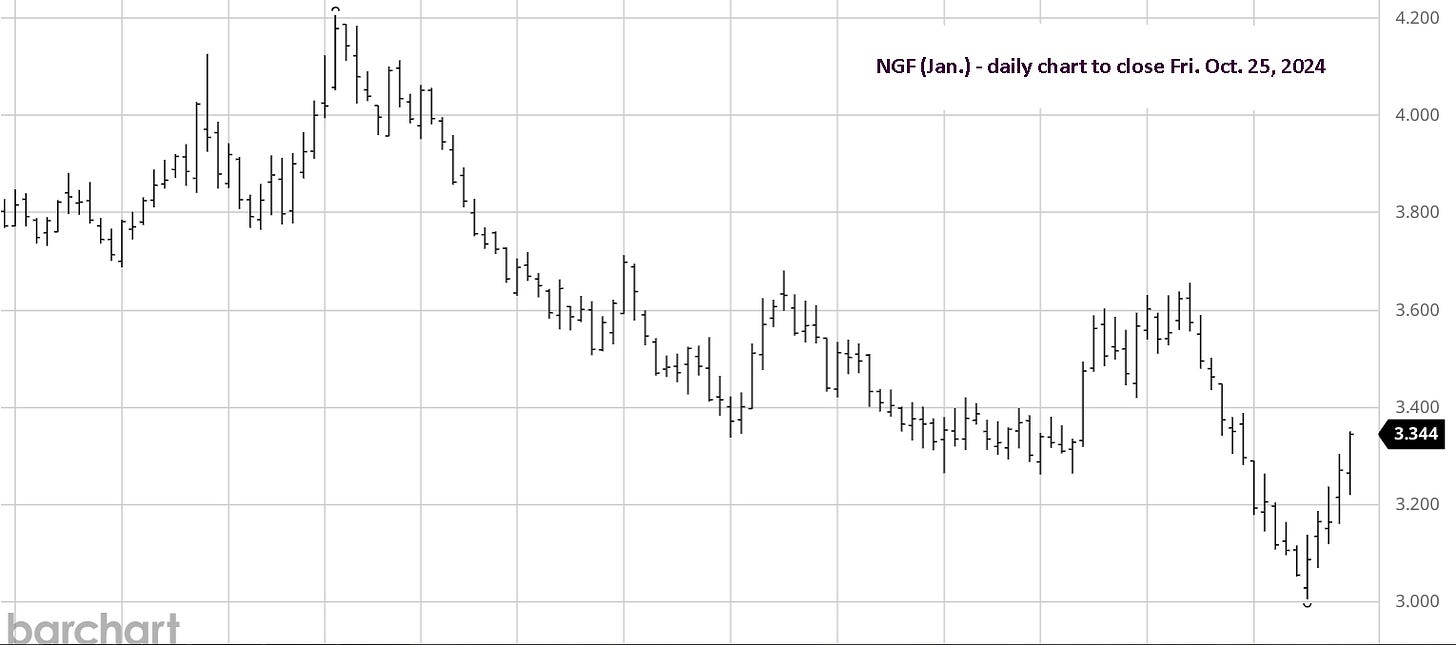

Update to Fri. Oct. 25: NG pushed a bit higher, the first week of October and I sold down to 25% of my original position, while trading for extra gains on the week as it moved up and down over a significant range. Thursday, Oct. 4 was a bullish report and NG pushed higher, then dropped and pushed back up to mid-range. A typical move in contrast to the report. Friday opened lower and all week that was a chance to re-buy and sell higher, so I bought. Then it fell, and I didn’t sell. I continued to fall and it simply seemed like a chance to re-buy shares I had sold. TOTALLY wrong!

Yes, the drop on Thursday, Sep. 26 was ridiculous, and it gapped higher the next day. Re-buying the low was a ‘gift’, and the low prices on Friday, Oct. 4, also seemed like a gift. With NG, it’s practically impossible to know what’s a gift and what’s a trap.

It opened lower on Monday, Oct. 7, broke the final short term support line, hit a low of 15.22 after 1:15 and promptly reversed, then held flat. On Tuesday, it was smacked down at 10:00 for 15 minutes, then pushed up steadily till 1:15 and shot higher for 15 minutes. Perhaps this is a gift, one might think. That is classic movement for unnatural price suppression that eventually gives way. Thirty minutes late, that burst was erased and it continued lower to close, back to Monday’s afternoon low. Perhaps a double bottom. It gapped lower on Wednesday, Oct. 8, rallied and fell, and you must sell again and wait to re-buy. It’s extremely difficult to sell when the price drop makes no sense and you ‘know’ it will go back up, but you simply have to sell.

Thursday, Oct. 10, you’re then ready and waiting to buy cheaper than you sold. It gaps down after a bullish report and move up. Perfect! You buy and hold. Friday gaps lower to open and remains weak all day, leaving a difficult decision to sell or hold over the weekend.

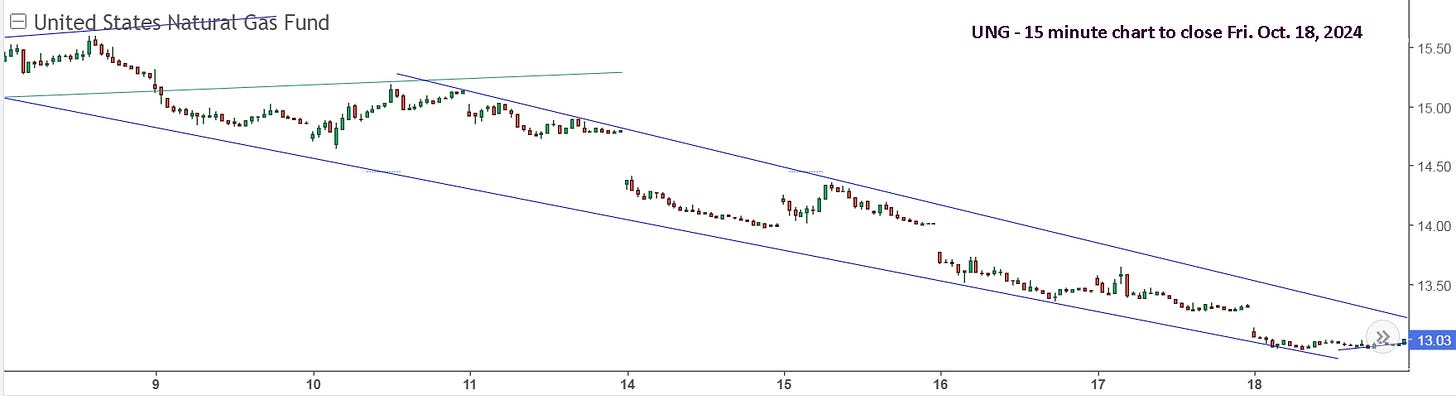

The gap lower on Monday is as ridiculously large as it was a week earlier, and it falls on the day, so you again MUST sell. I suspect it feels like a boxer, stuck on the ropes, taking a relentless beating. You have to get off the ropes. Naturally, Tuesday, Oct. 15 gap higher, making you question your decision to sell, but it’s lower than Monday’s high, where you should have sold, so wait for a move up. That comes after 10:00, so buy. It hits the new downtrend resistance line at 11:30 and starts to fall, so you have to sell.

It’s really important to forget all logic and reasoning and NG fundamentals justifying a higher price. The price is dropping. Simple. Don’t fight it. Eventually, it will indeed be a gift. After two large gaps lower over the weekend, it would be reckless to buy and hold on Friday, Oct. 18, even if you’re certain the bottom is in. The August lows were 12.57 and 12.71, so there’s room to fall from Friday’s low of 12.95. On the other hand, that could be a second higher low. Regardless, the primary objective is to remain safe and not lose money, even if you think it will only be short term. The drop in June made no sense either and UNG may never get back to that price.

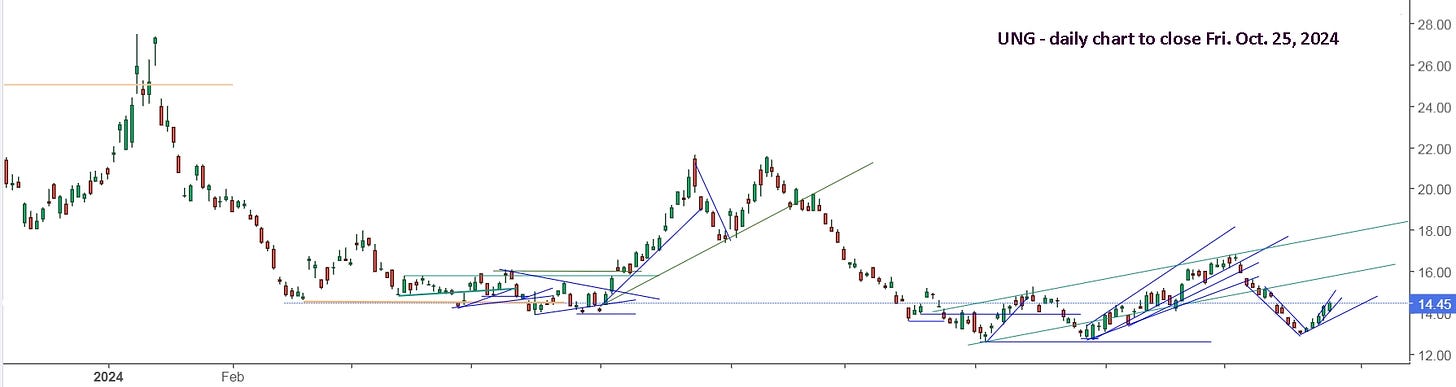

With a gap higher on Monday, Oct. 21, it was time to buy with a stop sell. When it broke the downtrend resistance line, optimism was warranted. When it held a possible new uptrend support line, then it was time to buy more at 1:30 when it pushed up. Tuesday, Oct. 22 was a buy early and hold. When the support line was tested on Wednesday, Oct. 23, it was time to buy back any shares sold, or buy more for a larger position.

A 30 minute view shows that the drop seemed slow and steady, but it was in fact steep and nasty. UNG is +10.3% from buying Monday, Oct. 21 and has a long way yet to go to get back to where it was on Friday, Oct. 4.

The daily chart shows clearly that shares MUST be sold when support is broken. New support lines are now in place, so respect them.

A look at the January contract shows that the drop below 3.40 makes absolutely no sense. Excess storage was down to just 5.1% and dropping every week. I was correct thinking the 3.60 price was too high, and 3.00 isn’t excessively low, but 2.71 for December is too low and 2.21 for November is simply ridiculous. Not as bad as -$40/bbl of oil, but still ridiculous.

I’m holding a large position in BOIL, but will sell on any break of support. Good luck!

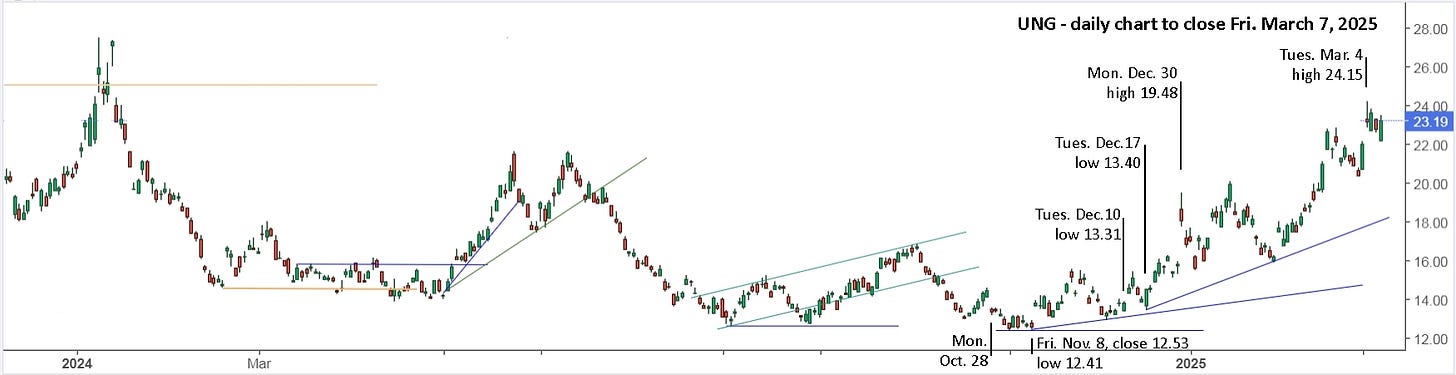

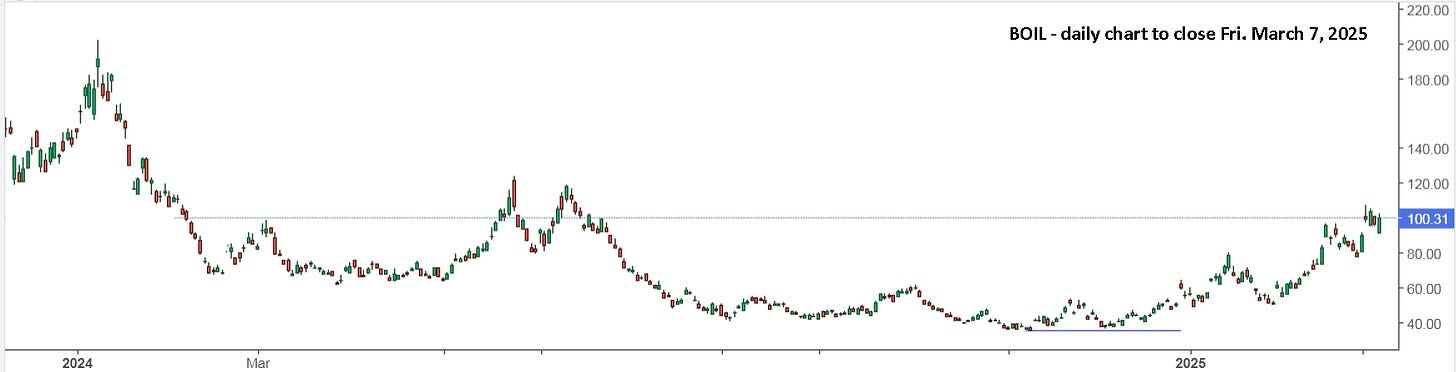

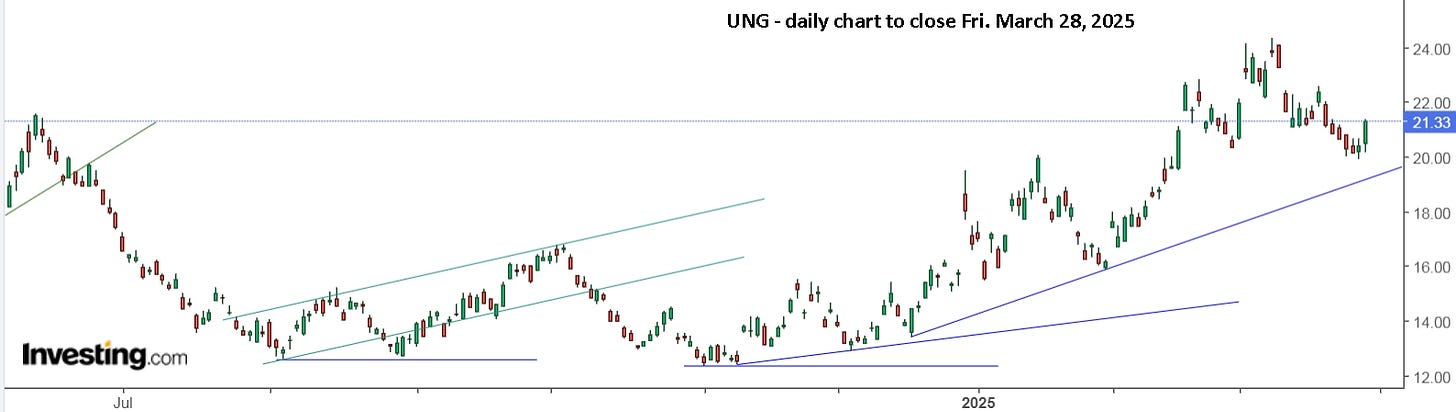

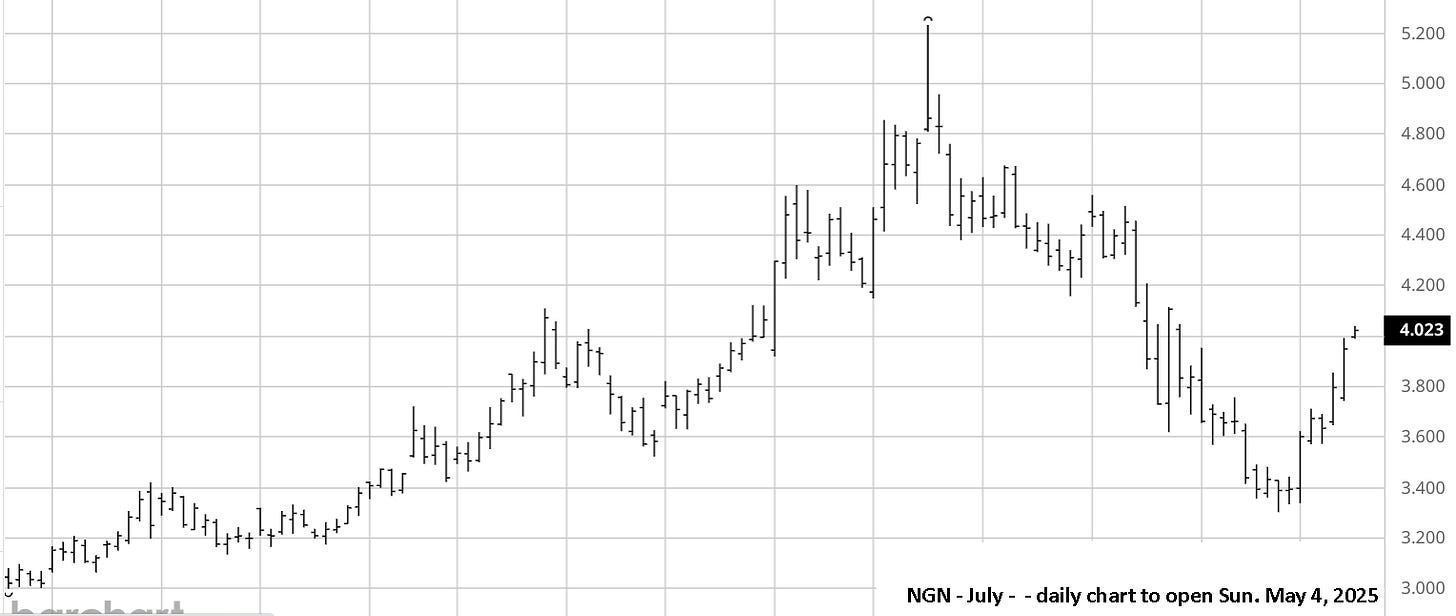

Update to Fri. March 7, 2025: Since my last update, NG has been a confusing and difficult trade, and it remains so at the moment. Here’s a look at UNG.

As you can see on the chart UNG and BOIL gapped way down Monday, Oct. 28 and I was holding a large BOIL position. The drop made no sense. Excess storage continued to drop and winter was coming. Greg was predicting NG could fall to $2, which I felt was ridiculous, but possible with another warm winter. Over the next 2 weeks, I continued the battle. The NG report on Thursday, Nov. 7 was distinctly bearish with a big add of 70 compared to 32 last year and 19 for the 5 year average. Excess storage also increased, breaking the long string off weekly reductions. It made absolutely no sense to risk holding BOIL again over the weekend with the price lower on Friday, November 8.

And thus is the wicked nature of NG, the Widow Maker. NG, UNG and BOIL gapped way up on Monday leaving me totally deflated. There is simply no way to trade that effectively and with a large position. Of course, if I then picked myself off the mat and got back in the fight, I would have more than doubled my money. Unfortunately, I didn’t. I simply didn’t have any fight left in me and chose to focus elsewhere.

Instead of a warm winter, it was the coldest January in much of the continent, especially the U.S., in at least a decade, bringing temperatures as much as 20–35 °F (11.1–19.4 °C) below average to a majority of the country. Yet, the price of NG fell back quickly from brief spikes higher. Arguably, because it was still over priced. And then it took off higher again in February, and even higher in March, with absolutely no justification.

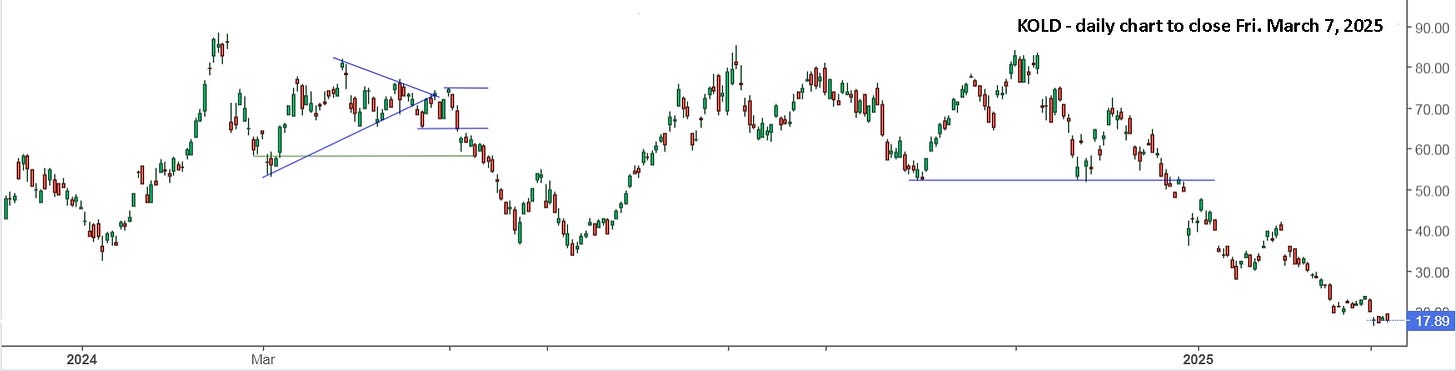

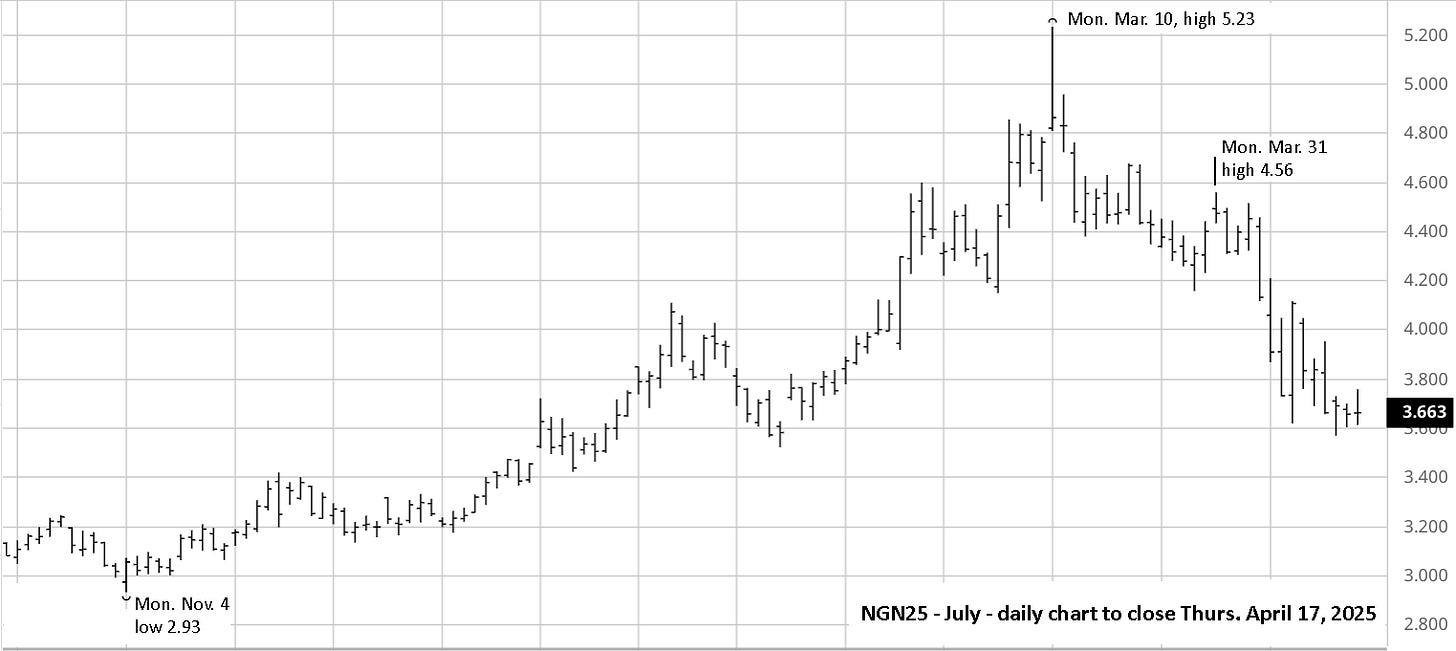

In December - January, Greg now felt NG could climb to $5. For me, that was as ridiculous as his $2 prediction. I mean, there’s no way that the swing in weather justifies a 2x price difference. But, such is the NG market. If you want to play the game, you have to accept that reality. Such large swings present large opportunities if you can get it right. Thus, I’ve now got some fight back in my to trade KOLD for the eventual and inevitable drop in price. Greg is also in KOLD now, and was typically early and now underwater.

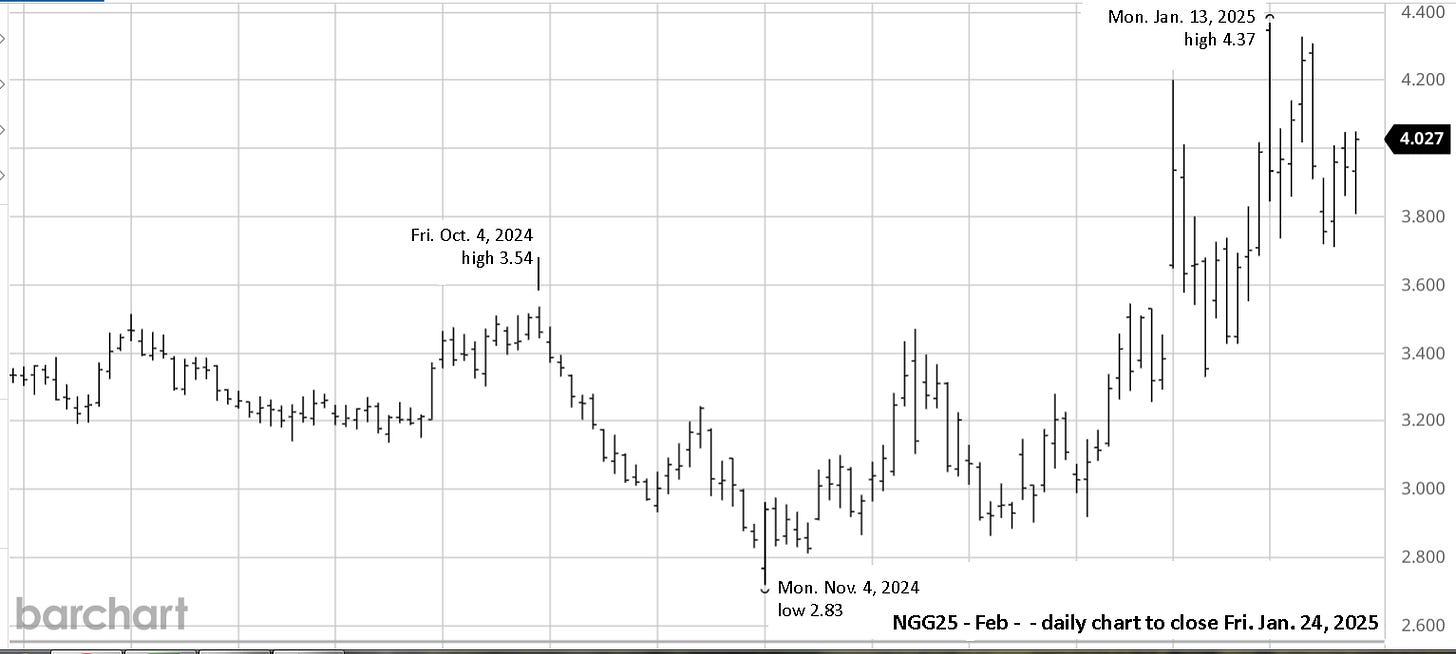

Here’s a look at the January contract that climbed over 50% in price in 2 months.

Here’s the February contract.

February 2026 is even more ridiculous.

That’s a year away! And the current weather has practically no legitimate impact, yet the price sky rockets up. I consider that pure manipulation, pushing the price at will.

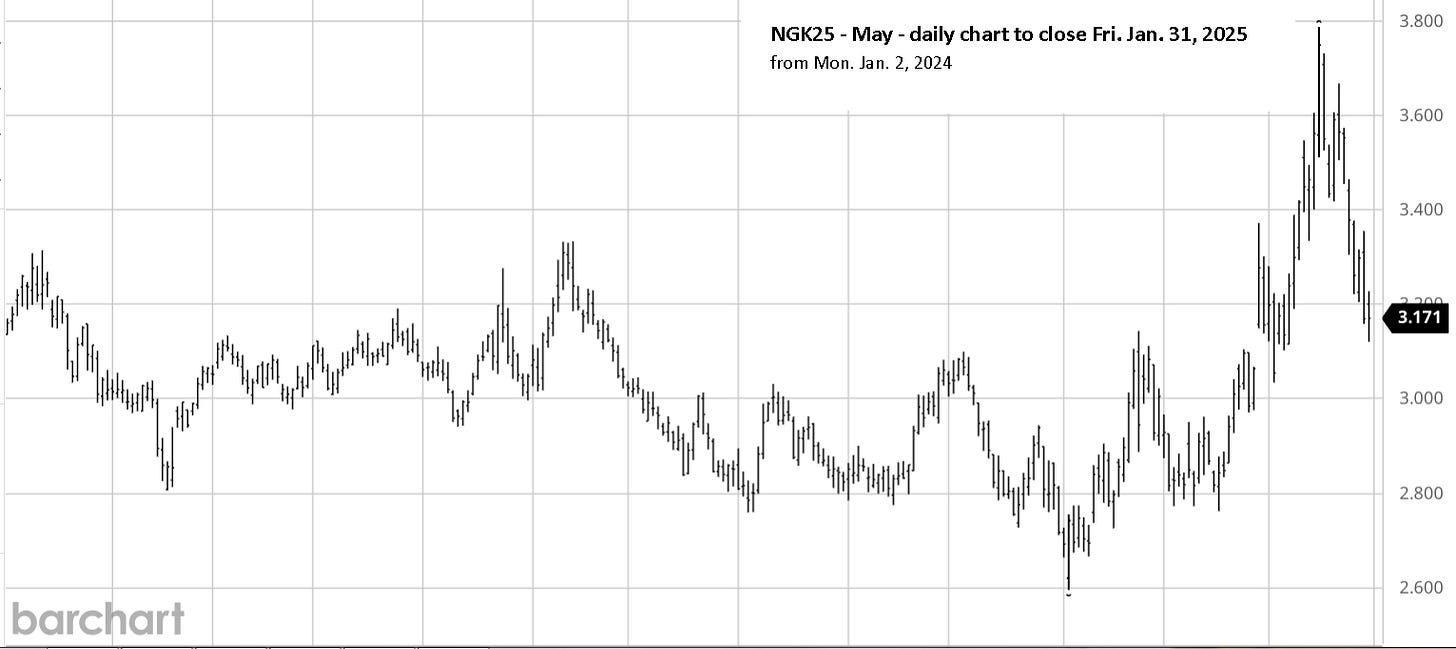

BOIL rolls contracts every 2 months, from January, to March, to May. Here’s a look at May, in January after the cold snap.

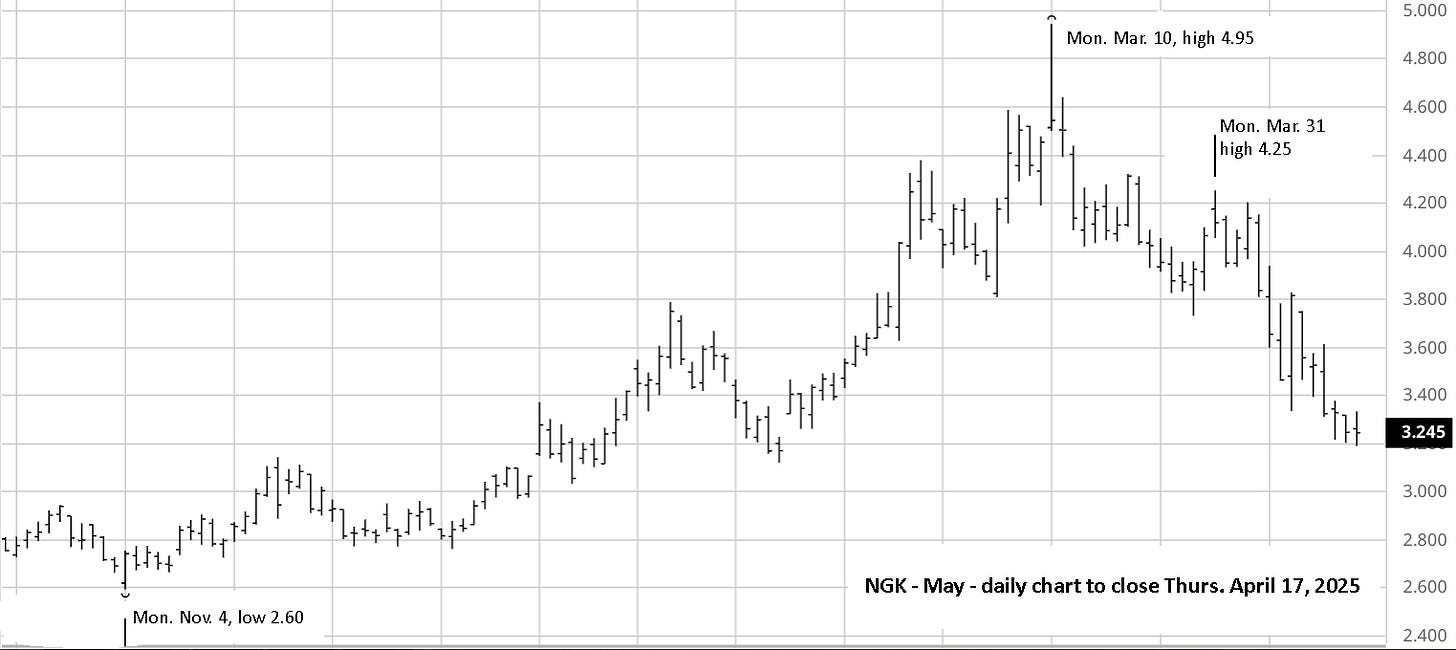

Here’s a look at it now.

All I can say is ridiculous! The spike and gap up in January to almost 3.40 was ‘ridiculous’ and was triggered on news of Ukraine not allowing NG from Russia to flow through Ukraine, along with a colder weather forecast. That immediately faded, then it rallied again, even higher, I suppose on actual cold weather. Then it fell back down quickly to 3.20 and a bit lower on Friday, January 31. Had sanity returned?

No!! The priced gapped up sharply on Monday, Feb. 3 and has been on steroids ever since. It reminds of when it roared up to $10 after Russian invasion of Ukraine. It went higher than I imagined and stayed high longer than I thought possible, but it eventually fell, and KOLD provided some huge gains. Here’s a current look at BOIL and KOLD.

BOIL more than doubled in 4 months. KOLD will eventually double as well. From November 23, 2022 to February 21, 2023, less than 4 months, KOLD went up 8x.

I’ve always preferred KOLD to BOIL, so I plan to stay with this fight for as long as it takes.

Update to Fri. March 28, 2025: The insanity continues, as does the fight. I thought the bulls were on the ropes this past week, but they somehow managed to push NG prices higher again on Friday, after a really bearish report on Thursday.

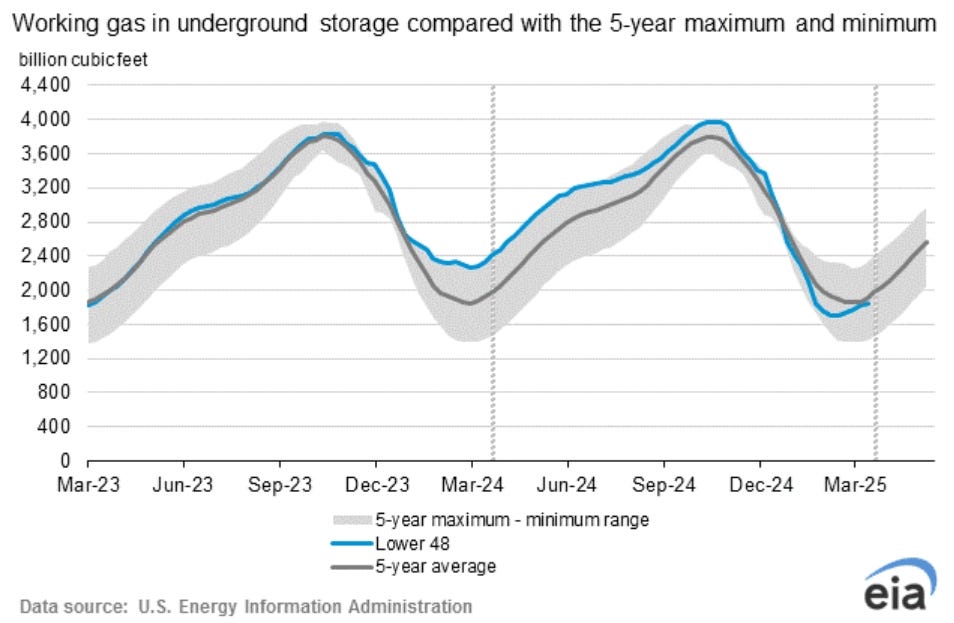

I find it very interesting how the blue line made a 1 week move to the right in January, then returned to the 5 year average. With the extreme warm weather in 2024, the blue line hugged the 5 year maximum till August. This year, it dropped sharply lower and turned sharply back the past 2 weeks.

NG spiked madly higher on Monday, March 10, but buying KOLD then was still very difficult and risky, since it could still go to $10. One could have bought March 11 or 12, but it was still risky, then it gapped way up it would have been difficult to stay with it.

I’m committed to the fight and am riding out the daily moves. I sold a bit this past week, but only a little since it should go much higher. Selling to avoid the drop on Friday is practically impossible, so I didn’t, and I bought more. It might gap lower on Monday, but I will simply buy more again.

The move in UNG is simply amazing with very little justification, but that’s the nature of the beast, and that’s what creates the opportunity. One simply needs to learn how to best play the game.

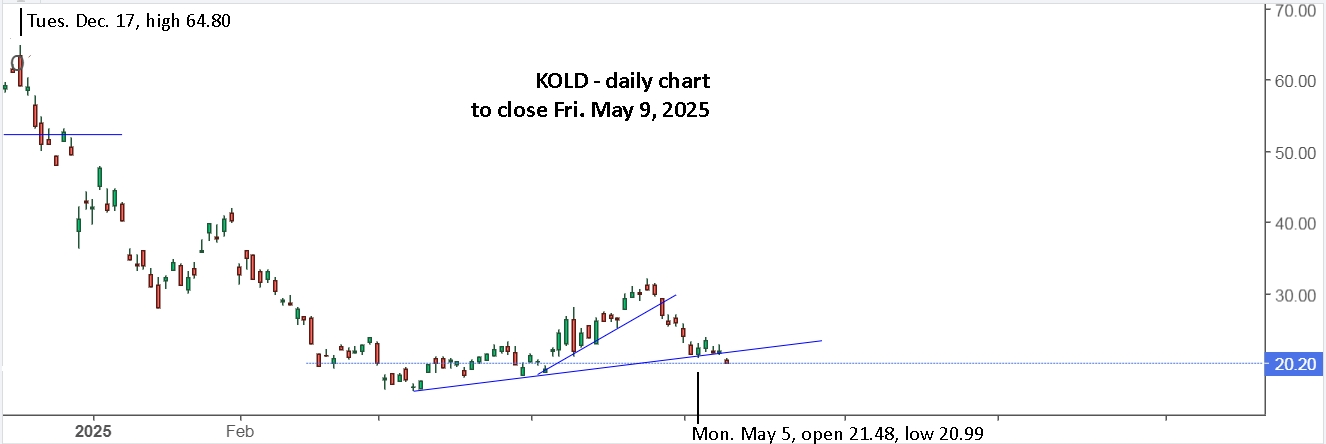

The KOLD daily chart looks horrendous at the moment, but it could look a lot different in 6 months time.

Good luck if you’re brave enough or crazy enough to take a bite of this apple.

Update to Thurs. April 17 : NG continues to defy gravity, but it’s no longer in the stratosphere near 4.00. Storage is essentially back to the 5 year average, production is still high, so I see nothing to hold NG prices above 3. The KOLD has now rolled to the July contract with an even higher price than May, so there should be plenty of upside left for the short trade.

It still surprises me that NG prices can be pushed over such a wide range, when there’s never any realistic chance of a shortage or excess. It’s complete madness really, and most contracts are longer term and are unaffected by the mad swings. It does however, create a tremendous trade opportunity, if you can get it right.

KOLD is up 63.2% from its Monday, March 12 low of 16.20, and up over 30% from a safe and easy buy at 20.00. Since the target remains for NG to drop to 3 or lower, there should be plenty of upside left. I won’t be surprised if it goes over 40 or 50.

Last Monday was a gift, opening lower for an easy buy and a sell on Tuesday for +19.3%. This Monday might provide a similar opportunity. If it drops, then a stop sell is advised, but watch closely for a reversal, since there’s nothing to support NG at the current price levels.

For my fellow Canadians, HND often trades even better than KOLD.

Update to Fri. May 2 : What a week! After getting down to reasonable price levels, NG blasted off into the stratosphere again near 4.00.

There is no way to justify this move. It’s completely irrational and a week ago I even would have said it’s impossible. It could have easily been a very profitable week if you simply followed the strategy and sold KOLD early Monday and bought BOIL.

After selling at 32 and expecting it go higher after a possible pullback, you’re thinking re-buy, which is a mistake, a huge mistake. Don’t think about what it should do, simply accept what it is doing and take quick action. After the first hour on Monday, it was a slow bleed and you’re waiting for reality to kick in, but it doesn’t kick in all week. Now, there’s nothing left to do buy battle back this coming week. Production remains high and storage is now slightly over the 5 year average, so NG should be around $3. That’s a big drop from $4, so get ready for the ride.

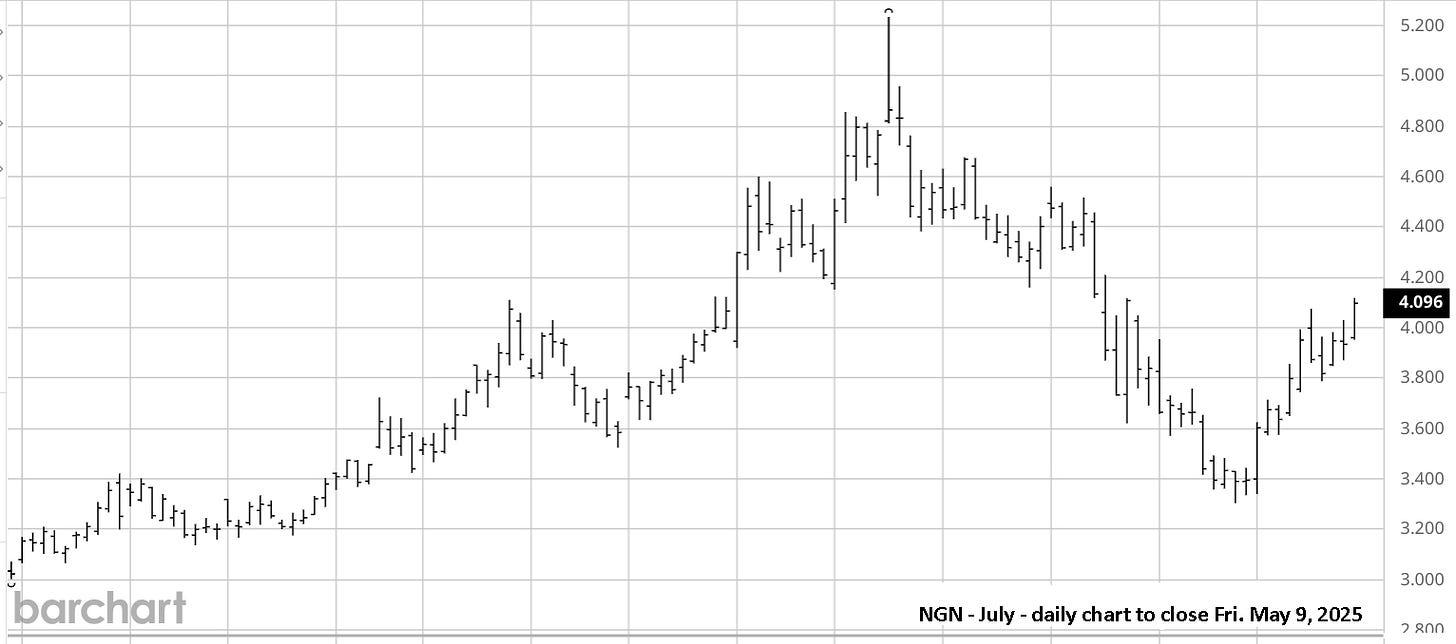

Update to Fri. May 9 : NG started the week off as I hoped opening higher and then falling. The fall continued on Tuesday and made a surprising reversal on Wednesday. The report on Thursday was again bearish with a triple digit injection pushing storage above the 5 year average. It didn’t push the price down much on the day and NG went way up on Friday. I can’t make any sense of it.

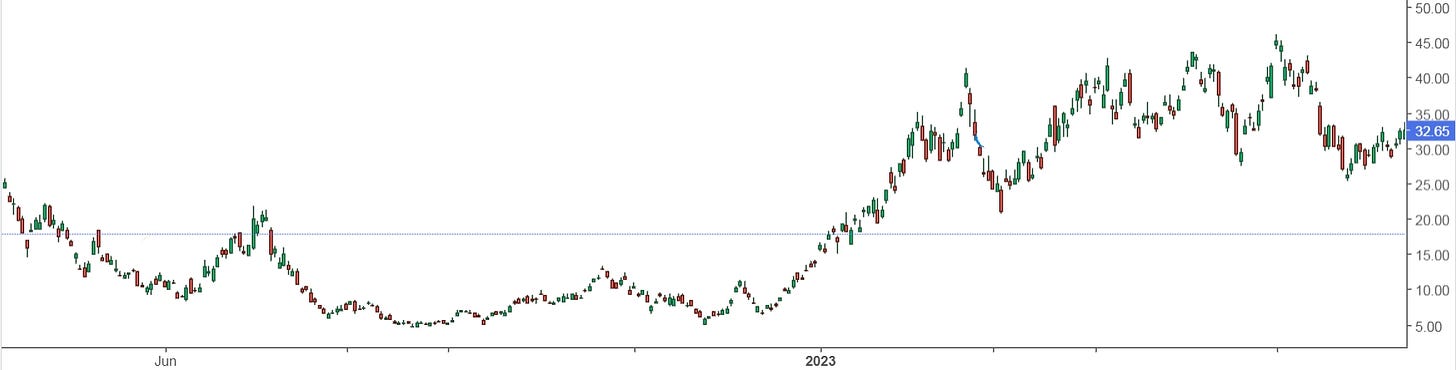

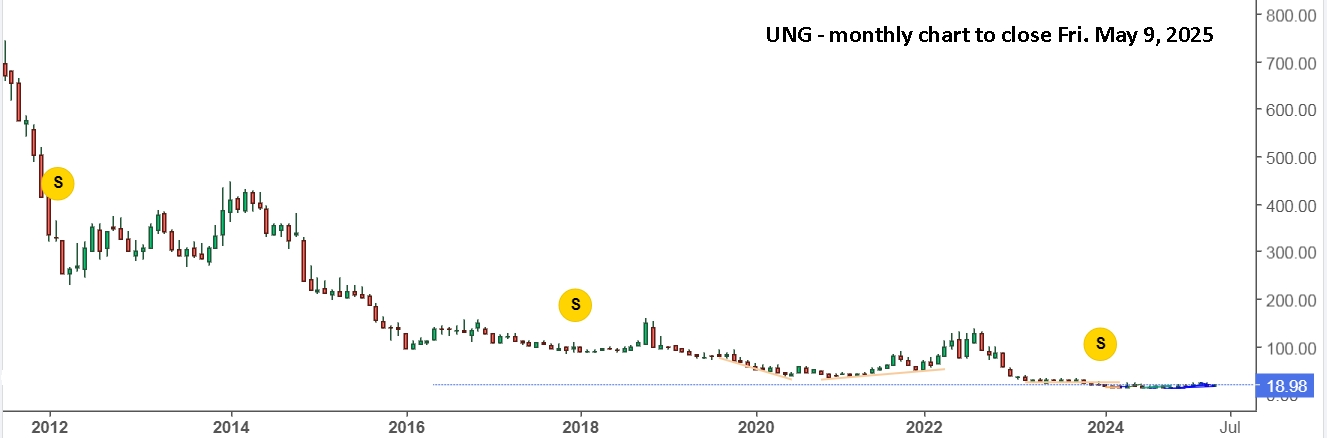

If UNG was a stock or market ETF, then the chart is clearly bullish and one could expect it to continue higher having broken the downtrend. It may indeed continue higher, but longer term it always goes lower, and significantly lower, because of contract roll. As an unleveraged ETF, you wouldn’t expect huge decay, but because future NG prices are usually higher, it is constantly paying more to roll into new future contracts. Here’s a monthly view.

Granted, UNG does hold up okay for extended periods of time, but over time, it’s a serious drop. Over this same period, BOIL drops from 3.2M to 69.56 on Friday. Since KOLD is a 3x leveraged ETF, like BOIL, one would expected serious decay with it as well. But, because it is constantly getting a discount when rolling to higher priced NG future contracts, the monthly chart is surprisingly different.

That’s remarkable, is it not? Regardless, one shouldn’t hold for long periods of time since decay is occurring, but there’s at least hope to get out of a hole if you happen to have bought too early.

The daily NG chart looks much the same as last week. You can see that Monday (Sunday night) opened higher, then it fell, as I expected. Tuesday was lower, Wednesday gapped higher which I expected it might so had sold some KOLD shares as a trade, but then NG pushed higher. Friday’s move to 4.09 is completely baffling.

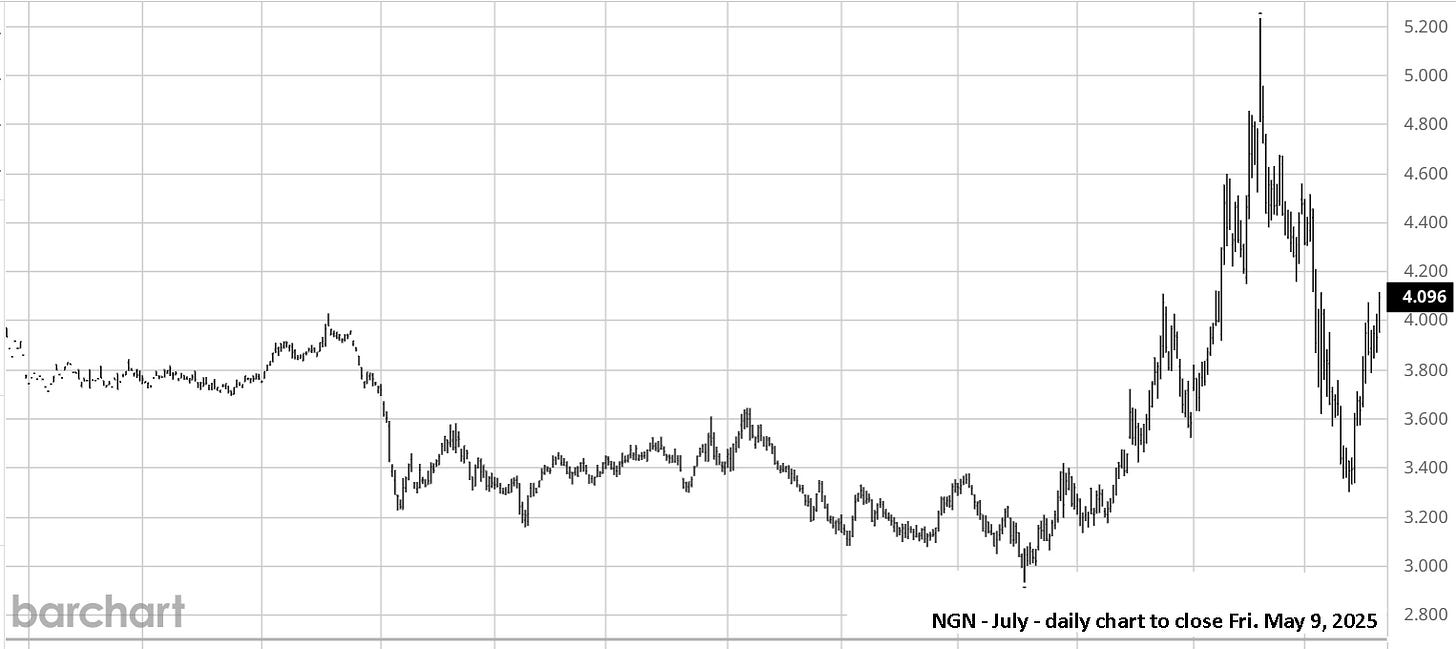

Here’s a 2 year look at this same contract, so there are no roll issues.

That looks like a head and shoulders chart forming and since storage is slightly above average the 5yr average, NG should logically be priced slightly below the 5yr average. As a futures contract, one could say that 3.40 is an average price, meaning it should drop to that, at least, but futures contracts are generally higher than the next month contract which closed at 3.795 on Friday, up from 2.86 just 2 weeks ago. Given the current storage volumes, 2.86 is a reasonable number. With high injections forecasted for the coming weeks. It’s hard to imagine the current prices holding.

It’s also useful to note that the left shoulder in the chart is January, 2025. Winter storms can easily pump up NG prices. It’s now May. As I wrote earlier, I can’t make any sense of the current pricing.

It’s hopefully abundantly clear that it’s best to combine charts, fundamentals and patience, LOTS of patience, when trading NG. I’m still hopeful that KOLD will make a double or triple over the next few months.

Good luck!

I told a friend over the weekend to look at buying HNU or BOIL. I hope he did as Monday gave a chance to buy at Friday's best price, and even slightly better. They rallied, fell back, then held flat all day. After hours, NG blasted higher and they were up 25% before the open. I sold out, expecting a dip, bought the dip and they're back up to the pre-open level for an extra 6%. With NG March only up to 1.78, it could easily continue higher, so I will hang on to BOIL but continue to watch for trade opportunities.

Did you hold a BOIL position over the weekend? I held a half position at 14.31. I will have to sell if it gaps down, but I simply bought the break of the downtrend. That is the risk. However, it could just be a retest of the breakout. The downtrend could act as support around 13.00. My stop sell is at 13.90 which was the breakout at the open on Friday.