North, south or east? Be ready for all outcomes.

This past week the markets blasted north and then u-turned south.

Last week I wrote, “despite my bias for the long potential, I will again be watching to go short next week with 15.00 being my ‘center line’ (for PSQ). Conversely, I’ll be watching QQQ for the big reversal that some are expecting. A move over 270 will have me watching closely.”

On Monday, Oct. 3, QQQ opened higher at 269.12 (basically Friday’s floor before it dropped hard in the final 10 minutes to close 267.26), made a low of 267.54 in the first 10+ minutes, then started climbing. A perfect time to buy with a stop sell at 267 and you may have put in a stop buy at 268 (+0.2% from the low). You now risk -0.4% if it falls to your stop at 267. Instead, it climbed to close 273.53 (+2.1% from your stop buy). It doesn’t get any lower risk than that. You had a plan going in and you executed according to the plan.

Tuesday opened way up and you should have been thinking, this is definitely too far too fast. When it stalled and held flat around 282.50, take the gain of +5.4% and be ready to go short. A major part of the plan for the week was to be ready for moves in both directions and buying PSQ after selling QQQ made complete sense.

I bought and sold PSQ on Tuesday, Wednesday and Thursday for small gains. Then on Thursday, just before the close, I re-bought my PSQ position and sold my TQQQ position. I just had a bad feeling so stayed out of the leveraged positions (TQQQ, SOXL, UVXY) and held PSQ. Sure, it would have been nice to have been holding SQQQ, but PSQ was the best choice. Don’t be greedy and play safe.

Luke Lango says, “The stock market got clobbered on Friday because the September jobs report came in hotter than expected, dashing all hopes that the Fed will come to the rescue of struggling stocks with some rate cuts.”

“The stage is now set for a pretty steep stock market crash over the next few weeks. But it’s also set for that crash to be the “final crash” of the 2022 bear market, and for a durable bottom to form in the stock market in the very near future.”

That could be true, but I say, next week is again completely unknown. The markets could start a hard drop lower, start a longer rally up, or continue sideways. North, south or east. All can be profitable.

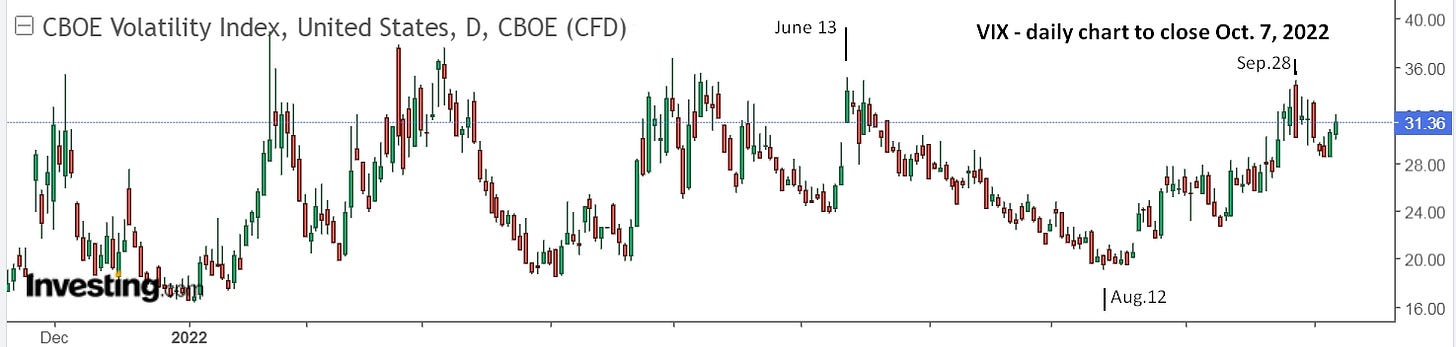

It seems too easy for it to rally from a similar bottom as in June. Still double bottoms are common and significant. VIX is also showing lower highs.

The CPI number is reported pre-open on Thursday so that will likely cause a big gap move as well, and it could be up or down. The recent moves have all been down but betting on a particular move is risky and it’s better to simply jump after the fact and then be ready for a reversal. There were no reversals on the days previously so that is helpful to keep in mind.

Taking the entire week off, sitting on the sidelines in cash, would also be an excellent strategy. Happy Thanksgiving to all Canucks.