UVXY - Fear is still the best trade

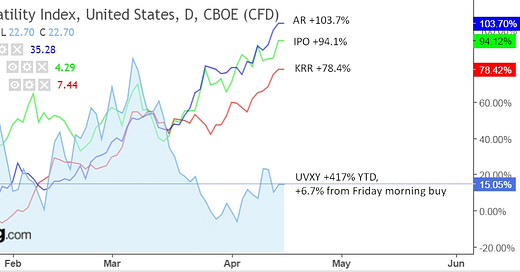

+417% YTD following a very simple strategy that Darryl Sutter would love.

If you watch hockey, you have to love how Darryl Sutter has turned around the Calgary Flames with a simple game strategy that works. Sure, the Oilers have McDavid and Draisaitl, who can put a lot of points on the board, but the +/- stats for Calgary’s top line is simply incredible: +55, +52, +48 (1st, 2nd and 4th overall in the league). That’s what you want with your investments: consistent winners with low risk of ‘goals against’.

Oil has been on a tear this year, so producers have done well, but did they match our +400% with UVXY?

Well, my picks (IPO, NVA, TGL) did well and I missed out on some nice gains with CVE and SU since I sold them last year, but when you’re picking an all-star team for the Olympics, you’re going to pick top players and leave some of your grinders, like CVE and SU, at home.

Natural gas has made a massive move this year, which I unfortunately missed, as I remained on the sidelines as a non-believer. I even tried shorting, thinking ‘this is ridiculous!’ Bad idea, like trying to hold the blue line when you shouldn’t and giving up a short handed goal.

I feel bad letting AR go at $21 as it pushed up to close $35.28 on Friday, but I first bought it in July, 2020 at $2.61, sold at $4.33 in August, then re-bought in September at $2.90s, so I can’t feel bad about selling out at $21. It’s a bit like losing Mark Giordano in the expansion draft. Yeah, you hate to lose him when he has some great years left, but you’re sure happy to have found him undrafted and got the best years with him.

Still, AR ‘only’ did +104% and we got +417% with UVXY and we’re back in as of Friday morning at 12.50 and it closed 13.34 (+6.7% from our buy price, so completely safe for Monday). I guess we’re doing okay without our Gio.

How about gold and gold miners? This could be a good year for gold and silver, but people have been saying that for years without much to show for it.

I suspect we may have finished the first period of game 1 with gold. KRR is the Auston Matthews of my bunch but looking at his +/- stat of 14, and knowing gold’s habit of suddenly getting smacked down, I’ll be ready to cash out quickly. GG, Galane Gold, is one I’ve been watching since last year and never bought. I think I will get some now before it gets discovered and its ‘trade’ value goes up. It could be the next hot rookie. KRR and WDO are my ‘veterans’ and I need a ‘rookie’.

So how about the markets overall? How have they done?

Yikes!! QQQ looks like the Canadiens! It was a star performer last year and look at it now! At Christmas, I and others said the markets could be headed lower. I’m sure there were some who predicted the let down in the Canadiens following their terrific drive to the Stanley Cup last year.

How have your investments done? How about Questrade’s Portfolios? Agressive -5.54%, Growth -4.81%, Balanced -4.01%, Income -3.20%, Conservative -2.42%. Their best performer since inception in Nov 2014, ‘Agressive’ has returned 80.18%. Needless to say, they haven’t made the playoffs since inception. They don’t have any 50 goal scorers on their bench. Their best fund’s best years were 20% in 2019 and 2021. What was your best year?

I know asking people how their investments are doing can be a touchy issue, but you’re the General Manager of your funds and if you’re not up 20% YTD overall, then it’s time to shake things up, whether that’s fire the coach, make some trades, read the riot act as Dad likes to say, or whatever. It’s time for change.

It’s also important to remember that change takes time. It takes time to adjust to a new system and a new strategy. It also takes practice and discipline to stick to the new game plan. And it also takes game time to be able to execute the game plan, game in and game out. Getting +417% with UVXY was ‘easy’ and was exactly how I ‘drew it up’ on the play board. Executing during the game, making the pass, taking the shot and getting back on defence was not ‘easy’. Sure, it was simple, just like Coach Sutter said, but it wasn’t easy.

It also takes time to change accounts apparently. One friend switching from Scotia Bank to a new financial advisor is still waiting, months later. What you can do now is open an account with Wealthsimple (for Canadians). It’s far better than Questrade or any online trading platform from the banks. It costs $0 to buy and sell stocks on WealthSimple. Questrade charges $4.95. Most of the banks charge about $9. Do you really want to give that money to them each and every time you hit the buy and sell button on your phone? I don’t, and Wealthsimple has great customer support and is continually improving their platform.

So, let’s look at the ‘goal scorers’ and see which one to get playing for us.

Everyone has heard the saying “buy low, sell high”, so it’s pretty difficult to justify buying any of the top performers year to date (YTD). UVXY on the other hand, looks like it’s back on sale, which it is, maybe. It’s like getting Cale Makar on your team; solid defence and tremendous scoring potential.

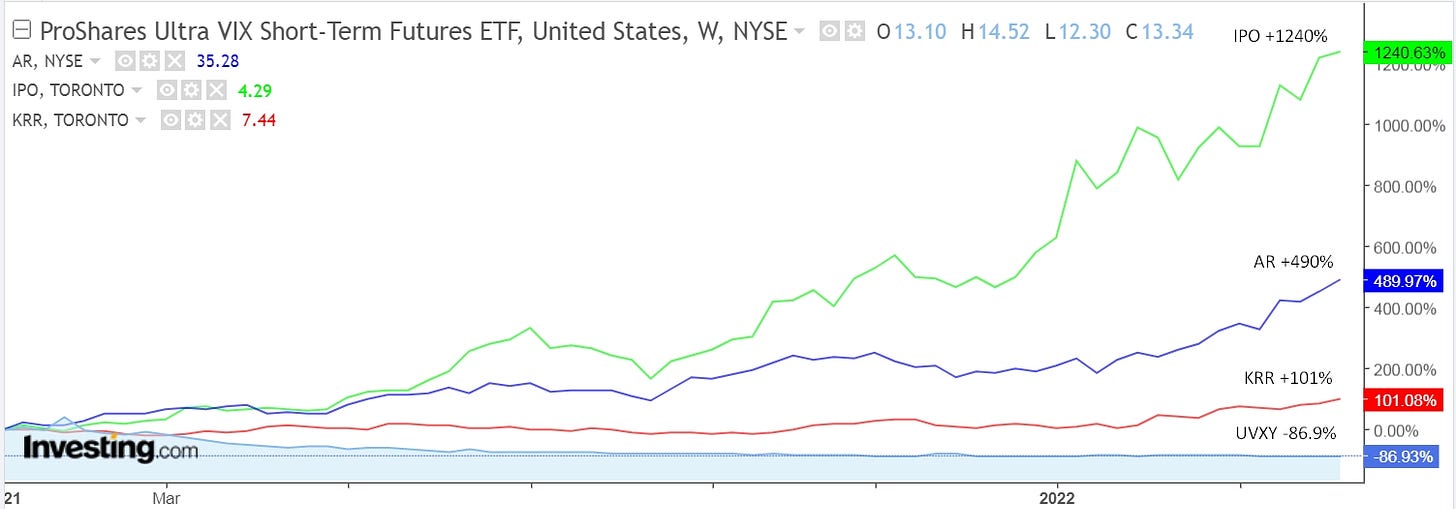

If we zoom out, you’ll see why I say UVXY is ‘maybe’ back on sale. If you leave Makar on the ice for the entire game, he’s going to perform terribly. He’ll make a ton of mistakes on defence and he’ll end up with a terrible +/- rating. He’s currently +45, which is very good. Patrick Kane on the other hand, has more points, but is -17. Clearly he needs to up his defensive game.

IPO was clearly an amazing ‘draft pick’. I first bought shares Jan.11, 2021 at 34 cents. It closed Friday at $4.29 and I’m still in with some shares, but not all of my original shares, unfortunately. UVXY is down -87% since then, and remember -100% is all your money, everything, so you don’t want to keep UVXY or Cale Makar on the ice all the time. Give them their shift, put them on for the power play and reap the rewards.

Now, let’s also remember that getting the best player in the draft will not necessarily get you the Stanley Cup. Sure, Edmonton did it with Gretzky, but he had a lot of great players by his side. McDavid would love to have the same lineup with him today.

So, you’re the GM of your investments. Can you pick the next ‘McDavid’ and more importantly, can you hang on to him for the full run? I bought TSLA at $30 not long after its IPO. It was down from $35 so I thought it was a decent buy. The next day it opened at $27, my typical luck, and before long it was down near $20. Well, you can’t give up on your star, so I stuck with it, trading for gains, and by the time is was back up to $27, I was nicely in profit and more certain that it was a potential winner. When it was over $400 and they were having quality issues and delays, I finally sold out completely. Taking into account the 5:1 stock consolidation in 2020, I could have held on for a top price of about $6000. Too bad I traded my star player.

We all have a list of stocks that we wish we had bought, like APPL when they came out with the iPod in 2001, but the stock didn’t get going till 2004.

Perhaps you bought in 2000 and didn’t sell on the big drop. After holding under 50 cents (today’s equivalent) for 3 years, perhaps you gave up and sold, taking the loss for tax purposes. Bad luck since it started its move in early 2004. The rest is history.

The tough question now is whether to keep holding or sell/trade. Was it good timing for Ottawa and Montreal to trade Mark Stone and Pacioretty and go with their young talent? That’s the calls the GM has to make and if you’re holding APPL, TSLA, NFLX, etc in your portfolio, then that’s the call you need to make. For me, it’s a much, much easier decision if I have Mark Giordano and Cale Makar on my blue line.

I’ve still got my oil stars IPO, NVA and TGL, along with some good junior oil prospects, supported by my gold star KRR and others making a solid fourth line. I’m ready to trade for GG (Galane Gold), a hot prospect who has taken off already this year so I’ll be forced to pay up to get it. SPOT (Goldspot) is a top prospect I already traded for but is in the minors for now.

As a GM, we also have to consider our salary cap. We’ve only got so much money to invest, so we have to do it wisely and get the best bang for our buck. At +417% YTD, UVXY is my best player by far. It’s also my best defensive player since I know I won’t wake up one morning with it down -30% or more, like NFLX and many others have done recently. I also know I can happily sell it whenever the price gets high, knowing I can always buy it again cheaper. I think the price of natural gas and oil are ‘too high’ and will come down, but they might go much higher first. Since none of the other ‘players’ outperformed UVXY and they’re at the end of a long shift, I think it’s wise to get them off the ice and let them rest.

Now, if you want UVXY on your team, you need to have funds ready and waiting. Your financial advisor won’t manage it for you, you have to do this one on your own. So, get an online trading account if you don’t have one already. If you’re Canadian, the best option by far is Wealthsimple and you can then trade HUV for free instead of UVXY. HUV doesn’t get the highlight reel goals that UVXY does, but he scores just as often since they both follow the VIX, the volatility index.

In 2020, a Canadian friend I met living on the beach in Baja, opened an account and put in $50. Once she got comfortable with it, she put in another $50. With $50, you can buy 4 shares of UVXY or 5 shares of HUV. If you did that at the start of the year and executed the game plan, you now have over $200 in your account and could have bought 15 shares of UVXY (keeping some cash in your pocket) or 20 shares of HUV on Friday.

Everyone is different. Some play community hockey, some play in the NHL. The great thing is, with $50 or $50k, everyone can play the same game. It’s time to get fear / volatility playing for you. I remember once years ago as a teenager at Sylvan Lake and it was a boring day, lazing around in the sun. Most people were loving it. Then, black clouds rolled in, the wind started blowing and everyone was running away from the beach to their vehicles, while a few of us were running back to the beach with our windsurfing gear. Now it was time to have some fun!! It’s time to get ready to have some fun of your own with UVXY.